Home Loan Interest Deduction Under Section 24 B Web 18 Dez 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can

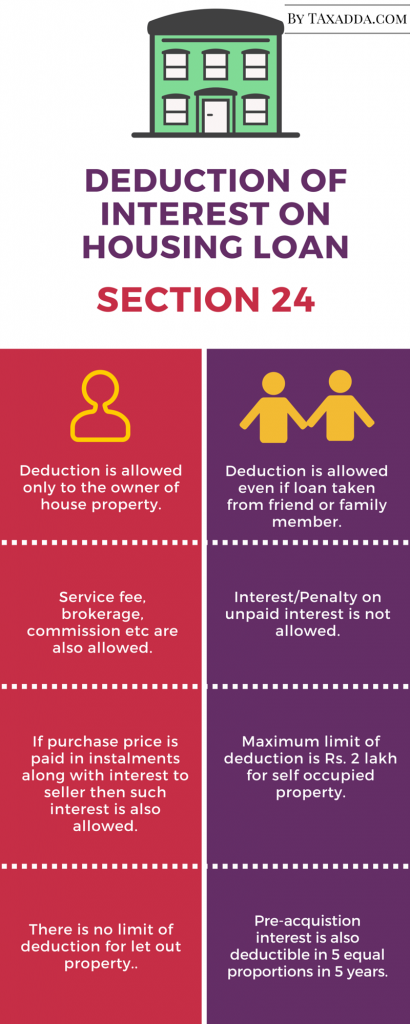

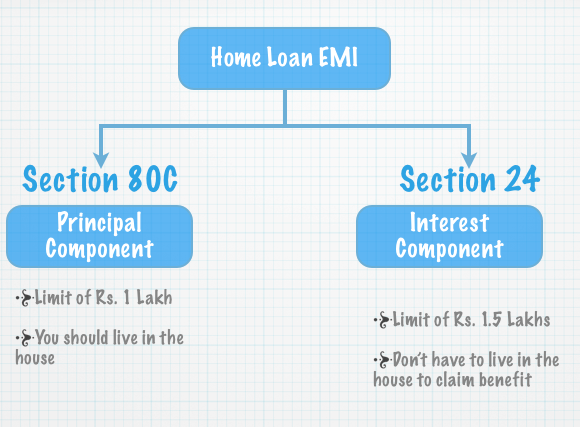

Web Vor 2 Tagen nbsp 0183 32 Section 24B is among the multiple provisions in the income tax law that talk about tax deductions against home loan interest payments Additional tax deduction against home loan interest payment is also offered under Section 80EE and Web 26 Juli 2023 nbsp 0183 32 As a homeowner you can claim a deduction of up to INR 2 lakh on your home loan s interest if you are self occupying the house You can also claim this deduction if your house is vacant However if you have let out your property the entire interest on the home loan can be claimed as a deduction

Home Loan Interest Deduction Under Section 24 B

Home Loan Interest Deduction Under Section 24 B

https://taxguru.in/wp-content/uploads/2021/05/Section-24-Deduction-–-Income-From-House-Property.jpg

Section 24 Of Income Tax Act Deduction For Home Loan Interest

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/09/section-24-of-income-tax-act.jpg

Home Loan Tax Benefits Learn To Save Income Tax On Home Loan

https://www.aavas.in/uploads/images/blog/tax-benifits-2022-2023-aavasin-min-195380998.jpg

Web 19 Mai 2020 nbsp 0183 32 Need clarification on claiming deductions under 24 b and 80EEA for a rented out property hypothetically 1 If the interest on loan is say 3 50 000 2 rental income Rs 100 000 3 less standard deduction Rs 70 000 4 24 b 3 50 000 5 Income from HP 2 80 000 Web 3 Jan 2024 nbsp 0183 32 As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of self occupied as well as vacant residential properties In case of let out or rented residential properties there no cap on tax deduction This deduction is applicable on

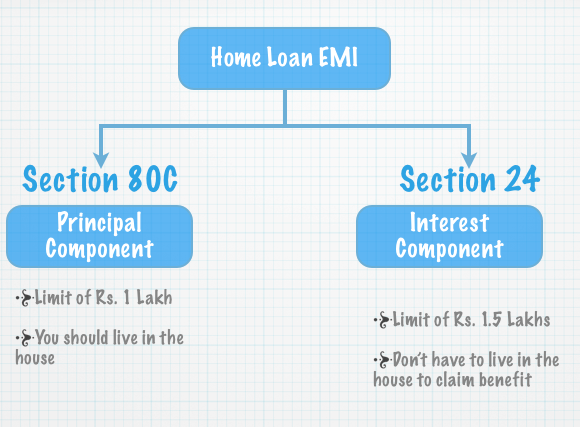

Web 13 M 228 rz 2023 nbsp 0183 32 Section 24 b of the Income Tax Act permits taxpayers to claim a deduction on the interest paid on home loans The deduction is available for both self occupied and rented properties Taxpayers can claim a maximum deduction of up to Rs 2 lacks per annum under Section 24 b of the Income Tax Act Web 14 M 228 rz 2023 nbsp 0183 32 Deduction for Interest on Housing Loan The deduction available under Section 24B is limited to the interest paid on the housing loan The principal amount paid towards the housing loan is not eligible for any deduction under this section The deduction is available on a yearly basis and the maximum deduction limit is Rs 2

Download Home Loan Interest Deduction Under Section 24 B

More picture related to Home Loan Interest Deduction Under Section 24 B

Home Loan Interest Deduction Procedure To Claim HomeCapital

https://i0.wp.com/blog.homecapital.in/wp-content/uploads/2022/08/HC_Blog-1-2.jpg?fit=600,337&ssl=1

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Student Loan Interest Deduction 2013 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-2013-1024x576.jpg

Web Home Loan Tax Benefits under 24 b Section 24 b offers income tax rebate on home loan but only on the interest part of the loan It is also applicable if you have taken a loan for home construction or renovation The deduction is applicable on the prepayment charges and processing charges you pay to your lender If you have rented out the Web Vor 5 Minuten nbsp 0183 32 A key expectation is an increase in the deduction limit for home loan interest payments under Section 24B which has remained unchanged at Rs 2 lakh annually since 2014 Check Free Credit Score on

Web 30 Nov 2023 nbsp 0183 32 Income Tax Section 24 b Pre Construction Interest on Home Loans Discover the nuances of claiming deductions under Section 24 b of the Income Tax Act for pre construction interest on home loans This article breaks down the relevant clause and provides clarity through an illustrative example Web 21 M 228 rz 2023 nbsp 0183 32 The taxpayer can claim a deduction of the entire home loan interest under Section 24B This will also be deducted from the income from the house property section The taxpayer can claim a deduction of the principal amount paid against the home loan This deduction is available under Section 80C

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Section-80EEA-Deduction-on-interest-paid-on-home-loan-1.png

Best Home Loan Rates

https://images.livemint.com/img/2021/12/26/original/loan_1640547127620.png

https://cleartax.in/s/home-loan-tax-benefits

Web 18 Dez 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can

https://housing.com/news/section-24b-tax-deduction-against-hom…

Web Vor 2 Tagen nbsp 0183 32 Section 24B is among the multiple provisions in the income tax law that talk about tax deductions against home loan interest payments Additional tax deduction against home loan interest payment is also offered under Section 80EE and

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Student Loan Interest Deduction What You Need To Know

Income Tax Benefits On Home Loan Loanfasttrack

Best Guide On Interest On Housing Loan Section 24b TaxAdda

Home Loan Interest Home Loan Interest Deduction Under Which Section

Home Loan Interest Home Loan Interest Deduction Under Which Section

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Section 24 Of Income Tax Act Types Deductions Exceptions And How To

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Home Loan Interest Deduction Under Section 24 B - Web 13 M 228 rz 2023 nbsp 0183 32 Section 24 b of the Income Tax Act permits taxpayers to claim a deduction on the interest paid on home loans The deduction is available for both self occupied and rented properties Taxpayers can claim a maximum deduction of up to Rs 2 lacks per annum under Section 24 b of the Income Tax Act