Hmrc Tax Rebate On Ppi Web 27 avr 2023 nbsp 0183 32 The tax is then passed to HMRC on your behalf How do I claim back the tax on my PPI pay out You can make a claim for a tax repayment on your PPI interest using form R40 or form R43 if you are

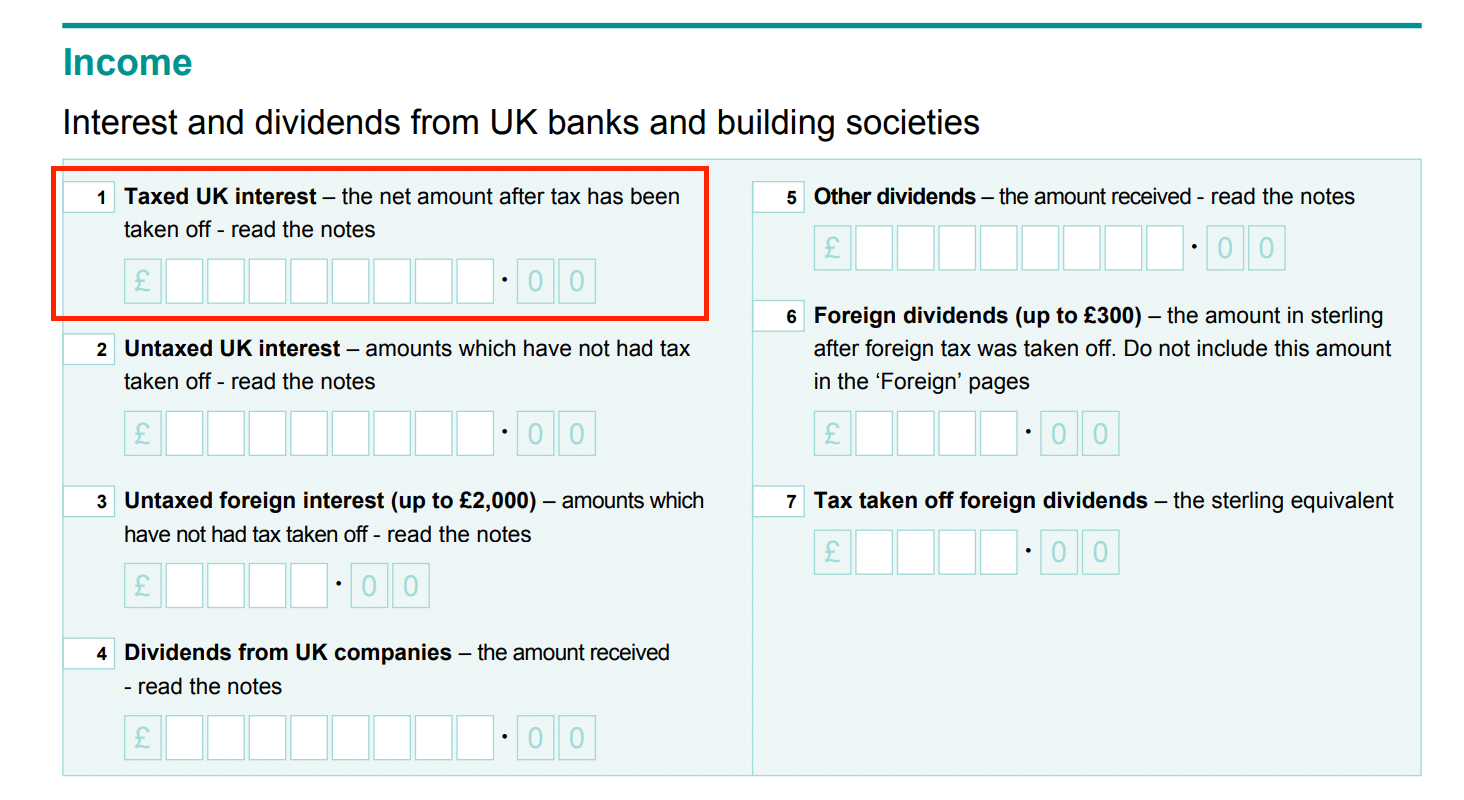

Web 3 avr 2023 nbsp 0183 32 Resources Trying to fill out an R40 to claim back tax deducted from PPI payouts and savings and investments We provide an annotated example to help illustrate how to complete the form You can use form Web The 8 interest paid by the firm will be taxable on the customer and it must be declared to HMRC or included in a self assessment tax return The following pages give examples of

Hmrc Tax Rebate On Ppi

Hmrc Tax Rebate On Ppi

https://static.wixstatic.com/media/a2fe96_fa523be98a3f49d3b750e8e1ca4700c3~mv2.png/v1/fill/w_600,h_320,al_c,q_85,enc_auto/a2fe96_fa523be98a3f49d3b750e8e1ca4700c3~mv2.png

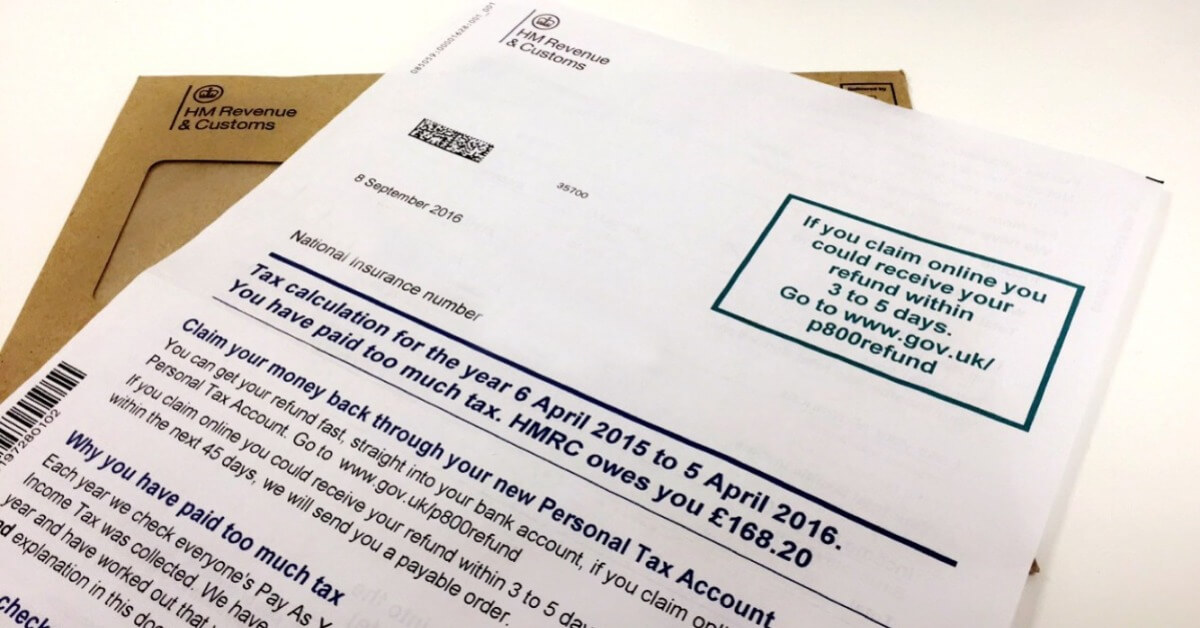

How To Claim and Increase Your P800 Refund Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/P800_Calculation.jpeg

Can I Claim Ppi Back From My Catalogue

http://ambertax.com/wp-content/uploads/P60-form-1.jpg

Web You could be eligible for a tax refund on your PPI payout without even realising it If you have received a payment protection insurance PPI payout you may be entitled to a tax Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return From HM Revenue amp Customs

Web 3 nov 2021 nbsp 0183 32 Tax is deducted at the basic 20 rate so for every 163 100 of statutory interest you earn you pay 163 20 in tax How to claim the tax back If you believe you are due tax Web 30 mars 2022 nbsp 0183 32 In December my neighbour was notified by HM Revenue and Customs that she was entitled to a rebate of 163 324 for the tax year 2020 2021 and that a cheque was

Download Hmrc Tax Rebate On Ppi

More picture related to Hmrc Tax Rebate On Ppi

HMRC PPI Refund Of Tax Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2022/07/tax-refund-hmrc.jpg

Hmrc Tool Tax Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form-768x731.png

Claim Your PPI Tax Rebate Your Claim Matters

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/07/women-with-banner-1-1536x1466.jpg

Web 3 f 233 vr 2023 nbsp 0183 32 What is Form R40 PPI The R40 form PPI is a form used by individuals in the UK to claim tax relief or tax repayment for overpaid tax on savings and investment income The form is used specifically for Web HMRC allow you to make a PPI tax rebate claim for the last four tax years If you miss the four year deadline you will miss out on the tax rebate due from your PPI refund For a

Web HMRC explains that most lenders deduct at the rate of 20 from the 8 interest and send that tax onto HMRC The 8 interest sum would be labelled interest gross and interest Web 6 juin 2023 nbsp 0183 32 Guidance Claim personal allowances and tax refunds if you live abroad How to claim a refund on tax and personal allowances on UK income if you re not resident in

HMRC PPI Tax Refund In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/08/8-min-768x216.jpg

Your PPI Tax Rebate

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=107920998964241

https://www.litrg.org.uk/tax-guides/tax-basics/…

Web 27 avr 2023 nbsp 0183 32 The tax is then passed to HMRC on your behalf How do I claim back the tax on my PPI pay out You can make a claim for a tax repayment on your PPI interest using form R40 or form R43 if you are

https://www.litrg.org.uk/resources/annotated-f…

Web 3 avr 2023 nbsp 0183 32 Resources Trying to fill out an R40 to claim back tax deducted from PPI payouts and savings and investments We provide an annotated example to help illustrate how to complete the form You can use form

Tax Rebate Calculator Hmrc CALCULATORUK FTE

HMRC PPI Tax Refund In UK EmployeeTax

How To Declare A PPI Refund On Your Tax Return PPI Rebates

PPI Tax Rebate YouTube

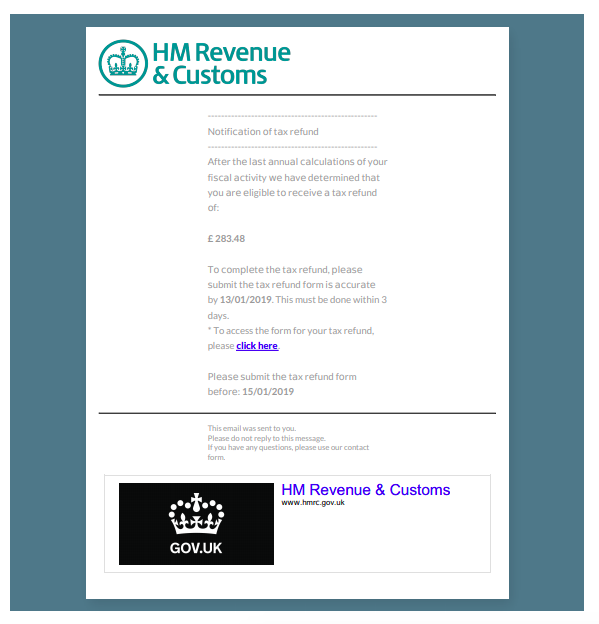

Watch Out For HMRC Tax Rebate Phishing Scams Wandera

Claim A Tax Rebate Using The Free HMRC App

Claim A Tax Rebate Using The Free HMRC App

Tool Tax Rebate HMRC How To Claim For Mechanics Trades

HMRC

Forms

Hmrc Tax Rebate On Ppi - Web 30 mars 2022 nbsp 0183 32 In December my neighbour was notified by HM Revenue and Customs that she was entitled to a rebate of 163 324 for the tax year 2020 2021 and that a cheque was