Home Improvements For Income Tax Rebate Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 9 sept 2022 nbsp 0183 32 The HOMES Rebate program would cover upgrades from solar panels to new windows that help your home become more energy efficient Under the law the Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Home Improvements For Income Tax Rebate

Home Improvements For Income Tax Rebate

https://mccannwindow.com/wp-content/uploads/2022/09/mccann-sept-energy-1200.png

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web 22 juin 2023 nbsp 0183 32 Credits are capped at 600 for windows and 500 for two doors Insulation Replacing your old insulation also comes with a 30 credit also up from 10 last year Web 22 d 233 c 2022 nbsp 0183 32 Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home

Web 8 mars 2021 nbsp 0183 32 Taxes Tax Deductible Home Improvement amp Repairs For 2022 Published on Mar 8 2021 7 minute read By Rebecca Henderson Reviewed by Expert Riley Adams Web The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit o insulation materials or systems and air sealing materials or

Download Home Improvements For Income Tax Rebate

More picture related to Home Improvements For Income Tax Rebate

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

What To Know About Montana s New Income And Property Tax Rebates

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ZJcd.img?w=1280&h=720&m=4&q=50

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

Web 30 d 233 c 2022 nbsp 0183 32 Improvements such as installing heat pumps heat pump water heaters insulation doors and windows as well as electrical panel upgrades home energy audits and more are covered by the tax credits Web 29 ao 251 t 2022 nbsp 0183 32 Tax Credits for Homeowners One of the key goals of the Inflation Reduction Act is to help businesses boost clean energy production However the bill also offers several tax credits and rebates

Web 6 ao 251 t 2023 nbsp 0183 32 Here are eight ways you can get a tax deduction or tax credit for home improvements Energy Efficient Improvements The federal government offers tax Web 28 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Program Up to 14 000 Potential savings are even bigger under this program which is limited to homeowners making up

Go Green Get Green Tax Rebates And Incentives For Green Home

https://i.pinimg.com/736x/cd/e4/46/cde44634acad50f7e7bcfd4aa5f93e45--home-hacks-green-homes.jpg

Income Tax And Rebate For Apartment Owners Association

https://image.slidesharecdn.com/incometaxandrebateforapartmentownersassociation-091116034252-phpapp01/95/income-tax-and-rebate-for-apartment-owners-association-6-728.jpg?cb=1258343000

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.cbsnews.com/news/inflation-reduction-act-joe-biden-climate...

Web 9 sept 2022 nbsp 0183 32 The HOMES Rebate program would cover upgrades from solar panels to new windows that help your home become more energy efficient Under the law the

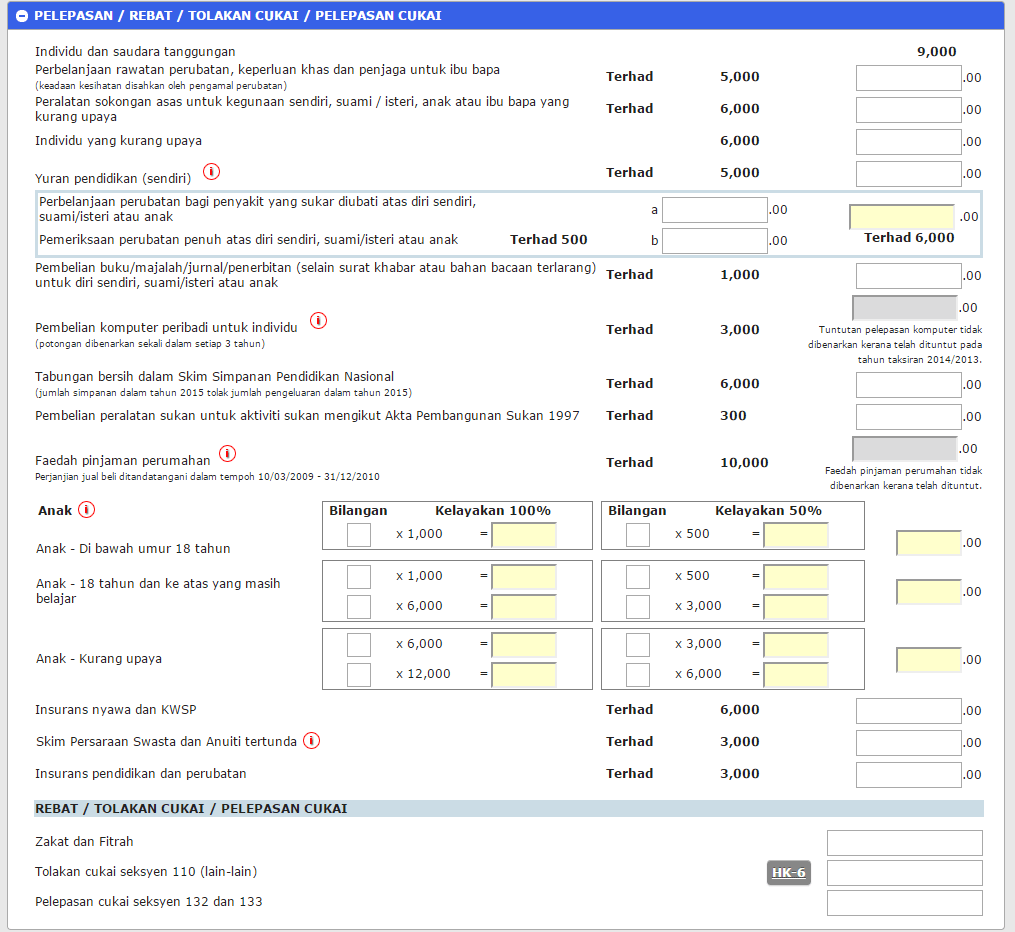

How to Step By Step Income Tax E Filing Guide IMoney

Go Green Get Green Tax Rebates And Incentives For Green Home

Individual Income Tax Rebate

Energy Efficiency Rebates And Tax Credits For Home Improvements In 2023

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Section 87A Tax Rebate Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Home Improvements For Income Tax Rebate - Web 22 d 233 c 2022 nbsp 0183 32 Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home