Hmrc Vat Refund Time In 2021 following the UK s departure from the EU EU VAT refund claims in the UK were required to be submitted online by 31 March 2021 for claims relating to the

It does not address the standard situation of VAT refunds where both vendor and customer are based in the same country For refunds we need to distinguish between 3 The expected refund date was 23rd June It s nearly two weeks past this date and I have had no correspondence by email post or any updates on my business tax

Hmrc Vat Refund Time

Hmrc Vat Refund Time

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

HMRC Uses Annual Report To Apologise For Service Levels AccountingWEB

https://www.accountingweb.co.uk/sites/default/files/hmrc_photot.jpg

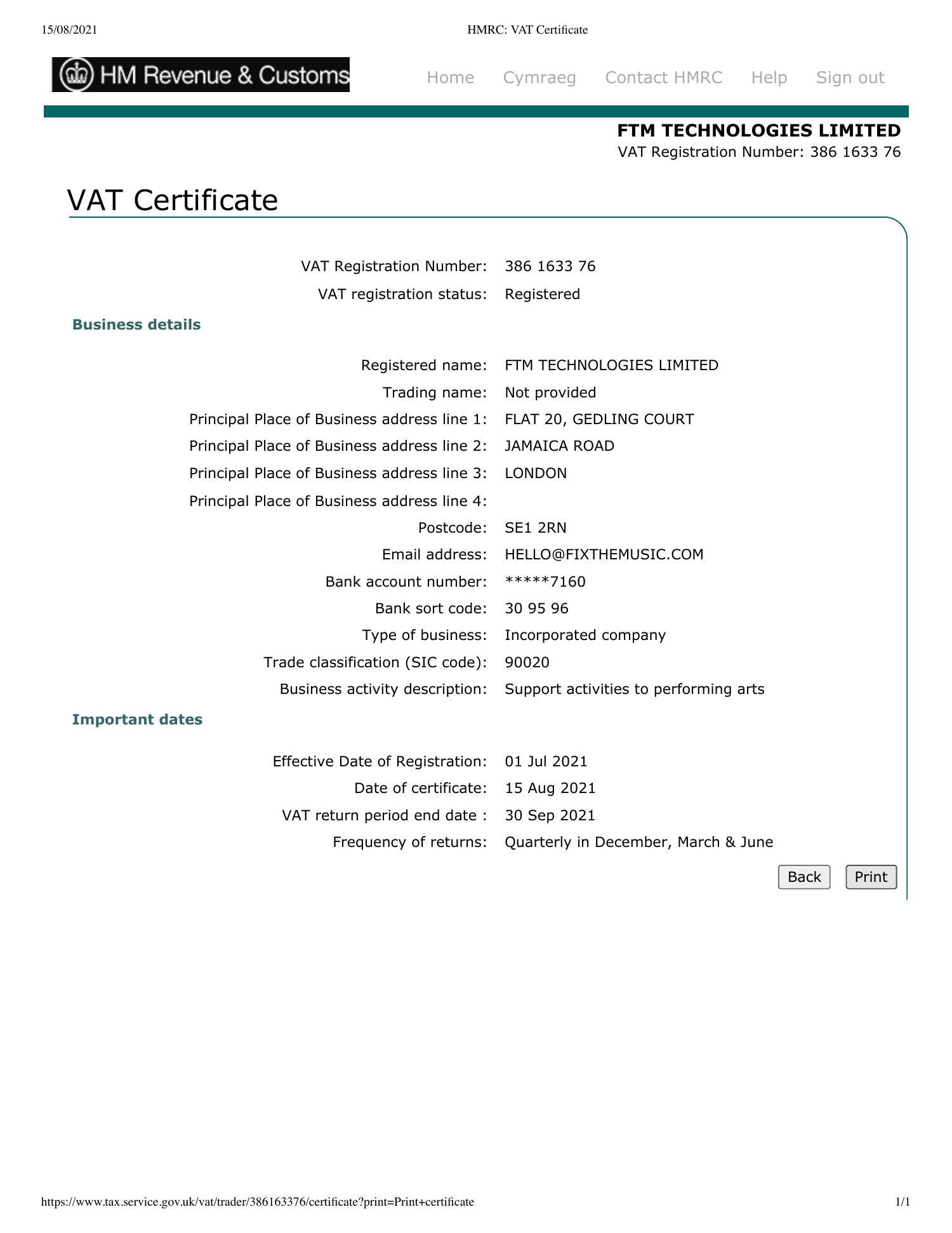

HMRC VAT Certificate pdf DocDroid

https://www.docdroid.net/file/view/6Vz7Tly/hmrc-vat-certificate-pdf.jpg

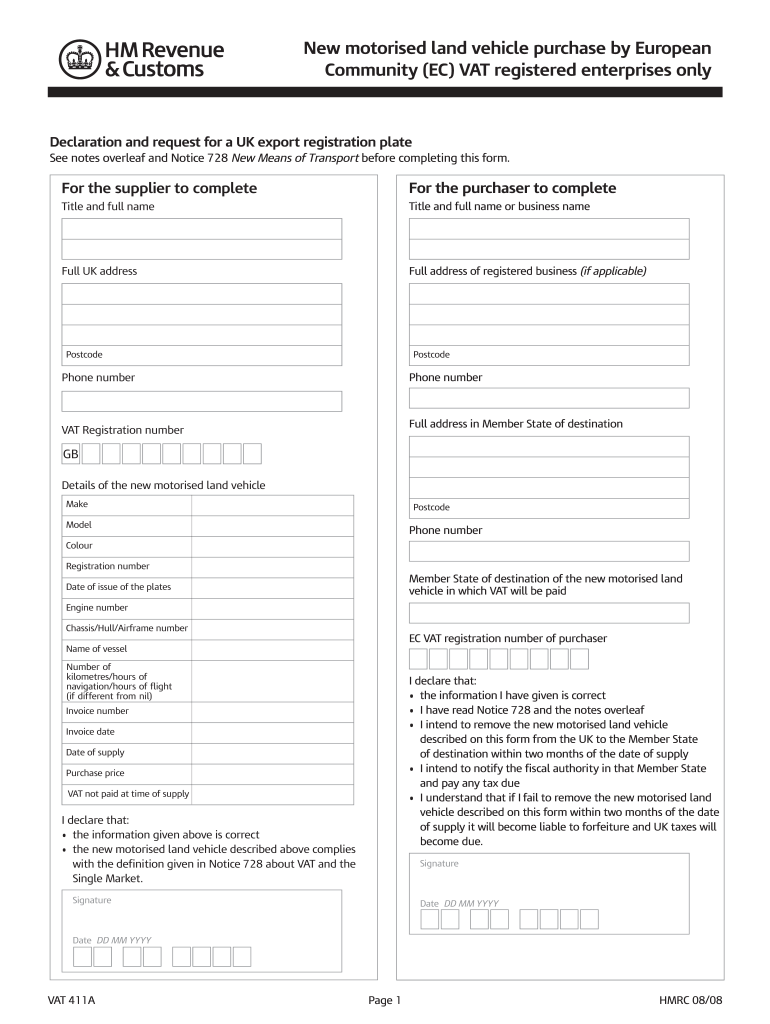

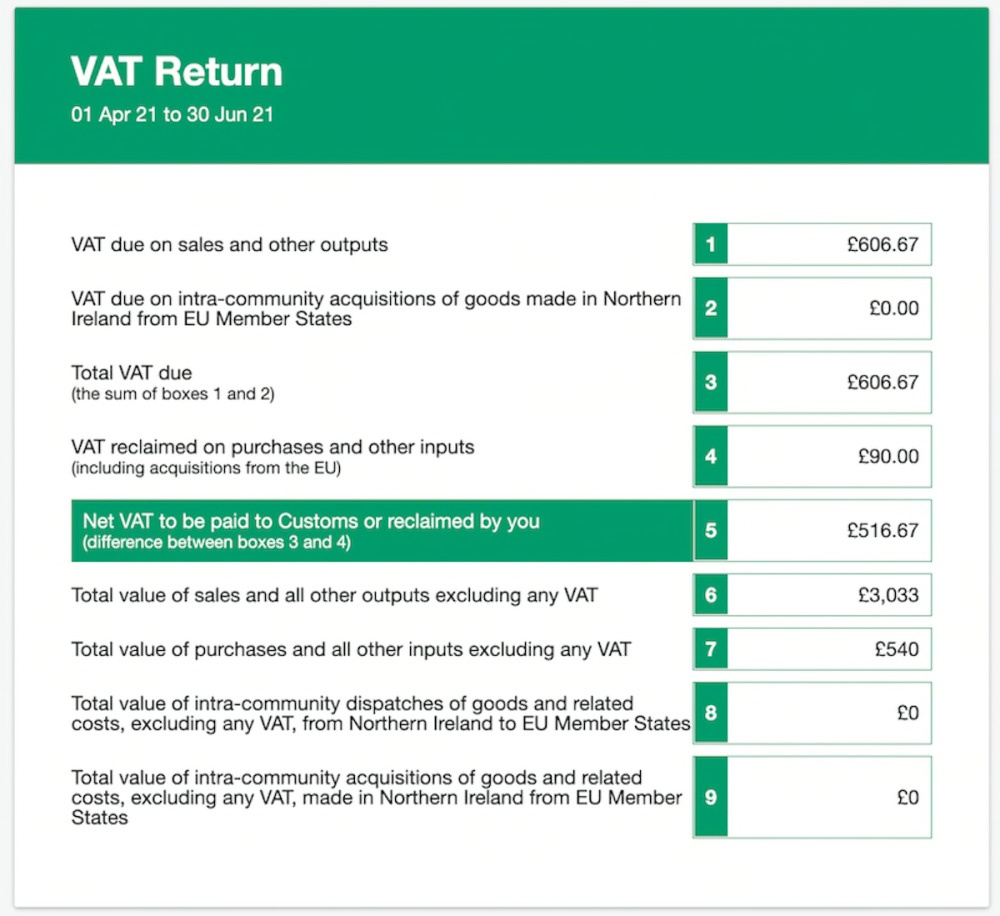

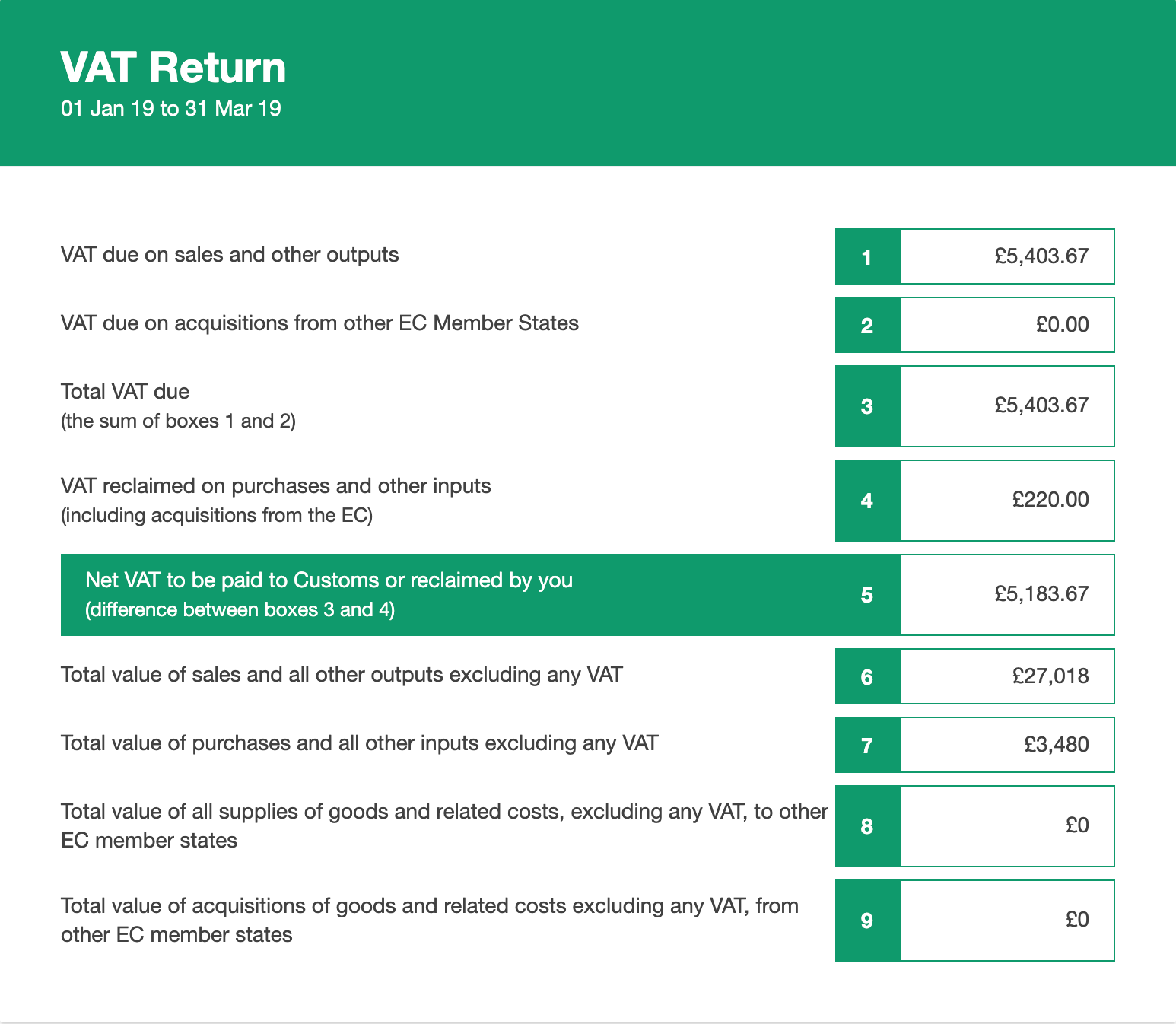

A business that is registered for VAT needs to submit its VAT returns to HMRC every three months The business needs to record for the three month period VAT65A Page 1 HMRC 10 19 Application for refund of VAT By a business person who isnot established in the UK Enter your Unique Reference Number URN only if this is

19 January 2022 Insight posted in Article HMRC has announced that further reforms to the VAT penalty regime to bring it in line with the other major taxes has been delayed The 30 day period for HMRC to enquire into your VAT return starts from the day you submit it So let s say your return is due by 7 August for the period ending June 30 If you are

Download Hmrc Vat Refund Time

More picture related to Hmrc Vat Refund Time

HMRC Vacancy Snapshot

https://amazingapprenticeships.com/app/uploads/sites/3/2018/06/HMRC-logo-1.jpg

Blank Vat Return Template Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/22/555/22555729/large.png

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

https://selectitaly.com/blog/wp-content/uploads/2016/03/D_D_Italia-VAT-Refund-2000x1500.jpg

The information about when you can expect a reply from HMRC is updated weekly 30 June 2022 Corporation Tax has been added to the list about when you can VAT refund not credited Posted Wed 10 Jan 2024 10 34 11 GMT by VAT repayment not credited to my account even after 30 days When I track the repayments

Tax refunds in the UK can take up to 12 weeks to be processed by HMRC with a further 5 days to 5 weeks added to receive your money There are a number of VAT VAT registration or deregistration Corporation Tax Repayment due to loss carry back Paper Self Assessment tax returns and other time sensitive postal

HMRC Customer Service Number Direct Call On 0844 3069181

https://phonenumbercustomerservice.co.uk/wp-content/uploads/2017/02/HMRC_logo.jpg

How Long To Get My Tax Refund From HMRC Swift Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

https://taxnews.ey.com/news/2021-2200-uks-imminent...

In 2021 following the UK s departure from the EU EU VAT refund claims in the UK were required to be submitted online by 31 March 2021 for claims relating to the

https://taxation-customs.ec.europa.eu/vat-refunds_en

It does not address the standard situation of VAT refunds where both vendor and customer are based in the same country For refunds we need to distinguish between 3

UK HMRC Changes Strategy With Online Traders Taxmen

HMRC Customer Service Number Direct Call On 0844 3069181

HMRC Issues Fraud Warning As Scam Calls Rise Clear Vision Accountancy

VAT Return Get Hands On Help With Your VAT Return

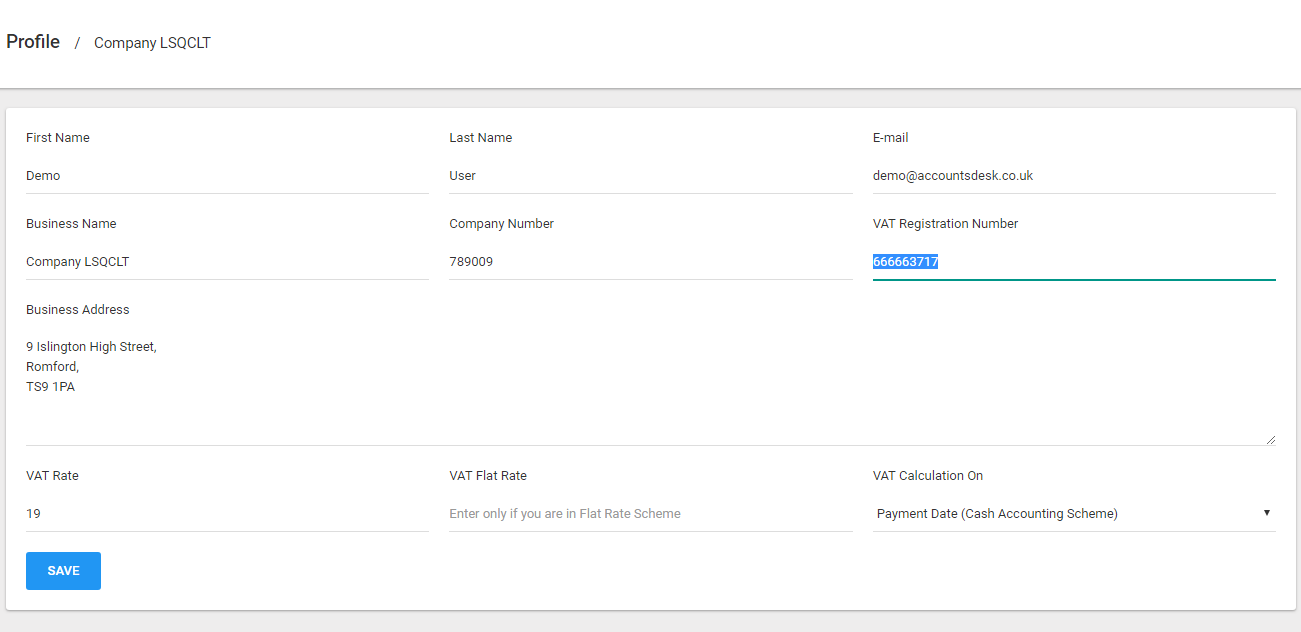

Try Making Tax Digital MTD VAT Demo With A Dummy Company

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

Special VAT Measures Covid 19 Belgian VAT Desk

Zimra Vat 7 Return Form Atlantacaqwe

HMRC Is Shite Tax Credits Under HMRC s Full Control

Hmrc Vat Refund Time - May 27 2023 14 min read How to Claim VAT Back in the UK A Comprehensive Guide Updated May 28 2023 Understanding Value Added Tax VAT and knowing how to