Home Loan Interest And Principal Tax Rebate Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that

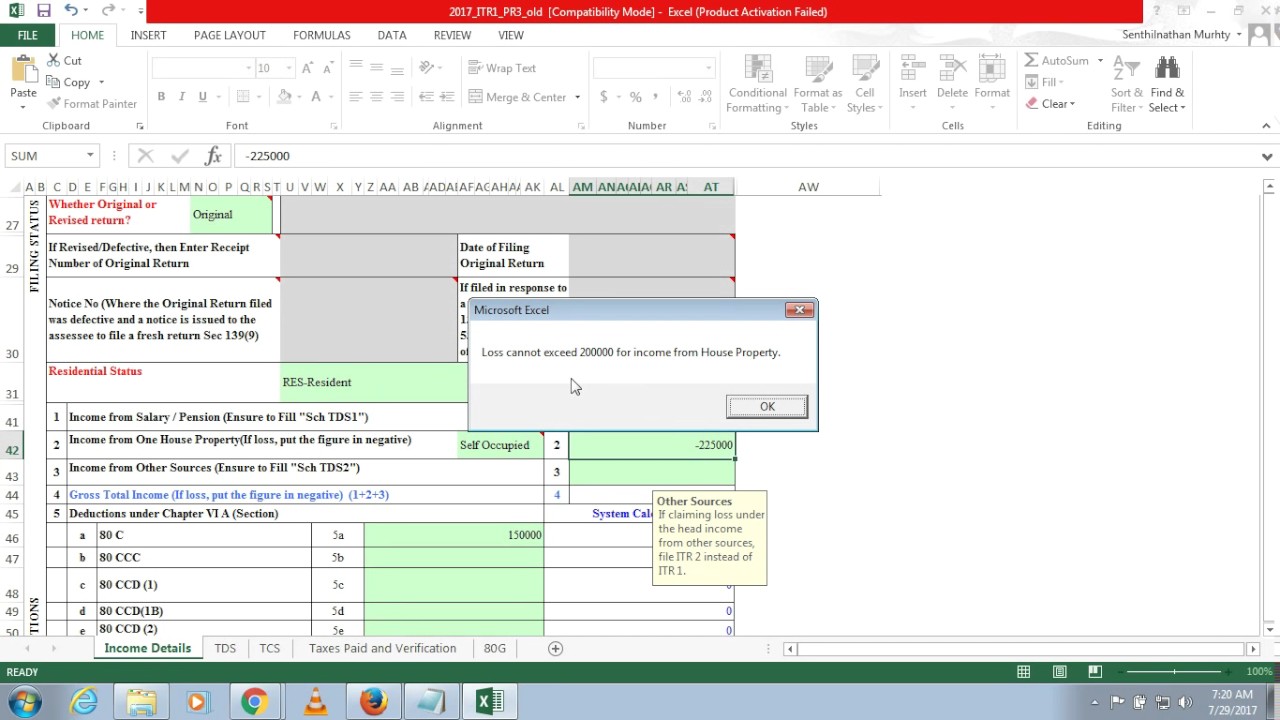

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web 25 mars 2016 nbsp 0183 32 To understand the key tax benefit on a home loan we are bifurcating the repayment techniques into four major elements tax

Home Loan Interest And Principal Tax Rebate

Home Loan Interest And Principal Tax Rebate

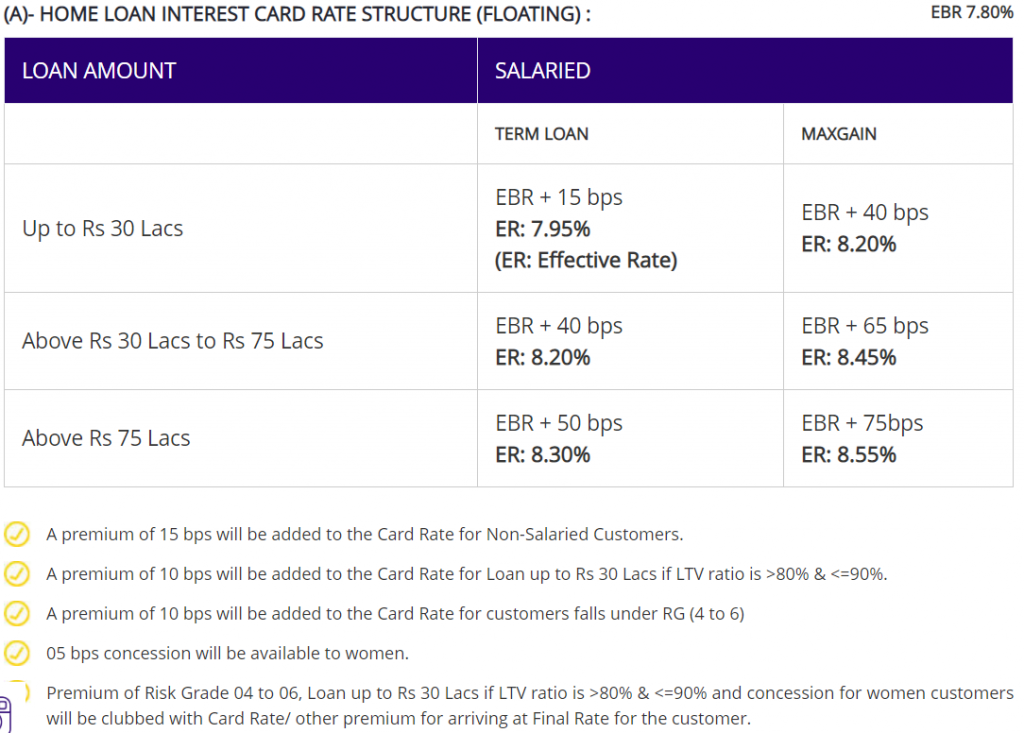

https://www.apnaplan.com/wp-content/uploads/2020/01/SBI-Home-Loan-Interest-Rate-wef-1-January-2020-1024x733.png

How To Lower Loan Interest Rates

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

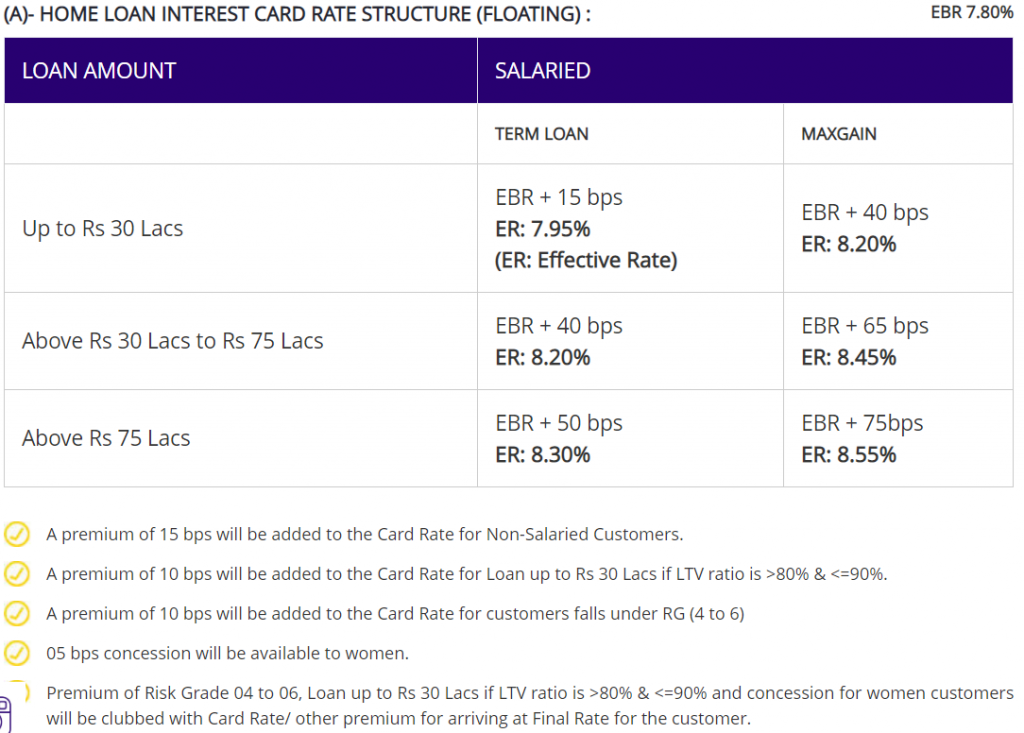

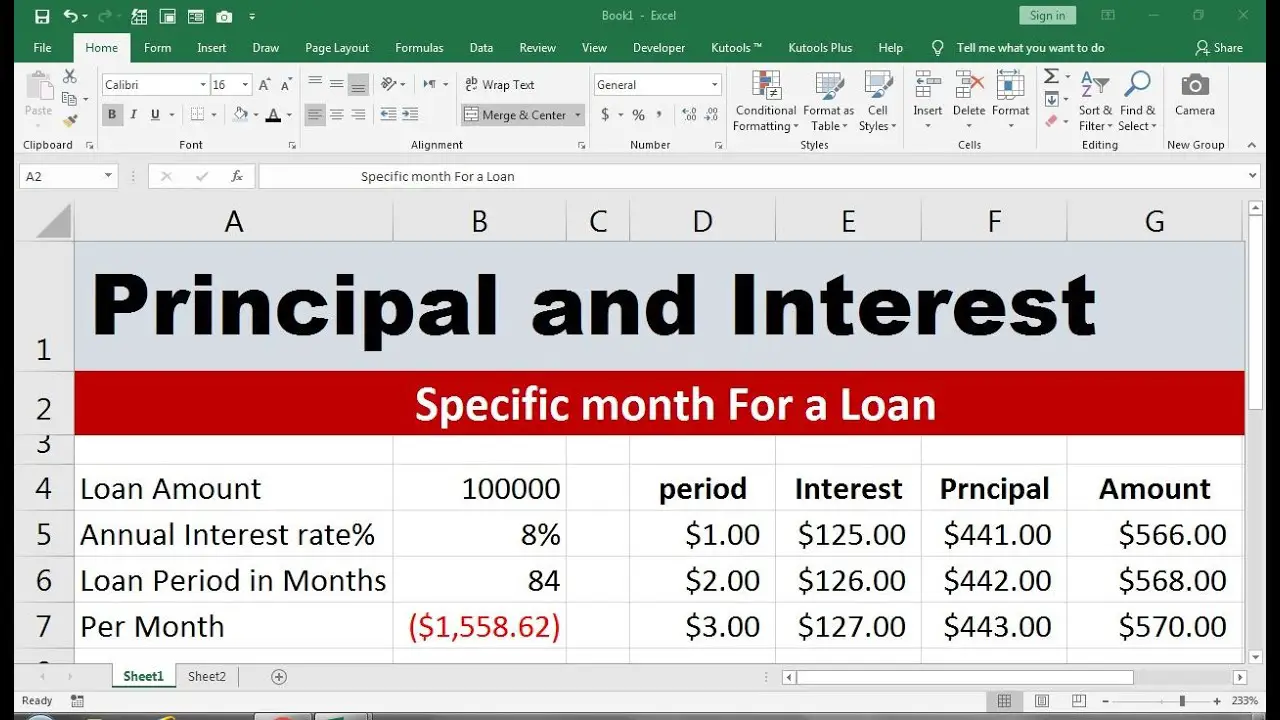

Home Loan EMI Calculator Free Excel Sheet Stable Investor

https://i2.wp.com/stableinvestor.com/wp-content/uploads/2020/11/Home-loan-EMI-interest-principal.png?resize=496%2C500&ssl=1

Web 9 f 233 vr 2018 nbsp 0183 32 Tax benefits of a Home Loan Section 80C Home Loan principal For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is Web 31 mai 2022 nbsp 0183 32 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan you can claim home loan

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income

Download Home Loan Interest And Principal Tax Rebate

More picture related to Home Loan Interest And Principal Tax Rebate

Home Loan Repayments Principal And Interest Or Interest Only

https://www.realestate.com.au/blog/images/519x1024-fit%2Cprogressive/2017/08/30112149/Bankwest_Infographic_v5-519x1024.jpg

The Five Year Rule For Buying A House

http://thismatter.com/money/real-estate/images/mortgage-payments-interest-principal-portions.gif

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Web When two people take out a house loan together they may split the tax benefits interest paid on loan is deductible up to Rs 2 lakhs under Section 24 b and the repayment of Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to

Web 1 f 233 vr 2021 nbsp 0183 32 The tax benefits for interest payment and principal repayment of home loan can be claimed by both only if they are joint owners as well as a co borrowers servicing Web Home Loan Tax Benefits under Section 80C Principal Deductions Section 80C deals with the principal amount deductions For both self occupied and let out properties you can

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Understanding Home Loan Refinance Interest Rates In 2023 Money

https://i.pinimg.com/originals/1b/66/fd/1b66fda37115a14cabf98db5215efe2d.jpg

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Rising Home Loan Interests Have Begun To Impact Homebuyers

Home Loan Tax Benefit Calculator FrankiSoumya

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

Essential Design Smartphone Apps

Mortgage Why Is The Breakdown Of A Loan Repayment Into Principal And

Loan Principal Definition Deltapart

Loan Principal Definition Deltapart

Best Home Loan Interest Rate Comparison

How To Calculate Principal And Interest For Mortgage

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

Home Loan Interest And Principal Tax Rebate - Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head