Home Building Tax Deductions New Home Construction Deductions Tax Credits in 2023 There are a few common tax deductions and credits for new home builds which we ve outlined

Deductible sales taxes may include sales taxes paid on your home including mobile and prefabricated or home building materials if the tax rate was the same as the general sales tax rate so you can take a Tax Tip 2022 138 September 8 2022 Making the dream of owning a home a reality is a big step for many people Whether a fixer upper or dream home homeownership is a

Home Building Tax Deductions

Home Building Tax Deductions

https://d1h86g9h1jpeic.cloudfront.net/2021/03/LG-taxes.jpg

How To Claim LTDC For Your Business Here s A Complete Process

https://okcredit-blog-images-prod.storage.googleapis.com/2021/01/Tax-deduction2.jpg

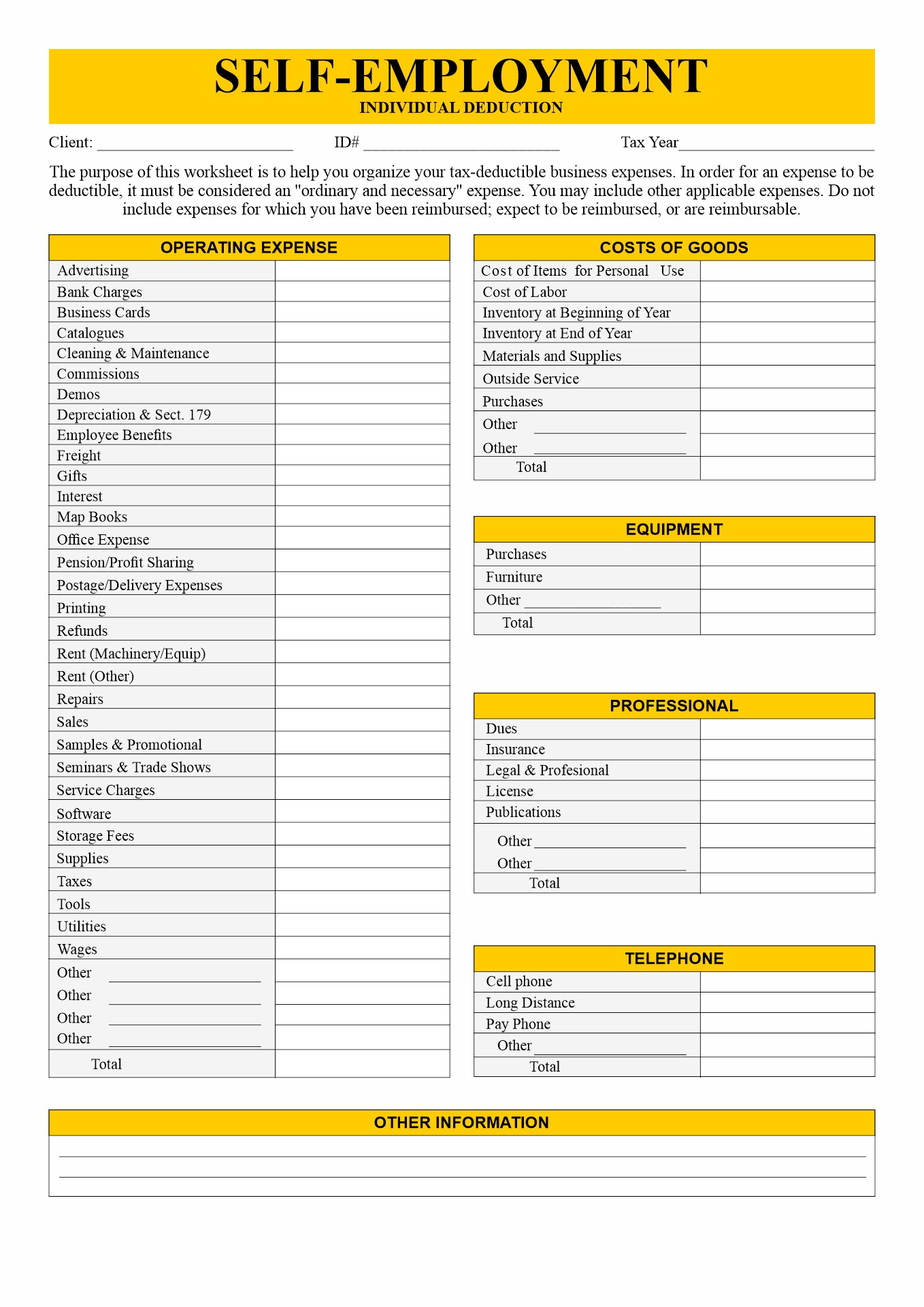

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

Save when you sell Under current law if you have owned and lived in the home for at least two of the five years leading up to the sale The first 250 000 of profit on the sale of a principal residence is Up to 1 200 for energy efficient home improvements in total Each door has a limit of 250 per door 500 total per year Windows have a limit of 600 per year

Construction Loan Interest If you ve recently built your new home and were able to itemize your deductions you can deduct the interest you paid during the first 34 It s typically structured as a 30 percent credit with a cap So for example the heat pump tax credit is 30 percent up to 2000 So if you spend 1000 then you could get a 300 credit But if you spend

Download Home Building Tax Deductions

More picture related to Home Building Tax Deductions

20 Self Motivation Worksheet Worksheeto

https://www.worksheeto.com/postpic/2014/10/self-employed-tax-deductions-worksheet_526560.png

Personal Income Tax Deductions And Allowances For 2016 Finance

https://th2-cdn.pgimgs.com/cms/news/2017/01/50650040_xxl.original.jpg

Your 2017 Tax Preparation Checklist The Motley Fool

https://g.foolcdn.com/editorial/images/436027/tax-form_tax-deductions_gettyimages-515708887.jpg

You do not have to be a first time home buyer if either of the following apply You can claim up to 10 000 on your 2023 tax return if you acquired a qualifying home Multifamily Homes 500 available for homes certified to eligible ENERGY STAR Multifamily New Construction MFNC program requirements with a larger tax credit

Heat pumps Your air conditioning and furnace are two of the biggest energy users in your home Switching to an energy efficient heat pump can net you a 30 In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state and local

Home Office Deduction Worksheet Excel Osakiroegner 99

https://i.pinimg.com/originals/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.png

FunctionalBest Of Self Employed Tax Deductions Worksheet

https://i.pinimg.com/474x/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

https://www.simplybuildable.com/knowledge-center/...

New Home Construction Deductions Tax Credits in 2023 There are a few common tax deductions and credits for new home builds which we ve outlined

https://www.irs.gov/publications/p530

Deductible sales taxes may include sales taxes paid on your home including mobile and prefabricated or home building materials if the tax rate was the same as the general sales tax rate so you can take a

Tax Credits Save You More Than Deductions Here Are The Best Ones

Home Office Deduction Worksheet Excel Osakiroegner 99

8 Tax Itemized Deduction Worksheet Worksheeto

Pin On Tax Credits Vs Tax Deductions

Home Sweet Homeowner Tax Deductions Centraljersey

5 Tax Deductions Small Business Owners Need To Know

5 Tax Deductions Small Business Owners Need To Know

When It Comes To Tax Deductions There s No Place Like Home Tax

Today We Are Discussing TAX DEDUCTIONS Tax Deductions Deduction Tax

List Of Tax Deductions Examples And Forms

Home Building Tax Deductions - Save when you sell Under current law if you have owned and lived in the home for at least two of the five years leading up to the sale The first 250 000 of profit on the sale of a principal residence is