Home Insulation Rebates 2024 On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

1 200 maximum amount credited Annual Limits on Energy Efficient Home Improvement Tax Credits In addition to limits on the amount of credit you can claim for any particular equipment installation or home improvement there are annual aggregate limits The overall total limit for an efficiency tax credit in one year is 3 200 We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for

Home Insulation Rebates 2024

Home Insulation Rebates 2024

https://www.gni.ca/pictures/blog/2015/12/insulation-rebates.jpg

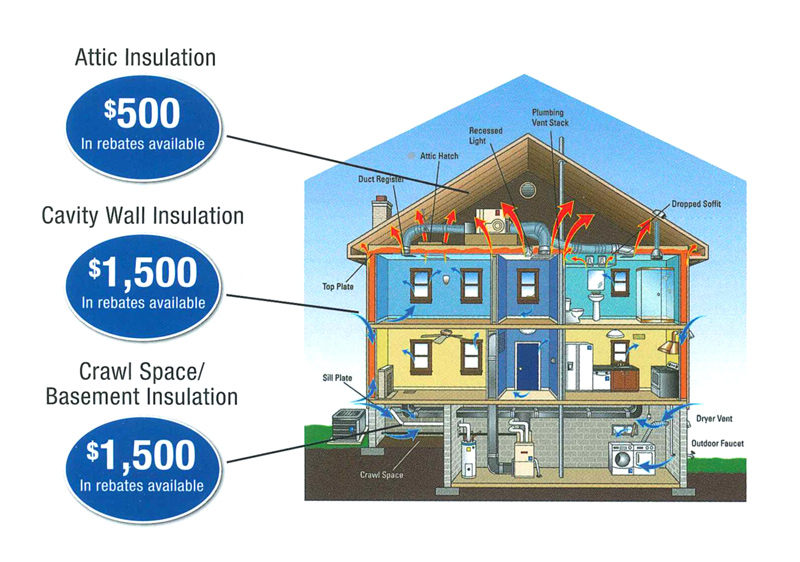

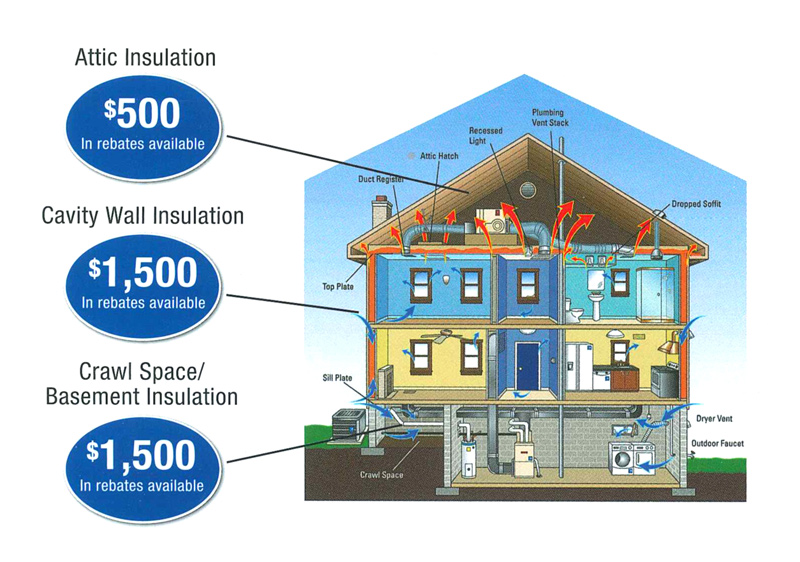

Save Money With Home Insulation Rebates Fase Two Insulation

https://fasetwoinsulation.com/wp-content/uploads/2023/04/home-insulation-rebate-photo.jpg

Home Insulation Guide For New Homeowners The Pinnacle List

https://www.thepinnaclelist.com/wp-content/uploads/2023/06/Home-Insulation-Guide-For-New-Homeowners.jpg

The Inflation Reduction Act is a piece of federal legislation passed in August 2022 that included 370 billion in clean energy investments Despite its name it s largely seen as a climate change The 25c tax credit for insulation and air sealing upgrades is increasing in 2023 to a max of 1200 per year Insulation rebates are also available in some cases you can get up to 1600 back on qualifying insulation upgrades There are often local utility company insulation rebates too in addition to the new federal ones

1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

Download Home Insulation Rebates 2024

More picture related to Home Insulation Rebates 2024

HEEHRA The High Efficiency Electric Home Rebate Program Guide

https://i.shgcdn.com/96933eb7-910e-41f2-89af-74aa6a439ba3/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Efficiency Manitoba Home Insulation Rebates Cold Country Spray Foam

https://coldcountrysprayfoam.com/wp-content/uploads/2022/12/Efficiency-Manitoba-Home-Insulation-Rebate.jpg

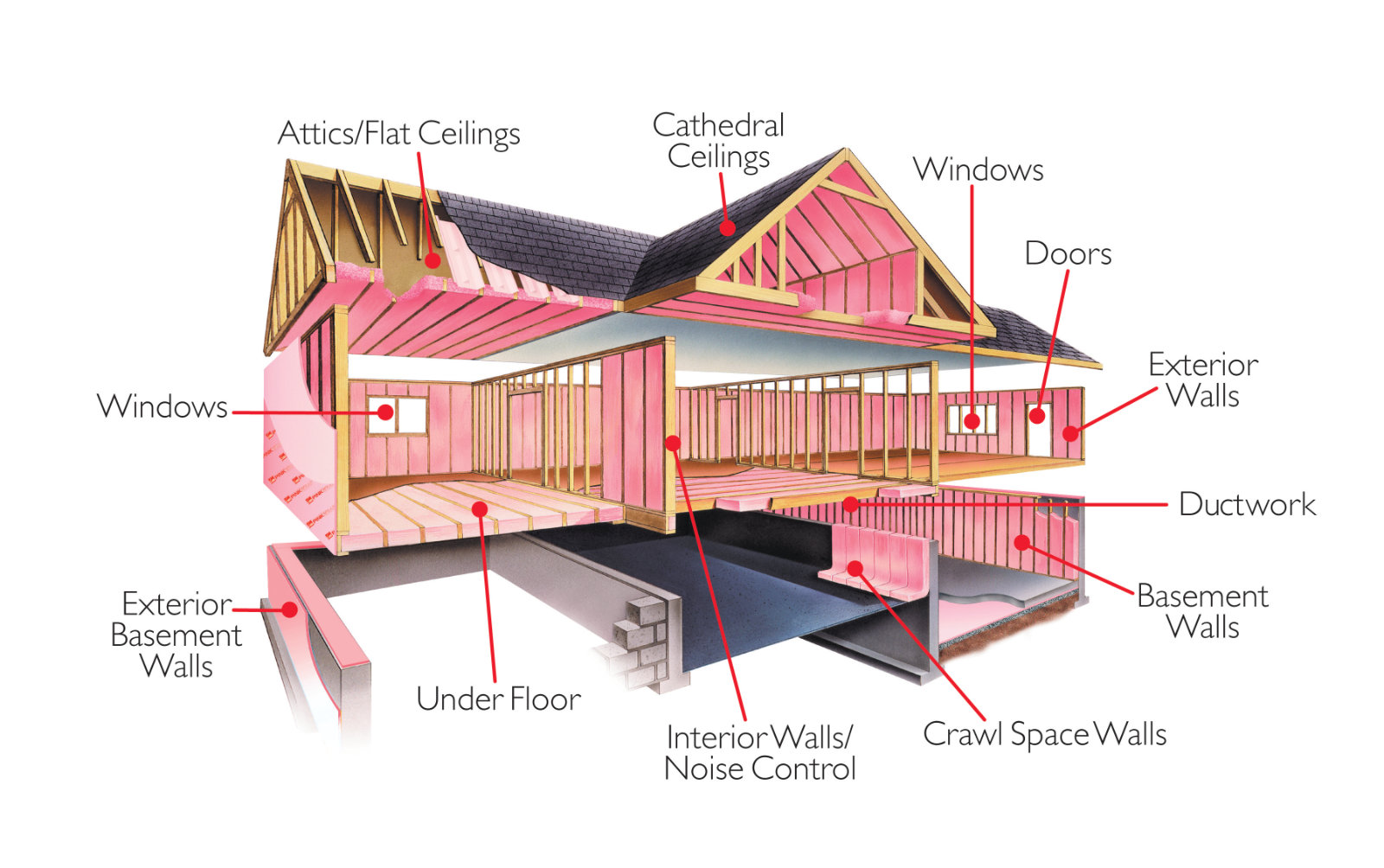

Vaulted Ceiling Insulation R Value Shelly Lighting

https://lynchinsulation.com/wp-content/uploads/2018/08/House-Cutaway-copy.jpg

By further improving your home s envelope with new ENERGY STAR certified exterior doors and a heat pump water heater you can claim up to 600 or 30 of the product cost for upgrading your windows in one taxable year 30 of the product cost up to 250 per door 500 maximum in one taxable year 30 of the project costs up to 2 000 for Home energy audits of a main home The maximum credit that can be claimed each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit The Inflation Reduction Act of 2022 part of the United States goal to reach net zero by 2050 provides nearly 369 billion for renewable energy equipment and energy efficient home improvements This is a powerful strategy as using low carbon building materials can significantly cut emissions while preserving a building s performance

Insulation Rebates In St Anthony MN Rebate For Insulation

https://www.centuryinsulation.com/wp-content/uploads/2023/03/Insulation-Rebates-in-St-Anthony-MN.jpg

Home Insulation Rebates For Ceiling Floor Walls Nova Scotia

https://ens-efficiency-ns-prod-offload-647701102377-ca-central-1.s3.ca-central-1.amazonaws.com/wp-content/uploads/2019/08/06191743/res-product-content-insulation.jpg

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.energystar.gov/about/federal_tax_credits/insulation

1 200 maximum amount credited Annual Limits on Energy Efficient Home Improvement Tax Credits In addition to limits on the amount of credit you can claim for any particular equipment installation or home improvement there are annual aggregate limits The overall total limit for an efficiency tax credit in one year is 3 200

Gallery Complete Home Insulation TVA Rebates

Insulation Rebates In St Anthony MN Rebate For Insulation

Insulation Rebates 33 Canadian Insulation Grants To Help You Stay Warm And Save Money

Earn Rebates Save Energy And Improve The Comfort Of Your Home By Upgrading Your Insulation And

LADWP Rebate Insulation Program Progressive Insulation Windows

Rebates Closed Cell Foam Insulation

Rebates Closed Cell Foam Insulation

Green Ontario Rebates Program Northstar Insulation

Fixing Various Problems With Attic Insulation Home Improvement Stack Exchange

Attic Insulation Methods Structure Tech Home Inspections

Home Insulation Rebates 2024 - 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5