Home Energy Rebate 2024 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and The 2024 Home Energy Efficiency Rebate Program I waive any and all claims against SoCalGas its parent company affiliate companies directors officers employees and agents arising out of activities conducted by or on behalf of SoCalGas in connection with my application for any rebate s under the 2024 Home Energy Efficiency Rebate Program

Home Energy Rebate 2024

Home Energy Rebate 2024

https://nationalhousingtrust.org/sites/default/files/styles/21_10_extra_wide/public/images/thermostat.png?h=252f27fa&itok=VVYgJYIX

News Flash Lorain OH CivicEngage

https://www.cityoflorain.org/ImageRepository/Document?documentID=4562

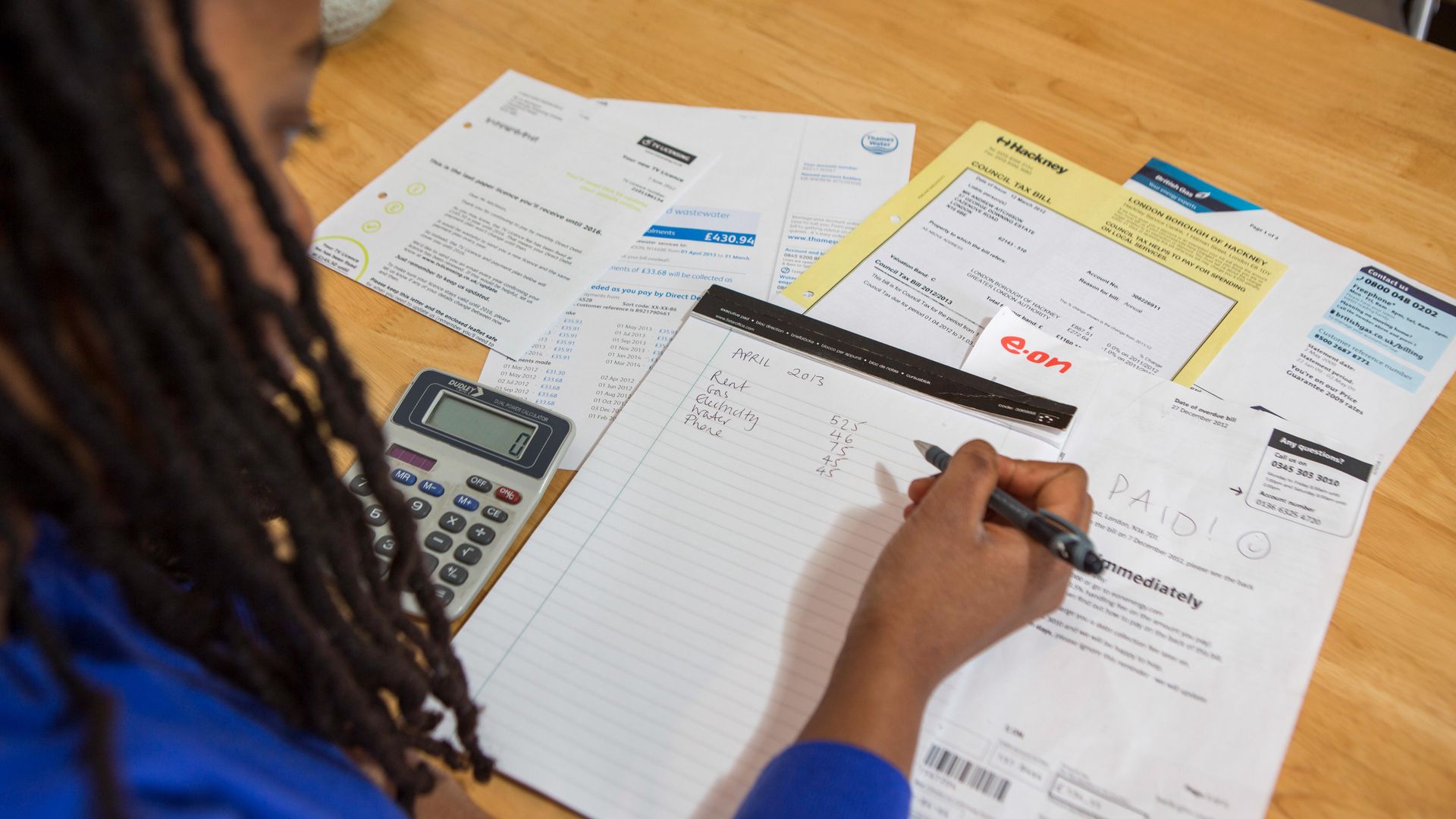

How Can You Get Your 150 Council Tax Rebate To Help With Increased Home Energy Costs

https://www.jantakareporter.com/wp-content/uploads/2022/04/energy-bills-rebate.jpg

Four states California Hawaii New Mexico and New York are the first to submit funding applications for the U S Department of Energy s DOE Home Energy Rebates program a historic 8 8 billion investment to lower costs for American families through energy efficiency and electrification thanks to President Biden s Inflation Reduction Act Home Energy Rebate Programs Requirements Application Instructions i INFLATION REDUCTION ACT HOME ENERGY REBATES Home Efficiency Rebates Program Sec 50121 Home Electrification and Appliance Rebates Program Sec 50122 PROGRAM REQUIREMENTS APPLICATION INSTRUCTIONS Applications Due by January 31 2025 VERSION 1 1

Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Greg Siedschlag the Department of Energy s chief communications strategist for the home energy rebates said the hope is to have the first rebate programs go live in the spring of 2024 with the majority of states and territories issuing rebates by the end of 2024

Download Home Energy Rebate 2024

More picture related to Home Energy Rebate 2024

Home enerwisesolutions ca

https://enerwisesolutions.ca/wp-content/uploads/2021/01/rebate.png

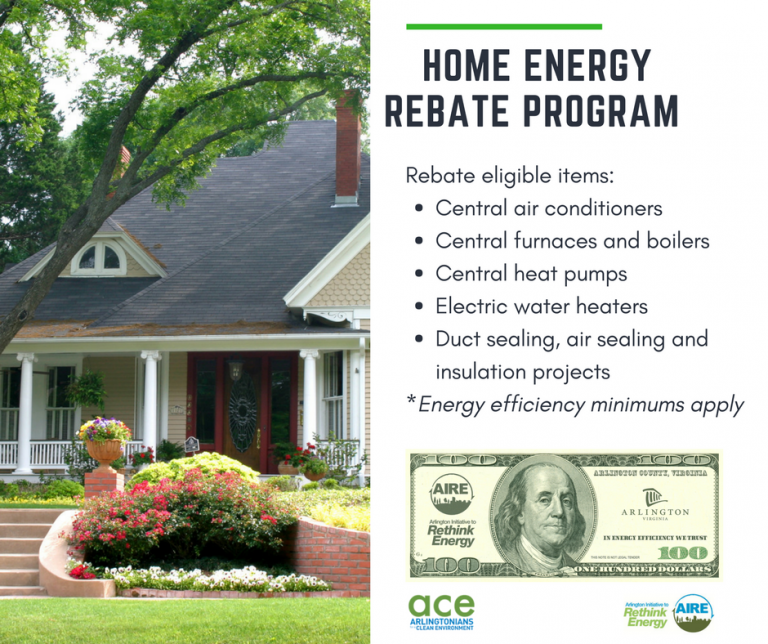

Home Energy Rebate Program 1 EcoAction Arlington

https://www.ecoactionarlington.org/wp-content/uploads/2018/02/Home-Energy-Rebate-Program-1-768x644.png

Home Efficiency Rebate HER

https://www.mapleair.com/ie_landing_pages/images/steps/step-3.jpg

Energy Efficiency and Electrification Rebates for 2024 Update Per the latest guidance from the US Department of Energy the home electrification rebates listed below are expected to be available in some areas in the second half of 2024 and available in most areas by early 2025 RINALDI So what the rebates will do is help a homeowner make that more climate friendly decision because if they choose the more efficient the higher technology the more electric technology

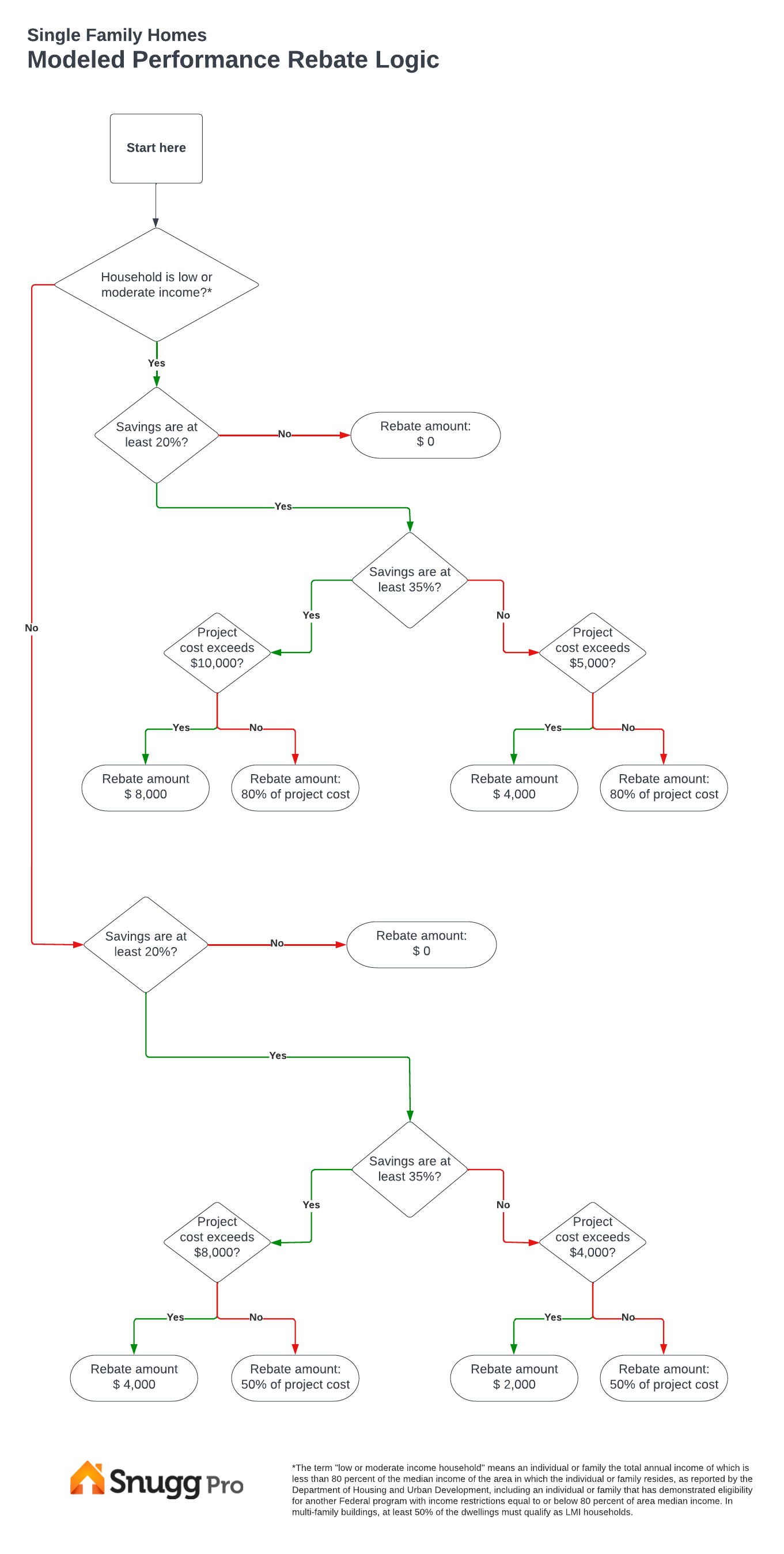

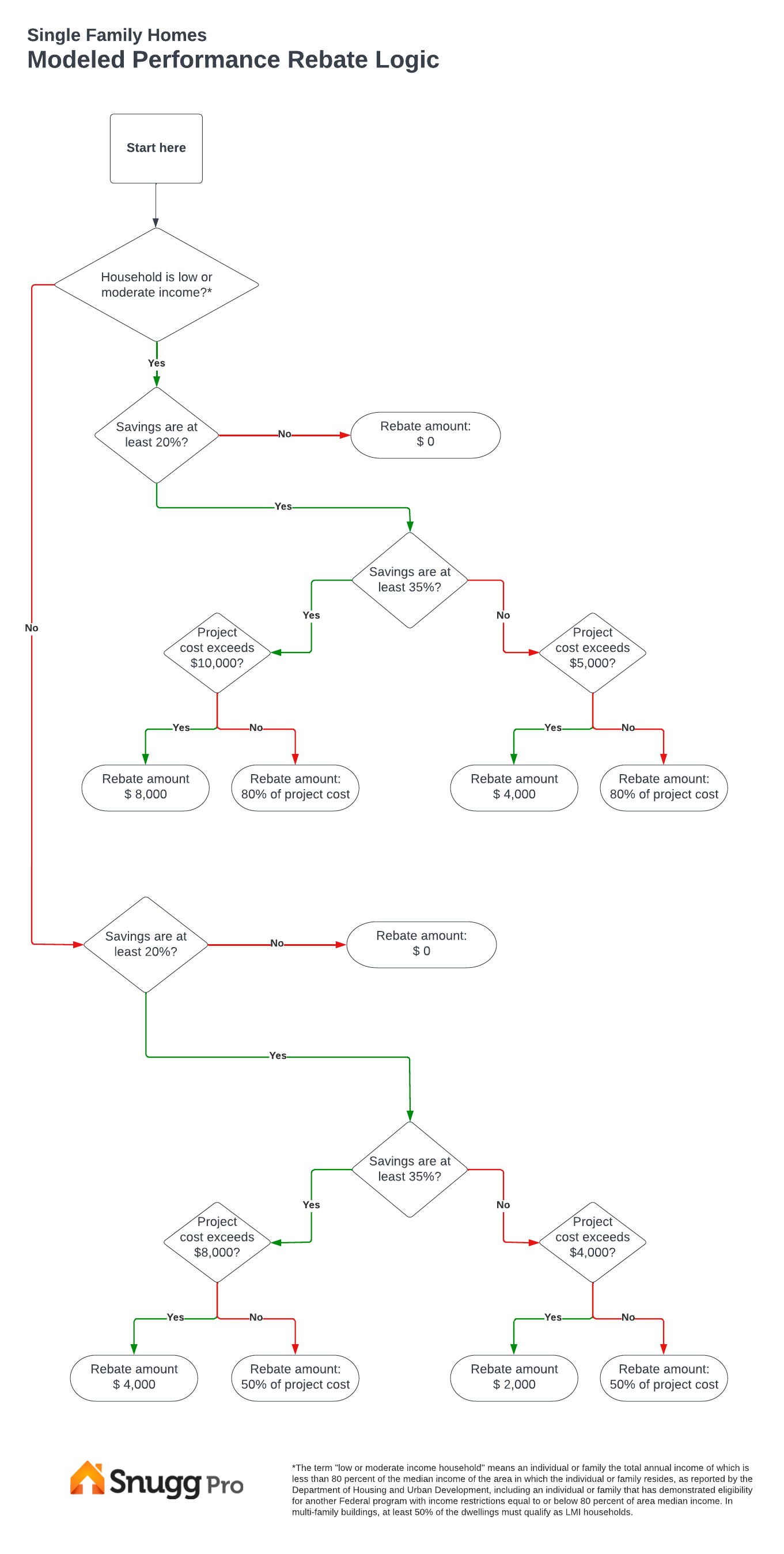

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project The Home Efficiency Rebates program provides up to 4 3 billion in formula grants to state energy offices to fund whole home energy efficiency upgrades in single and multi family houses Meanwhile

What The Climate Bill s HOMES Rebates Program Means For States Energy Offices And Home Performance

https://snuggpro.com/images/uploads/HOMES_Rebate_Program_Modeled_Savings.png

Edmonton Energy Rebate For Commercial Building Retrofits Solar Ninjas

https://solarninjas.energy/wp-content/uploads/2020/08/Rebate-rs-scaled-2560x1280.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

2023 Residential Clean Energy Credit Guide ReVision Energy

What The Climate Bill s HOMES Rebates Program Means For States Energy Offices And Home Performance

Home Efficiency Rebate HER

Construction Industry In Alaska Helped By Legislators Support Of Home Energy Rebate YouTube

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Seresto Rebate Form PrintableRebateForm

Seresto Rebate Form PrintableRebateForm

The 200 Energy Bills Rebate Everything You Need To Know TechRadar

Lensrebates Alcon Com

Mobil One Offical Rebate Printable Form Printable Forms Free Online

Home Energy Rebate 2024 - Jan 9 2023 Getting a substantial instant discount would simplify electrification for homeowners and widen its appeal But that means a system must be put in place for a contractor a state