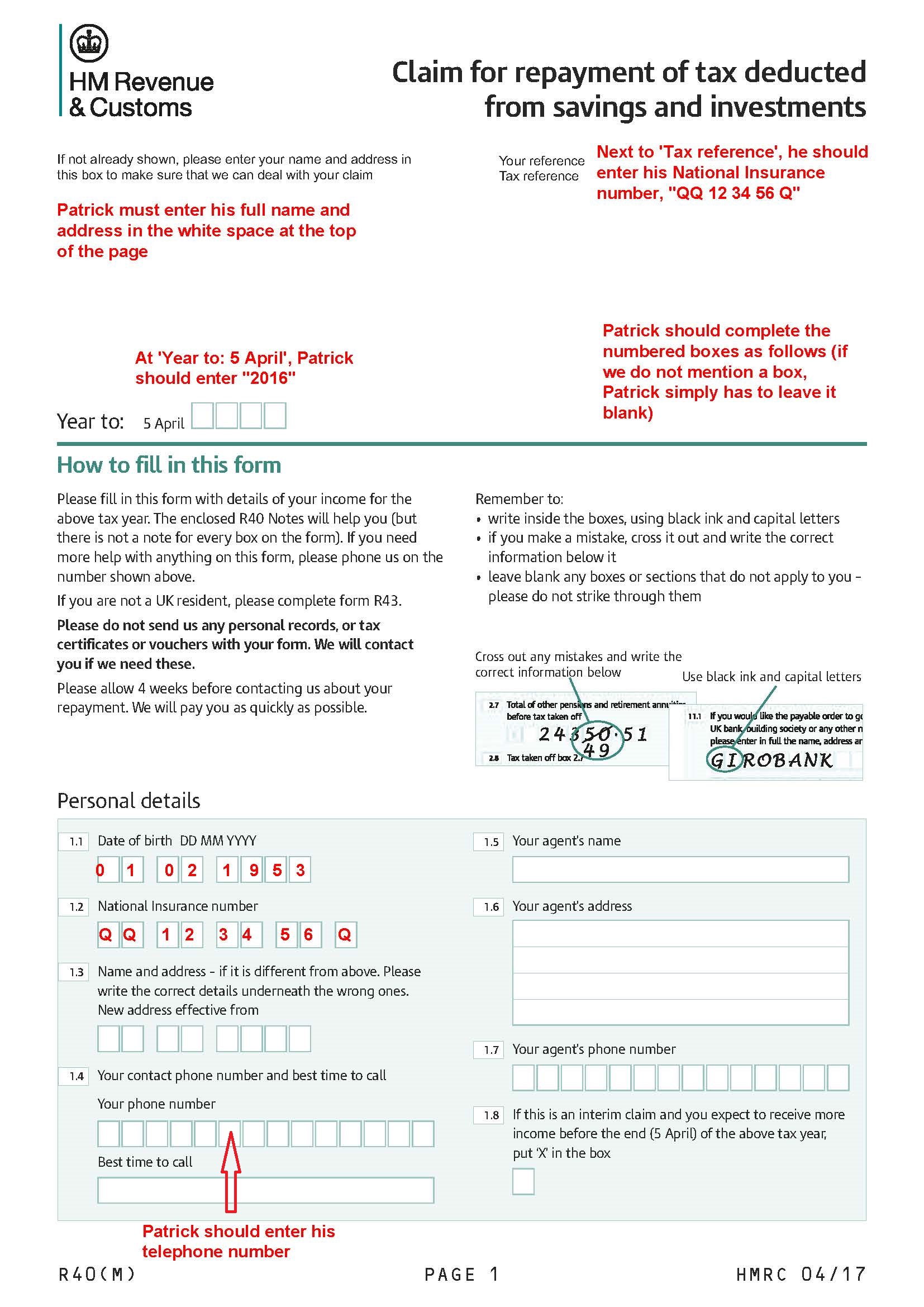

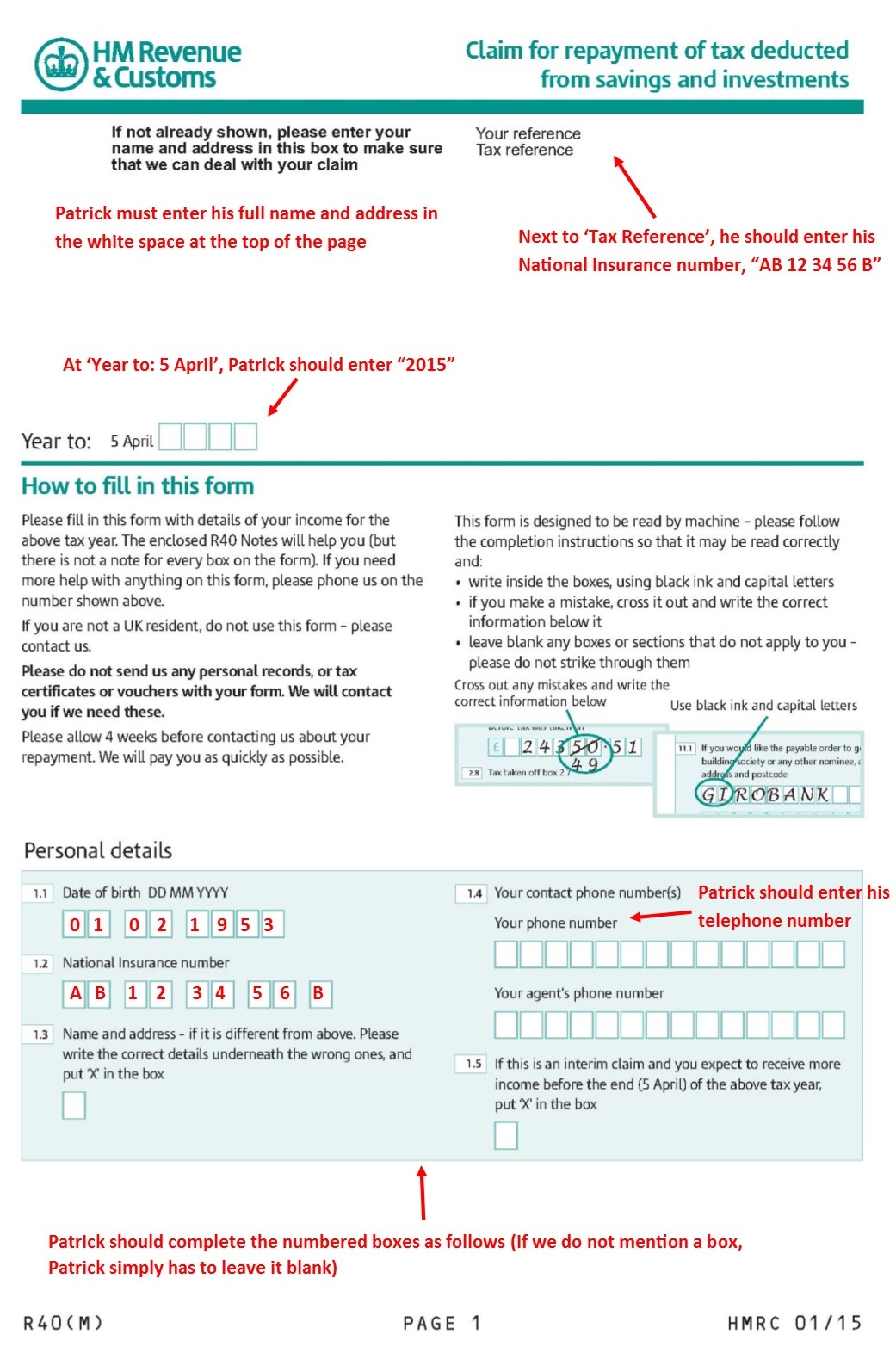

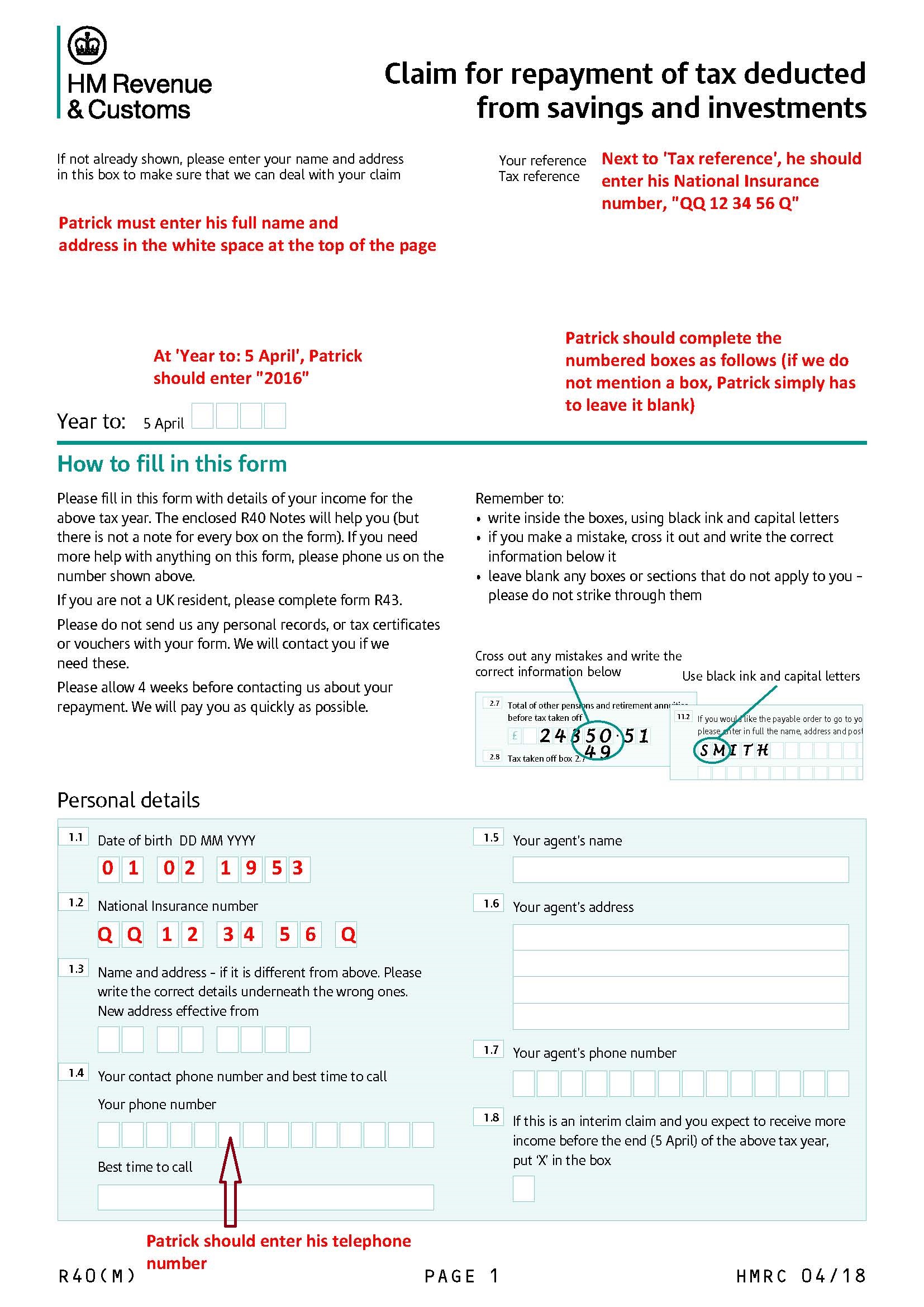

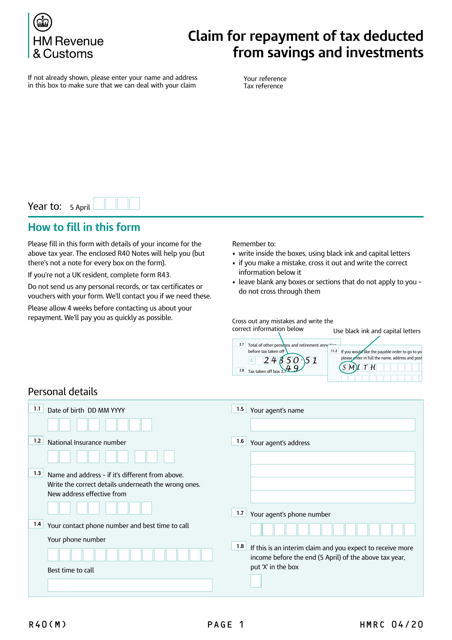

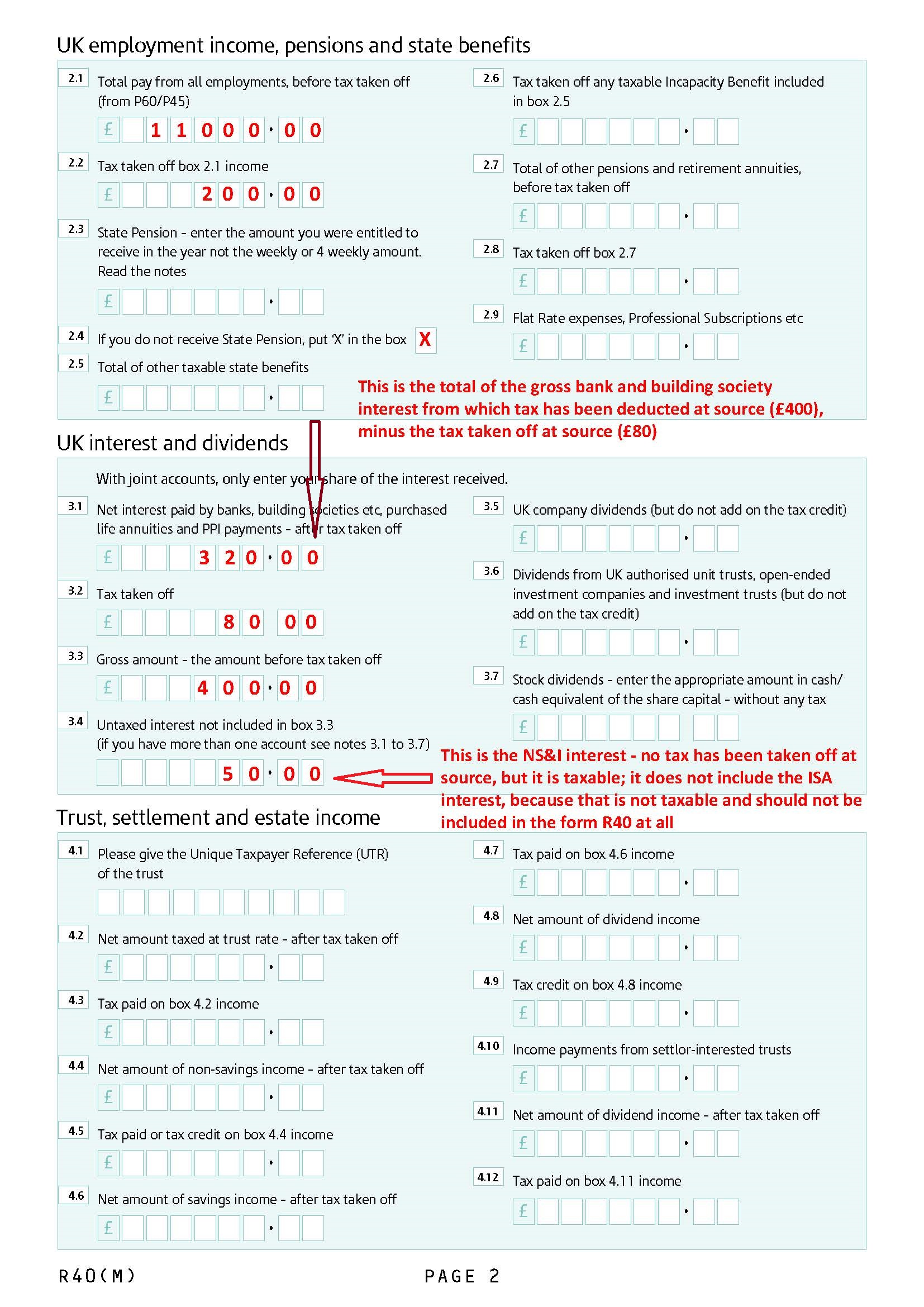

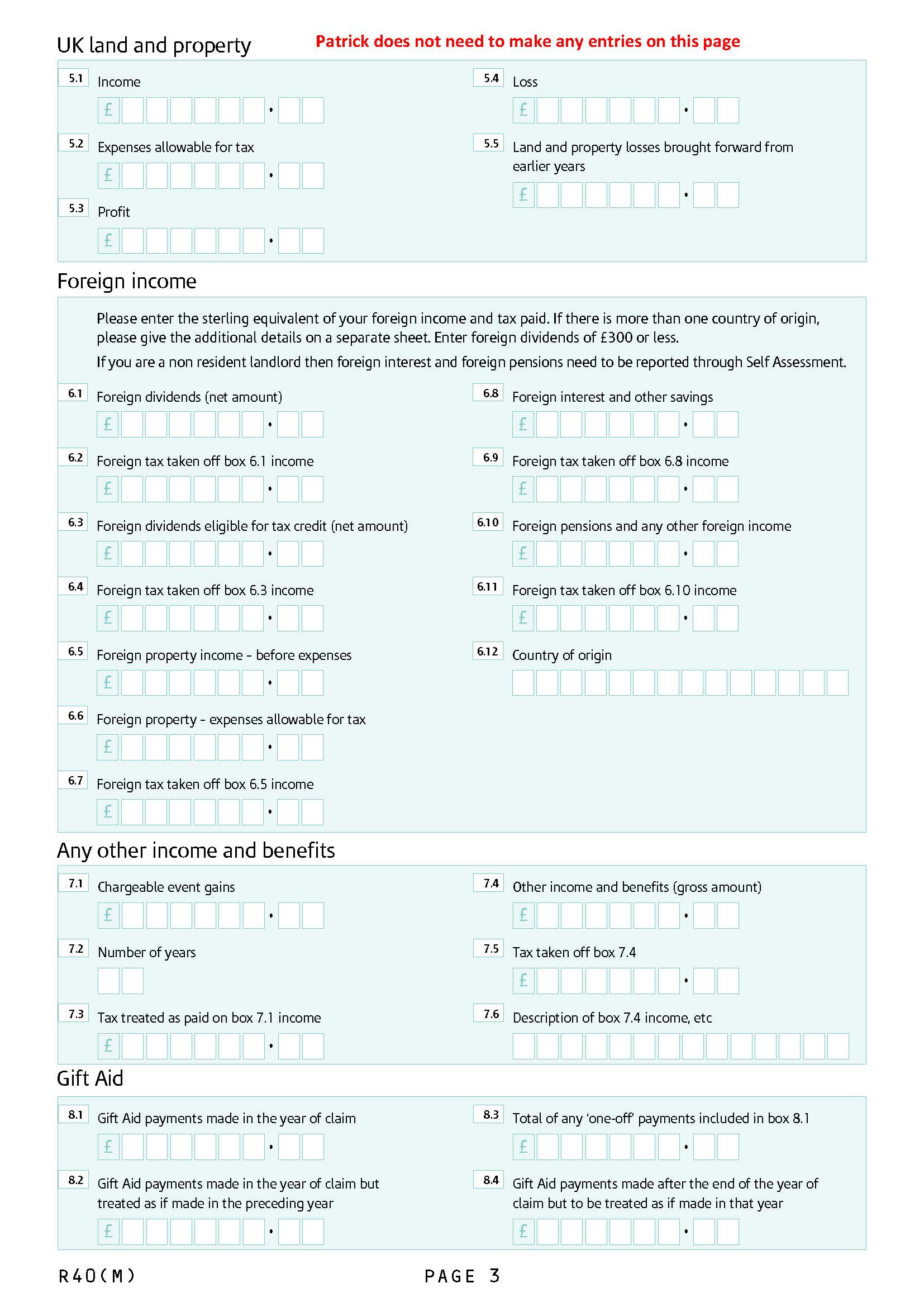

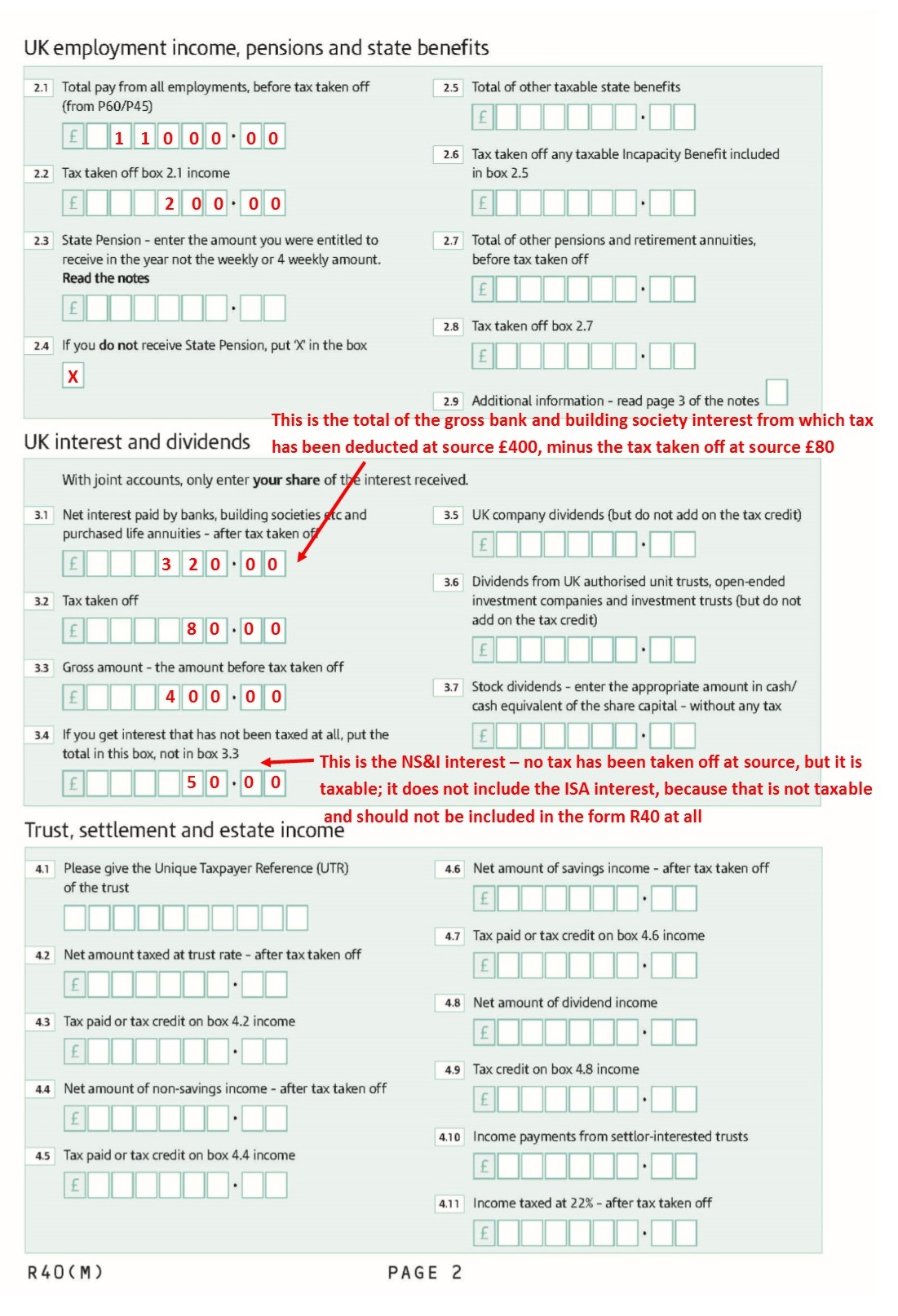

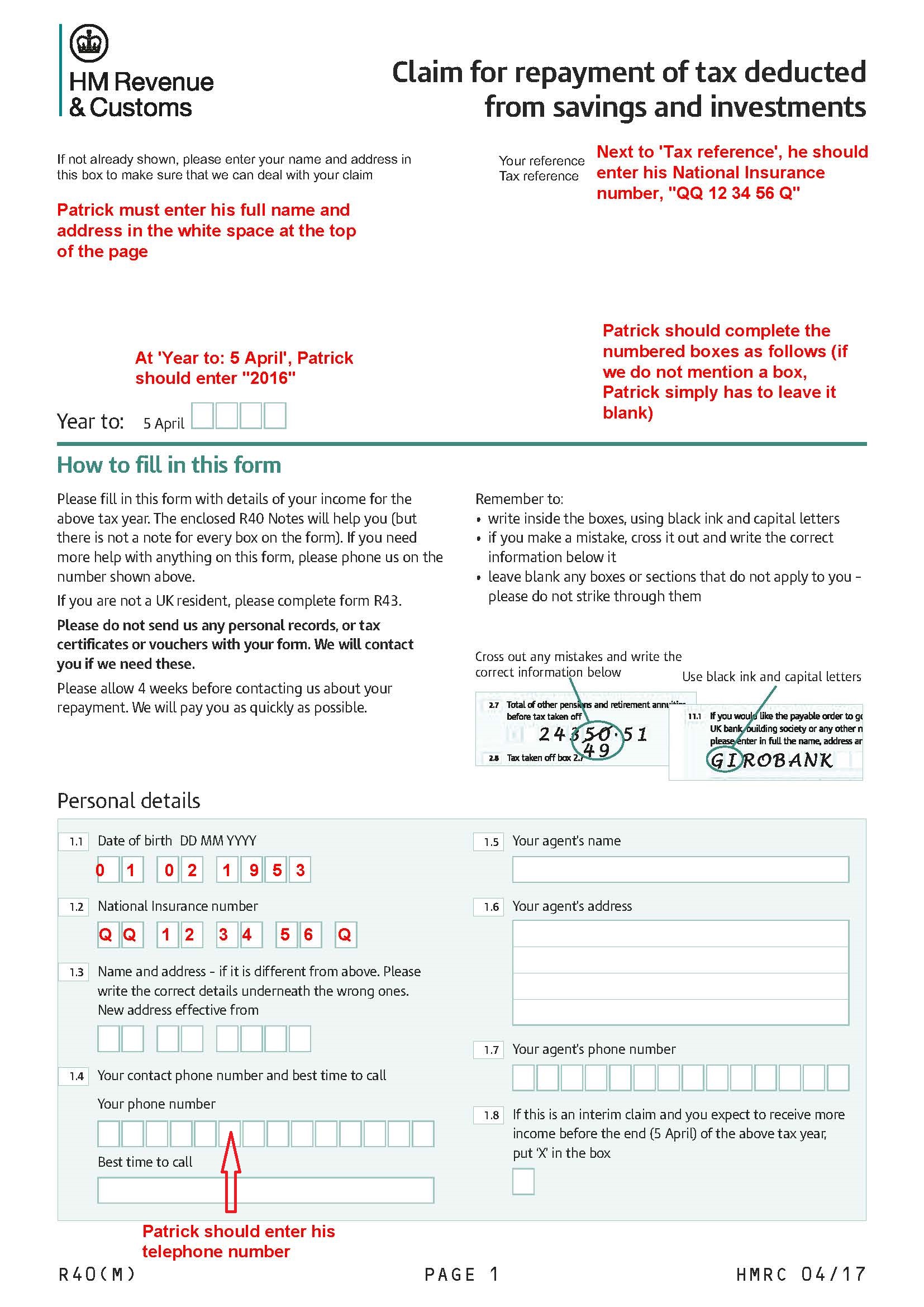

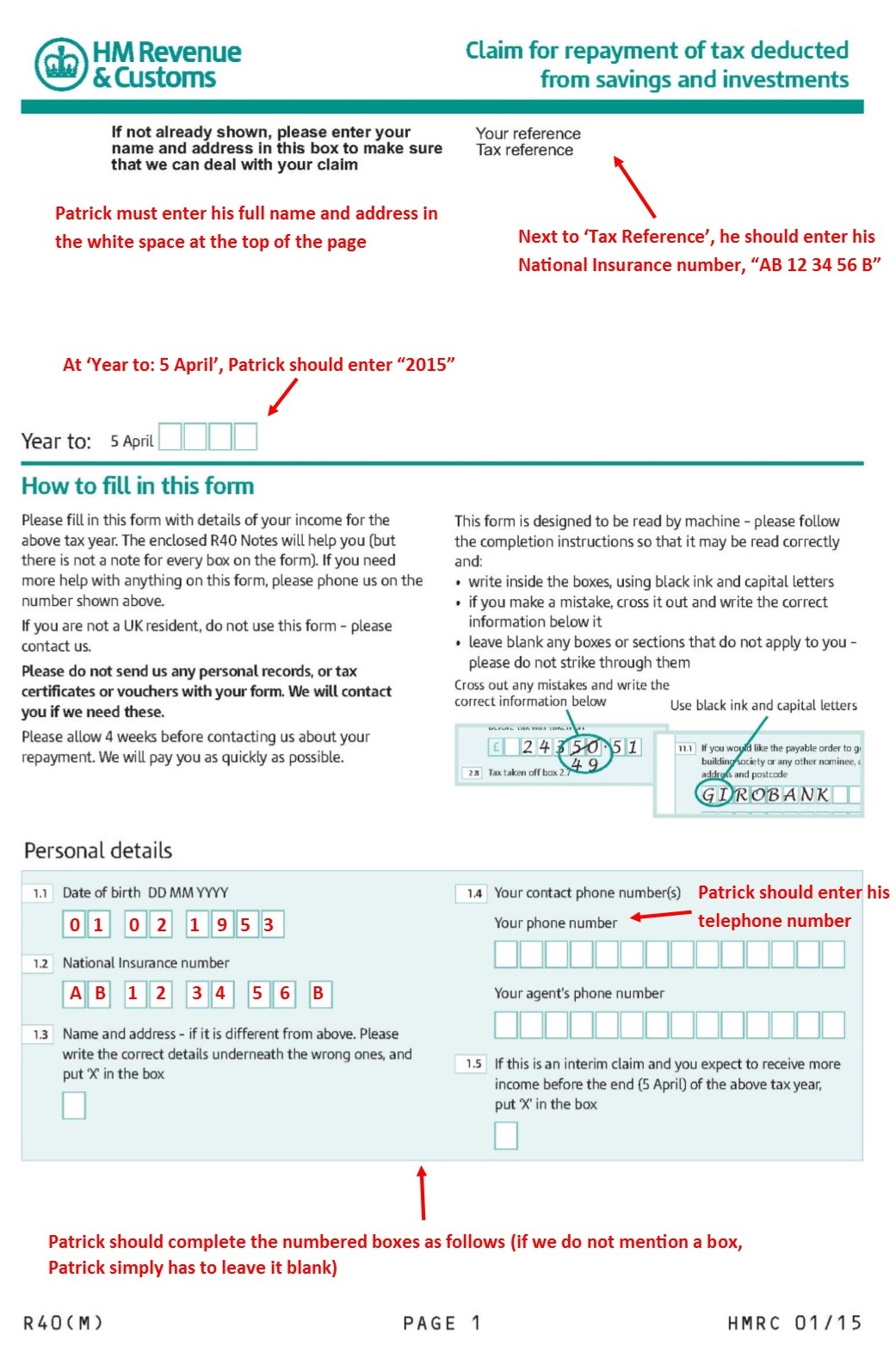

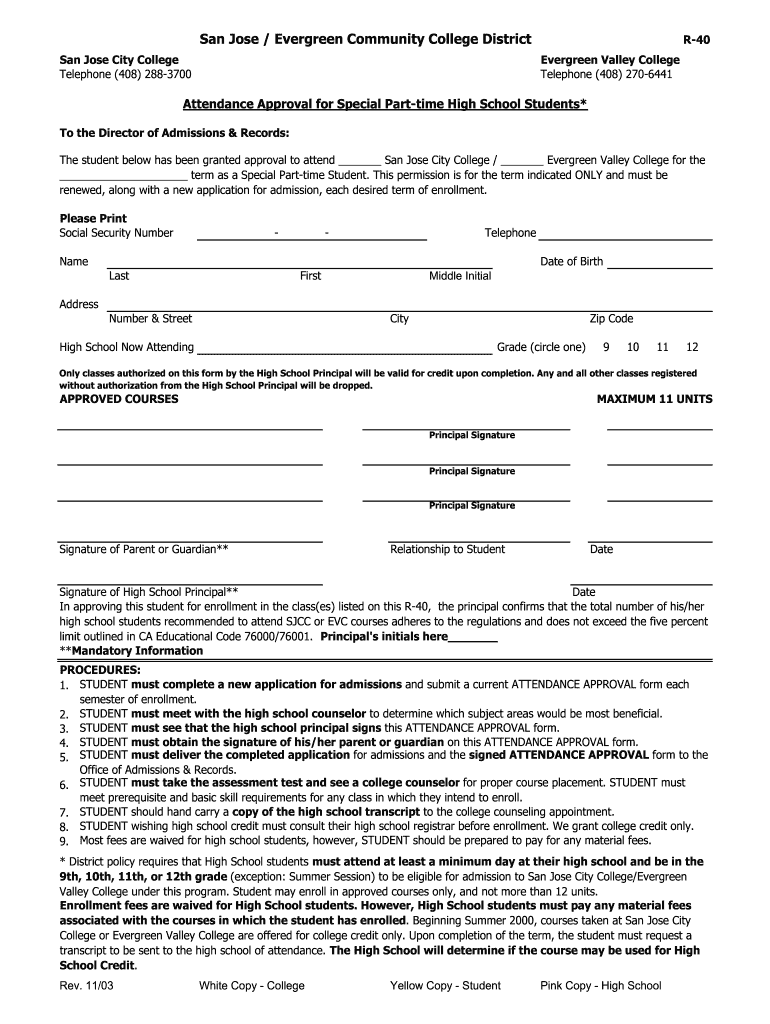

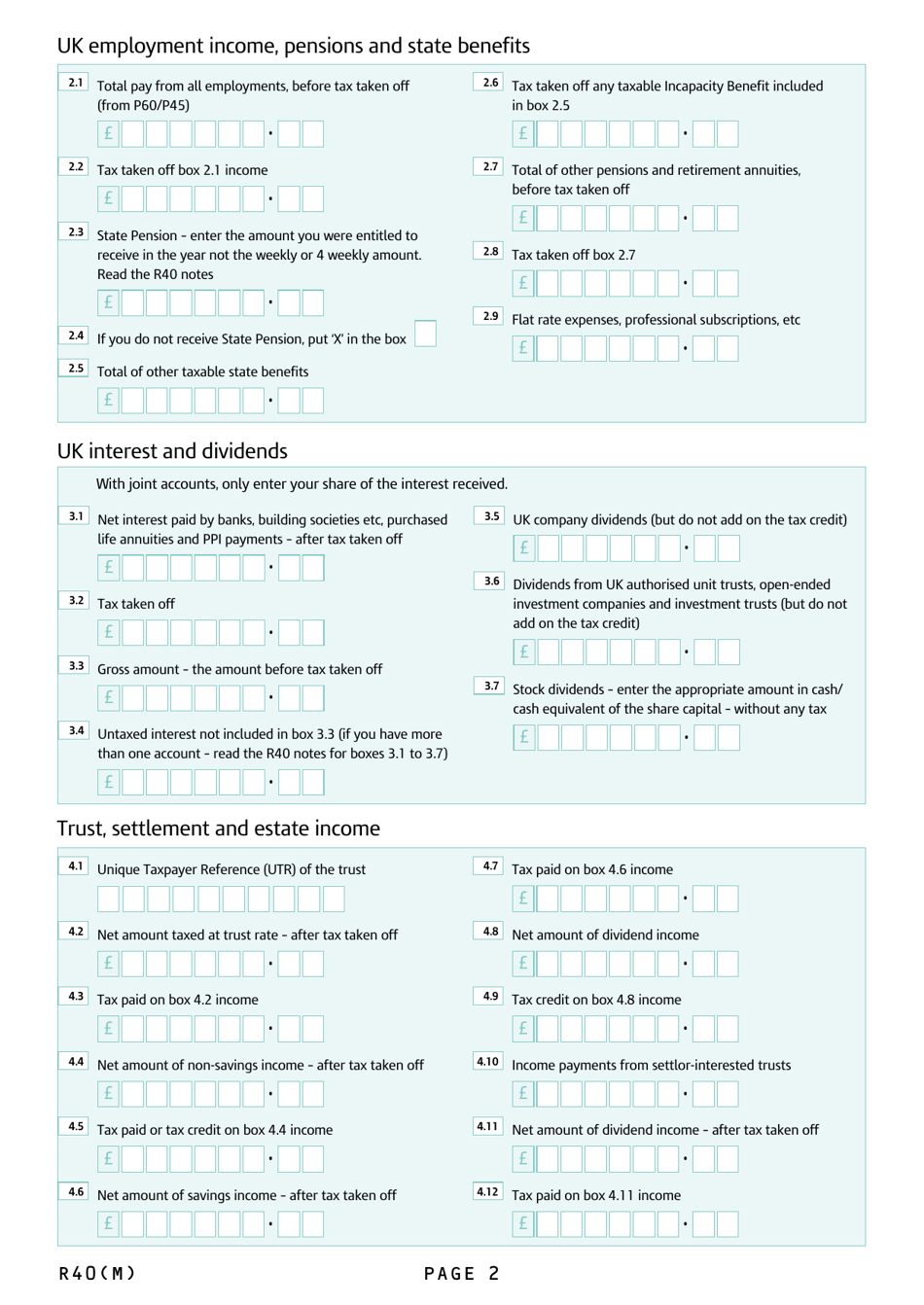

Hmrc Tax Rebate Form R40 Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

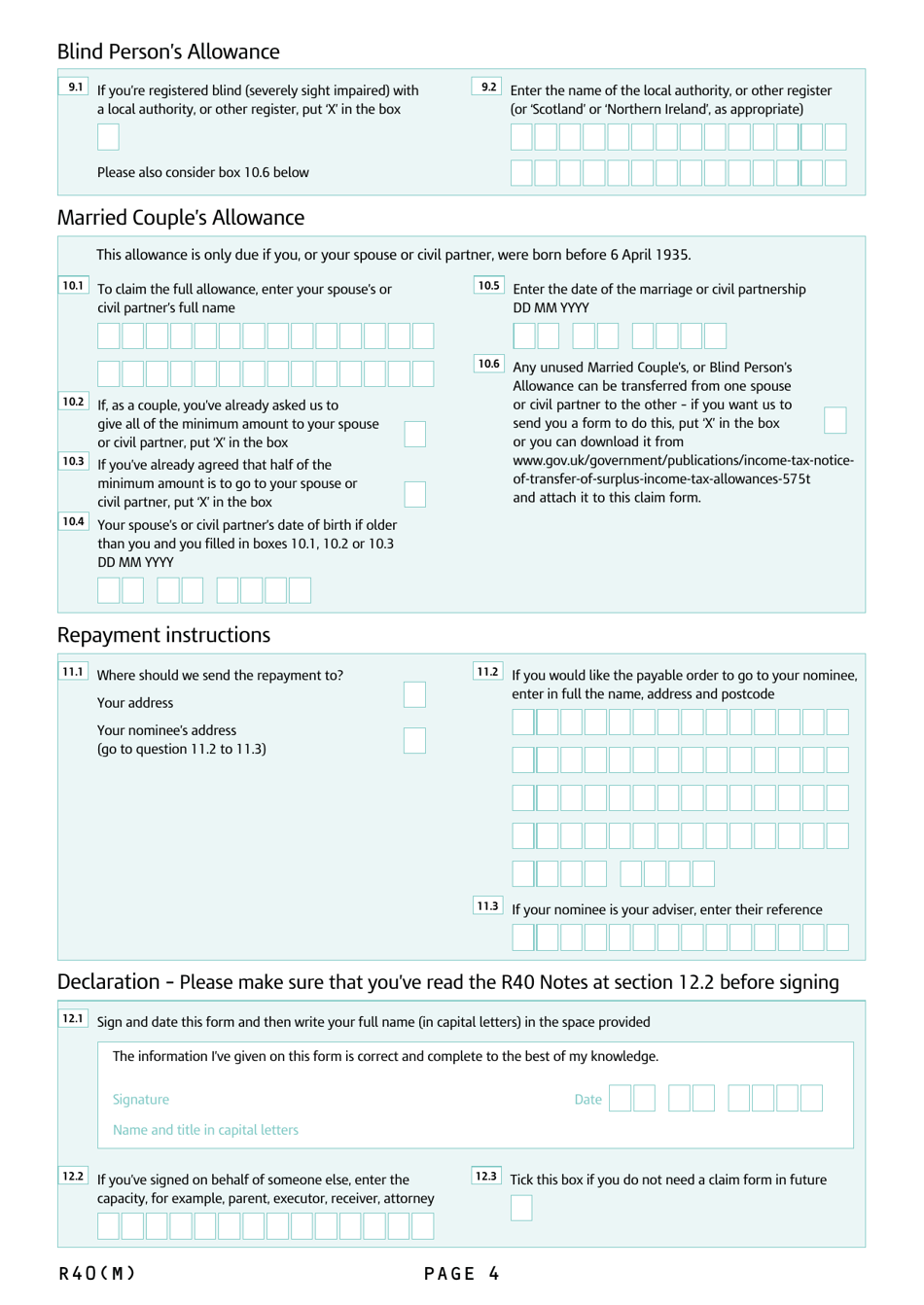

Web 163 2 8 ink and capital letters 11 1 If you would like the payable order to go building society or any other nominee address and postcode I R OB A N K to your bank enter their name Web HM Revenue and Customs BX9 1ZR United Kingdom Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier

Hmrc Tax Rebate Form R40

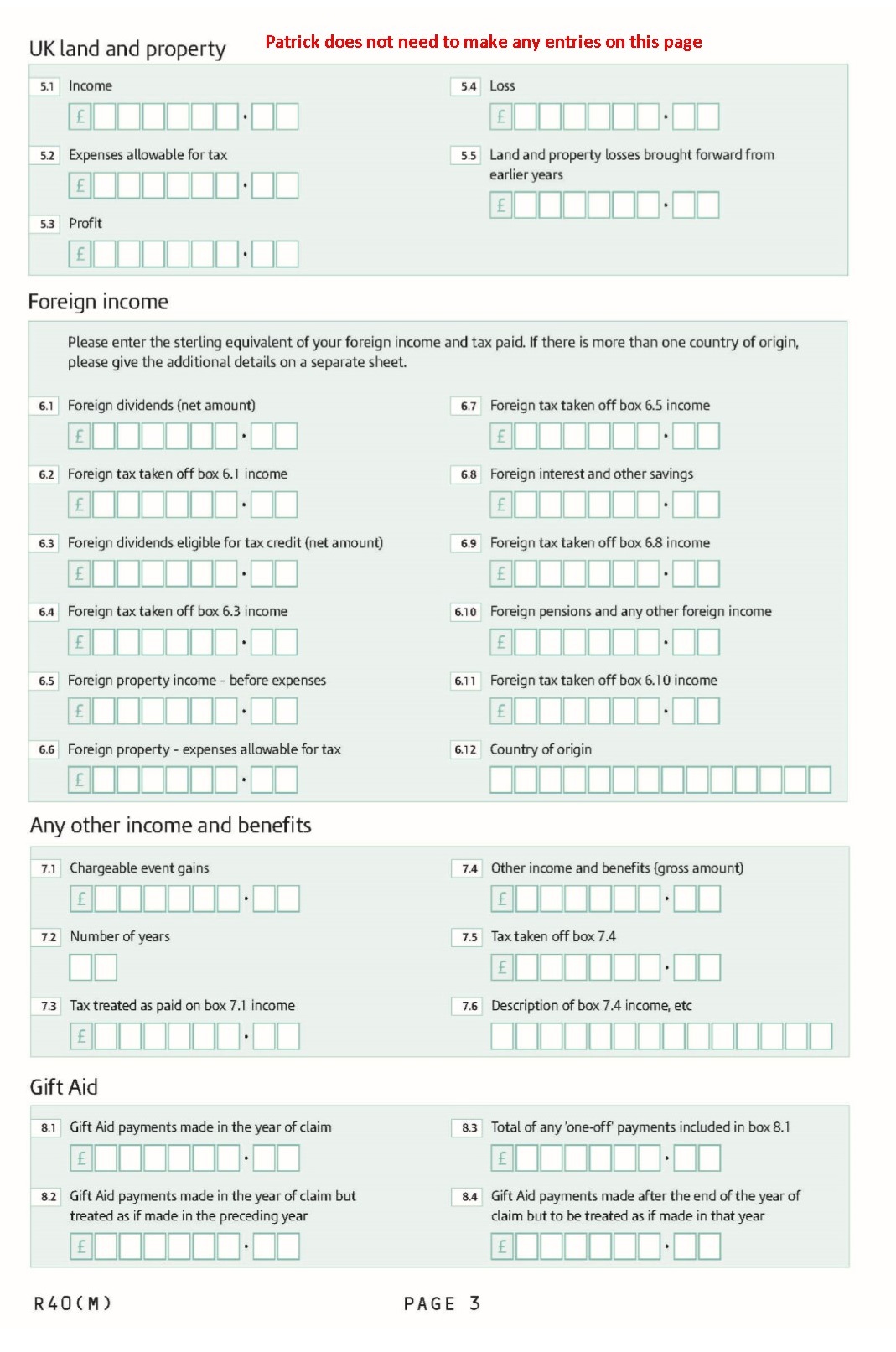

Hmrc Tax Rebate Form R40

https://www.litrg.org.uk/sites/default/files/files/R40_annotated_form_Page_1.jpg

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

http://www.litrg.org.uk/sites/default/files/files/R40 1.5.jpg

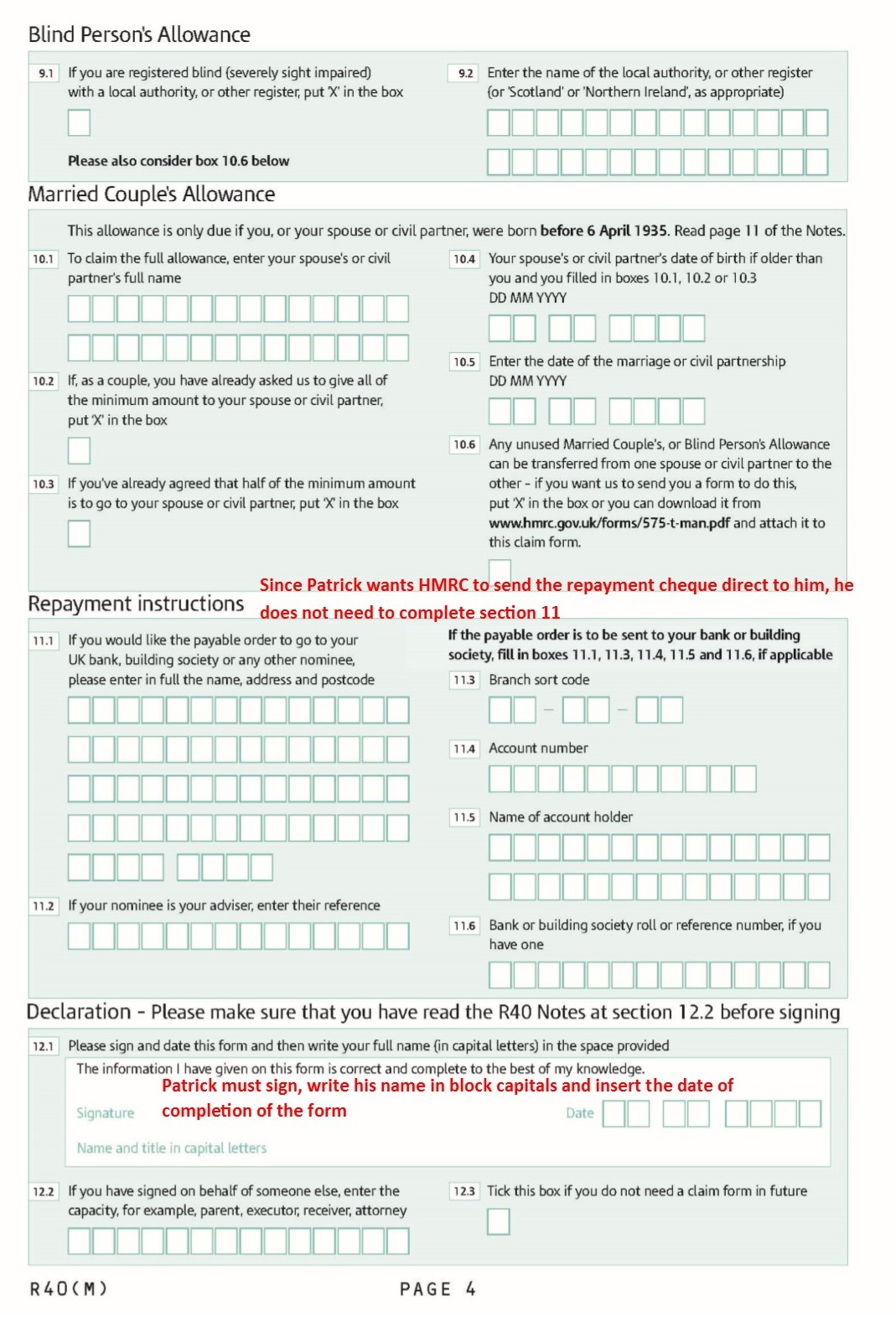

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_M_2018 annotated form FINAL_Page_1.jpg

Web 19 nov 2014 nbsp 0183 32 1 March 2018 Form Claim a tax refund if you re a non resident merchant seafarer 22 April 2020 Form Claim an Income Tax refund 15 August 2014 Form Claim Web 3 avr 2023 nbsp 0183 32 As we are in 2023 24 you can make a claim going back to the 2019 20 tax year It is possible to use the form to claim a repayment of tax relating to the current tax year known as an interim claim if you know

Web 6 juin 2023 nbsp 0183 32 Work out the tax year you re claiming for for example the current tax year and the last 4 tax years Check what UK income you have like UK property UK Web 1 janv 2014 nbsp 0183 32 HM Revenue and Customs HMRC forms and associated guides notes helpsheets and supplementary pages

Download Hmrc Tax Rebate Form R40

More picture related to Hmrc Tax Rebate Form R40

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

https://data.templateroller.com/pdf_docs_html/2117/21170/2117038/form-r40-claim-for-repayment-of-tax-deducted-from-savings-and-investments-united-kingdom_big.png

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_M_2018 annotated form FINAL_Page_2.jpg

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_M_2018%20annotated%20form%20FINAL_Page_3.jpg

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the Web 0300 200 3610 from outside the UK phone 44 161 930 8331 or go to www hmrc gov uk Claim for repayment of tax deducted from savings and investments If not already shown

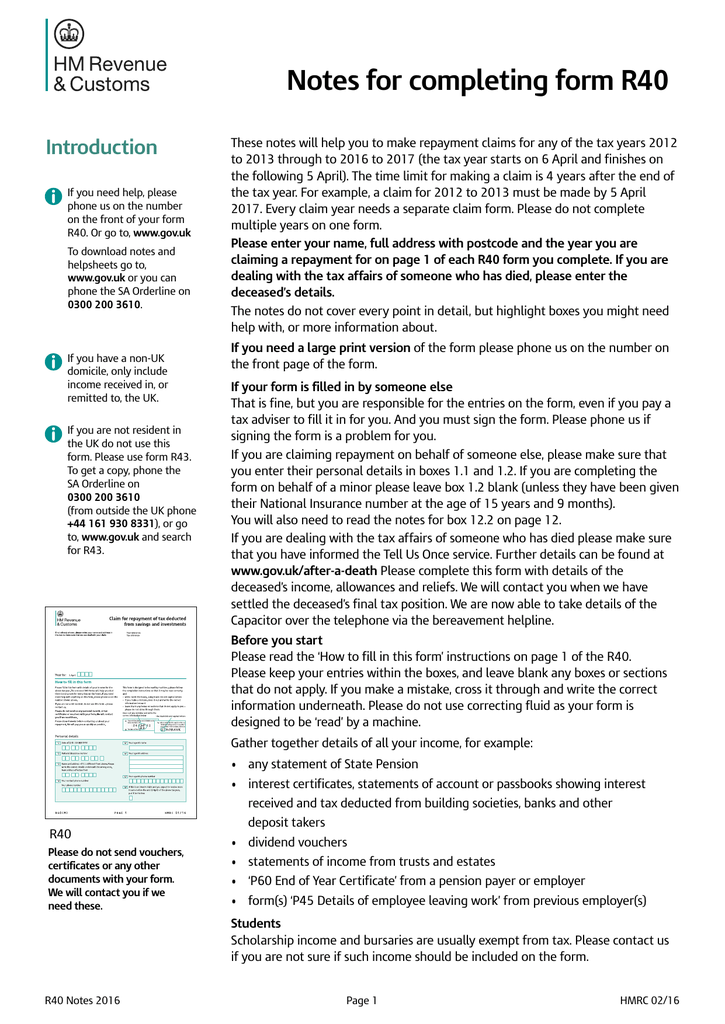

Web Notes for completing form R40 These notes will help you complete the form R40 You need to complete a separate claim for each tax year The tax year starts on 6 April and Web 15 ao 251 t 2014 nbsp 0183 32 Claim a tax refund if you ve overpaid tax You can also use this form to authorise a representative to get the payment on your behalf From HM Revenue amp

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

https://www.litrg.org.uk/sites/default/files/files/R40_annotated_form_Page_4.jpg

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

http://www.litrg.org.uk/sites/default/files/files/R40 2.1.jpg

https://assets.publishing.service.gov.uk/.../file/1172652/R40…

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

https://assets.publishing.service.gov.uk/.../R40_M__internet_…

Web 163 2 8 ink and capital letters 11 1 If you would like the payable order to go building society or any other nominee address and postcode I R OB A N K to your bank enter their name

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Notes For Completing Form R40

R40 Form Fill Online Printable Fillable Blank PDFfiller

R40 Notes Notes For Completing Form R40

R40 Notes Notes For Completing Form R40

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

If A Lender Took Tax Off A Refund Reclaim Some Using The R40 Form

Hmrc Tax Rebate Form R40 - Web 21 nov 2020 nbsp 0183 32 YouTube 0 00 4 50 How to successfully complete the UK GOV PPI TAX R40 Refund claim form Walk thru online TAX return fred gaskit 265 subscribers