Hmrc Tax Return Contact Number Monday to Friday 8am to 8pm Saturday 8am to 4pm Closed on Sundays and bank holidays Phone Call HMRC for help with questions about Income Tax and Class 4 National Insurance including

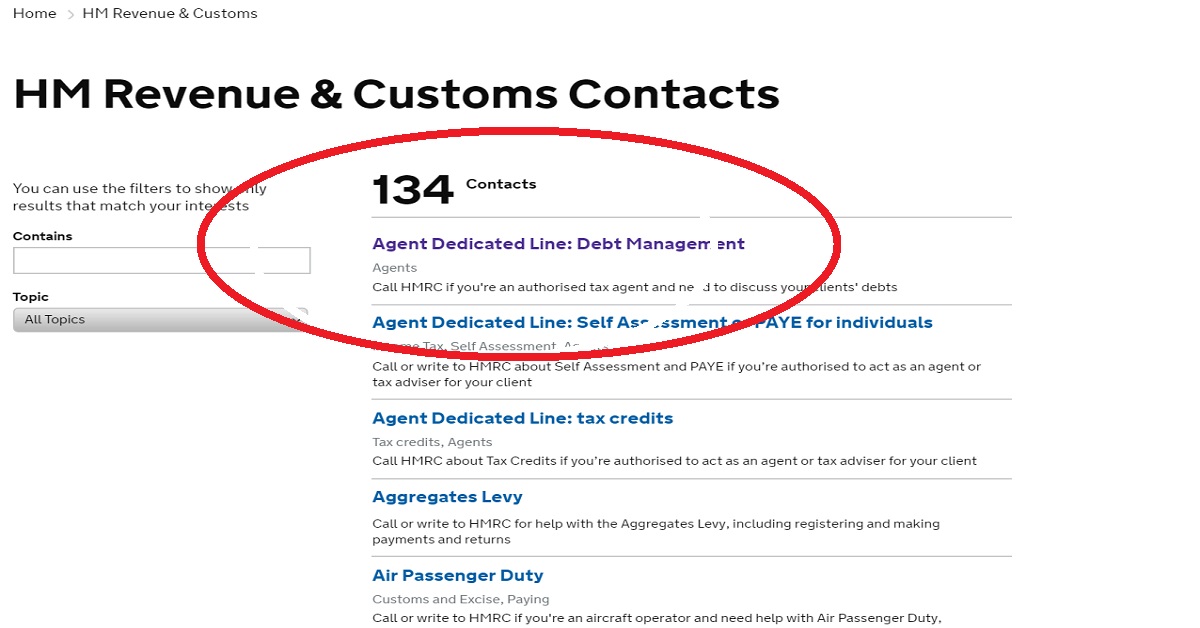

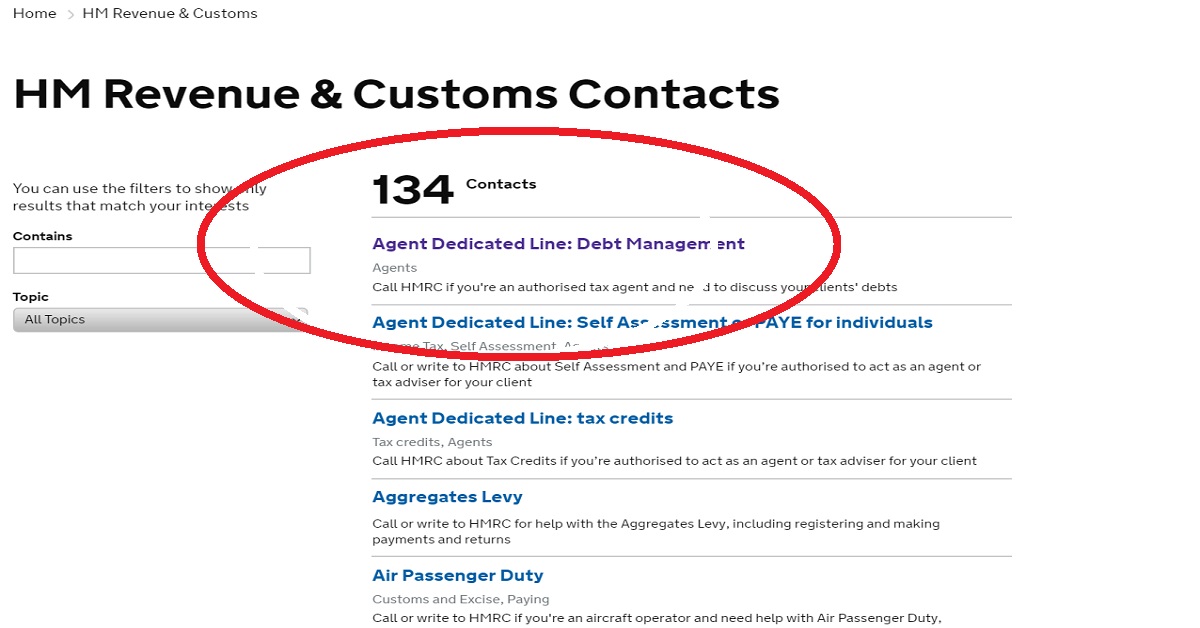

Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 VAT general enquiries 0300 200 3700 Tax Credits helpline 0345 300 3900 Join the faculty Latest tax news A list of regularly used HMRC contact information including telephone numbers online contact options and postal addresses together with a number of tips This information will help direct tax agents to the appropriate point of contact within HMRC

Hmrc Tax Return Contact Number

Hmrc Tax Return Contact Number

https://www.signnow.com/preview/560/820/560820246/large.png

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

Are You Looking For HMRC Self assessment Contact Number Regarding Help

https://i.pinimg.com/originals/34/29/12/34291290ab6124c0d0b447a5f1fd2562.png

Contacting the HM Revenue Customs Income Tax Office by phone or in writing The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain Fortunately you can still speak to HMRC by phone live chat or post In this guide we ll cover everything you need to know about contacting HMRC including phone numbers email addresses and postal addresses as well as alternative means of contact or finding the answers to your questions

What s the guide Do I need to fill in a Self Assessment tax return How to register for a Self Assessment tax return What are the Self Assessment deadlines What information will I need to fill in a Self Assessment tax return How to fill in a Self Assessment tax return How to complete the supplementary pages of a Self Assessment tax return Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my experience Before you

Download Hmrc Tax Return Contact Number

More picture related to Hmrc Tax Return Contact Number

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

Exp Code On Invoice Hybridlasopa

https://i2.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/HMRC-UTR-Number.jpg

How To Print Your SA302 Or Tax Year Overview From HMRC Love

https://www.loveaccountancy.co.uk/wp-content/uploads/2017/10/Screen_Shot_2017-10-11_at_18_12_37.png

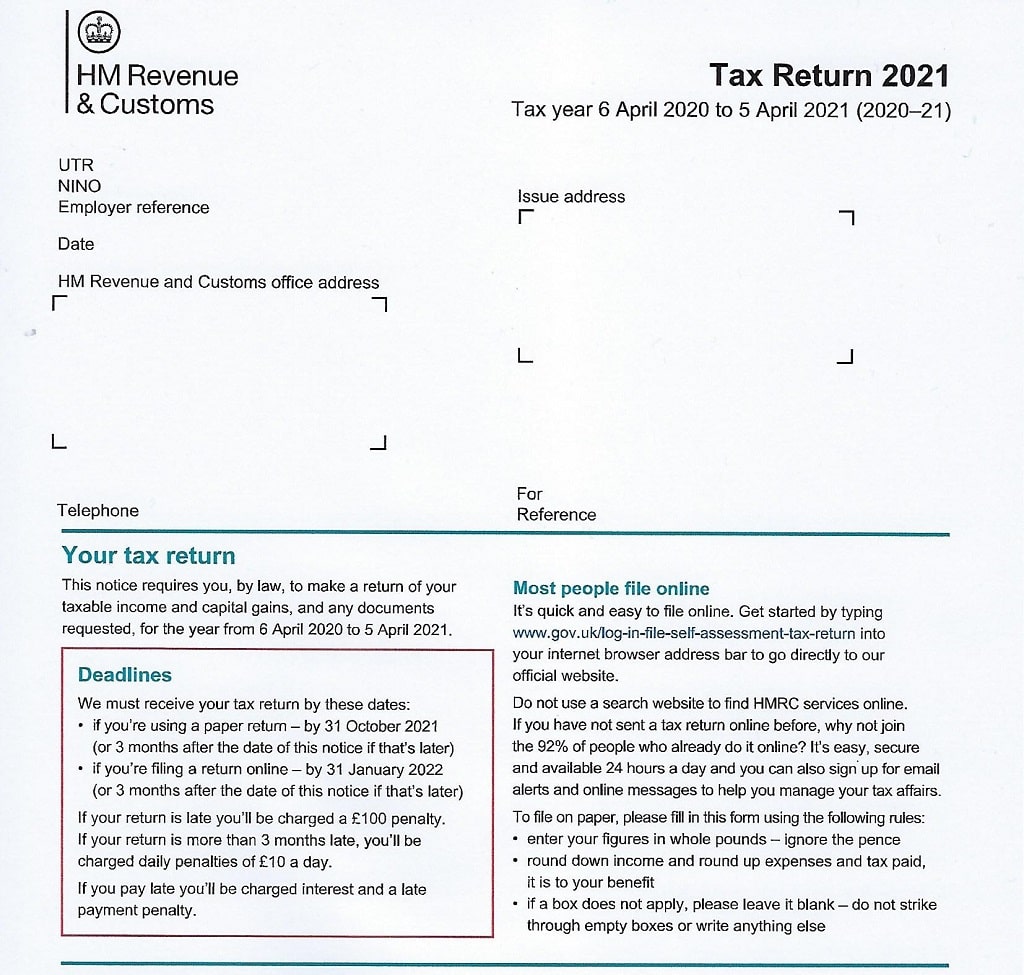

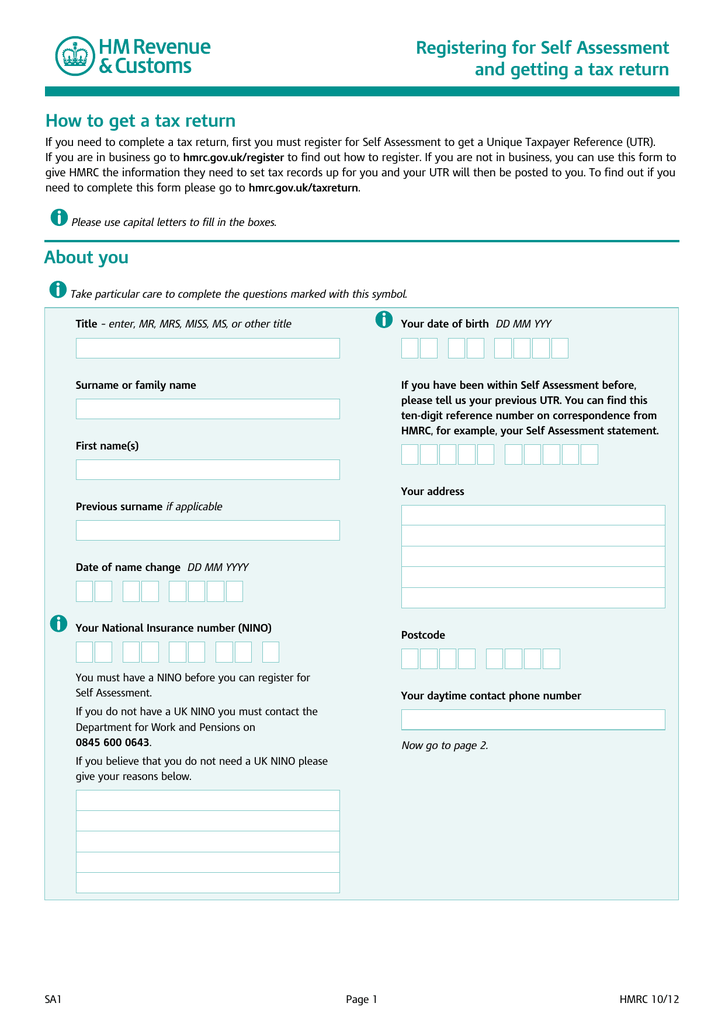

Short Tax Return notes Tax year 6 April 2021 to 5 April 2022 2021 22 SA211 Notes 2021 22 Page 1 HMRC 12 21 Help with filling in your tax return These notes will help you fill in your paper Short Tax Return Alternatively why not send us your tax return online By sending it in online it s a convenient 24 hour service 0300 200 3300 0300 200 3319 textphone or 44 135 535 9022 outside UK VAT If you don t know your Flat Rates from your Standard Rates our VAT article can have you up to speed in no time If you need to discuss registering or de registering with HMRC the numbers are 0300 200 3700 0300 200 3719 textphone or 44 2920 501

Mr Slokan who helps advise his clients with their tax needs says the best time to call is 8am when the lines open He warns that delaying this by even an hour and calling at 9am could leave you The main telephone number is HMRC s tax credit helpline 0345 300 3900 There is also NGT text relay if you cannot hear or speak on the phone dial 18001 then 0345 300 3900 From abroad you can ring 44 2890 538 192 You will normally be asked for your national insurance number

HMRC Customer Service Contact Numbers Tax Helpline 0300 200 3300

https://customerservicecontactnumber.uk/wp-content/uploads/2016/08/hmrc-contact-page.jpg

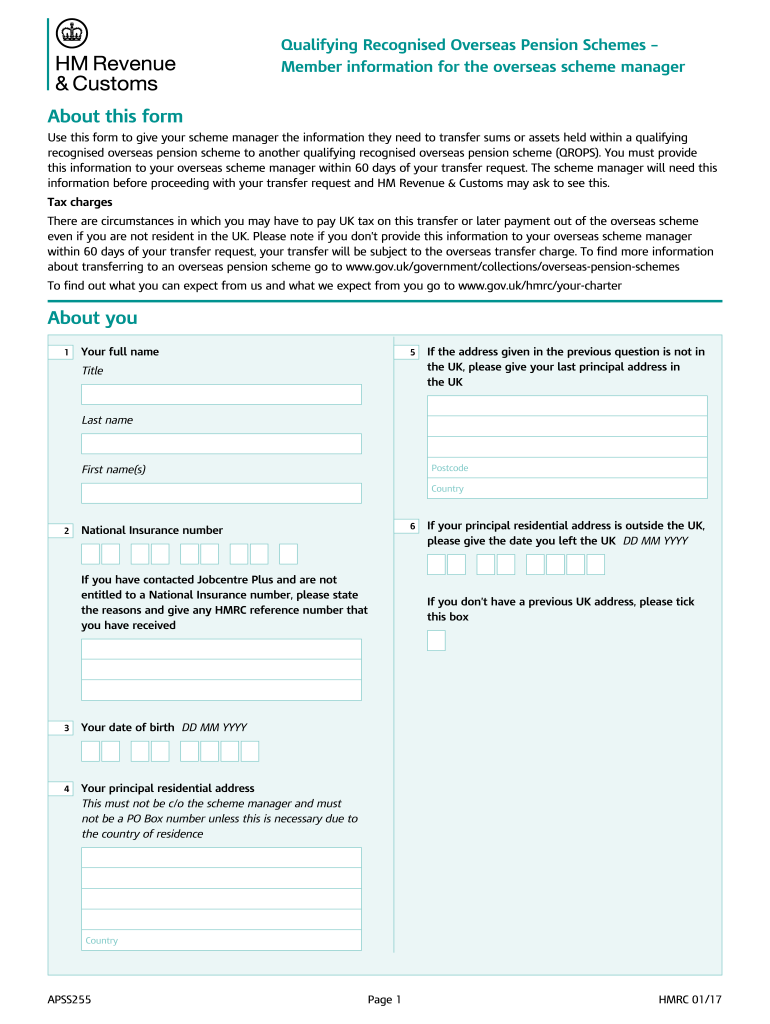

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

https://www.iexpats.com/wp-content/uploads/2015/11/HMRC.jpg

https://www.gov.uk/government/organisations/hm...

Monday to Friday 8am to 8pm Saturday 8am to 4pm Closed on Sundays and bank holidays Phone Call HMRC for help with questions about Income Tax and Class 4 National Insurance including

https://www.lovemoney.com/guides/55286

Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 VAT general enquiries 0300 200 3700 Tax Credits helpline 0345 300 3900

HMRC R D Compliance Check Eligibility Nudge Letters

HMRC Customer Service Contact Numbers Tax Helpline 0300 200 3300

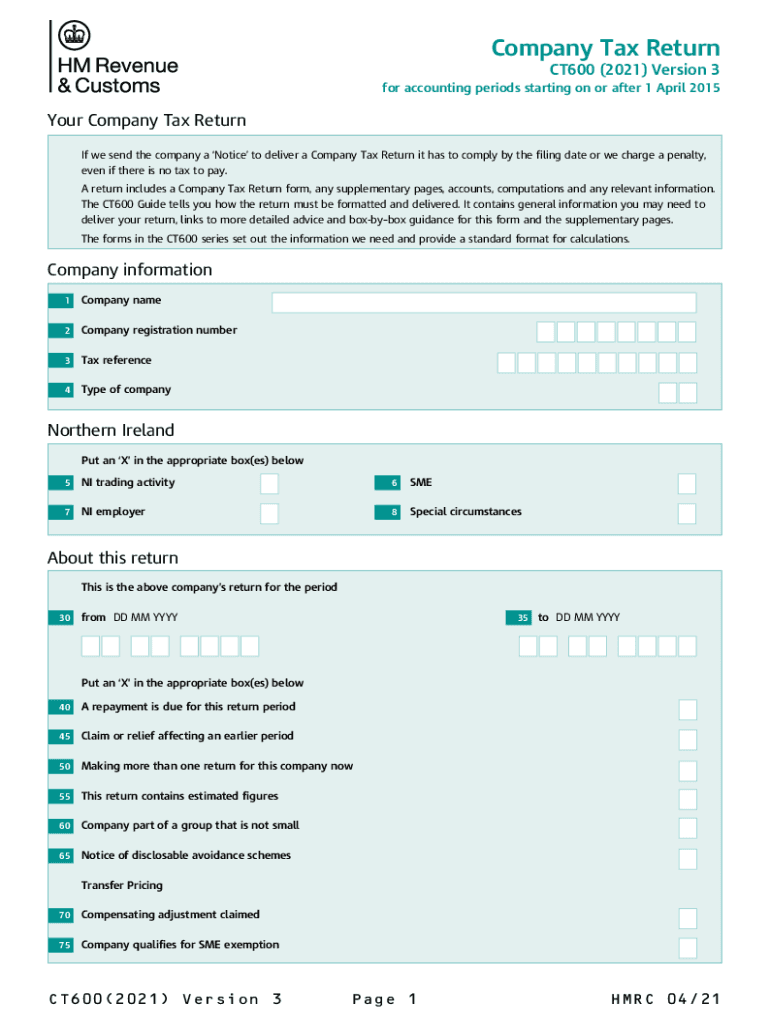

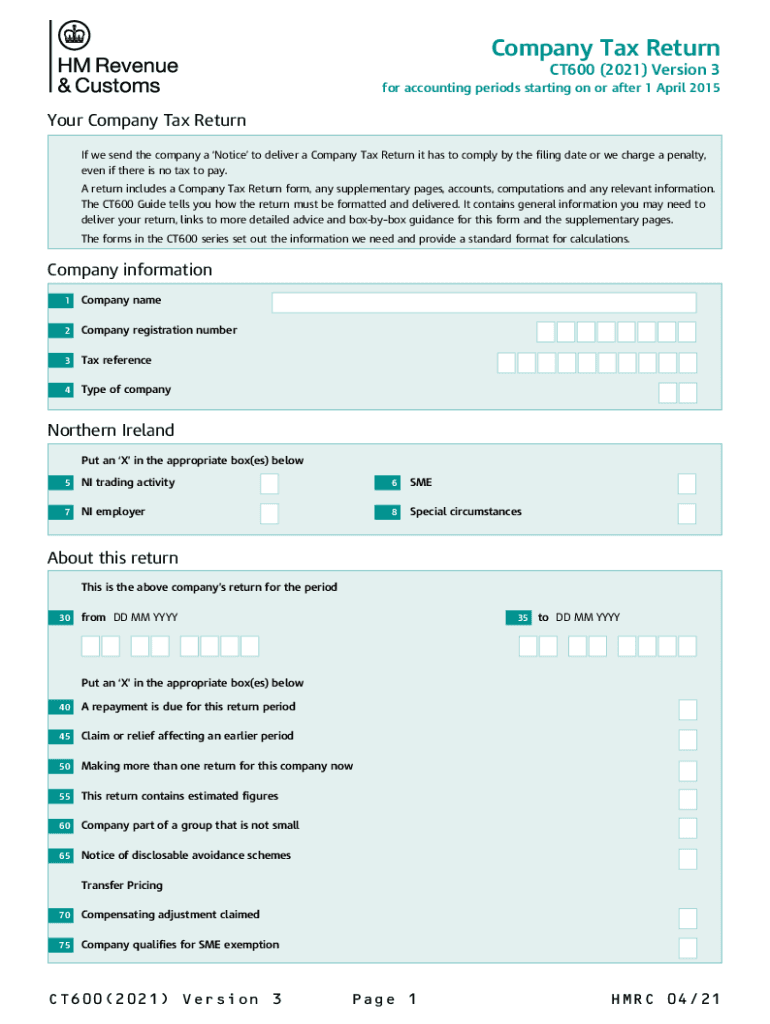

HMRC 2021 Paper Tax Return Form

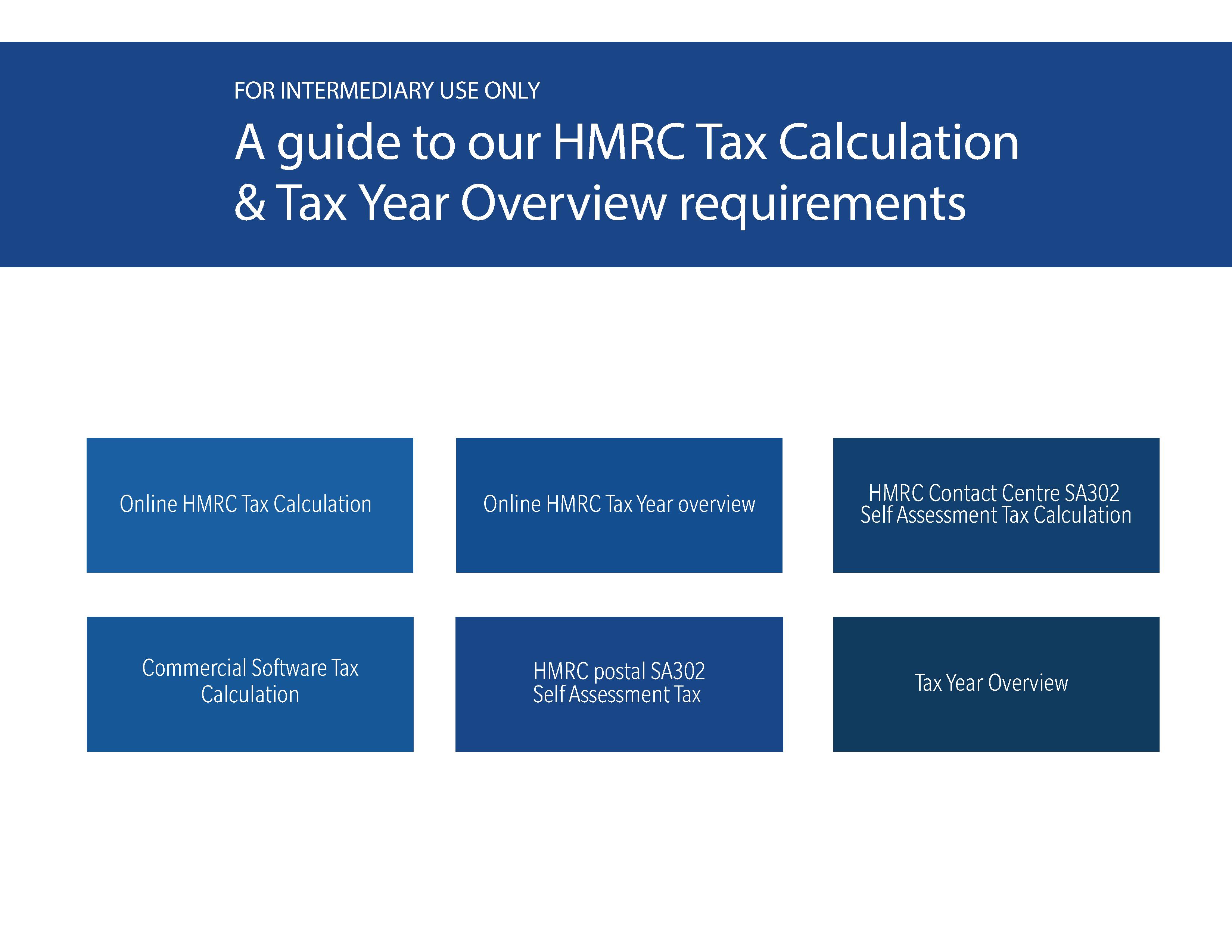

A Guide To Our HMRC Tax Calculation Tax Year Overview Requirements

C1603 Form Fill Out And Sign Printable PDF Template SignNow

2016 HMRC Tax Return Form

2016 HMRC Tax Return Form

Hmrc X Rates Management And Leadership

What Is A UTR Number And How Do I Get One GoSimpleTax

.jpg)

Self Assessment Tax Return

Hmrc Tax Return Contact Number - Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my experience Before you