Home Loan Interest Exempt From Income Tax You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross

No housing loan interest is not entirely tax exempt in India However the Indian tax code offers deductions for a portion of the interest you pay on your home Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan

Home Loan Interest Exempt From Income Tax

Home Loan Interest Exempt From Income Tax

https://s3.studylib.net/store/data/008803372_1-0745cfb1d5b84f2ed4a8a101bc9718d1-768x994.png

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

https://studentaid.gov/sites/default/files/2020-tax-exempt-interest-income.PNG

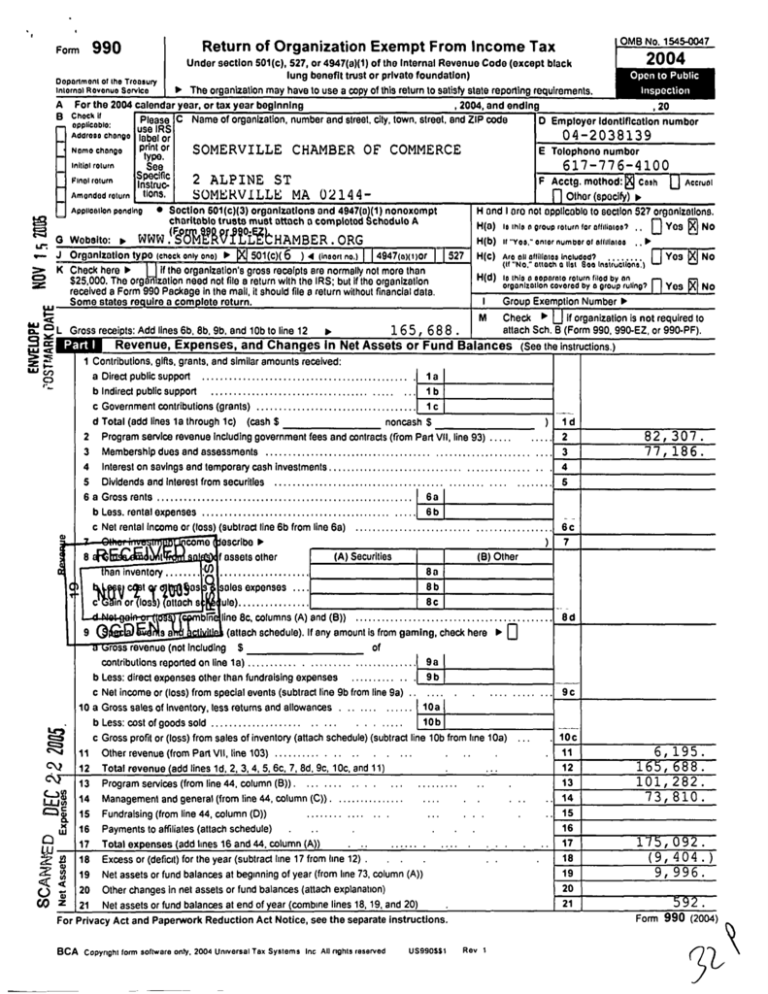

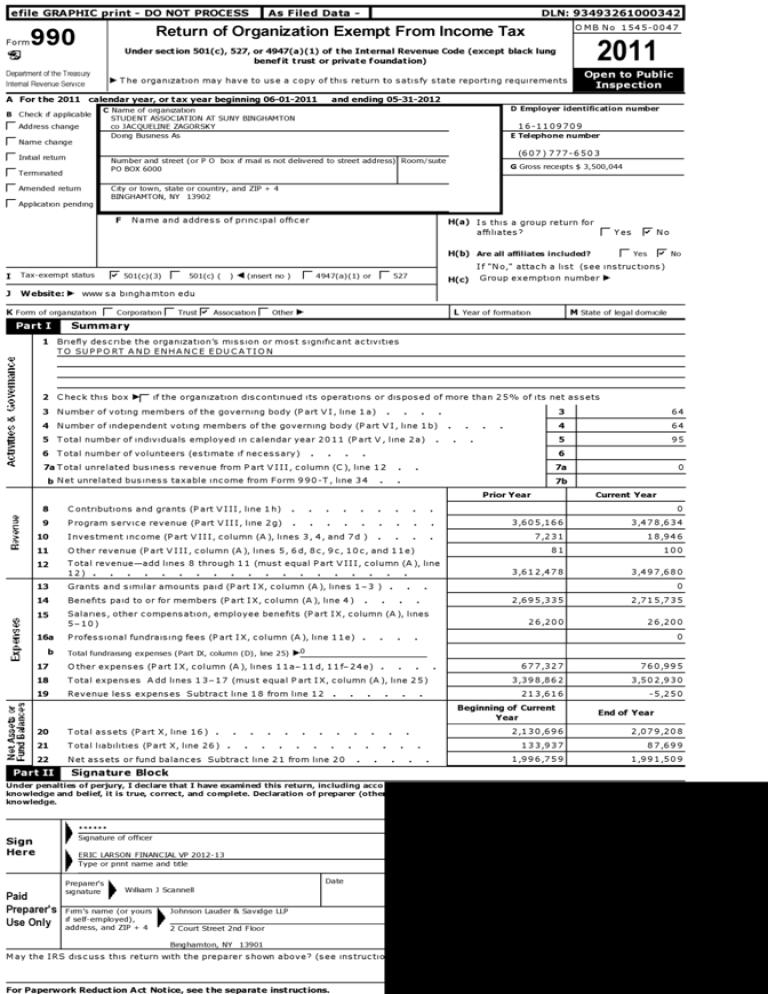

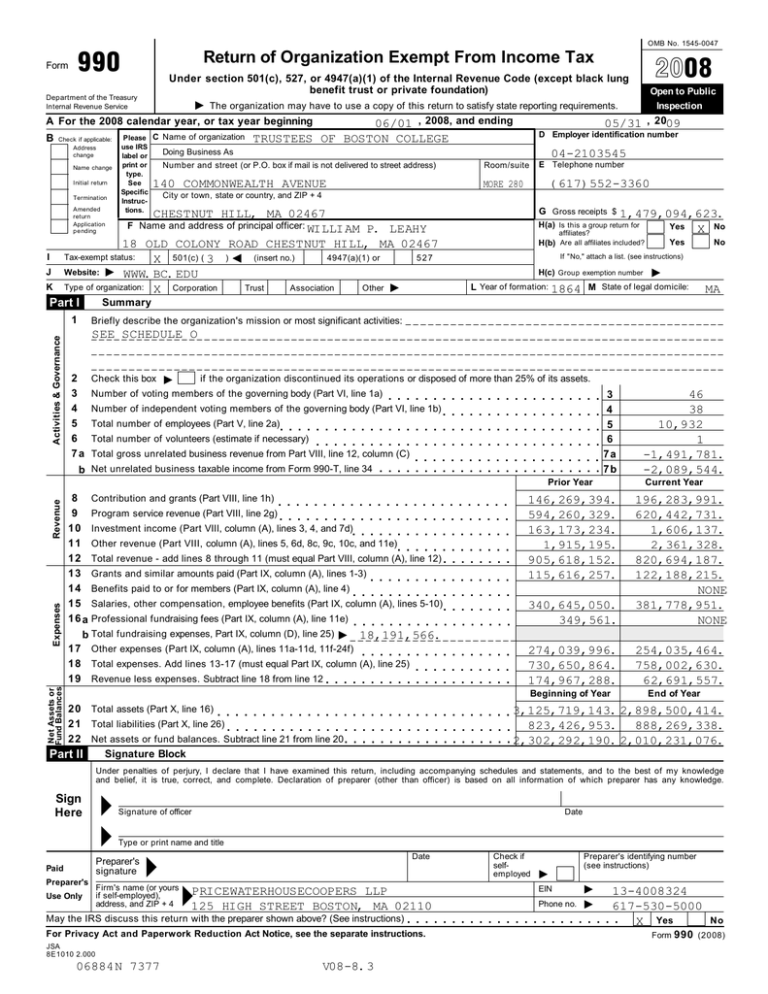

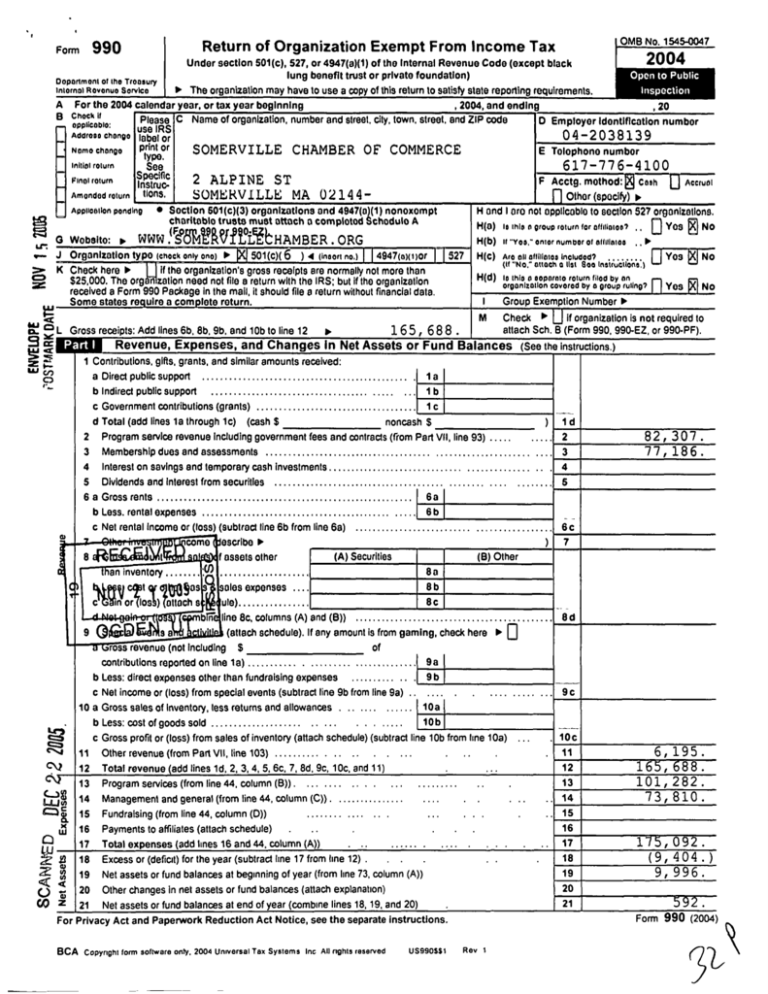

Return Of Organization Exempt From Income Tax

https://s3.studylib.net/store/data/008745489_1-48b7bcba1320697857246c3686c37f93-768x994.png

How Much Housing Loan Interest Can Be Exempt from Income Tax Who is Eligible for Sections 80EE and 80EEA Which is Best Section 80EE or 80EEA How to Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and

You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your home loan when Section 80EE allows Income Tax Benefits on Interest on Home Loan to first time buyers in the following events This deduction will be provided only if the cost of the property acquired is not more than Rs

Download Home Loan Interest Exempt From Income Tax

More picture related to Home Loan Interest Exempt From Income Tax

Return Of Organization Exempt From Income Tax

https://s2.studylib.net/store/data/011162563_1-682d946a30ca6322d9d33ebd26b9794a-768x994.png

Pin On Property Finance

https://i.pinimg.com/originals/5b/9c/f2/5b9cf2873744df5288180e2fd7e7be02.jpg

Non Resident Tax Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-nrta1-download-fillable-pdf-or-fill-online-authorization-for-non-2.png

If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of What is House Rent Allowance HRA Exemption Rules and Calculation Can a taxpayer claim both deductions on Home Loan HRA What if you don t receive

You can only deduct home mortgage interest to the extent that the loan proceeds from your home mortgage are used to buy build or substantially improve the home securing This 750 000 limitation applies to the total of both mortgages For example if you owe 600 000 on your main home and 800 000 on a vacation home you cannot

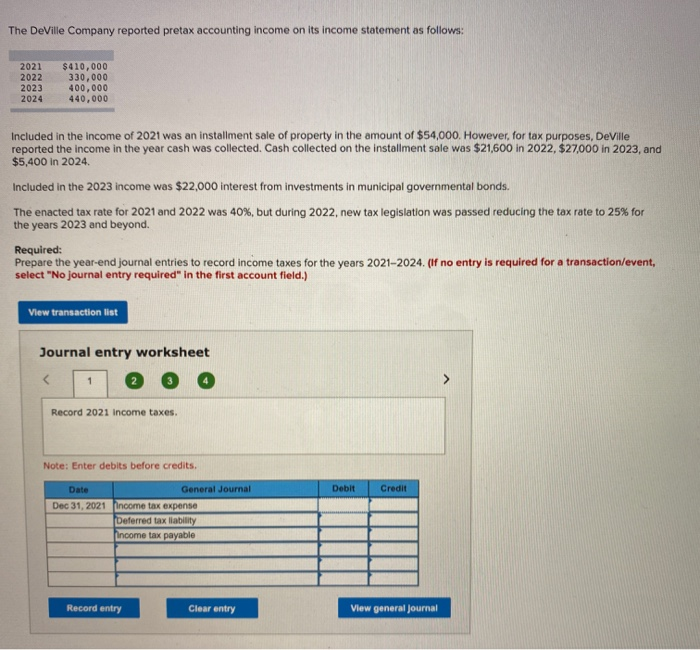

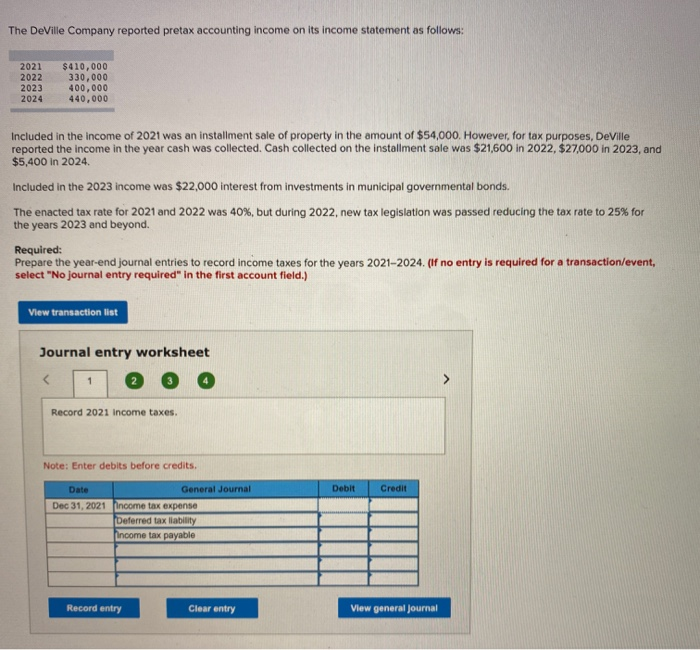

Solved The Deville Company Reported Pretax Accounting Income Chegg

https://media.cheggcdn.com/study/a79/a7930476-efd2-4c64-9068-c9bd05750e4c/image.png

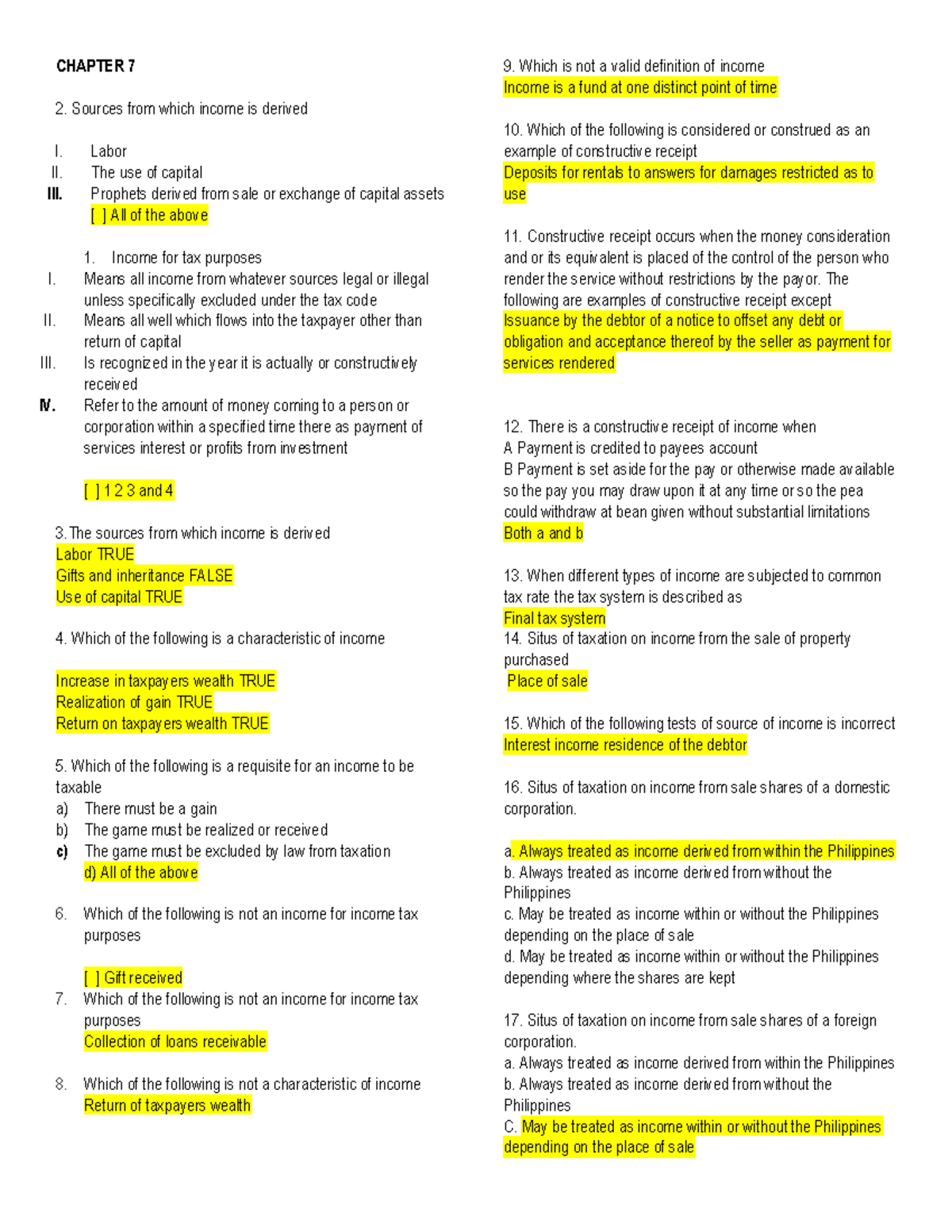

7 8 INCOME TAXATION CHAPTER 7 8 SOLMAN WITH QUESTIONS CHAPTER 7

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6e5684456052e320dbda610ce45da4f2/thumb_1200_1553.png

https://www.hdfc.com/.../home-loan-tax …

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross

https://tax2win.in/guide/income-tax-benefit-on-housing-loan-interest

No housing loan interest is not entirely tax exempt in India However the Indian tax code offers deductions for a portion of the interest you pay on your home

Best Home Loan Rates

Solved The Deville Company Reported Pretax Accounting Income Chegg

Home Loan Lowest Interest Rate

Return Of Organization Exempt From Income Tax The Nature Fill

Taxation Of Exempt Interest Dividends In Arizona An Overview Lietaer

Home Loan Interest Rate Home Sweet Home

Home Loan Interest Rate Home Sweet Home

Money Received From Relatives Is Exempt From Income Tax

Home Loan Interest Exemption In Income Tax Home Sweet Home

Sbi Home Loan Rates From July 2019 Home Sweet Home Insurance

Home Loan Interest Exempt From Income Tax - 1 Best answer ErnieS0 Expert Alumni If you have interest income from federal agency bonds that are exempt from Pennsylvania income tax make your