Hmrc Personal Tax Email Address Dealing with HMRC Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

Corresponding with HMRC by email Updated 26 October 2023 Use the following information to decide whether you want to deal with us by email We take the security of personal information The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how to

Hmrc Personal Tax Email Address

Hmrc Personal Tax Email Address

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

The Super Easy New Way To Get Access To Your HMRC Personal Tax And Self

https://www.spondoo.co.uk/wp-content/uploads/2022/04/How-to-access-to-access-my-HMRC-Personal-Tax-and-Self-Assessment-Account.png

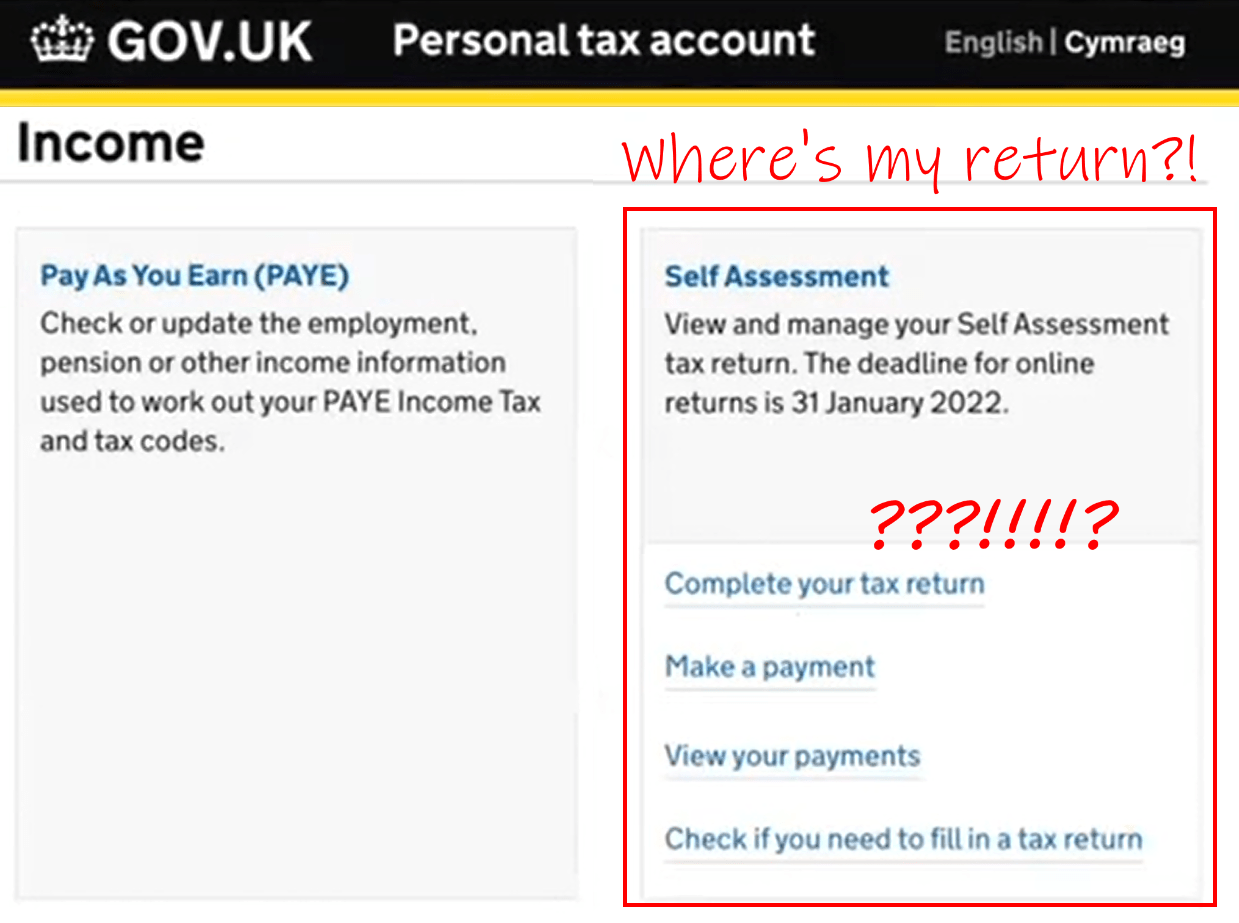

You ve Filed A Tax Return So Why Doesn t It Show In HMRC s Personal

https://www.untied.io/hubfs/Untitled1334.png

So if you do need to contact HMRC about your Self Assessment be sure to have the following Your personal details full name address date of birth Your National Insurance number Your Government Gateway ID Your Unique Tax Reference Number UTR Previous Self Assessment tax returns if relevant You can get all the current directors names here Here is a list of HMRC people that may be useful If you can add to it do let me know through the contact page Sam Louks telephone 03000 530 709 or email samuel louks hmrc gov uk Andrew Martel telephone 03000 517 495 or email andrew martel hmrc gov uk

Latest tax news A list of regularly used HMRC contact information including telephone numbers online contact options and postal addresses together with a number of tips This information will help direct tax agents to the appropriate point of contact within HMRC You cannot contact HMRC by email You will either need to telephone 441355359022 or write to HM Revenue and Customs BX9 1AS You can appeal penalties provided we have received your tax return Guidance can be found at Self Assessment appeal against penalties for late filing and late payment Thank you

Download Hmrc Personal Tax Email Address

More picture related to Hmrc Personal Tax Email Address

RDG Accounting Is Your HMRC Personal Tax Account Riddled With Mistakes

https://www.rdgaccounting.com/wp-content/uploads/2018/04/hmrc-personal-tax-account-snapshot.png

2017 Form UK HMRC APSS255 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/454/115/454115474/large.png

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled-1024x683.jpeg

The completed template can be emailed to the VCR Team at enterprise centre hmrc gov uk or posted to Venture Capital Reliefs Team HM Revenue Customs WMBC BX9 1QL You may find the following Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 VAT general enquiries 0300 200 3700 Tax Credits helpline 0345 300 3900 You can find more relevant numbers on

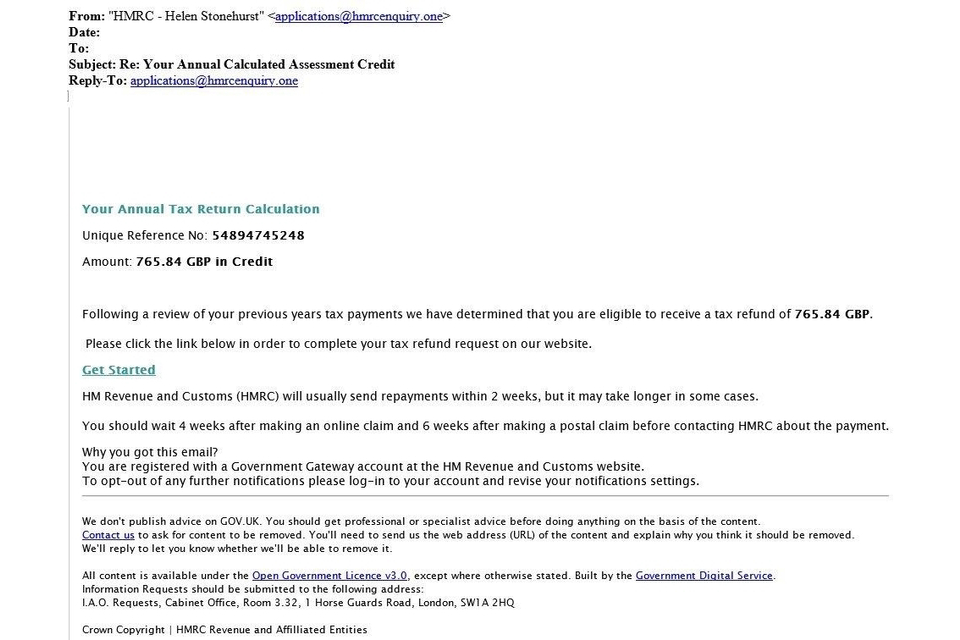

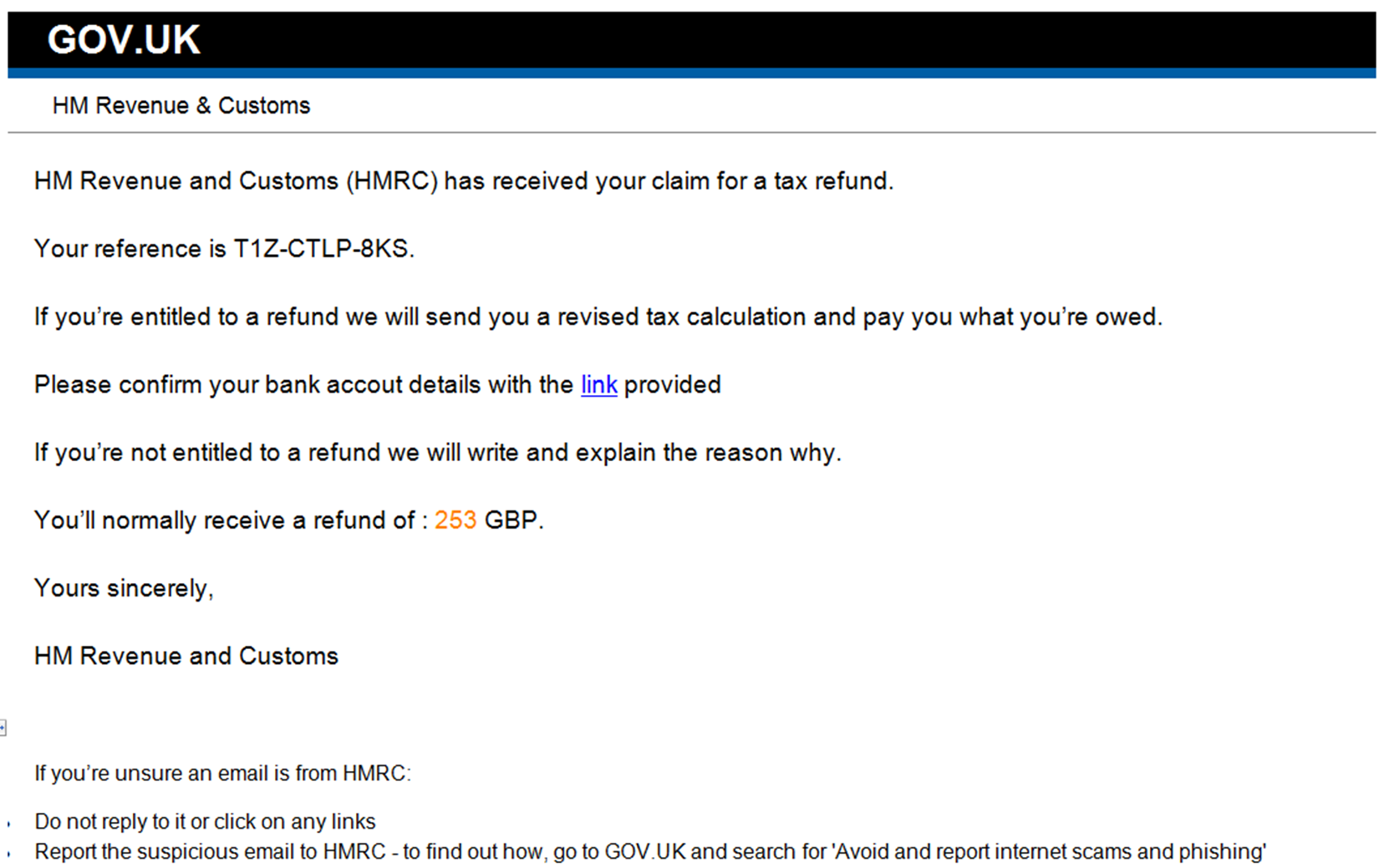

October 19 2022 Although there is no general facility to contact HMRC by email it is slowly moving into the 21st century by providing the option to receive an email response But of course this comes with a few conditions Dealing with HMRC by The email or text call will promise a tax rebate and often ask for personal information such as your name address date of birth bank and credit card details including passwords and your mother s maiden name If you provide the information money can be stolen from your bank account and your details could be sold on to criminal gangs

Examples Of HMRC Related Phishing Emails Suspicious Phone Calls And

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/149506/Example_of_a_scam_email.jpg

HMRC Personal Tax Account Gov uk Services Login

https://www.dnsassociates.co.uk/assets/img/hmrc-personal-tax-account.png

https://www.gov.uk/contact-hmrc

Dealing with HMRC Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

https://www.gov.uk/government/publications/...

Corresponding with HMRC by email Updated 26 October 2023 Use the following information to decide whether you want to deal with us by email We take the security of personal information

HMRC NRL1 PDF

Examples Of HMRC Related Phishing Emails Suspicious Phone Calls And

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Personal Tax Accounts

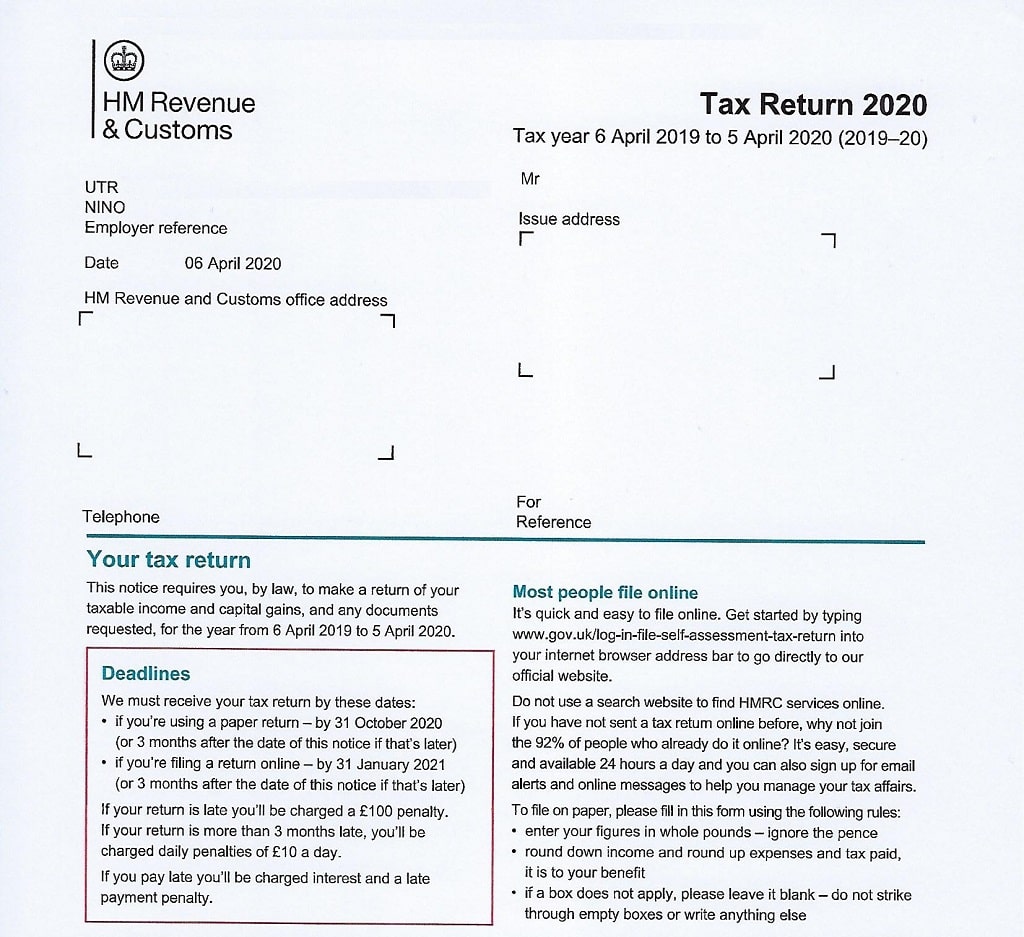

HMRC 2020 Tax Return Form SA100

How To Spot HMRC Phishing Emails Lurking In Your Inbox

How To Spot HMRC Phishing Emails Lurking In Your Inbox

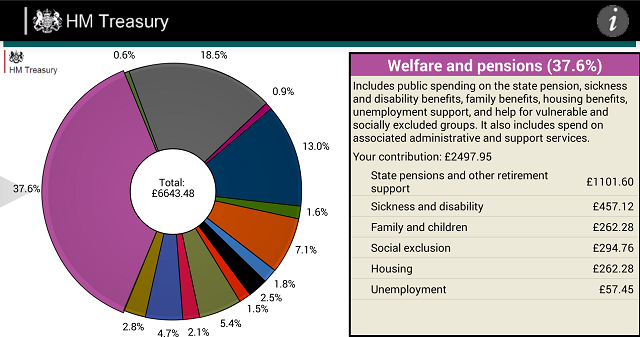

HMRC Personal Tax Summaries

Cash Declaration HM Revenue Customs Hmrc Gov Fill And Sign

Grab Help Centre

Hmrc Personal Tax Email Address - If you re self employed or in a partnership you can write to HMRC using the address on the latest correspondence you ve received from them or speak to them via the Income Tax helpline If you need to update your details for Corporation Tax you can write to your Corporation Tax Office using the address found on your most recent tax forms