Hmrc What Can I Claim Tax Back On Self Employed How to claim Keep records of all your business expenses as proof of your costs Add up all your allowable expenses for the tax year and put the total amount on your Self

If you re self employed you ll be charged tax based on the amount of profit you ve made in a tax year but there are a number of expenses you can claim that will If you re self employed there are a number of expenses you claim depending on your occupation Claiming expenses will reduce the amount of tax you

Hmrc What Can I Claim Tax Back On Self Employed

Hmrc What Can I Claim Tax Back On Self Employed

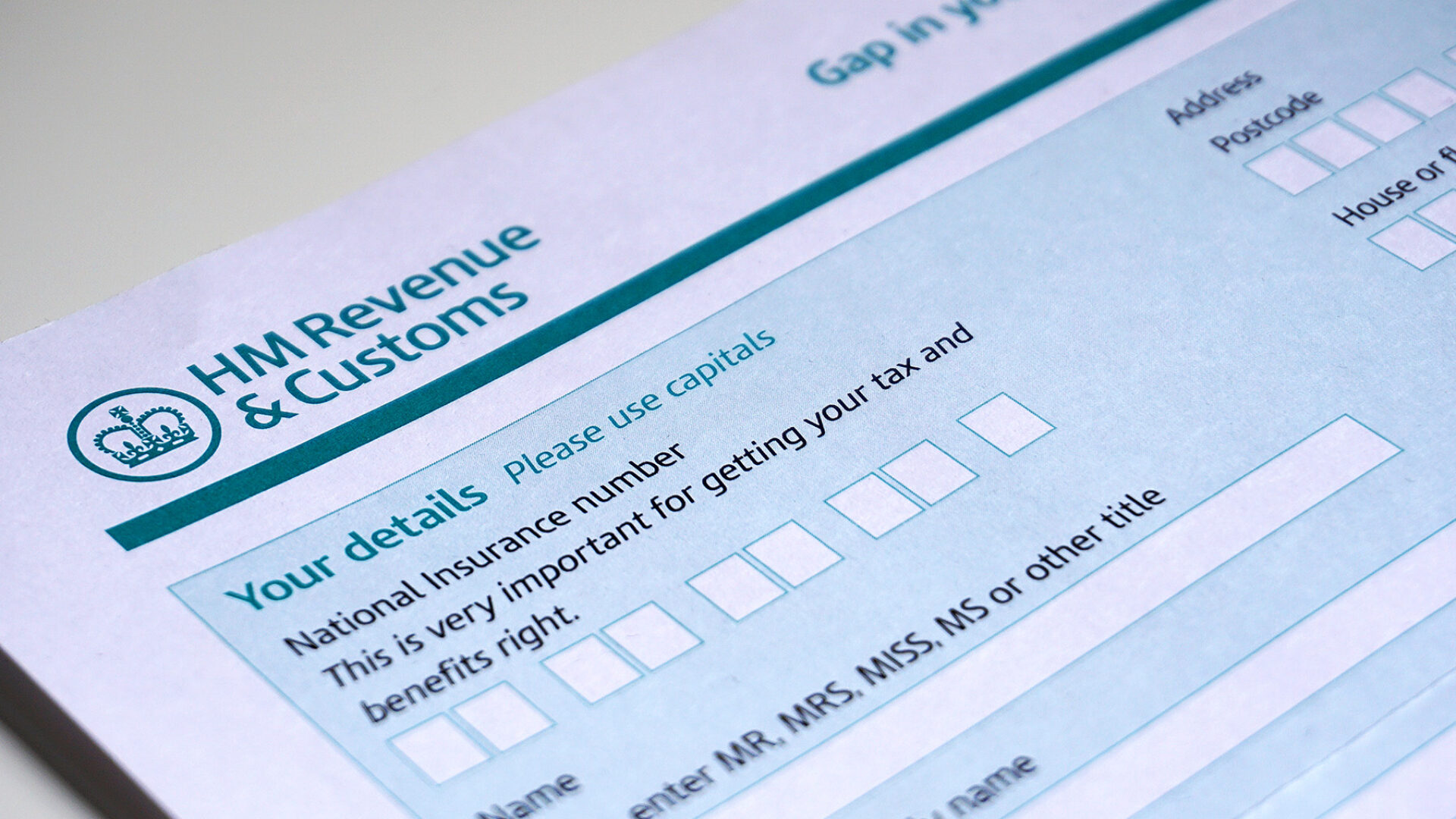

https://www.whyattaccountancy.com/wp-content/uploads/2022/01/HMRC-tax-return.jpg

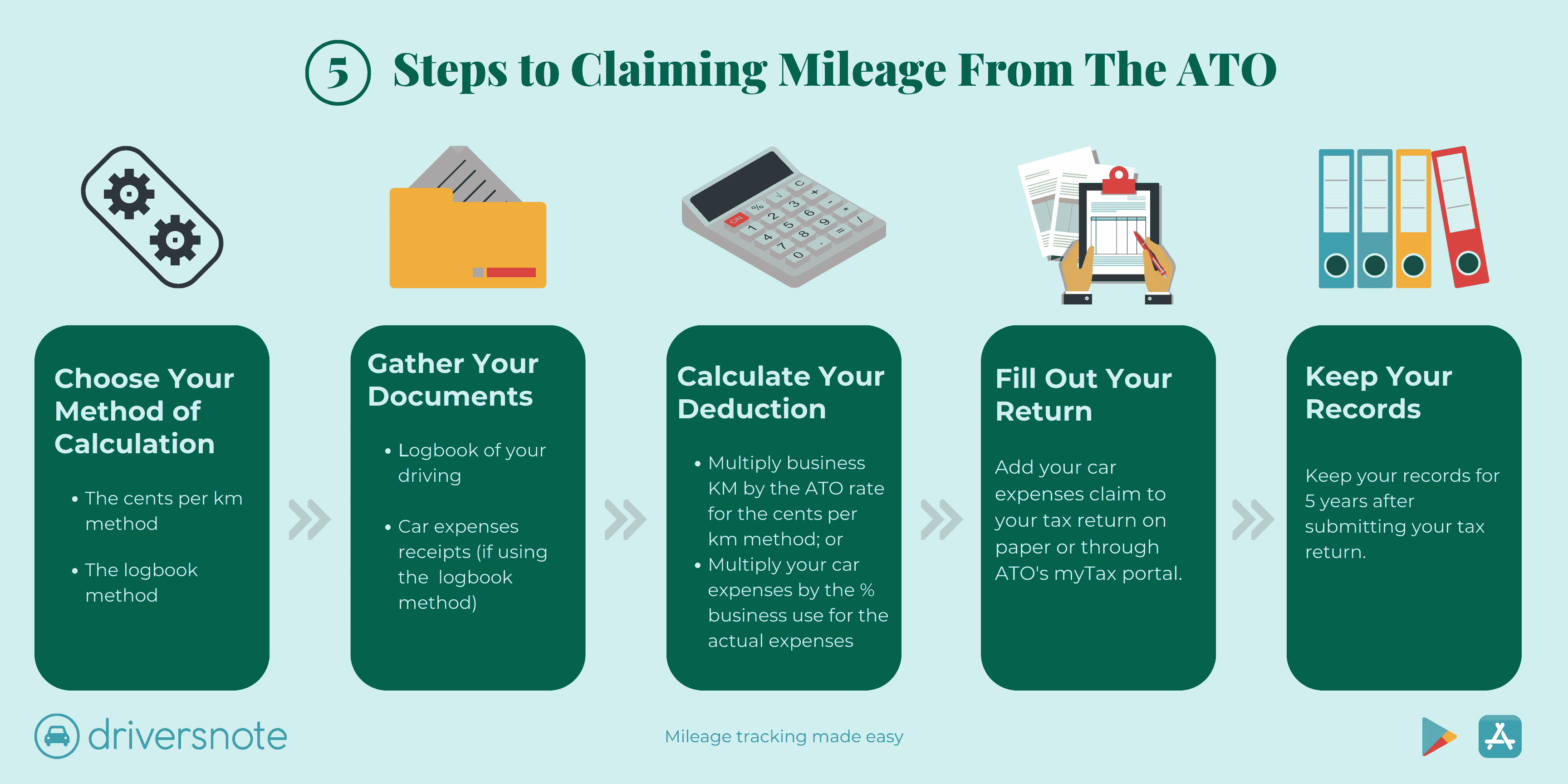

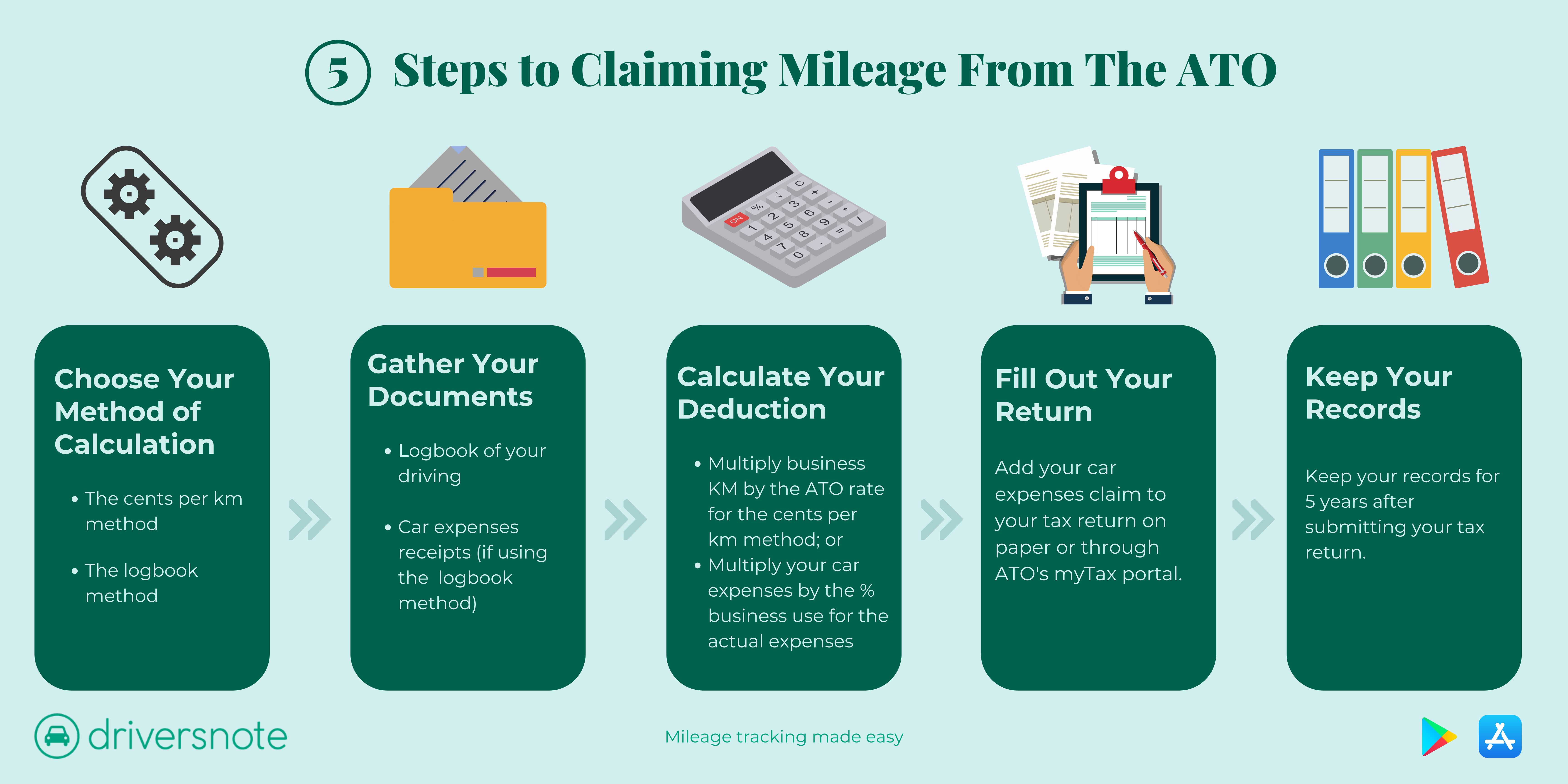

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

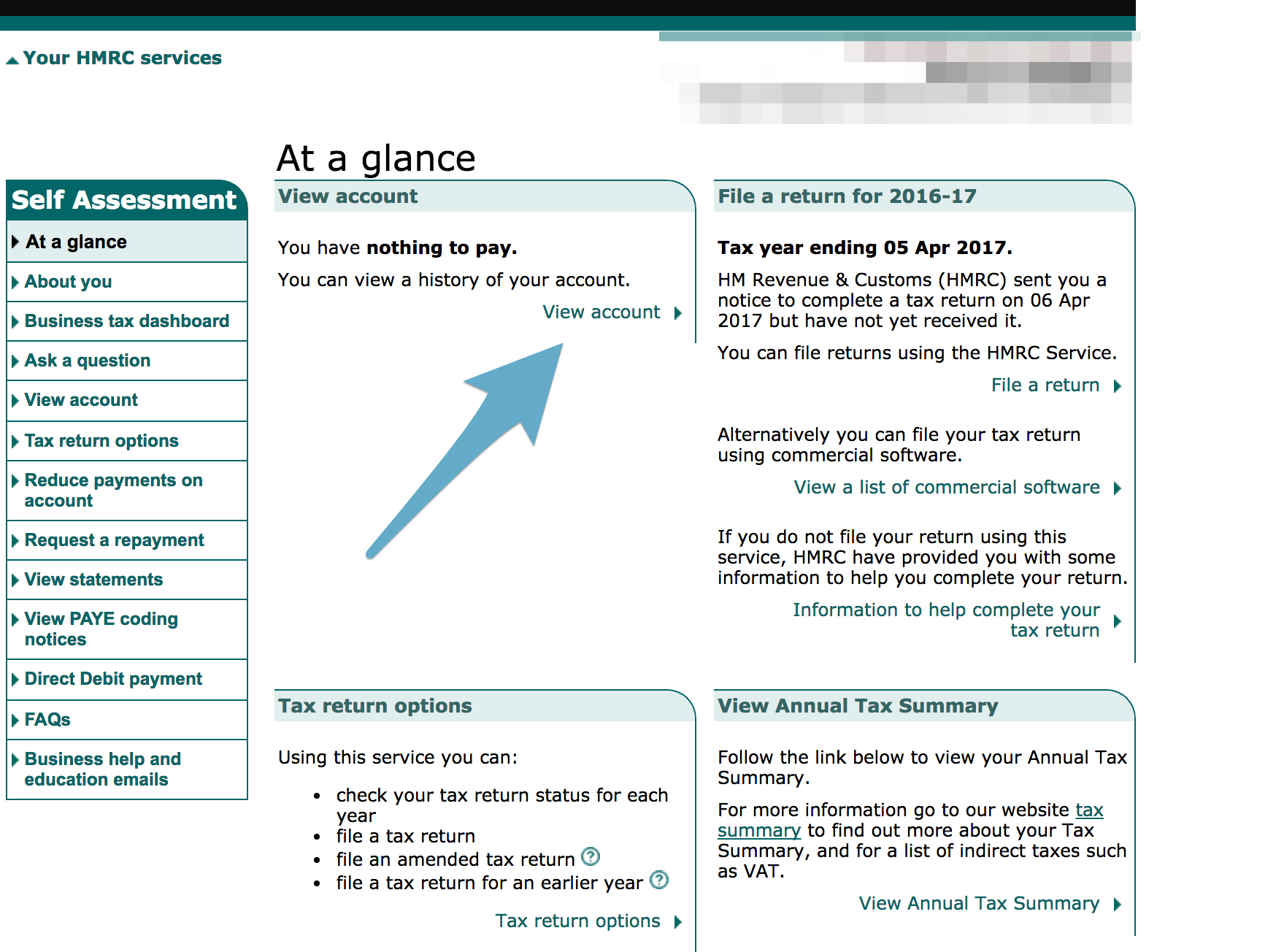

How Do I Find My Self Assessment Unique Taxpayer Reference On The HMRC

https://i.ytimg.com/vi/LXw9ily9rTo/maxresdefault.jpg

If you re self employed allowable expenses can reduce your Self Assessment tax bill In this article we talk about how your business can claim back Self employed sole traders limited company directors shareholders and LLP members are all required to send Self Assessment tax returns to HMRC every year

In this guide we tell you how to reduce your tax if you re self employed and a list of allowable expenses you can claim as deductible from HMRC Did you know that if you re self employed you might be able to claim back some of the money you spend on food The self employed daily food allowance can be

Download Hmrc What Can I Claim Tax Back On Self Employed

More picture related to Hmrc What Can I Claim Tax Back On Self Employed

How To Claim Tax Back In Ireland Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2022/01/Blog-Image-how-do-i-claim-tax-back.jpg

How To Pay HMRC Self Assessment Income Tax Bill In The UK

https://www.gatwickaccountant.com/wp-content/uploads/2022/08/How-to-Pay-HMRC-Self-Assessment-Income-Tax-Bill-in-UK.jpg

How To Print Your SA302 Or Tax Year Overview From HMRC Love

https://www.loveaccountancy.co.uk/wp-content/uploads/2017/10/Screen_Shot_2017-10-11_at_18_12_15.png

And if you are self employed and complete an annual Self Assessment then you will need to complete your tax return before HMRC can process any rebate If your claim is 2 500 or less HMRC normally gives you relief for your expenses through your tax code straight away If you claim an estimated figure they will review it at the

The self employed can apply for a tax refund from HMRC if they ve overpaid tax Read on to find out if you re eligible and how to apply If you re self employed you can claim tax relief on everyday business expenses when you file a self assessment tax return That means the tax you d usually

Elc Self Employment Business Expense Form Employment Form

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/08/elc-self-employment-business-expense-form.jpg

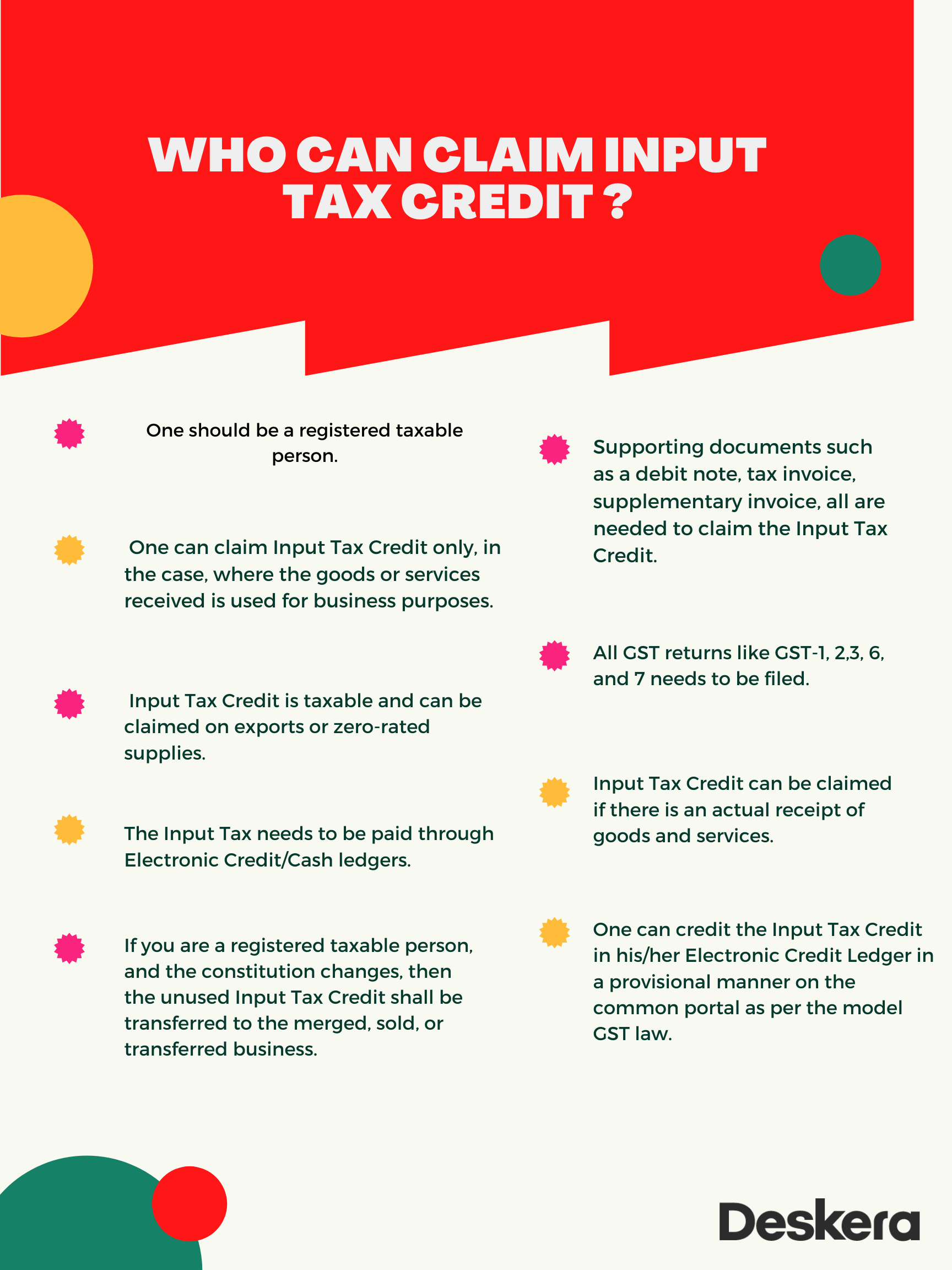

What Is Input Credit ITC Under GST

https://www.deskera.com/blog/content/images/2021/08/ITC-CLAIM.png

https://www.gov.uk/expenses-if-youre-self-employed/how-to-claim

How to claim Keep records of all your business expenses as proof of your costs Add up all your allowable expenses for the tax year and put the total amount on your Self

https://www.which.co.uk/money/tax/income-tax/...

If you re self employed you ll be charged tax based on the amount of profit you ve made in a tax year but there are a number of expenses you can claim that will

Self Employed Tax Preparation Printables Instant Download Etsy In

Elc Self Employment Business Expense Form Employment Form

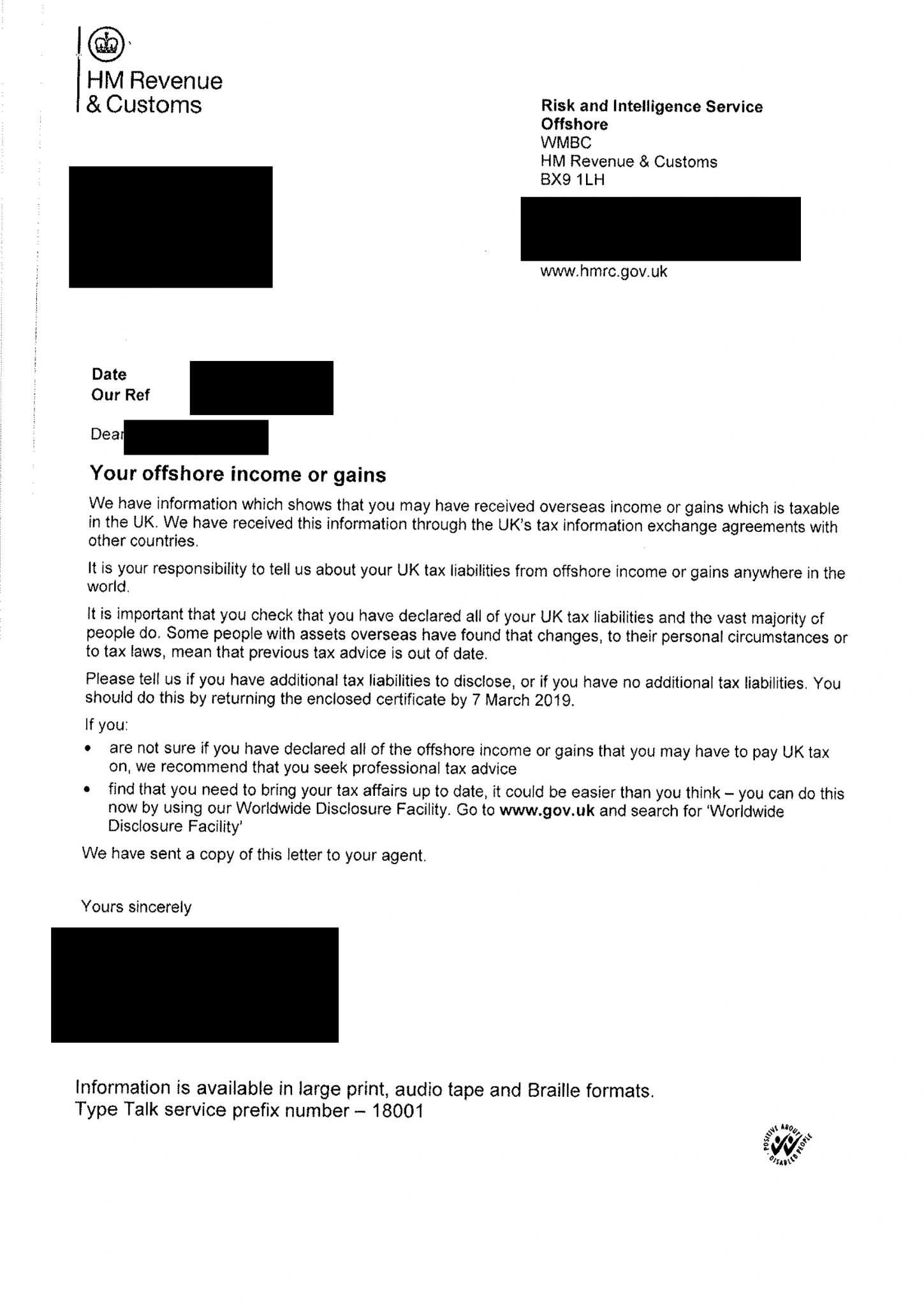

Letter From HMRC About Overseas Assets Income Or Gains

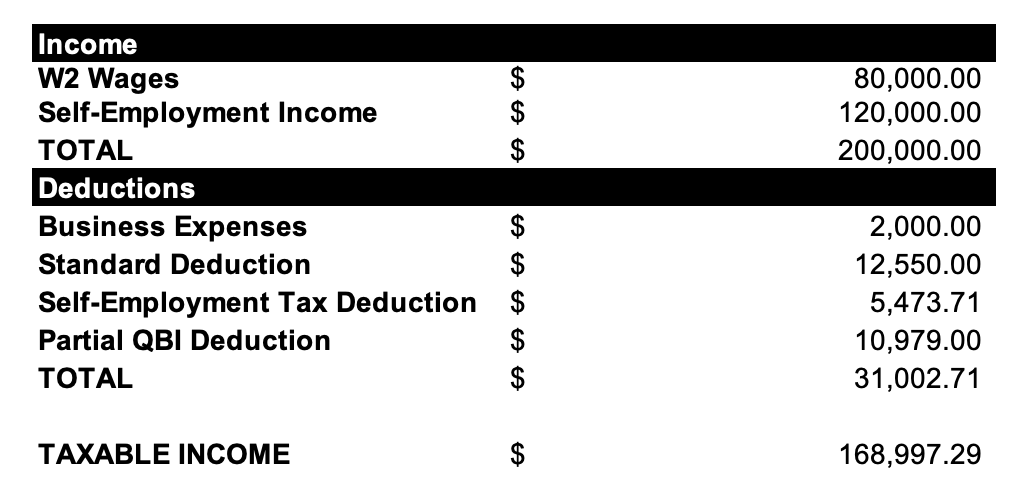

Calculate Self Employment Tax Deduction ShannonTroy

Hmrc Self Assessment Form Employment Employment Form

Company UTR Number A Guide Mint Formations

Company UTR Number A Guide Mint Formations

Consumer Column What Can I Claim Tax Back For When WFH

The Ultimate List Of Self Employed Expenses You Can Claim

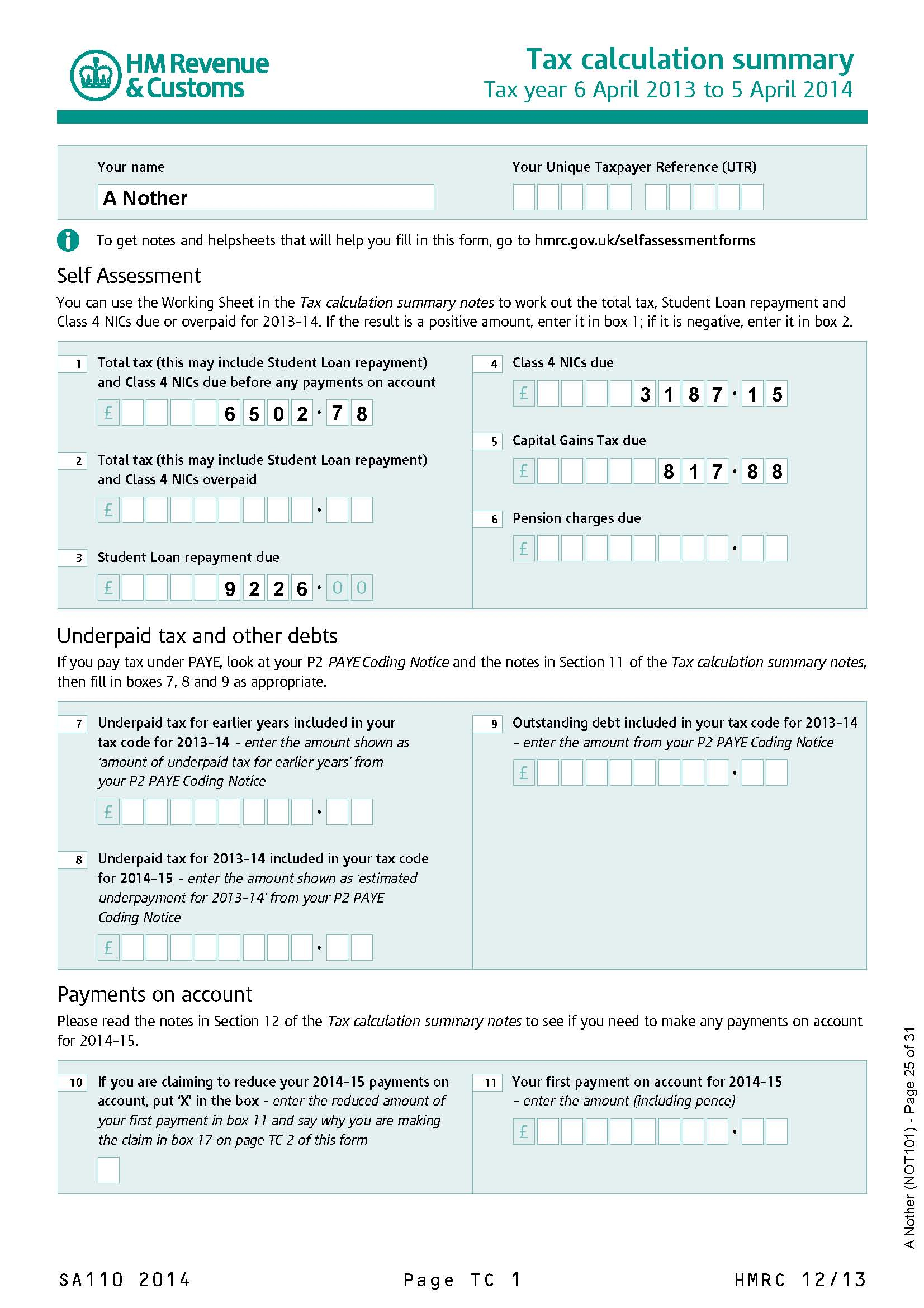

How To Obtain Your Tax Calculations And Tax Year Overviews

Hmrc What Can I Claim Tax Back On Self Employed - Did you know that if you re self employed you might be able to claim back some of the money you spend on food The self employed daily food allowance can be