Home Improvement Tax Incentives Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed

Home Improvement Tax Incentives

Home Improvement Tax Incentives

https://makingadifference.works/wp-content/uploads/2017/05/WyJxPfUl.jpeg

Are Home Improvements Tax Deductible LendingTree

https://www.lendingtree.com/content/uploads/2020/09/are-home-improvements-tax-deductible.jpg

7 Home Improvement Tax Deductions INFOGRAPHIC Tax Deductions

https://i.pinimg.com/originals/bb/c7/4e/bbc74ee927d067f43bbaf4252e12eb28.jpg

Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the year Making Our Homes More Efficient Clean Energy Tax Credits for Consumers UPDATED JULY 2024 Visit our Energy Savings Hub to learn more about saving money on

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on

Download Home Improvement Tax Incentives

More picture related to Home Improvement Tax Incentives

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

2023 Energy Efficient Home Credits Tax Benefits Tips

https://accountants.sva.com/hubfs/sva-certified-public-accountants-biz-tip-energy-efficient-home-improvement-credit-more-opportuniities-in-2023-01.png

.png)

Inflation Reduction Act Energy Cost Savings

https://www.whitehouse.senate.gov/imo/media/image/HomeEnergy (1).png

As part of President Biden s Investing in America agenda American families can lower their energy costs by upgrading home appliances insulating their homes and making The Inflation Reduction Act expands a homeowner efficiency tax credit called the Energy Efficient Home Improvement Credit This covers up to 30 of the cost of energy upgrades with a cap

Tax credit These are dollar for dollar reductions on your tax bill When you claim a tax credit the amount you owe goes down the exact same dollar amount Tax incentive These encourage taxpayers to do something Which home improvements qualify for the Energy Efficient Home Improvement Credit Beginning January 1 2023 the credit becomes equal to the lesser of 30 of the sum

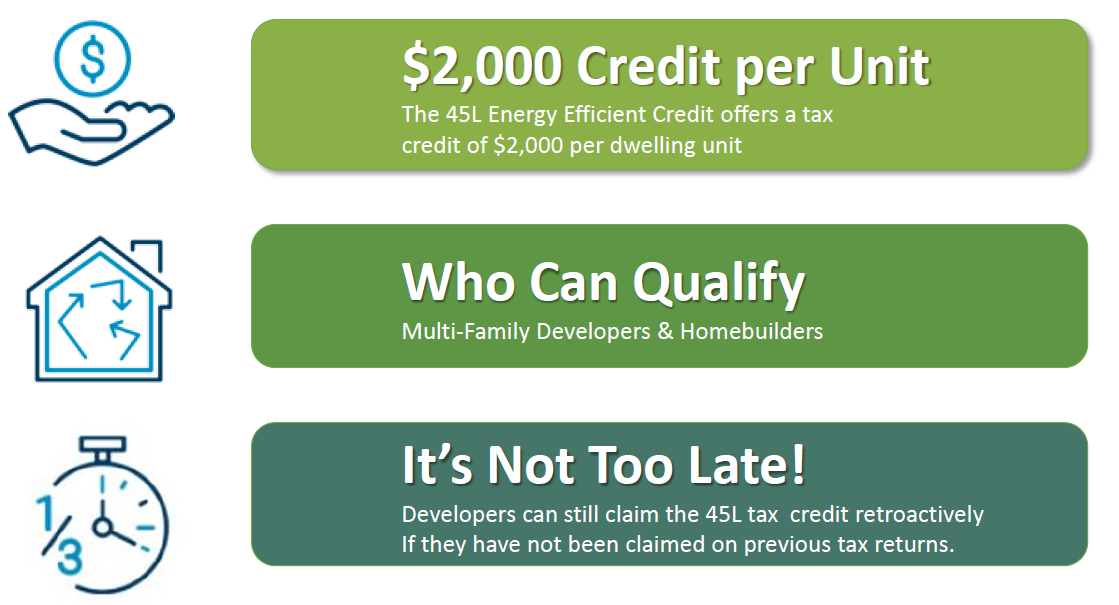

2021 Available Tax Incentives For Energy Efficiency CoVa Green Homes

https://www.covagreenhomes.com/wp-content/uploads/2021/09/45L-Tax-Image.png

5 Home Improvement Projects You Should Never DIY

https://www.royalhomeimprovements.ca/wp-content/uploads/2018/01/5-Home-Improvement-Projects-you-Should-Never-DIY.jpeg

https://www.irs.gov/newsroom/irs-home-improvements...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act

https://www.irs.gov/credits-deductions/home-energy-tax-credits

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who

How An Outsourced Tax Consultant Helps Capture Employment Incentives

2021 Available Tax Incentives For Energy Efficiency CoVa Green Homes

A Small House With Solar Panels On It s Roof And Plants Growing On The

Competitive Taxes And Incentives EDPA

Invest Your Tax Refund In Home Improvements Elite Renovations

Federal Government Offers Homeowners Tax Credit For Energy Efficient

Federal Government Offers Homeowners Tax Credit For Energy Efficient

Understanding The Energy Efficient Home Improvement Tax Credit

M R Home Improvement Home Improvement Contractor Installs Decks In

Home Improvement And Preparedness Tax Holidays In Each State

Home Improvement Tax Incentives - The Energy Efficient Home Improvement tax credit is capped at 1 200 annually for most improvements though taxpayers are able to claim the 2 000 credit for heating and cooling