Home Loan Interest Exemption In Income Tax Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan principal Section 80C Deduction Available for Property construction property purchase Can be claimed for Self occupied rented deemed to

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a home loan between 1 April 2016 to 31 March 2017 Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under Section 80EEA Principal repayment can be claimed under Section 80C

Home Loan Interest Exemption In Income Tax

Home Loan Interest Exemption In Income Tax

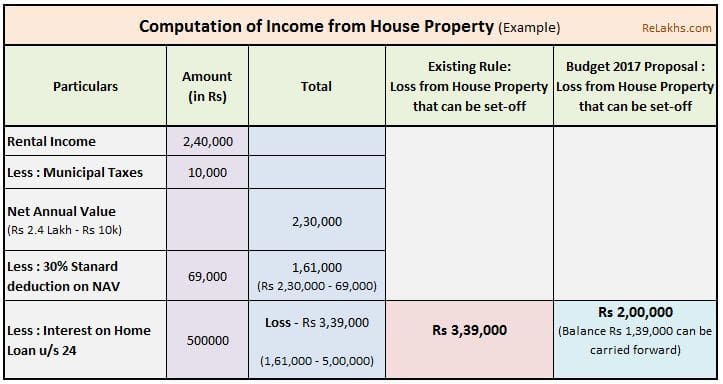

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

How Housing Loan Tax Benefit

https://financialcontrol.in/wp-content/uploads/2020/02/section-24-of-income-tax-act.jpg

Home Loan Interest Home Loan Interest Exemption In Income Tax Fy 2016 17

https://2.bp.blogspot.com/-cN32m4O9mcM/WDcN-xG4G9I/AAAAAAAADis/1bAfLE9_WKEJyqfxftzoMXVByKmc1YhcACLcB/s1600/Form%2B16%2B3.jpg

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a maximum of Rs 2 lakh The deduction of Rs 50 000 introduced in Budget 2016 is Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section

The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year The Income Tax Act does not allow any tax exemptions on home loan payments What it offers is tax deduction under Section 80C and 24 b on home loan principal repayment and interest payment made during a financial year

Download Home Loan Interest Exemption In Income Tax

More picture related to Home Loan Interest Exemption In Income Tax

Pin On Infographics

https://i.pinimg.com/originals/6e/0d/21/6e0d21b75e7a9c7b8ba9983b3ed8adc6.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

Tax Exemption On Home Loan Interest

https://www.loankorner.com/wp-content/uploads/2016/11/tax-exemption-on-home-loan.jpg

In simpler terms you cannot avail exemptions on both the principal and interest paid for a home loan on a self occupied property through the new income tax filing However you can still claim an exemption on the interest paid for a home loan on a rental property Individuals who have taken a home loan for purchasing or constructing a residential property can claim tax deductions on the interest paid on the loan under Section 24 of the Income Tax Act Additionally principal repayments are eligible for

This part explains what you can deduct as home mortgage interest It includes discussions on points and how to report deductible interest on your tax return Generally home mortgage interest is any interest you pay on a loan secured by your home main home or a second home The loan may be a mortgage to buy your home or a second No matter when the indebtedness was incurred for tax years beginning in 2018 through 2025 you cannot deduct the interest from a loan secured by your home to the extent the loan proceeds weren t used to buy build or substantially improve your home

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

House Loan Interest Tax Deduction Home Sweet Home Insurance

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan principal Section 80C Deduction Available for Property construction property purchase Can be claimed for Self occupied rented deemed to

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a home loan between 1 April 2016 to 31 March 2017

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Home Loan Interest Home Loan Interest Exemption Section

Can I Claim Both Home Loan And HRA Tax Benefits

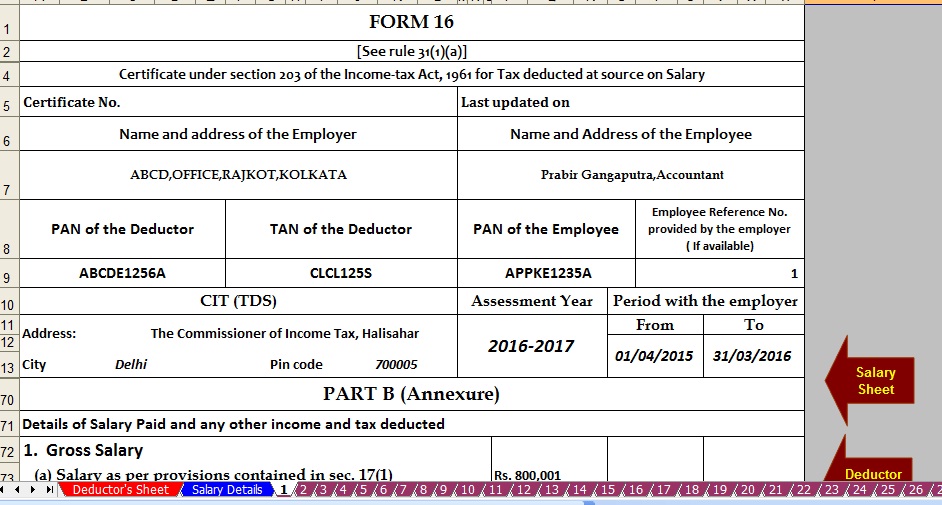

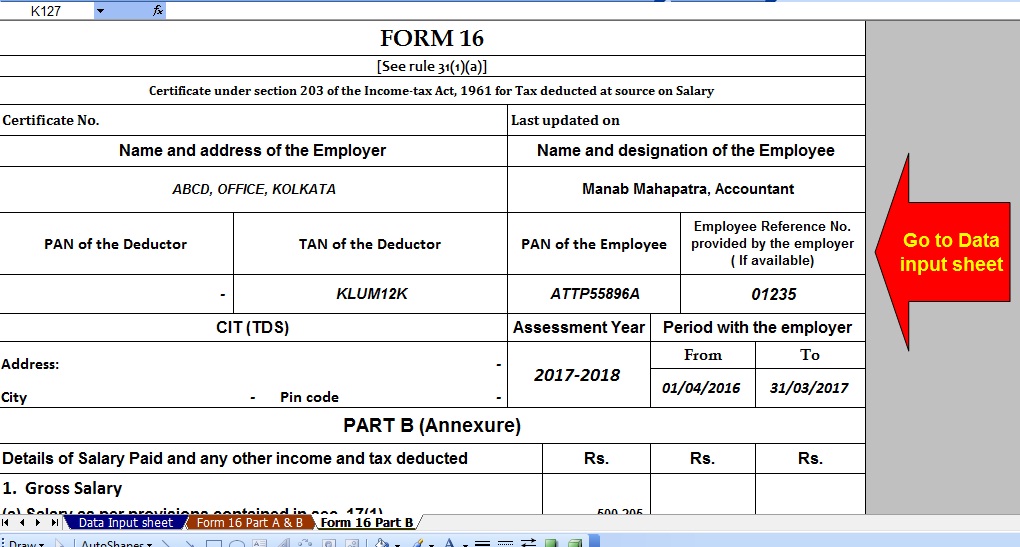

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

How To Get A Second Home Loan For Rental Income

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Home Loan Interest Exemption In Income Tax - Get income tax benefits on Home Loan under Section 24 80EE and 80C Know how much income tax exemption on a housing loan you can claim in 2024