Home Loan Exemption In Income Tax Fy 2022 23 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than 45 lakh can still claim

Avail Income Tax Benefits on Home Loan under section 24 b 80C for up to Rs 2 00 000 Know home loan tax benefits for FY 2022 23 for second home loan joint home loan Know all about the tax saving benefits available under the Income Tax Act for FY 2020 21 AY 2021 22 available for home buyers with and without home loans

Home Loan Exemption In Income Tax Fy 2022 23

Home Loan Exemption In Income Tax Fy 2022 23

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

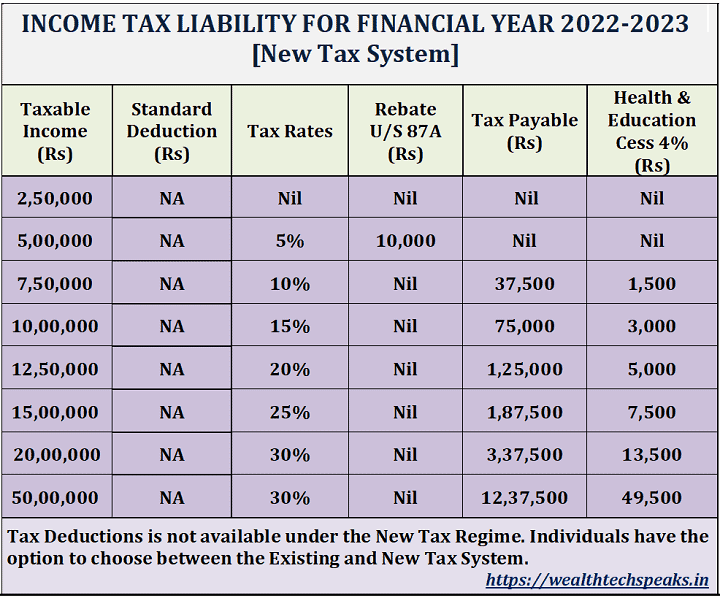

Old Tax Regime Vs New Tax Regime For The Assessment Year 2024 25

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

Section 80EEA Interest on Home Loan For First Time Home Owners This is Section 80EEA which provides taxpayers with an extra deduction for paying interest on a house loan Whereas Section 24 exempted interest on Deduction of Interest on Home Loan for the property House Property owners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family

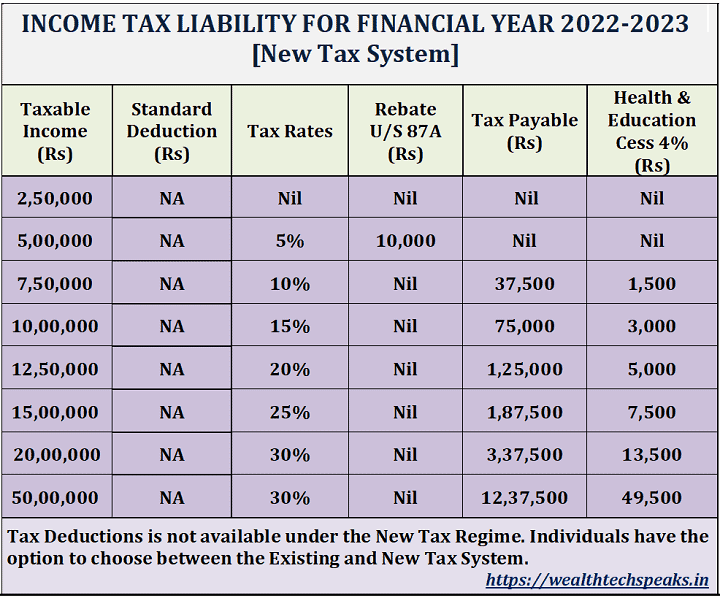

What are the Exemptions and Deductions Available Under the New Regime Under the New tax regime you can claim tax exemption for the following Transport The new regime under Section 115BAC gives individuals and HUF taxpayers an option to pay income tax at lower rates with fewer exemptions and deductions to claim Keep reading to

Download Home Loan Exemption In Income Tax Fy 2022 23

More picture related to Home Loan Exemption In Income Tax Fy 2022 23

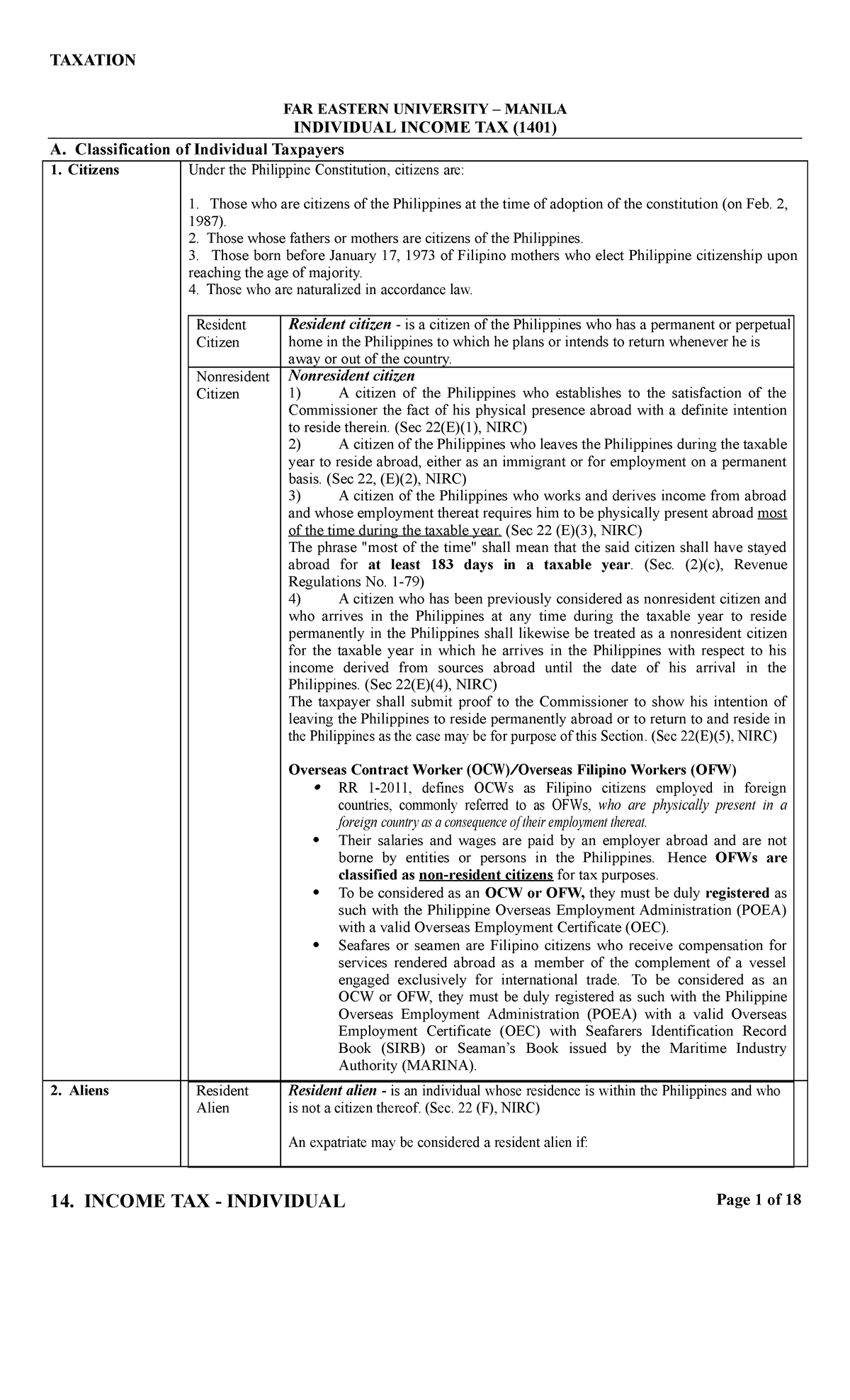

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Income Tax Calculation 2022 23 How To Calculate Income Tax FY 2022 23

https://i.ytimg.com/vi/aTDYGbVWpas/maxresdefault.jpg

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

Check out the Home Loan tax benefits under Sections 24 b 80EE and 80C to save tax on your Home Loan Learn how much tax exemption you can claim on a housing loan To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed of all income tax

Home loan borrowers may claim an income tax deduction of up to Rs 1 50 000 on the principal amount paid back throughout the year under Section 80C of the Income Tax Act How is tax exemption calculated on home loan If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

https://wealthtechspeaks.in/wp-content/uploads/2022/03/Income-Tax-Liability-New-Tax-System.png

Income Tax Calculator Ay 2023 24 Excel Apnaplan Printable Forms Free

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

https://www.livemint.com › money › persona…

New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than 45 lakh can still claim

https://www.magicbricks.com › homeloan › …

Avail Income Tax Benefits on Home Loan under section 24 b 80C for up to Rs 2 00 000 Know home loan tax benefits for FY 2022 23 for second home loan joint home loan

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

Income Tax Appellate Tribunal Recruitment Https www itat gov in

20 Online Tax Estimator BenHollyanne

Income Tax Budget 2024 10

Income Tax 2022 How Is The Rent Payment Declared Income Tax

Income Tax 2022 How Is The Rent Payment Declared Income Tax

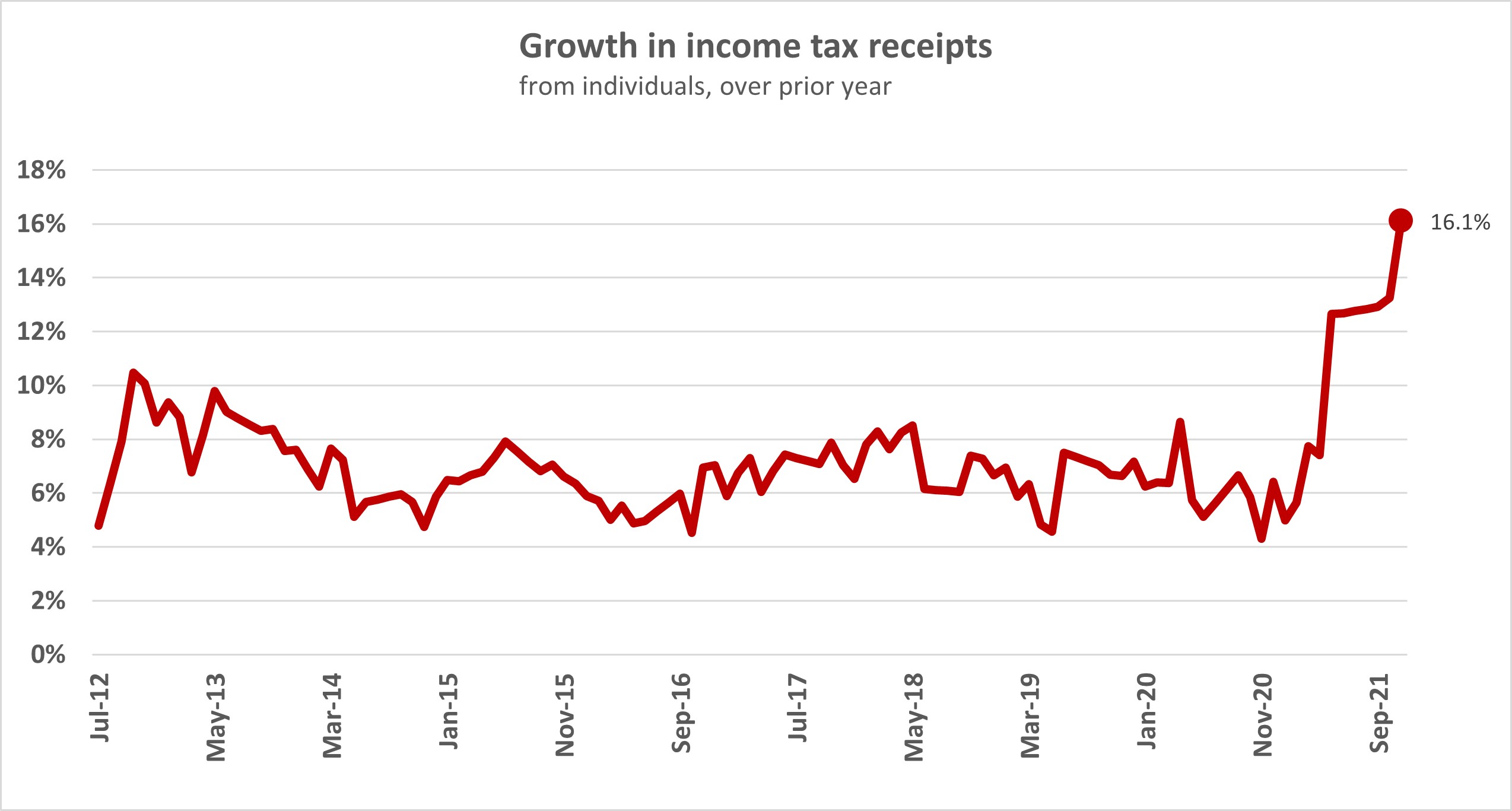

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Income Tax Calculation Example 2 For Salary Employees 2023 24

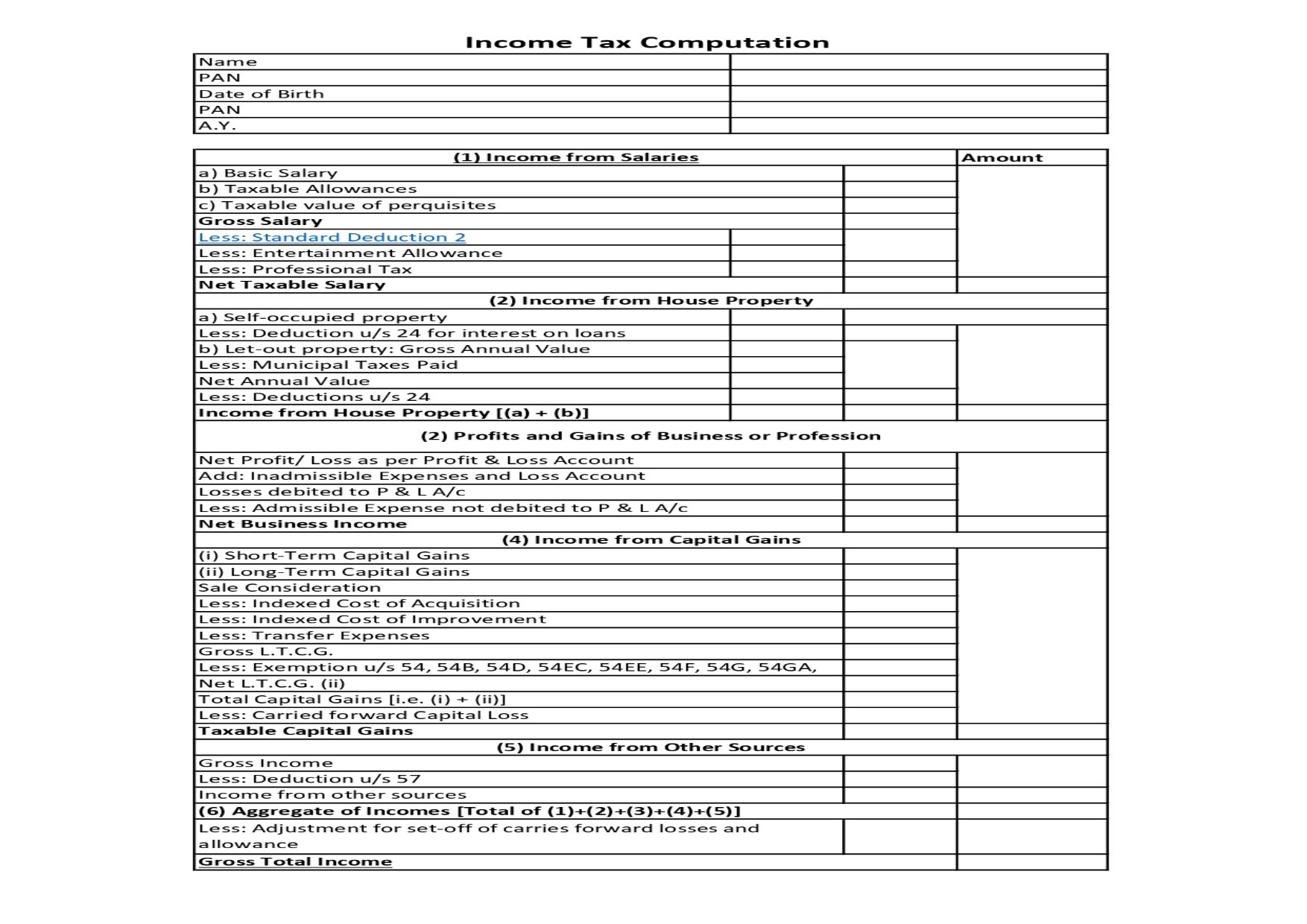

Income Tax Computation Format PDF A Comprehensive Guide

Home Loan Exemption In Income Tax Fy 2022 23 - Tax benefits on Home Loan A Home Loan is eligible for tax deduction under Section 24b 80EE 80EEA and 80C of the IT Act Let s get to know more in detail 1 Avail tax deduction of up to