Hmrc Tax Return Tracking You can now use the tool to check when you ll receive a reply to queries and requests about employers PAYE and National Insurance Child Benefit has been added to the list about when you can

Sign into or set up a personal tax account to check and manage HMRC records including Income Tax change of address Self Assessment and company car tax Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year return 4 weeks after you file a paper return Check your refund Information is updated once a

Hmrc Tax Return Tracking

Hmrc Tax Return Tracking

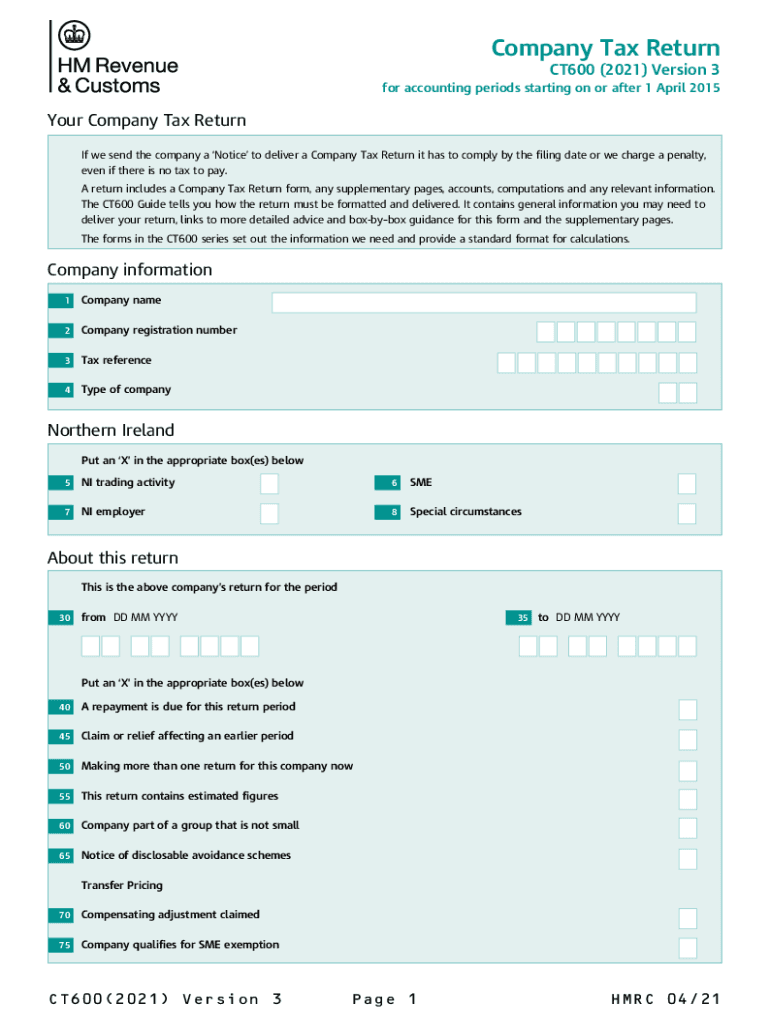

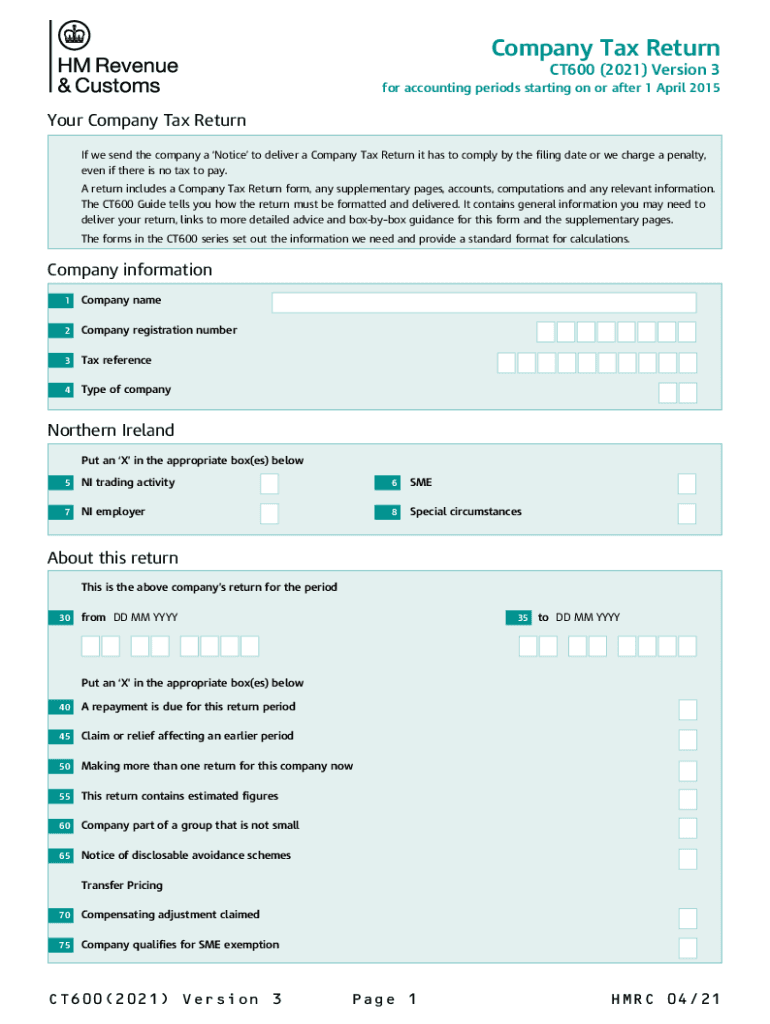

https://www.signnow.com/preview/560/820/560820246/large.png

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled.jpeg

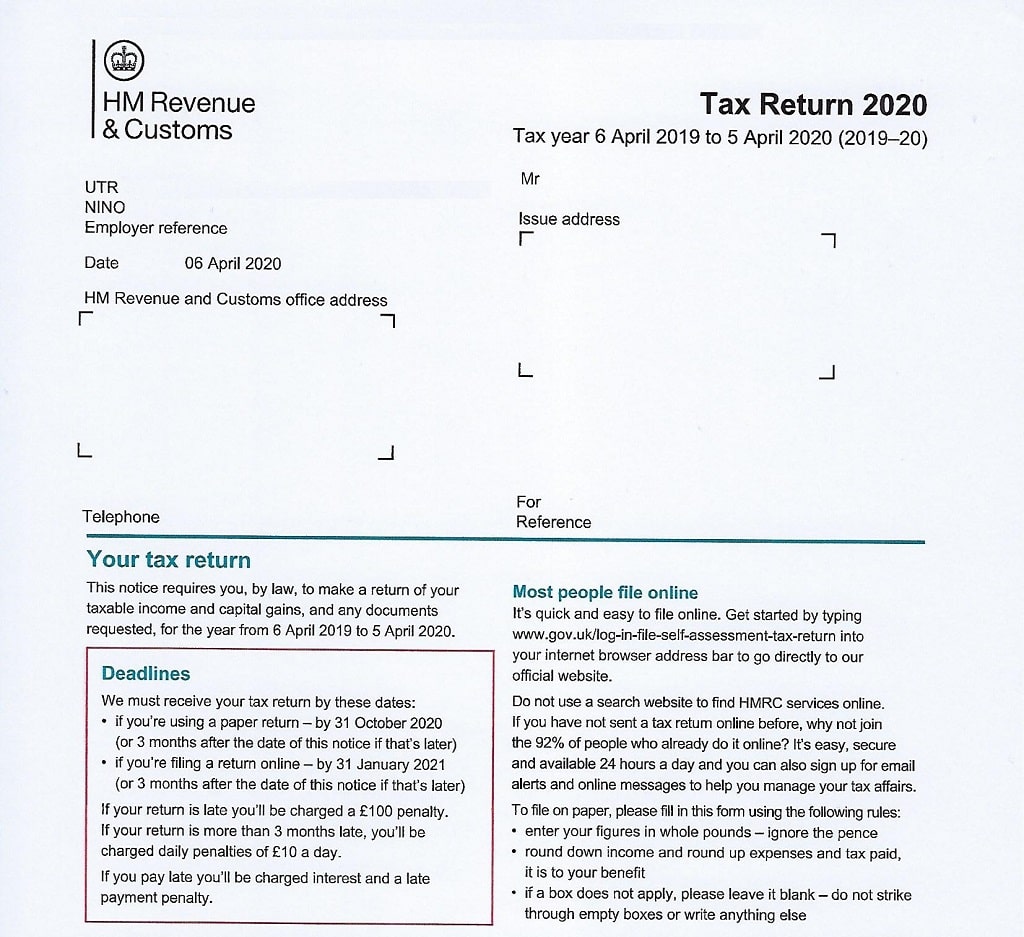

HMRC Self Assessment tax return SPICe Spotlight Solas Air SPICe

https://spice-spotlight.scot/wp-content/uploads/2016/02/hmrc_self_assessment_tax_return.jpg

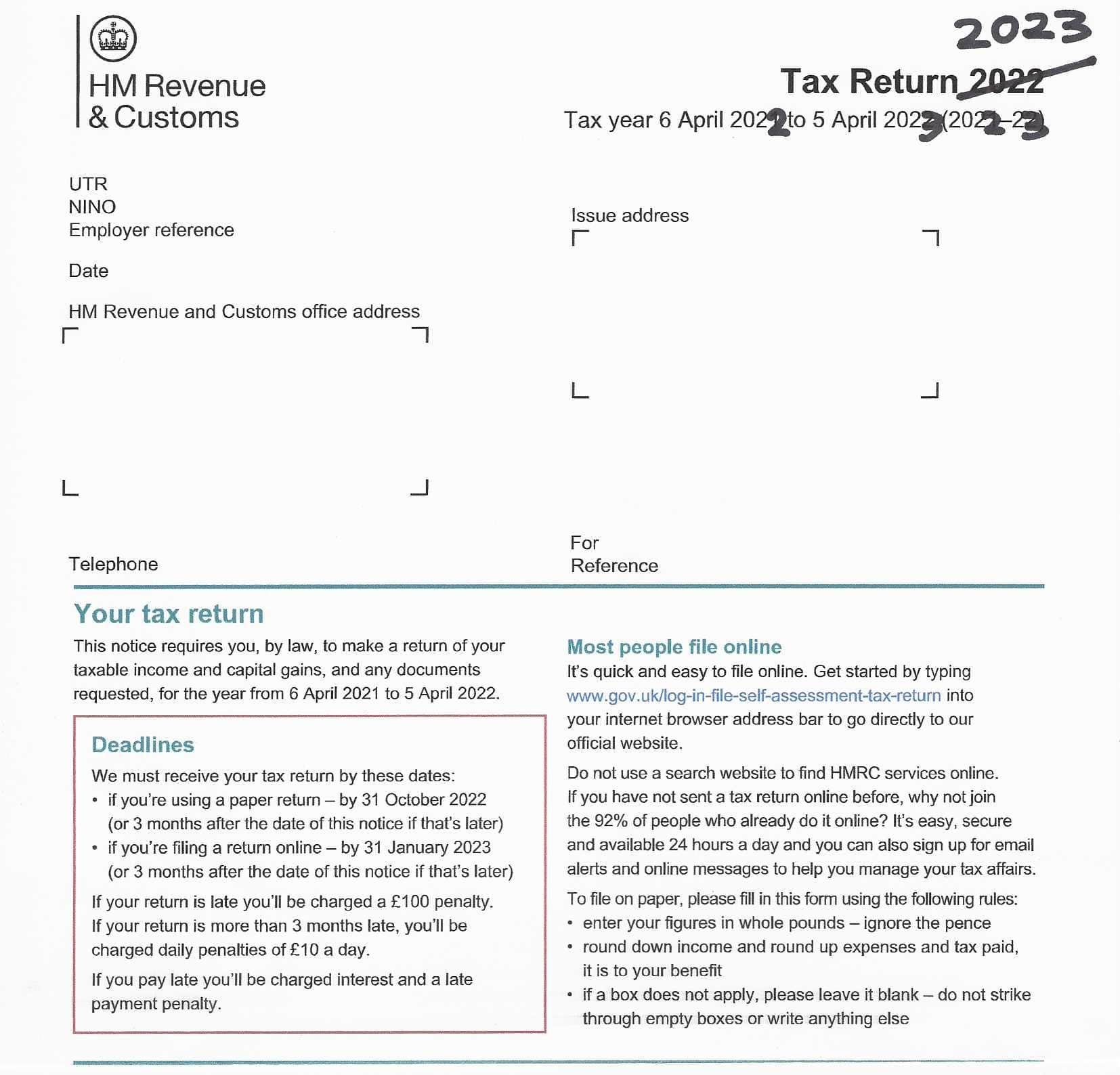

Currently HMRC are not reporting any delay to the processing of paper Self Assessment tax returns on their service dashboard At the moment the service dashboard says that all paper tax returns received before 31 October 2022 the paper filing deadline will be processed before 31 December 2022 Learn how to keep track of the status of your tax return once you have submitted it to HMRC And how to deal with post submission queries

1 Joining the dots At the heart of HMRC s counter evasion efforts lies a powerful computer program called Connect Launched in the summer of 2010 it sifts vast quantities of information Your first port of call to check the status of your refund is to phone 0300 200 3300 That s HMRC Lines are open from 8am 8pm Monday Friday and 8am 4pm Saturday Be prepared to give your name and address and your ten digit tax reference code if you re self employed

Download Hmrc Tax Return Tracking

More picture related to Hmrc Tax Return Tracking

HMRC No Longer Fining 100 For Late Tax Returns Market Business News

http://marketbusinessnews.com/wp-content/uploads/2015/02/HMRC.jpg

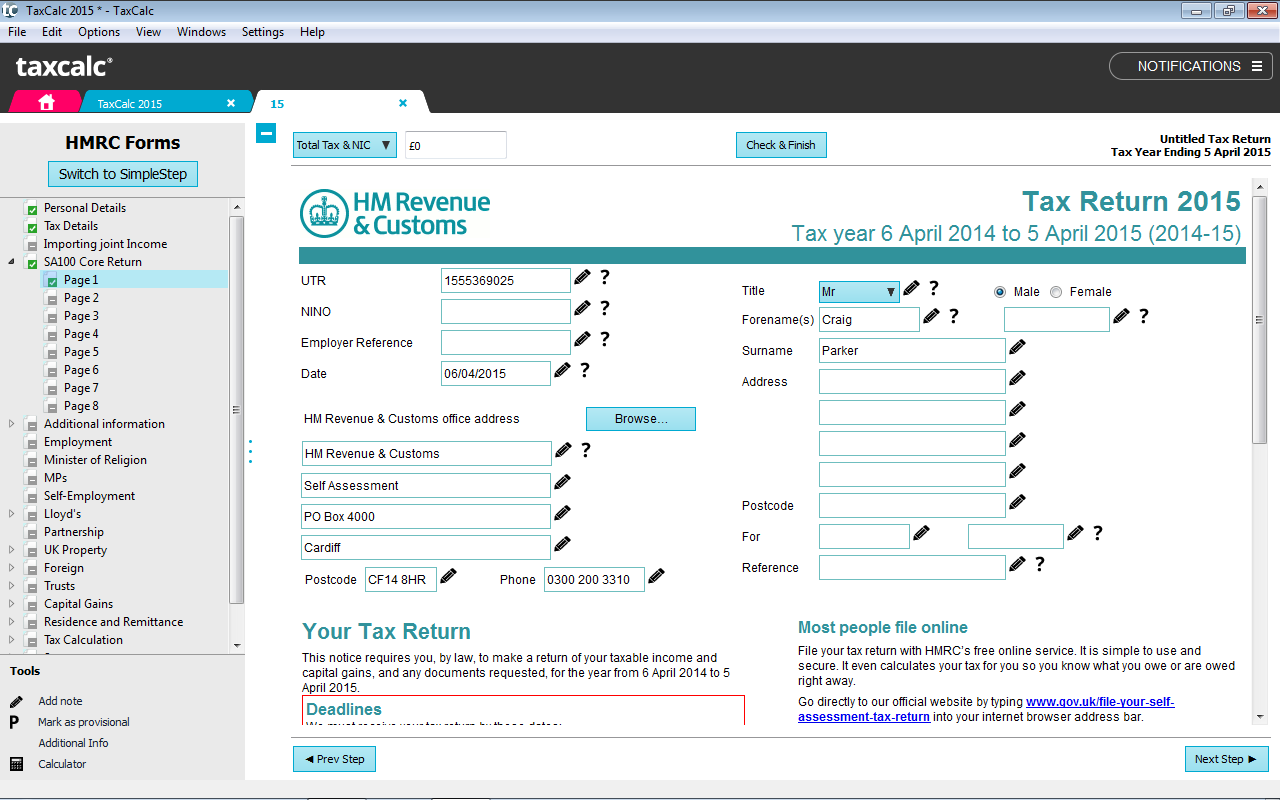

Online Tax Hmrc Online Tax Return

https://www.taxcalc.com/images/products/productScreenshots/Individual4.png

Trying To Locate The 2023 HMRC Paper Tax Return Form Online

https://taxhelp.uk.com/wp-content/uploads/Where-is-the-2023-HMRC-SA100-Tax-Return-Form-m.jpg

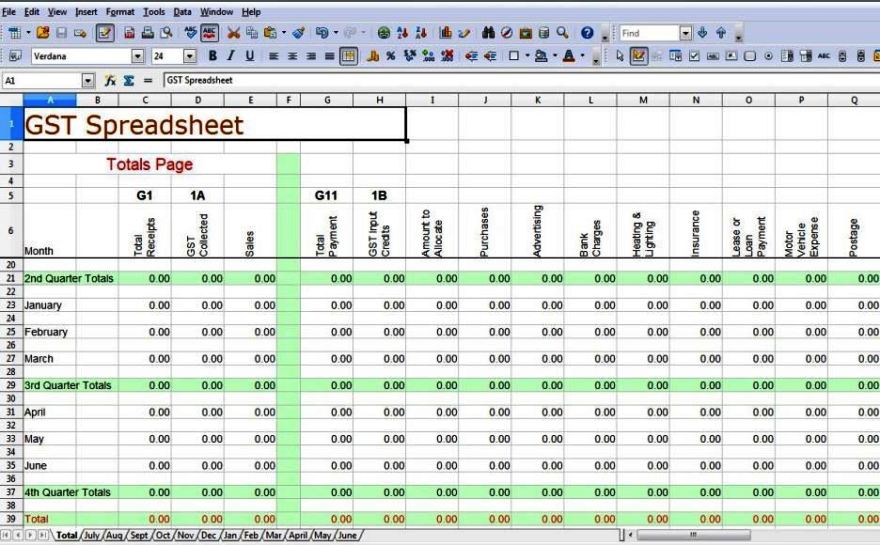

Making Tax Digital MTD involves keeping digital records of accounts and sending summaries to HMRC every quarter ie every three months instead of filing one final return annually You ll need to use HMRC approved software to do this if you re not sure which software to choose you can check the government guidance To check if you still need to fill in a tax return go to www gov uk check if you need a tax return If you do not need to fill in a return you must contact us by 31 January

If a taxpayer asserts as Mr Oddy does that returns have been posted in sufficient time for them to be received by HMRC by the due date this puts HMRC to proof that they have not been so received Introduction This guide gives you general advice about what records you need to keep for tax purposes and how long to keep them It gives some examples of typical records you may need if you re

Stock Photo HMRC Tax Return Paul Maguire

https://paulmaguirephoto.com/wp-content/uploads/2020/07/c40910-1024x683.jpg

HMRC TAx Investigations Call Us On 020 8168 1680 For Your FREE

https://maxproaccountants.co.uk/wp-content/uploads/2019/07/HMRC-TAx-Investigations.jpg

https://www.gov.uk/guidance/check-when-you-can...

You can now use the tool to check when you ll receive a reply to queries and requests about employers PAYE and National Insurance Child Benefit has been added to the list about when you can

https://www.gov.uk/personal-tax-account

Sign into or set up a personal tax account to check and manage HMRC records including Income Tax change of address Self Assessment and company car tax

H R BLOCK TAX RETURN PROGRAM FOR AT HOME On Mercari Tax Software Hr

Stock Photo HMRC Tax Return Paul Maguire

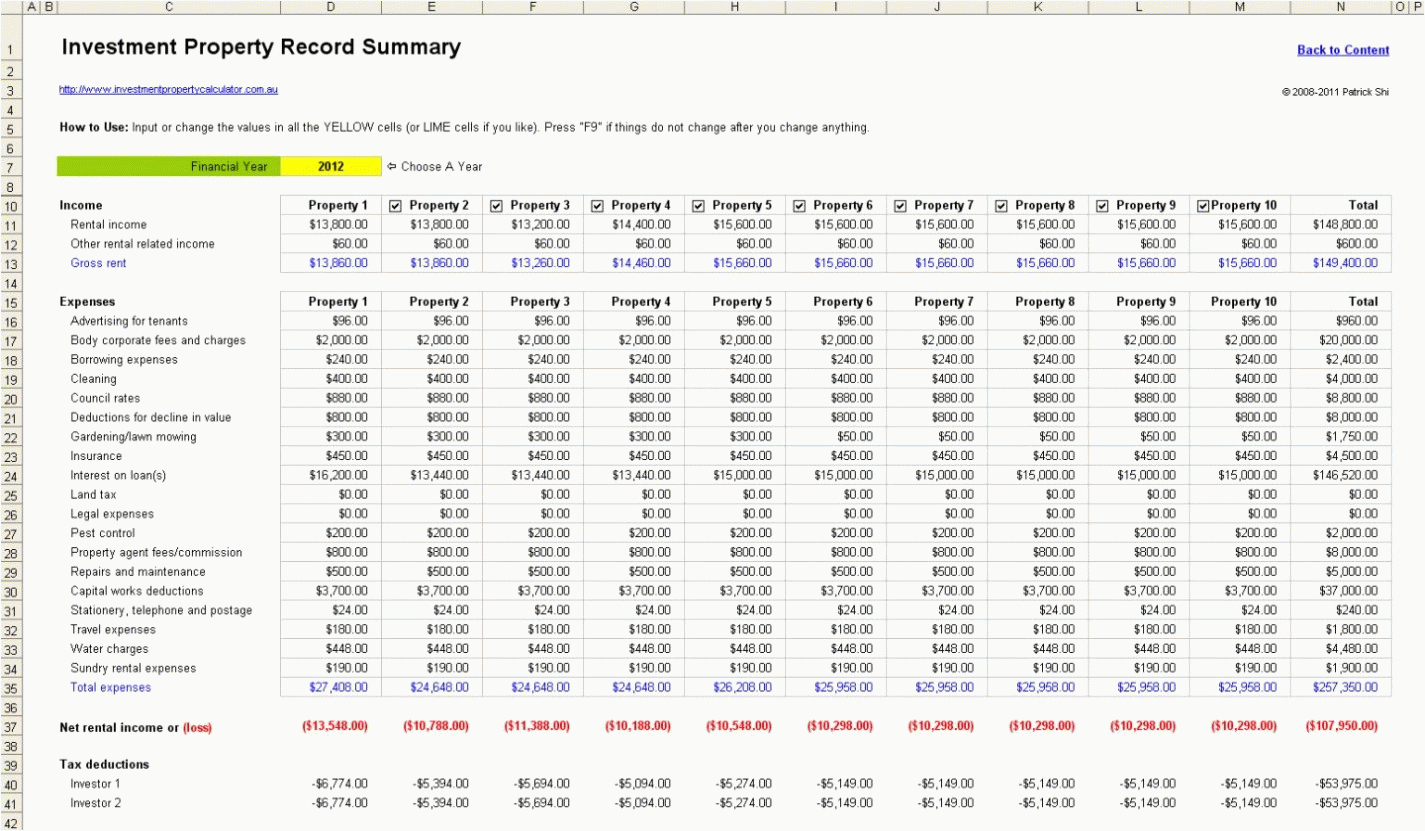

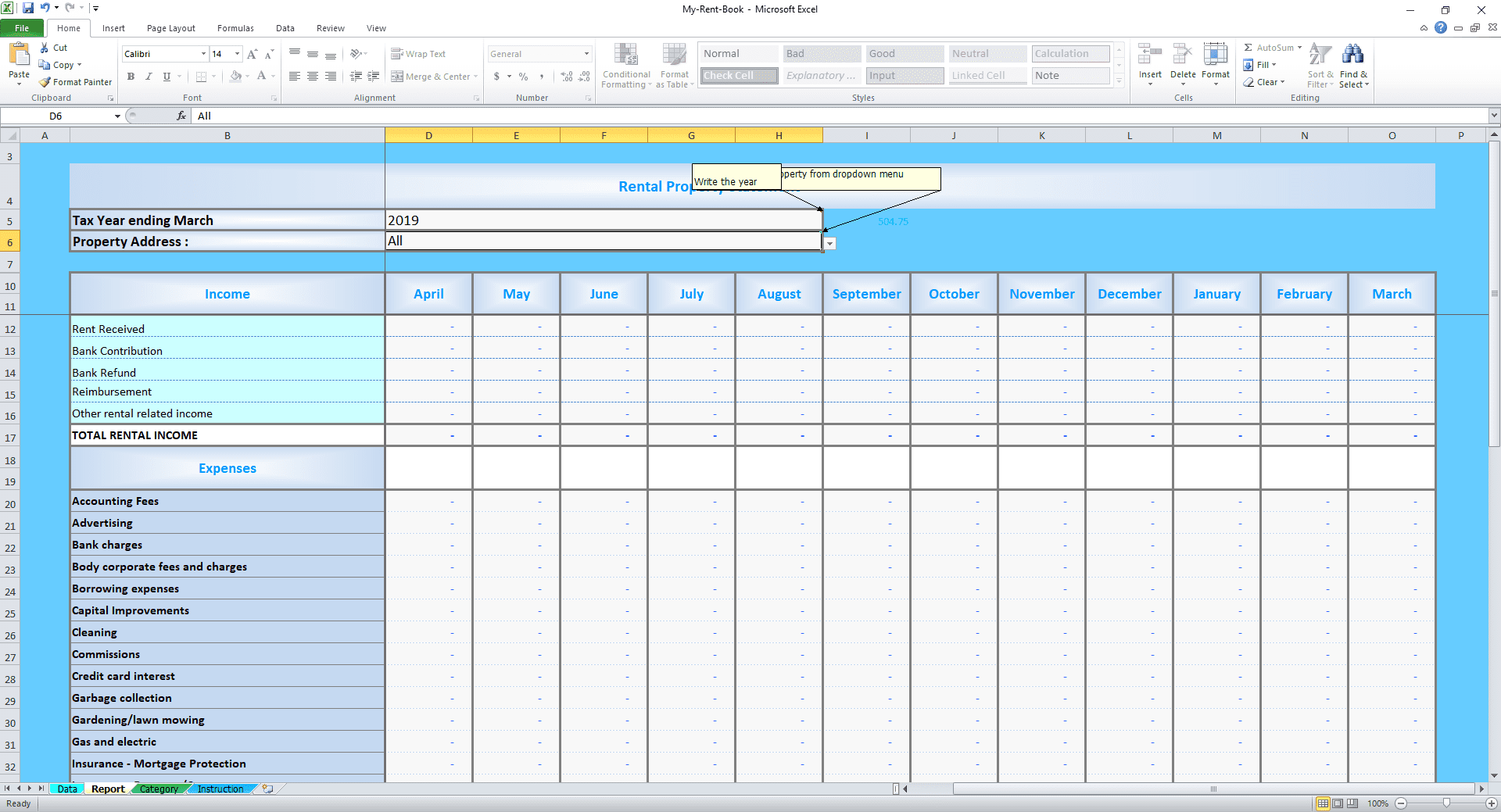

Tax Return Spreadsheet Template Spreadsheets Bank2home

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC 2020 Tax Return Form SA100

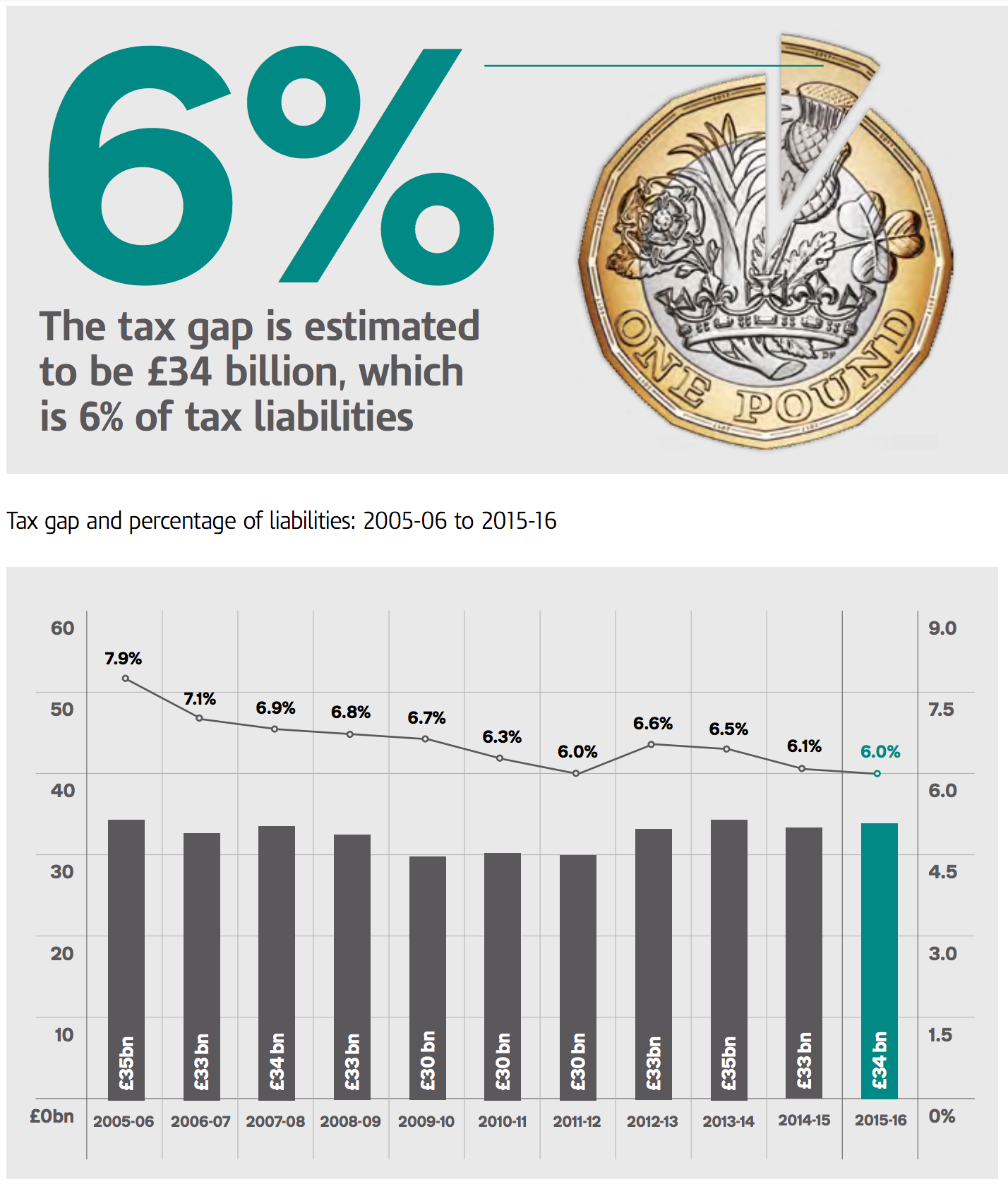

Rental Income Template

Rental Income Template

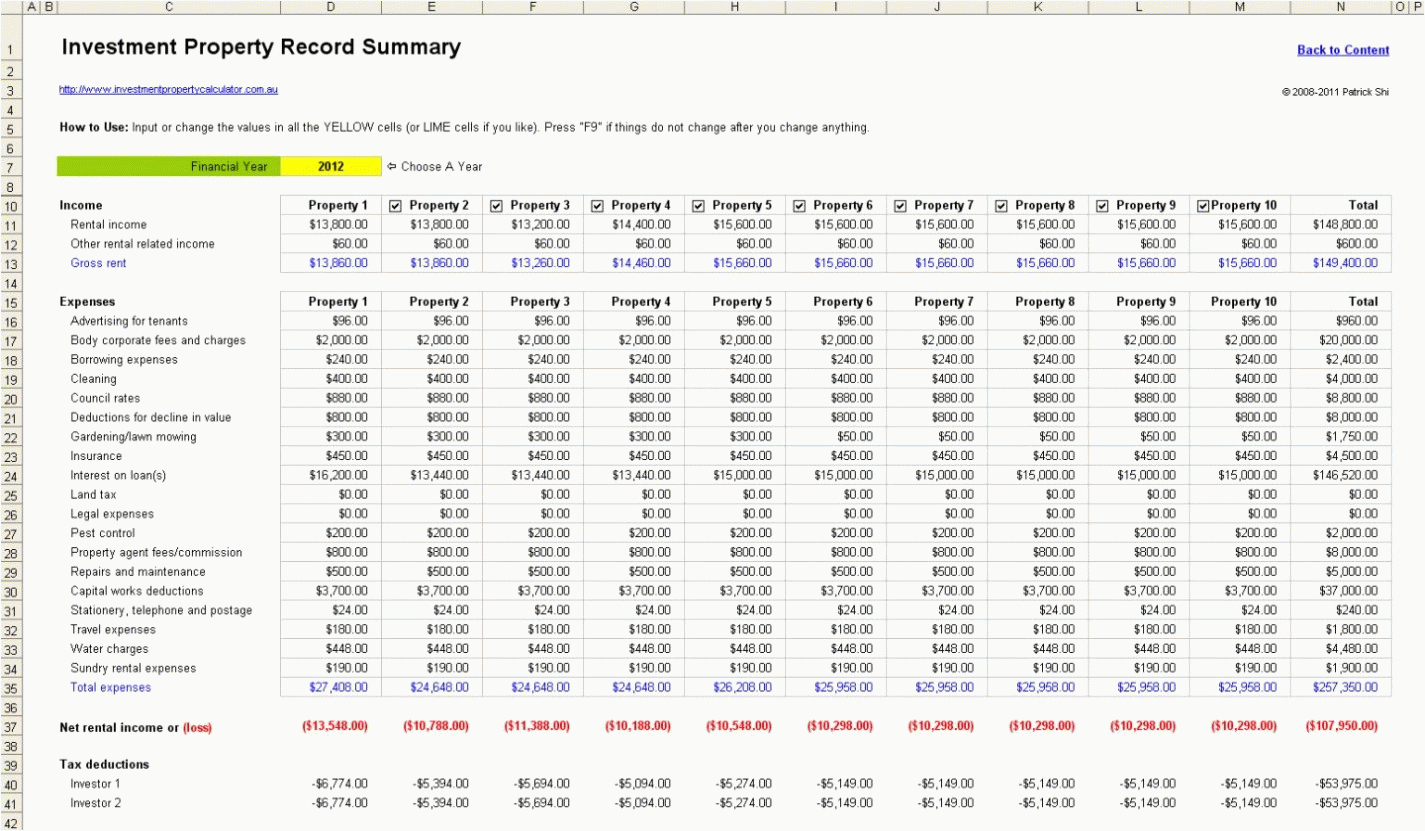

HMRC s New Tax Gap Data Too Predictable To Be Reliable

Free Tax Return Spreadsheet NZ Rental Tax Services

2016 HMRC Tax Return Form

Hmrc Tax Return Tracking - View returns you ve made before check your details print your tax calculation sign up for paperless notifications If you did not file a tax return last year