Welcome to Our blog, an area where interest meets info, and where day-to-day subjects come to be engaging conversations. Whether you're seeking insights on lifestyle, modern technology, or a bit of whatever in between, you've landed in the right place. Join us on this exploration as we dive into the worlds of the regular and remarkable, making sense of the globe one blog post each time. Your journey into the remarkable and diverse landscape of our Home Loan Deduction In Income Tax Calculator begins here. Check out the exciting web content that awaits in our Home Loan Deduction In Income Tax Calculator, where we unravel the ins and outs of numerous subjects.

Home Loan Deduction In Income Tax Calculator

Home Loan Deduction In Income Tax Calculator

Home Loan Deduction In Income Tax itrfiling YouTube

Home Loan Deduction In Income Tax itrfiling YouTube

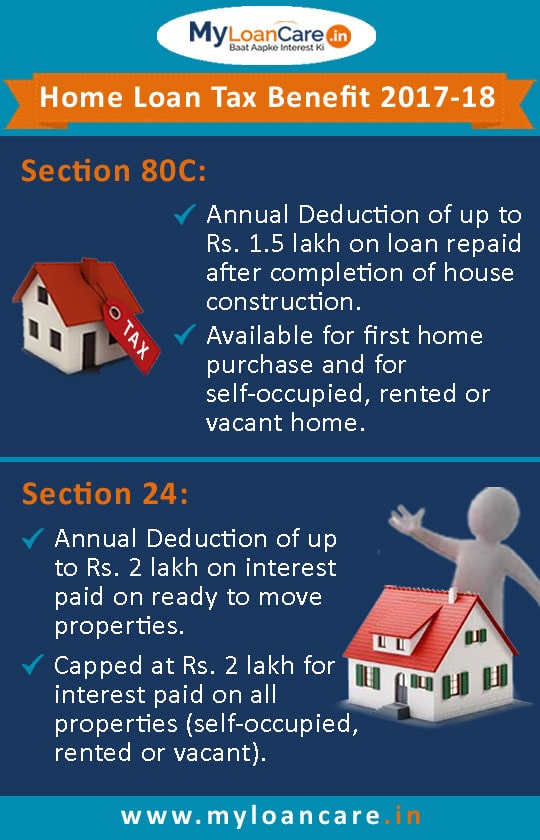

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Gallery Image for Home Loan Deduction In Income Tax Calculator

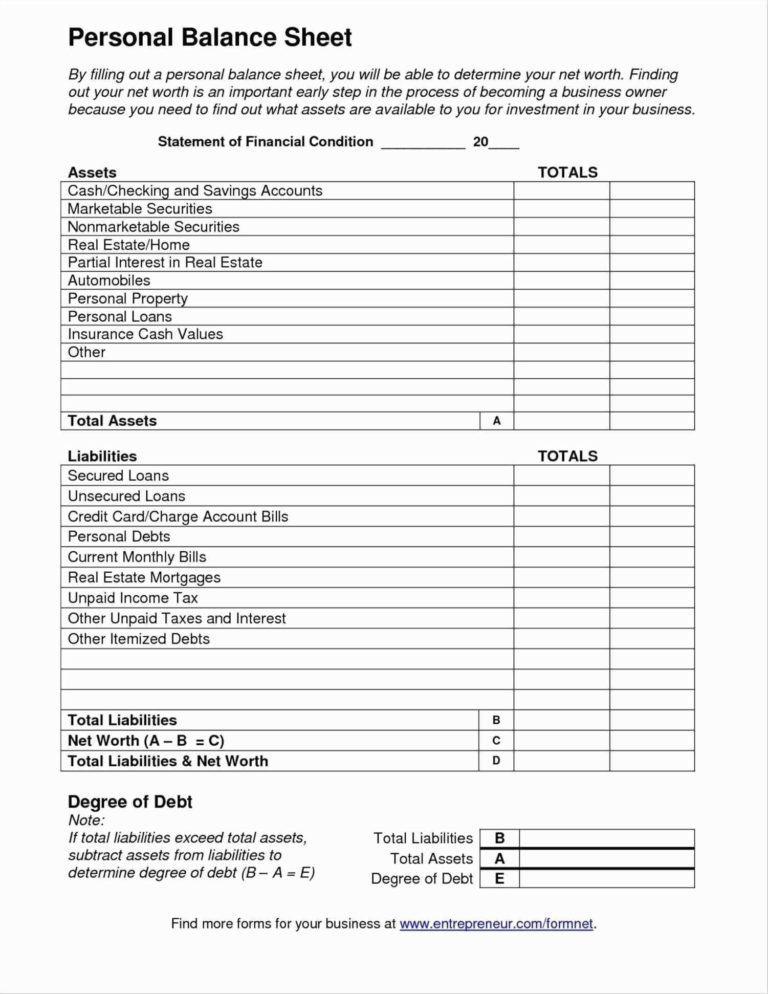

Printable Small Business Tax Deductions Worksheet

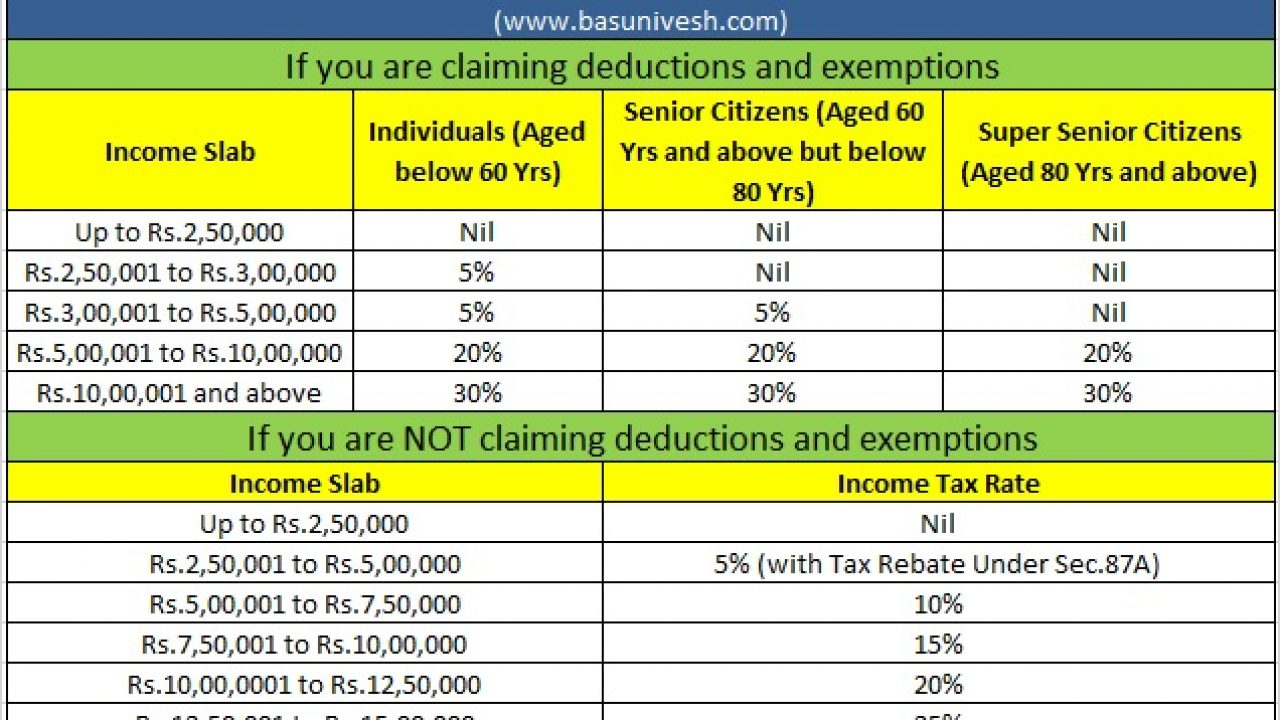

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

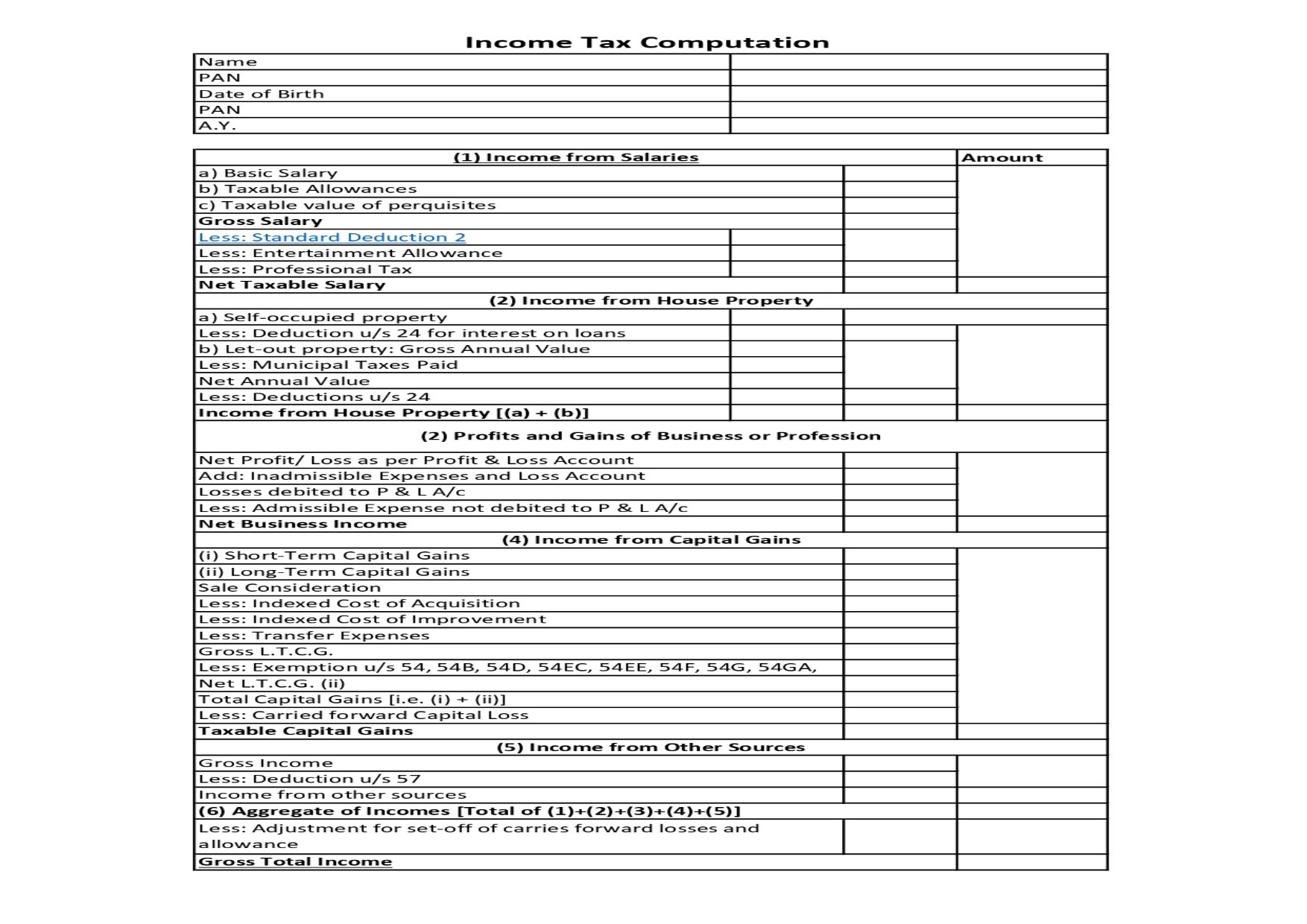

Income Tax Computation Format PDF A Comprehensive Guide

Home Loan Benefits For Income Tax Home Sweet Home Modern Livingroom

Income Tax Benefits On Home Loan Loanfasttrack

Singapore Corporate Income Tax Calculator 2022 ODINT Consulting

Singapore Corporate Income Tax Calculator 2022 ODINT Consulting

Section 24 Of Income Tax Act House Property Deduction

Thank you for picking to explore our web site. We genuinely wish your experience exceeds your expectations, which you discover all the details and sources about Home Loan Deduction In Income Tax Calculator that you are looking for. Our commitment is to give an user-friendly and interesting system, so feel free to browse through our web pages effortlessly.