Hmrc Trust And Estate Tax Return Address Write to HMRC for help with queries about trusts You do not need to include a street name city name or PO box when writing to this address Couriers should use a different

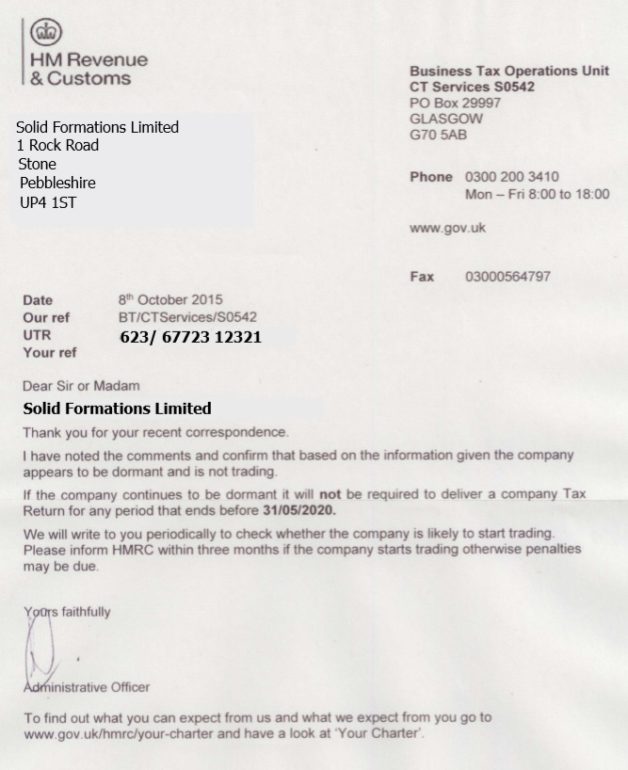

HMRC will send you a UTR for the estate within 15 working days Use this to either fill in a Trust and Estate Tax Return form SA900 and post it to HMRC by the 31 October of the Trust and Estate Tax Return These notes will answer most of your questions If you need more help please phone your HM Revenue and Customs office on the number shown

Hmrc Trust And Estate Tax Return Address

Hmrc Trust And Estate Tax Return Address

https://imgv2-2-f.scribdassets.com/img/document/432833194/original/dbdf54ee7e/1669020247?v=1

Trust And Estate Tax Return

https://s3.studylib.net/store/data/025214610_1-1342a01f3df2447d1403bb0e0ffd2b3d-768x994.png

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

Trust and Estate Tax Return 2022 for the year ended 5 April 2022 2021 22 Tax reference Date HM Revenue Customs Phone Issue address For Reference This HMRC Form SA900 is used to file a Trust and Estate Tax Return in the United Kingdom This form is crucial for trustees or personal representatives managing trust funds or estates that need to report

You should address items to HMRC Administration of Estates BX9 1EL United Kingdom for complex estates correspondence including appeals and Trust All paper trust tax returns for both resident and non resident trusts should be sent to HMRC Trusts Estates Trusts Ferrers House PO Box 38 Castle Meadow

Download Hmrc Trust And Estate Tax Return Address

More picture related to Hmrc Trust And Estate Tax Return Address

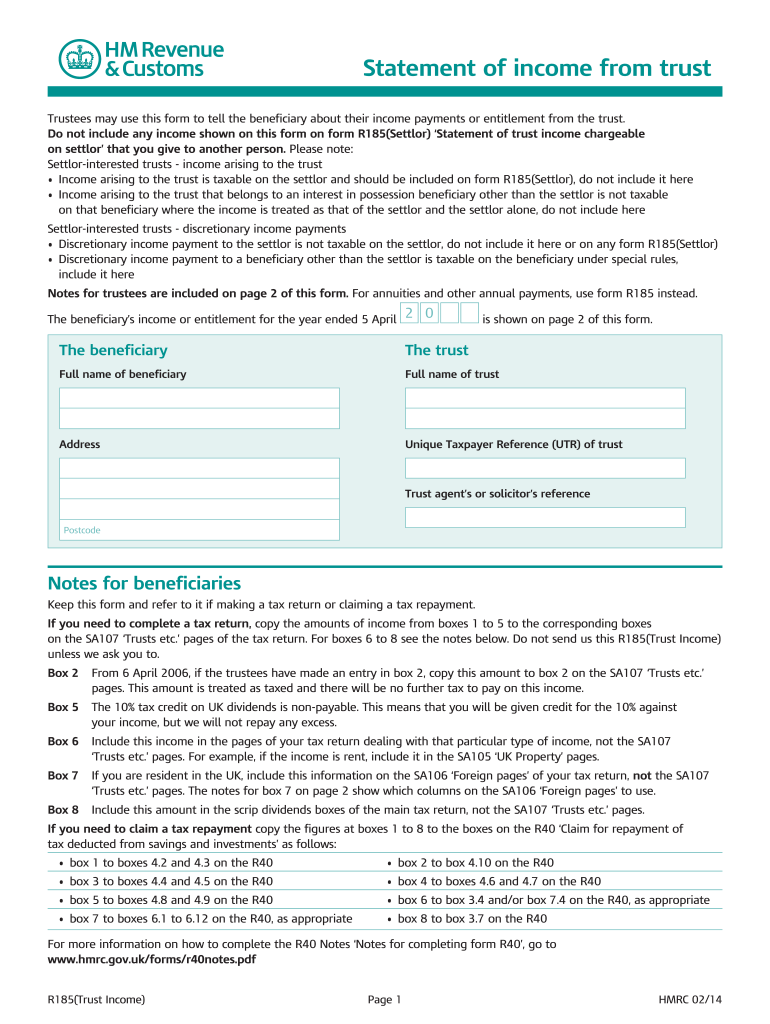

R185 Trust Income Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/22/556/22556390/large.png

HM Revenue Customs Are Changing The Rules Around Its Trust Register

https://gsigroup.co.uk/wp-content/uploads/2022/08/HMRC_Trust_Register_Deadline.jpg

Trust And Estate Tax Return

https://s3.studylib.net/store/data/025224085_1-678505129a03fddbcaa6ce73cf07f68b-768x994.png

Once your trust has been registered with the Trust Registration Service TRS it will need to be claimed in order for its registration and tax details to be managed Read our guide below to find Guidance and forms covering trusts and estates Including how to work out what s taxable register and manage your details

There are several ways to send a trust and estate tax return to HMRC You can either Fill in the paper form Self Assessment Trust and Estate Tax Return SA900 This guidance note covers the requirement to submit an SA900 trust and estate tax return and provides links to the relevant forms on the HMRC website It

English Tax Form Sa900 Trust And Estate Tax Return 2020 From HM Revenue

https://static.vecteezy.com/system/resources/previews/012/977/844/large_2x/english-tax-form-sa900-trust-and-estate-tax-return-2020-from-hm-revenue-and-customs-lies-on-table-with-office-items-hmrc-paperwork-and-tax-paying-process-in-united-kingdom-photo.jpg

5MLD Trust Registration Service Rayner Essex

https://rayneressex.com/wp-content/uploads/2022/07/Living_trust_and_estate_planning-scaled.jpg

https://www.gov.uk/.../contact/trusts

Write to HMRC for help with queries about trusts You do not need to include a street name city name or PO box when writing to this address Couriers should use a different

https://www.gov.uk/probate-estate/reporting-the-estate

HMRC will send you a UTR for the estate within 15 working days Use this to either fill in a Trust and Estate Tax Return form SA900 and post it to HMRC by the 31 October of the

English Tax Form Sa900 Trust And Estate Tax Return 2020 From HM Revenue

English Tax Form Sa900 Trust And Estate Tax Return 2020 From HM Revenue

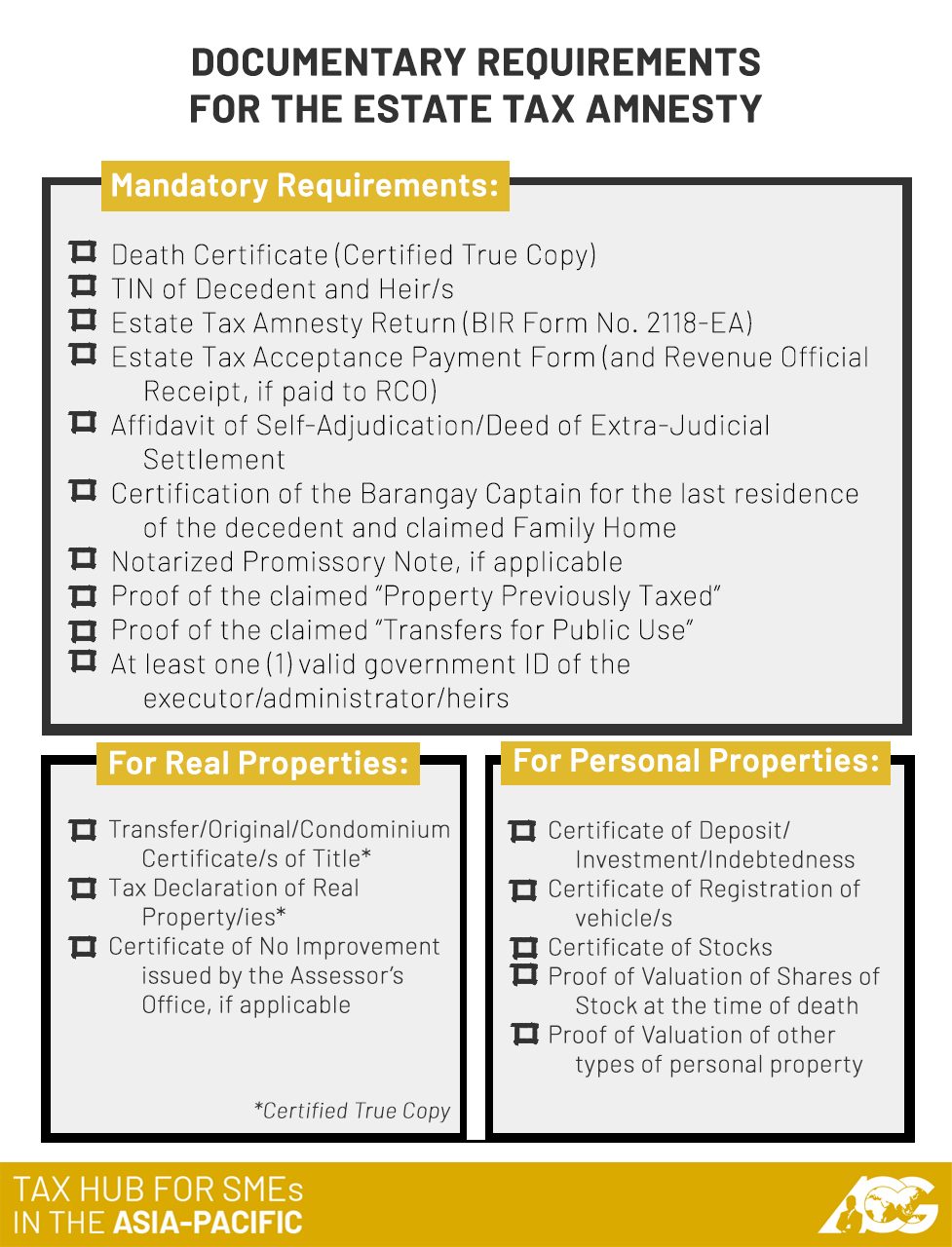

AskTheTaxWhiz How Do I Avail Of Estate Tax Amnesty

Trust And Estate Tax Return

Trust And Estate Tax Return NJ

Estate Tax Return Tax Services By Bajwa CPA In Mississauga

Estate Tax Return Tax Services By Bajwa CPA In Mississauga

English Tax Form Sa900 Trust And Estate Tax Return 2020 From HM Revenue

Dormant Account Activation Request Letter Cricketgawer

Irs Mail Address Finder

Hmrc Trust And Estate Tax Return Address - Trust and Estate Tax Return 2022 for the year ended 5 April 2022 2021 22 Tax reference Date HM Revenue Customs Phone Issue address For Reference This