Hmrc Reference Number Pension Scheme When adding yourself as a scheme administrator on Pension schemes online you ll be asked for the scheme s Pension Scheme Tax Reference PSTR If you do not have

HMRC PSTR number You need to be aware that HMRC recently changed the format for all tax references for registered schemes Take a look at the HMRC user guide for help in obtaining Find out about the requirements for pension scheme administrators insurance companies members and employers and how to report them to HMRC The notification of

Hmrc Reference Number Pension Scheme

Hmrc Reference Number Pension Scheme

http://www.iexpats.com/wp-content/uploads/2015/11/HMRC.jpg

Help With HMRC Pressure The Directors Helpline

https://www.thedirectorshelpline.org/media/nu4pdniz/logo-jpg.png

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

A Pension Scheme Tax Reference PSTR number is given to pension schemes when they re registered for tax relief and exemptions It s usually used by employers rather You must tell HM Revenue Customs HMRC about your pension input amount and liability to the AA charge If your total pension input amount is more than your AA charge use the SA101

What are PSR numbers and where can I find them A Pension Scheme Registry PSR number is allocated to the pension scheme by The Pensions Regulator and can be obtained from the A PAYE reference number or Employer Reference Number consists of a unique set of letters and numbers used by HMRC to identify your employer and their Pay As You Earn PAYE scheme The reference is in two

Download Hmrc Reference Number Pension Scheme

More picture related to Hmrc Reference Number Pension Scheme

Fill Free Fillable HMRC New Starter Checklist 2020 PDF Form

https://assets.fill.io/bundlelogos/hmrc.png

2021 HMRC R D Tax Credit Statistics All You Need To Know

https://forrestbrown.co.uk/wp-content/uploads/2021/09/513_HMRC-stats-2021-01.png

Exp Code On Invoice Hybridlasopa

https://i2.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/HMRC-UTR-Number.jpg

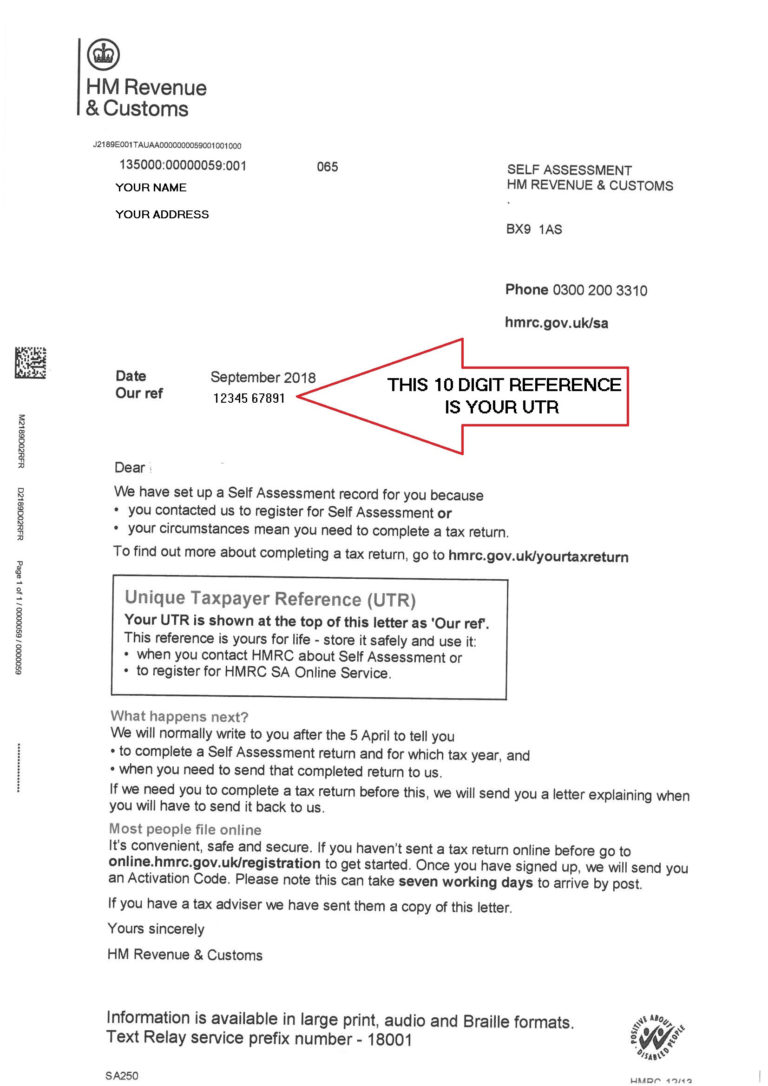

From time to time you may find the following tax reference numbers useful if you have to deal with HMRC in any corresondence relating to your pension scheme for example You can normally only access the money from age 55 age 57 from 2028 Prior to making any decision about the suitability of a SIPP or transferring any existing pension plan s into a SIPP

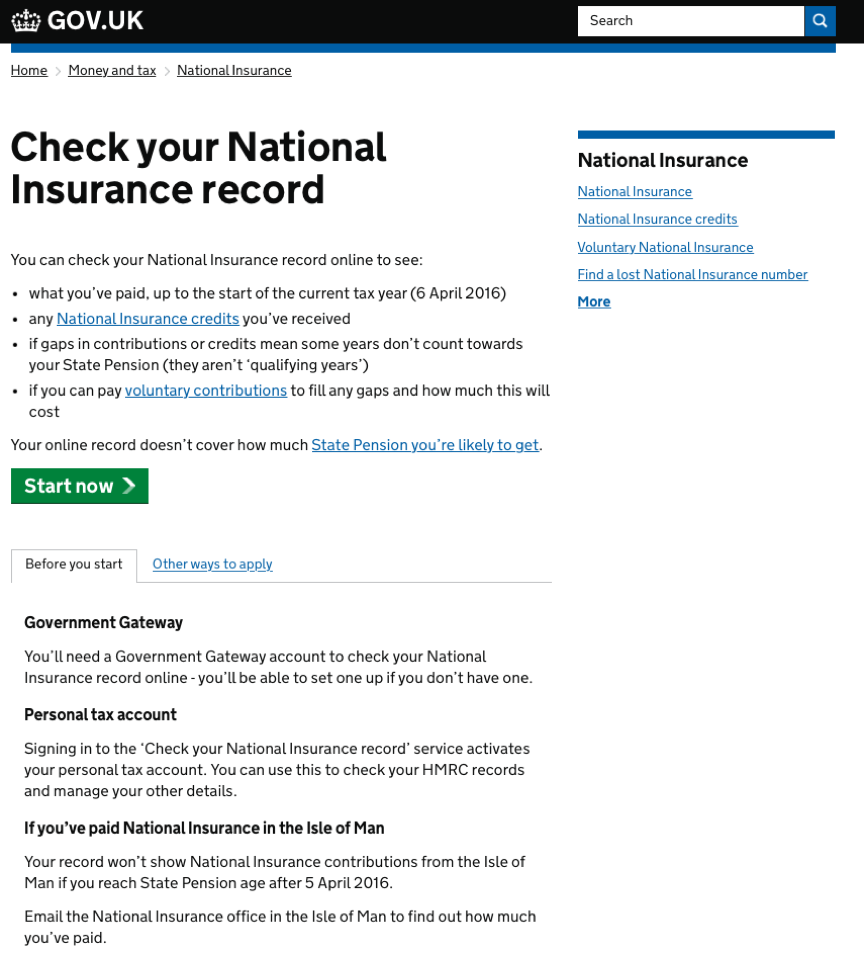

Send HMRC a query about pension schemes Use the online form call or write to HMRC to get help with queries about Annual Allowance Lifetime Allowance relief at source for pension Where do I find my accounts office reference number AORN Your unique 13 character accounts office reference number AORN can be found on You can use your accounts office

What Is An ERN PAYE Reference Number And Why Do I Need It

https://www.informdirect.co.uk/wp-content/uploads/2015/12/Screenshot-2022-06-28-133204-1024x282.jpg

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled-1024x683.jpeg

https://www.gov.uk › government › publications › pension...

When adding yourself as a scheme administrator on Pension schemes online you ll be asked for the scheme s Pension Scheme Tax Reference PSTR If you do not have

https://helpfiles.thepensionsregulator.gov.uk › ...

HMRC PSTR number You need to be aware that HMRC recently changed the format for all tax references for registered schemes Take a look at the HMRC user guide for help in obtaining

Automate Pension Form Document Processing With SimplyInsured In 2 Minutes

What Is An ERN PAYE Reference Number And Why Do I Need It

What Is Employer s PAYE Ref Number Claim My Tax Back Employer PAYE

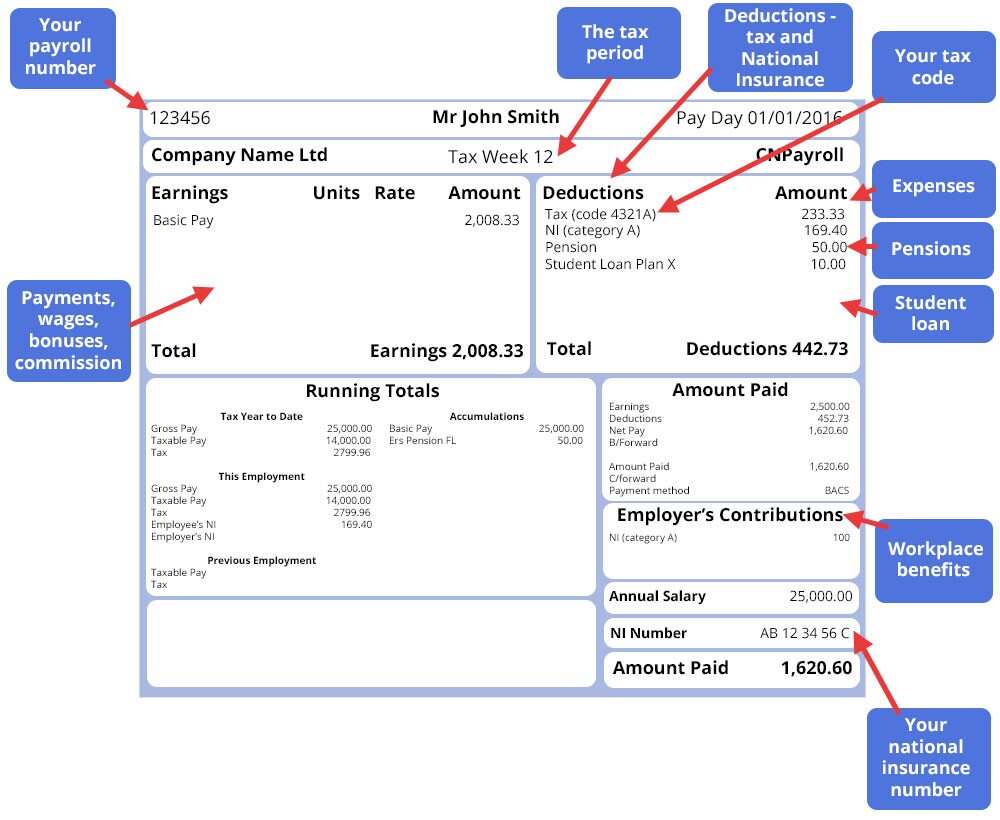

Understanding Your Salary Pay Slip In Ghana YEN COM GH

How To Check Your National Insurance Contributions Record Holborn Assets

What Is An Employer Tax Reference Number Taxtotal

What Is An Employer Tax Reference Number Taxtotal

Information Guide For Unique Tax Reference Numbers

Huge Update To HMRC QROPS List Sees Deletion Of 118 Schemes QROPS Review

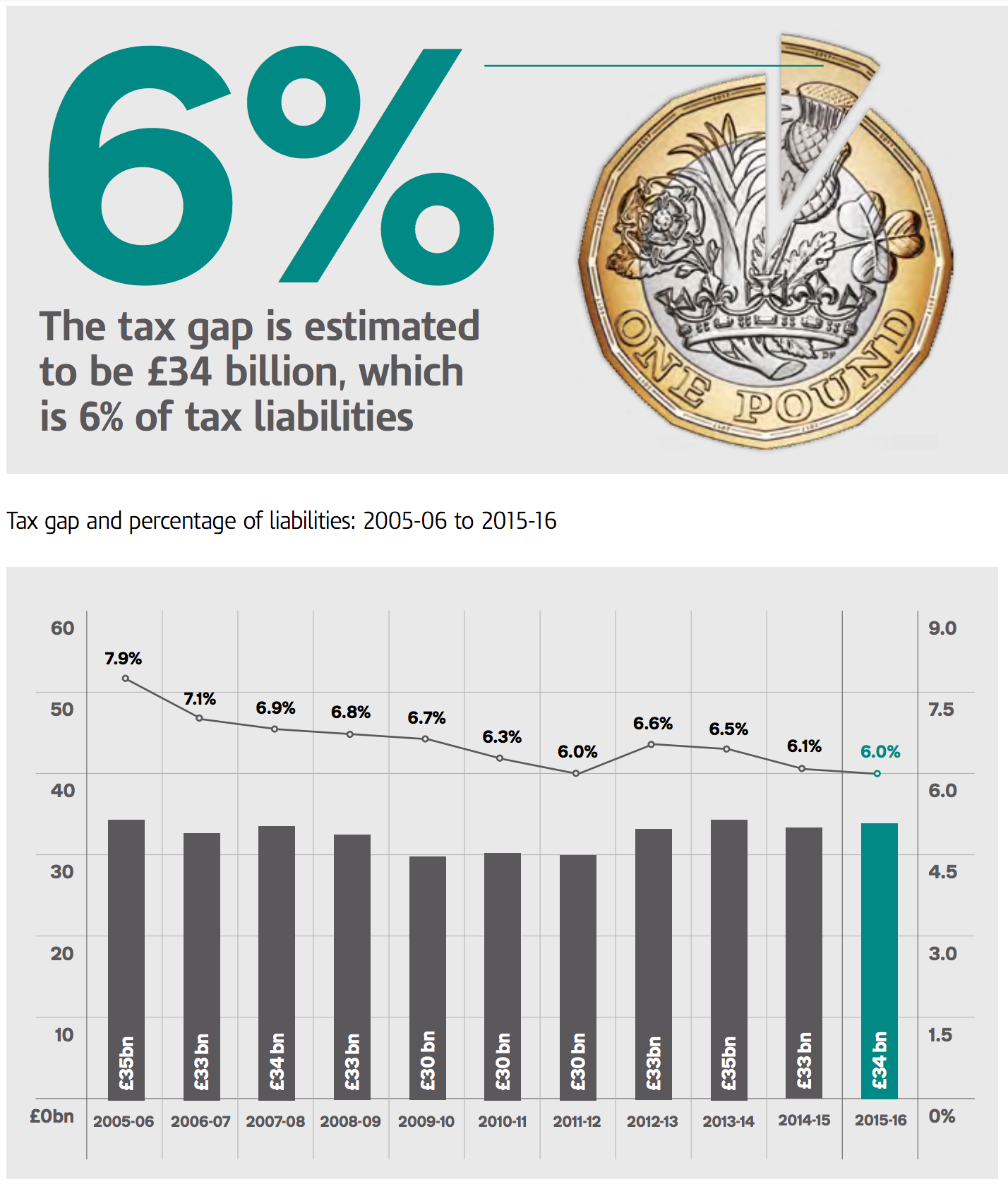

HMRC s New Tax Gap Data Too Predictable To Be Reliable

Hmrc Reference Number Pension Scheme - Information you ll need to confirm in your scheme return Scheme details including name Pension Scheme Registry PSR number address scheme type HMRC reference number and