Home Loan Interest Exemption Limit Verkko 18 jouluk 2023 nbsp 0183 32 For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on

Verkko Tax Benefits Part of the interest paid on a home loan can be deducted in taxation and capital gains on a home are tax exempt after two years of living in the home See Tax Verkko 5 helmik 2023 nbsp 0183 32 Principal repayment The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh

Home Loan Interest Exemption Limit

Home Loan Interest Exemption Limit

https://images.livemint.com/img/2019/11/10/original/homerates_1573373193166.png

Calculation Of Exemption On House Loan Interest Examples Prasanta

https://prasantapradhan24809.files.wordpress.com/2018/04/houseloanex1.jpg?w=1024

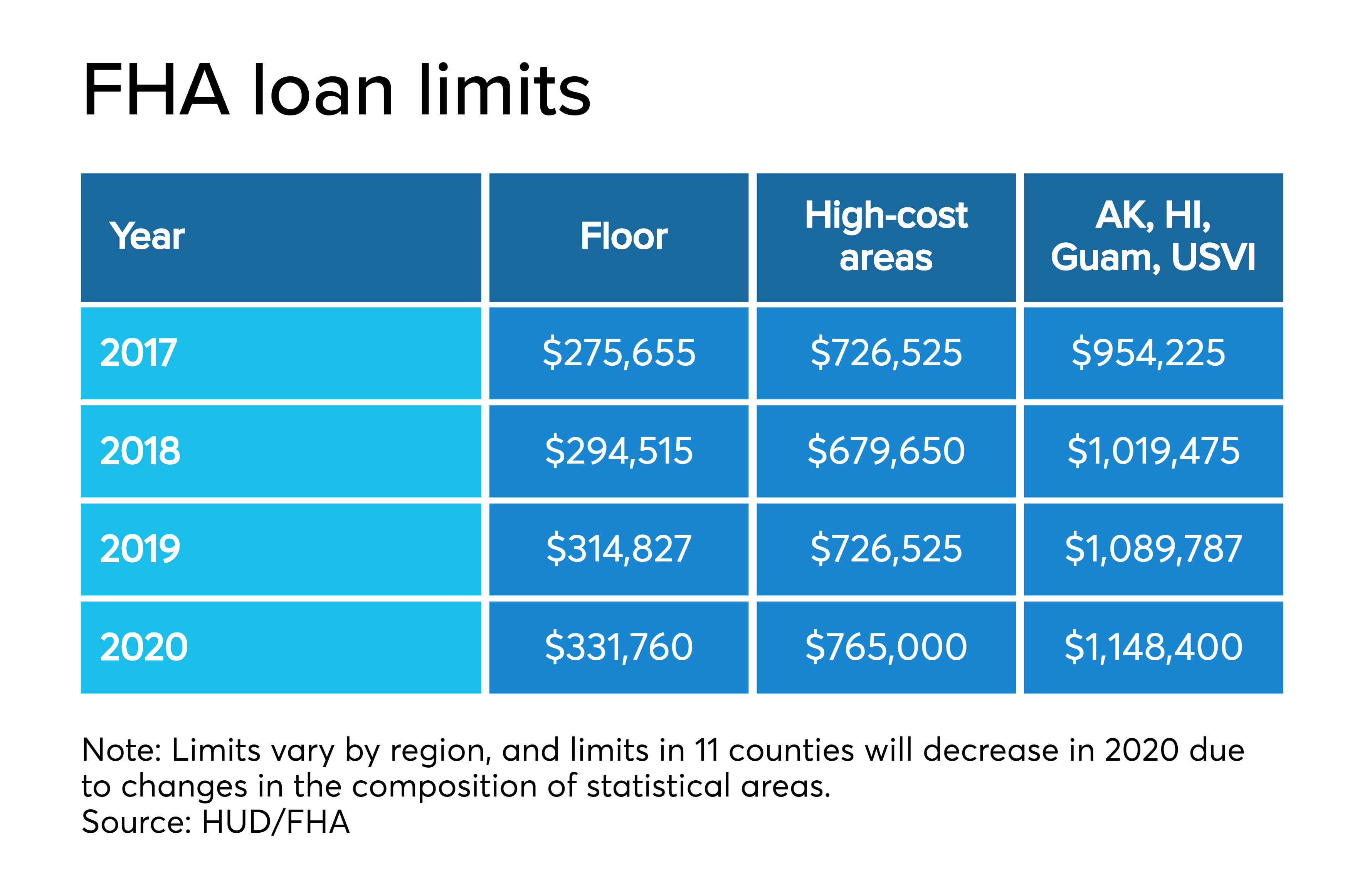

Home Loan Interest Home Loan Interest Exemption Section

https://4.bp.blogspot.com/-RxzCLOdoRSw/WSBu8ZXi6mI/AAAAAAAAEto/CpVp6Z-p5ncM4WJ6D_PoMnQginiQs5lMwCLcB/s1600/Govt%2BNon%2BGovt%2BPage%2B2.jpg

Verkko 14 jouluk 2023 nbsp 0183 32 Amount limit The deduction is up to Rs 50 000 It is over and above the Rs 2 lakh limit under Section 24 of the Income Tax Act Read more about the Verkko 11 jouluk 2023 nbsp 0183 32 Under the objective Housing for all the government extended the interest deduction allowed for low cost housing loans taken during the period

Verkko 22 syysk 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can Verkko 4 tammik 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers

Download Home Loan Interest Exemption Limit

More picture related to Home Loan Interest Exemption Limit

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

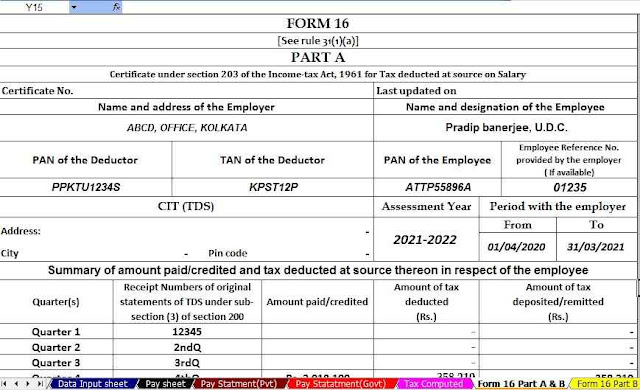

Section 80EEA Exemption For Interest On Home Loan With Automated Income

https://1.bp.blogspot.com/-5kx2FLvoaMw/X_dF9k4UtjI/AAAAAAAAPEw/mxj4cuwTdRIVTI2t19NHTlVvYOG60irtgCNcBGAsYHQ/w640-h390/Form%2B16%2BPart%2BA%2526B%2B%25282%2529.jpg

Home Loan Interest Home Loan Interest Exemption Budget 2017

https://mysouthlakenews.com/wp-content/uploads/2017/06/Infographic-Homestead-vs-1024x576.jpg

Verkko 3 maalisk 2023 nbsp 0183 32 To provide relief on interest on home loan Section 80EE of income tax act was implemented which enables first time home buyers to claim an additional Verkko 25 maalisk 2016 nbsp 0183 32 The value of the house should not be more than Rs 50 Lakh amp The home buyer should not have any other existing residential house in his name Get to know the tax benefits on home loan

Verkko You can get home loan tax benefit under different sections like Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid Verkko 22 maalisk 2023 nbsp 0183 32 Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on

https://www.expat-finland.com/housing/home_loans_in_finland.html

Verkko Tax Benefits Part of the interest paid on a home loan can be deducted in taxation and capital gains on a home are tax exempt after two years of living in the home See Tax

Home Loan Interest Home Loan Interest Exemption Section

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Home Loan Interest Home Loan Interest Exemption Section

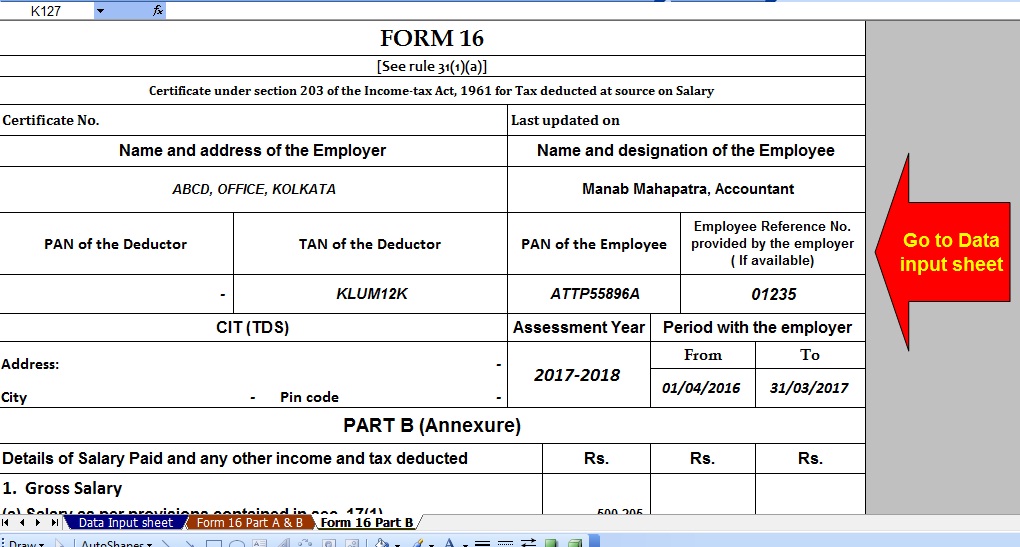

FHA Plans To Raise Mortgage Limits In Most Areas National Mortgage News

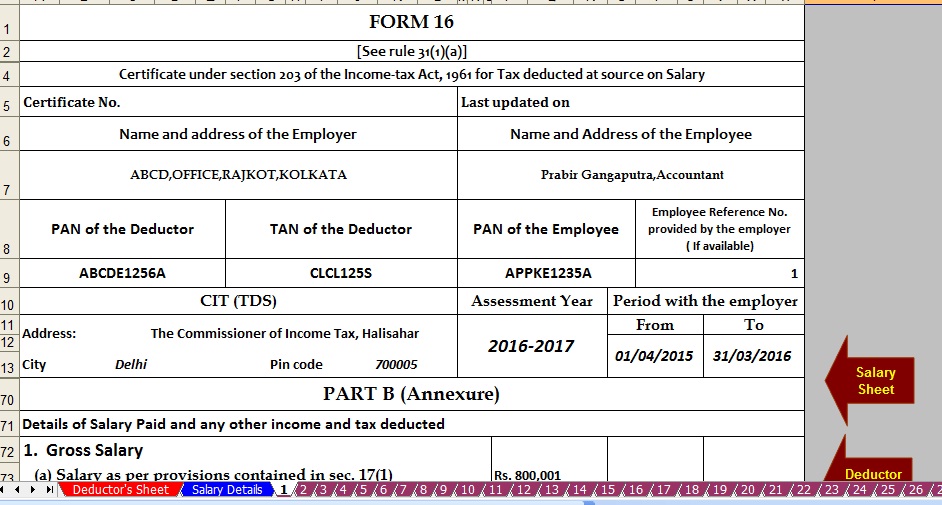

Home Loan Interest Home Loan Interest Exemption In Income Tax Fy 2016 17

What Is A Good Credit Score To Buy A House Or Refinance

What Is A Good Credit Score To Buy A House Or Refinance

Comparing Interest Rates On Home Loan Archives Yadnya Investment Academy

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Home Loan Interest Tax Exemption Section 24 Home Sweet Home Modern

Home Loan Interest Exemption Limit - Verkko 28 jouluk 2023 nbsp 0183 32 Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum