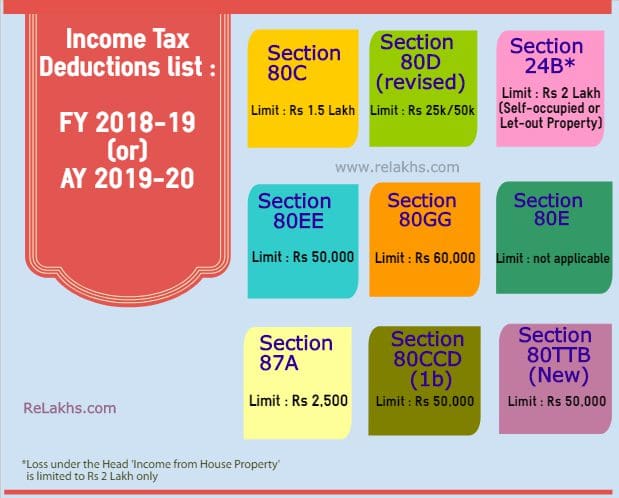

Home Loan Income Tax Rebate India Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Home Loan Income Tax Rebate India

Home Loan Income Tax Rebate India

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Web 10 mars 2021 nbsp 0183 32 1 Deduction on repayment of principal amount of home loan The EMI paid by you has two components principal repayment and interest paid The amount repaid as principal component in the EMI can

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Web 31 mars 2019 nbsp 0183 32 Apply Now Principal Repayment of Home Loan Section 80C In any financial year you can also avail of a deduction on the principal portion of your home loan EMIs This deduction is available under

Download Home Loan Income Tax Rebate India

More picture related to Home Loan Income Tax Rebate India

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Web 20 mars 2023 nbsp 0183 32 A Home Loan is a financial source for your dream come true along with making a better deal for tax savers A home loan provides a number of benefits upon repayment through tax Web Under section 24 of the Income Tax Act you are eligible for home loan tax benefit of up to 2 lakhs for the self occupied home In case you have a second house the total tax

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Web Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

Home Loan Tax Benefit 2019 20 In Hindi Home Sweet Home Insurance

https://quickbooks.intuit.com/in/resources/in_qrc/uploads/2019/02/India-Budget-2019-2020-2.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://economictimes.indiatimes.com/wealth/…

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Latest Income Tax Rebate On Home Loan 2023

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Income Tax Benefits On Home Loan Loanfasttrack

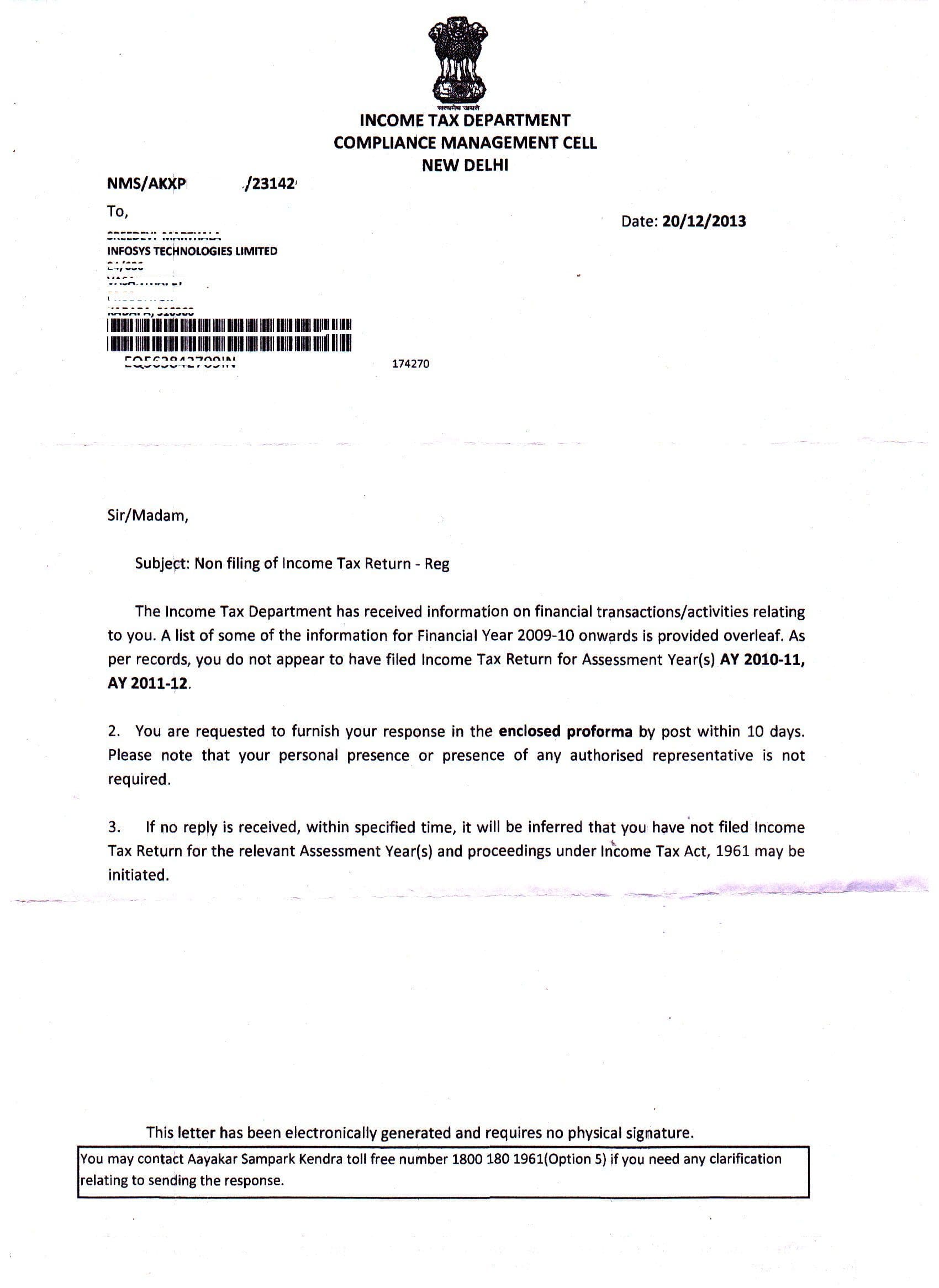

How To Respond To Non Filing Of Income Tax Return Notice

Home Loan Income Tax Rebate India - Web Section 24 b of the Income Tax Act allows a deduction of up to Rs 2 lakh while Section 80C allows a deduction of up to Rs 1 5 lakh Additionally Section 80EEA allows a