Home Accessibility Expenses Eligible Expenses How much is the Home Accessibility Tax Credit The credit is worth 15 of up to 10 000 of expenses per year which can provide a maximum benefit of 1 500 per year Who is eligible for the Home Accessibility Tax Credit

Home accessibility expenses for the family head or spouse Important note It is important to enter the medical expenses under the profile of the family member that directly The Home Accessibility Tax Credit HATC is a federal nonrefundable credit that currently allows qualifying 65 or older or those who qualify for the Disability Tax Credit or eligible individuals to claim up to 10 000 in

Home Accessibility Expenses Eligible Expenses

Home Accessibility Expenses Eligible Expenses

https://s3.studylib.net/store/data/007783568_2-ce6693b5ed4cb9d25441e26bfd42732d-768x994.png

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

https://www.patriotsoftware.com/wp-content/uploads/2017/06/FSA-eligible-expenses-compressed.png

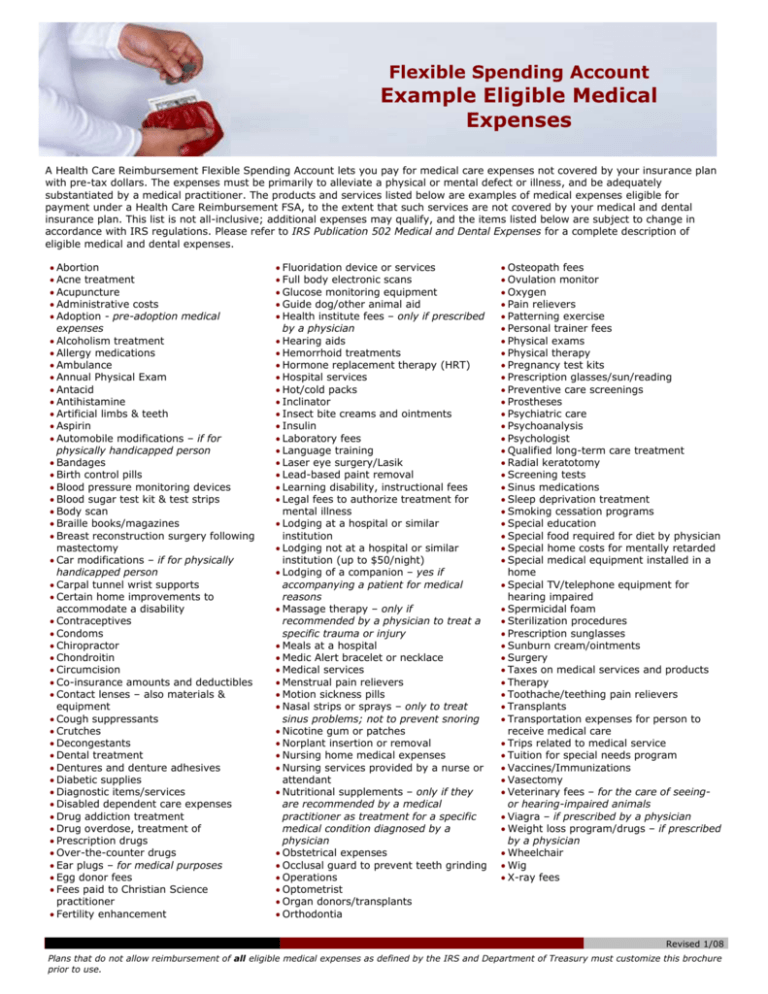

FSA Eligible Expenses Your Health Care Reimbursement Account

https://s3.studylib.net/store/data/007086489_1-0040e0dc9a9cb9861143298c01edaf4f-768x994.png

Home accessibility expenses If you renovated your home in order to make it more accessible you might be able to claim the Home accessibility expenses Under this tax credit the maximum you can claim is 10 000 The Home Accessibility Tax Credit is a non refundable tax credit introduced in the Federal 2015 Budget The credit is for qualifying expenses incurred in 2016 or later for work performed or goods

Renovations that make homes safer or more accessible for seniors or the disabled may qualify for the Home Accessibility Tax Credit HATC If you are a senior or What Expenses Qualify for the HATC In general the CRA considers qualifying expenses to be those that permanently alter the residence to make it safer or

Download Home Accessibility Expenses Eligible Expenses

More picture related to Home Accessibility Expenses Eligible Expenses

Expenses Free Of Charge Creative Commons Suspension File Image

https://www.picpedia.org/suspension-file/images/expenses.jpg

Expenses Free Of Charge Creative Commons Chalkboard Image

https://www.picpedia.org/chalkboard/images/expenses.jpg

Tax Tips Session 5 Home Accessibility Expenses YouTube

https://i.ytimg.com/vi/oRhMkaZP4V4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgWihPMA8=&rs=AOn4CLAlIMYjmYgPMJ8OX2REuh-bV1rpGg

Amounts on line 31285 are eligible expenses you incurred to make an eligible home more accessible To review and confirm the source amount of your home accessibility The home accessibility tax credit HATC was introduced by the federal government to help make homes safer and more accessible for people with disabilities those eligible for the disability tax credit and

Up to 10 000 in expenses can be claimed under the Home Accessibility Tax Credit for renovations and alterations that are enduring in nature and integral to the to the The Home Accessibility Tax Credit is a non refundable tax credit for eligible renovations to improve the accessibility of your home A maximum of 20 000 per year

How To Report Home Accessibility Expenses By Using TaxTron Web YouTube

https://i.ytimg.com/vi/K-Zl-YZHPQU/maxresdefault.jpg

FSA Eligible Expense List Flexbene

https://flexbene.com/wp-content/uploads/2022/12/Eligible-FSA-Expenses-2023-1-862x1116.jpg

https://goodcaring.ca/explainers/home...

How much is the Home Accessibility Tax Credit The credit is worth 15 of up to 10 000 of expenses per year which can provide a maximum benefit of 1 500 per year Who is eligible for the Home Accessibility Tax Credit

https://www.canada.ca/content/dam/cra-arc/serv...

Home accessibility expenses for the family head or spouse Important note It is important to enter the medical expenses under the profile of the family member that directly

Expenses Free Of Charge Creative Commons Lever Arch File Image

How To Report Home Accessibility Expenses By Using TaxTron Web YouTube

Expenses App Saving App Finance App App Layout Face Id App Ui

Housekeeping How I Reduced My Expenses By 20 Breaking Latest News

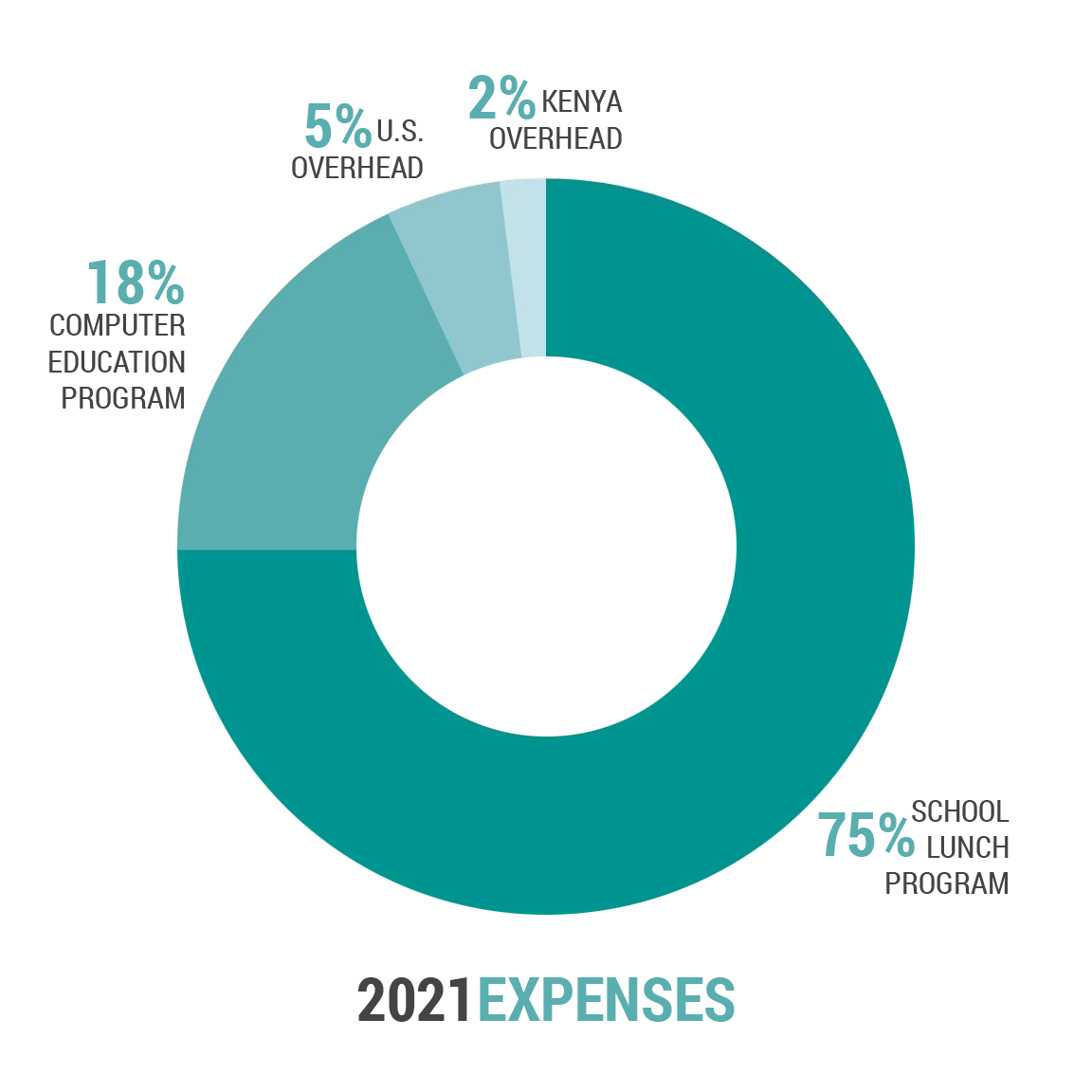

2021 Expenses Kenya Kids Can

Health Spending Account HSA Coverage List Of Eligible Expenses

Health Spending Account HSA Coverage List Of Eligible Expenses

Home Accessibility Expenses

Expenses Free Of Charge Creative Commons Handwriting Image

Home Finance Budget Worksheet How To Create A Home Finance Budget

Home Accessibility Expenses Eligible Expenses - What Expenses Qualify for the HATC In general the CRA considers qualifying expenses to be those that permanently alter the residence to make it safer or