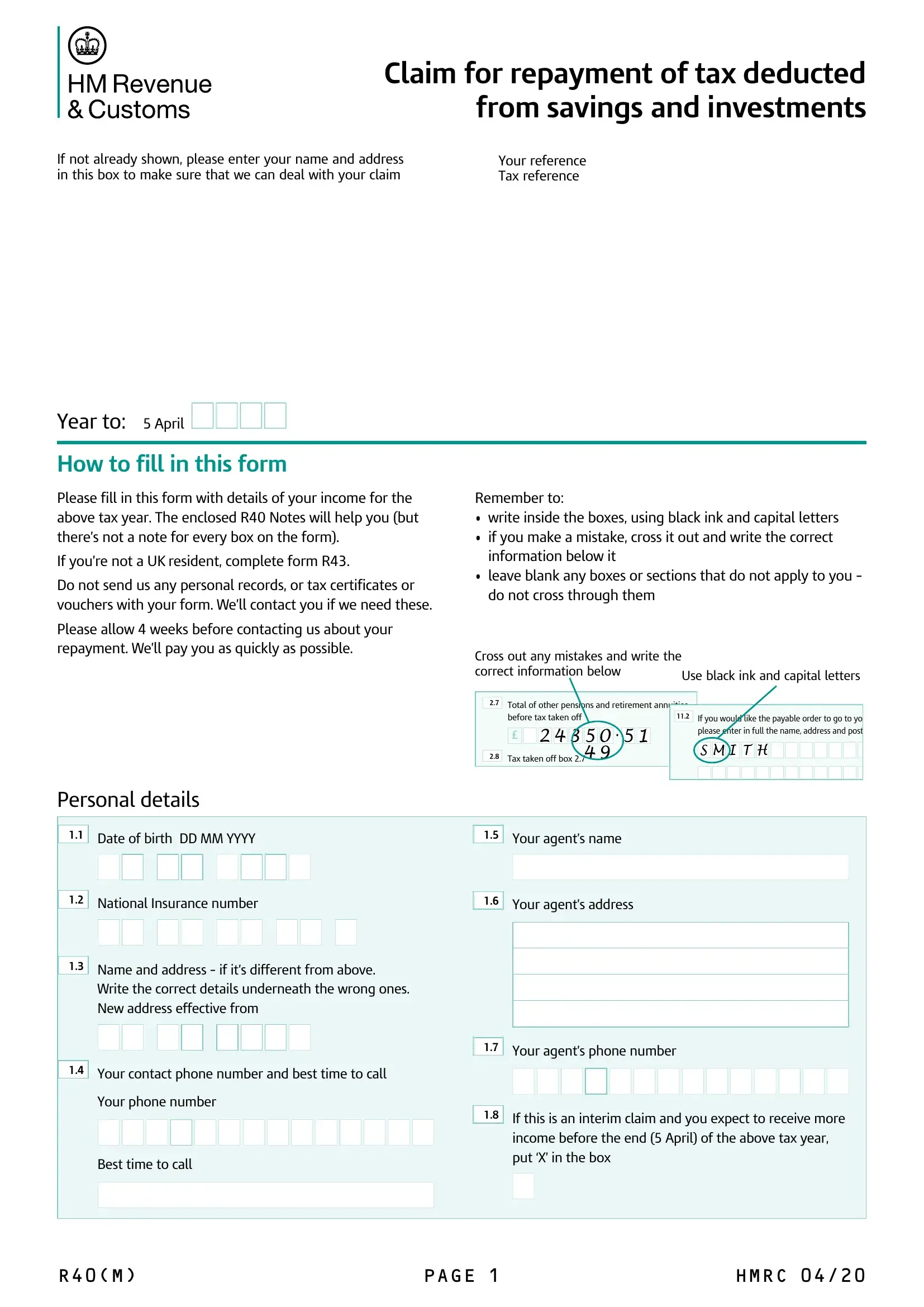

Hmrc R40 Contact Number Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and a tax

The enclosed R40 Notes will help you but there is not a note for every box on the form If you need more help with anything on this form please phone us on the number shown above If If you need help please phone us on the number on the front of your form R40 Or go to www hmrc gov uk or you can phone the SA Orderline on 0300 200 3610 If you have a non UK

Hmrc R40 Contact Number

Hmrc R40 Contact Number

https://www.accountingweb.co.uk/sites/default/files/hmrc_photot.jpg

HMRC Scam Calls Statistics And Origin Of The Calls

https://www.unknownphone.com/images/og_images/hmrc.png

HMRC Customer Service Number Direct Call On 0844 3069181

https://phonenumbercustomerservice.co.uk/wp-content/uploads/2017/02/HMRC_logo.jpg

Call HMRC for help with questions about Income Tax including PAYE coding notices Marriage Allowance and changing your personal details Have your National Insurance number with you To speak with an HMRC Self Assessment adviser call 0300 200 3310 44 161 931 9070 if you are calling from overseas HOWEVER this line is not being answered until September 2023 When they are open again

Contact HMRC for changes of details rates credits Statutory Payments online statements and for help with gaps in your National Insurance contributions If you are entitled to a refund of tax deducted from savings and investment income you can claim the refund using form R40 if you do not complete a Self Assessment return

Download Hmrc R40 Contact Number

More picture related to Hmrc R40 Contact Number

HMRC Contact Helpline Number Today 00355680906050

https://24-7helpline.co.uk/wp-content/uploads/sites/15/2016/05/32-HRMCC.jpg

Help With HMRC Pressure The Directors Helpline

https://www.thedirectorshelpline.org/media/nu4pdniz/logo-jpg.png

HMRC UK Customer Service Contact Numbers Lists

https://customerservicecontactnumber.uk/wp-content/uploads/2016/08/HMRC-1024x536.jpg

Probably best to ring HMRC and ask them what you need to complete on the R40 the help line is 0300 200 3300 you ll need your National Insurance number lines are open 8 Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

A guide on how to contact HM Revenue and Customs Offices by phone or in writing including necessary details Feel free to contact us on 0333 006 4847 or request a call back by texting 075 6464 7474 If you are entitled to a refund of tax deducted from savings and investment income you

HMRC Issues Fraud Warning As Scam Calls Rise Clear Vision Accountancy

https://clearvisionaccountancygroup.co.uk/wp-content/uploads/2022/10/FI-HMRC-fraud-warning.png

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

https://www.gov.uk/government/organisations/hm...

Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and a tax

https://assets.publishing.service.gov.uk/...

The enclosed R40 Notes will help you but there is not a note for every box on the form If you need more help with anything on this form please phone us on the number shown above If

SOOC TB H M4 2 R40 LIGHT GUIDE The Fluid Power Catalogue

HMRC Issues Fraud Warning As Scam Calls Rise Clear Vision Accountancy

Uk R40 Tax Form Fill Out Printable PDF Forms Online

What Is An R40 Form Goselfemployed co

HMRC Unveil Online Boost For Self Assessment Tax Customers

HMRC To Move To New Digital ID System In 2023 THINK Digital Partners

HMRC To Move To New Digital ID System In 2023 THINK Digital Partners

R40 Live Rounder Records

HMRC List Of QROPS Who Is On It Axis finance

HMRC Contact Number 0843 509 2500 Gov UK Benefits

Hmrc R40 Contact Number - If you have any questions regarding your specific circumstances please feel free to get in touch with the team at Accountwise your local Wokingham Accountants on 0118