Home Building Tax Credits 1 Tax Write Offs for Insulating Your House 2 Refundable Nonrefundable Education Tax Credits 3 Documentation Needed for a Geothermal Tax Credit Several tax breaks are available to you if

For homes acquired before 2023 The credit amount is 1 000 or 2 000 depending on the energy saving requirements met Find details in About Form 8908 Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to

Home Building Tax Credits

Home Building Tax Credits

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

HMRC Reveals Details Of R D Credits Anti fraud Campaign Tax Tips G T

https://galleyandtindle.co.uk/wp-content/uploads/2022/07/RD-Tax-Credits.jpg

For eligible homes and apartments referred to as dwelling units in 45L acquired on or after January 1 2023 the tax credit is now specifically tied to certification Energy efficient home credit provides up to 5 000 to home builders for cost saving upgradesWashington D C As part of the Biden Harris Administration s

There are tax credits available for new home construction They come in the form of tax deductions tax breaks and and tax credits A credit is used to reduce the This tax credit is eligible for homes and units acquired on or after January 1 2023 that meet ENERGY STAR program requirements for single family

Download Home Building Tax Credits

More picture related to Home Building Tax Credits

Federal Tax Credits To Support Affordable Housing In Detroit Friedman

https://friedmanrealestate.com/wp-content/uploads/2019/06/federal-tax-credits-to-support-affordable-housing.jpg

Tax Credits Life At HMRC

https://lifeathmrc.blog.gov.uk/wp-content/uploads/sites/20/2016/07/Tax-Credits.jpg

Tax Credits To Claim In 2021 ProFed Credit Union

https://profedcu.org/uploads/page/top-tax-credits-to-claim.png

Published August 29 2022 Fact checked by Ryan Eichler If you ve been considering making green home improvements you might be in for some budgetary luck President Biden signed the Inflation The energy efficient home improvement credit is allowed to offset regular income tax reduced by the foreign tax credit plus alternative minimum tax Sec

Highlights of the tax credits for new home construction in 2023 and 2024 include New Home Construction Tax Credit Eligible persons can claim a tax credit OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

https://i.pinimg.com/originals/4c/9c/70/4c9c7048997bbeb1f91747edd3b1b1c5.jpg

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

https://finance.zacks.com/tax-writeoffs-build…

1 Tax Write Offs for Insulating Your House 2 Refundable Nonrefundable Education Tax Credits 3 Documentation Needed for a Geothermal Tax Credit Several tax breaks are available to you if

https://www.irs.gov/credits-deductions/credit-for...

For homes acquired before 2023 The credit amount is 1 000 or 2 000 depending on the energy saving requirements met Find details in About Form 8908

Georgia Tax Credits For Workers And Families

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

R D Tax Credits For Manufacturing The TIER Group

Geothermal Tax Credits Incentives

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

CAPITALIZE ON YOUR WOTC TAX CREDITS

CAPITALIZE ON YOUR WOTC TAX CREDITS

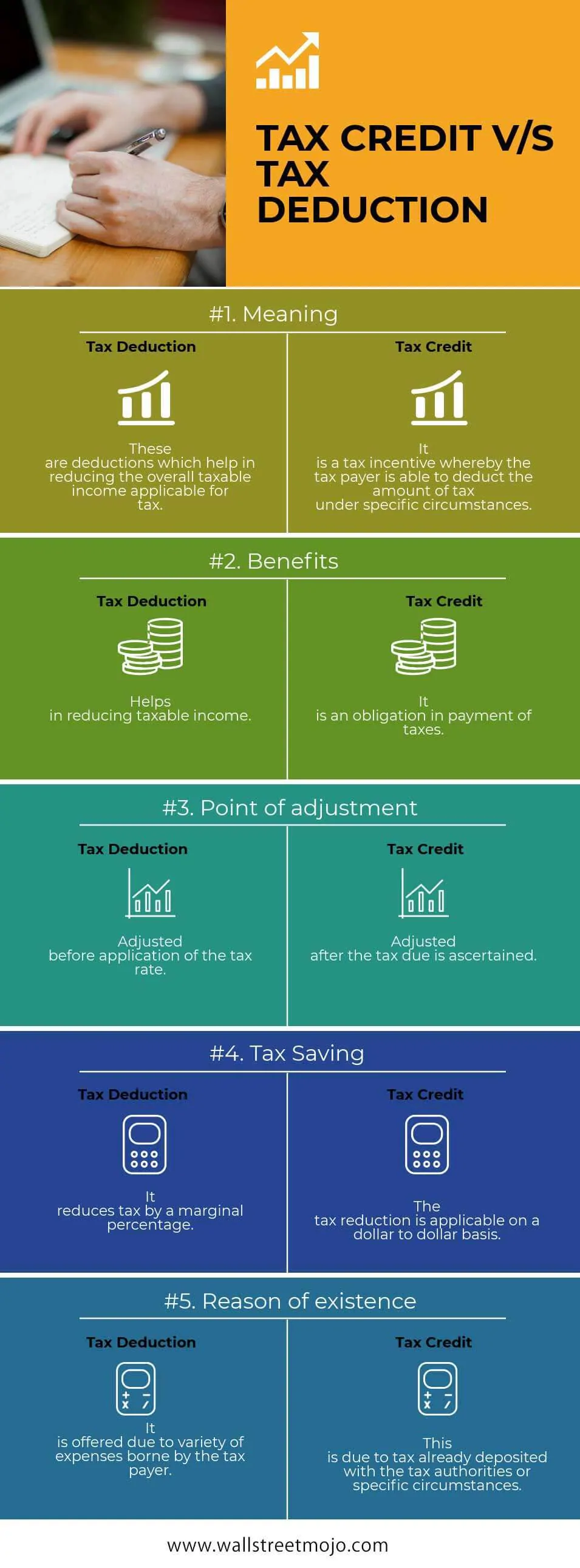

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

20 Billion In Tax Credits Fails To Increase College Attendance The

Nearly Half A Million Taxpayers Yet To Renew Tax Credits HMRC Warns

Home Building Tax Credits - Energy efficient home credit provides up to 5 000 to home builders for cost saving upgradesWashington D C As part of the Biden Harris Administration s