Home Loan Interest Income Tax Rebate Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Web 0 INR Tax before Home Loan 0 INR Tax after Home Loan 0 INR Apply Now Apply Now Home Loan Tax Benefit Whether you are a salaried or a self employed individual you Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Home Loan Interest Income Tax Rebate

Home Loan Interest Income Tax Rebate

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Web Income tax benefit on home loan s interest in the pre construction period As you know Section 24 of the Income Tax Act allows you tax benefits on interest paid on home Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

Download Home Loan Interest Income Tax Rebate

More picture related to Home Loan Interest Income Tax Rebate

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

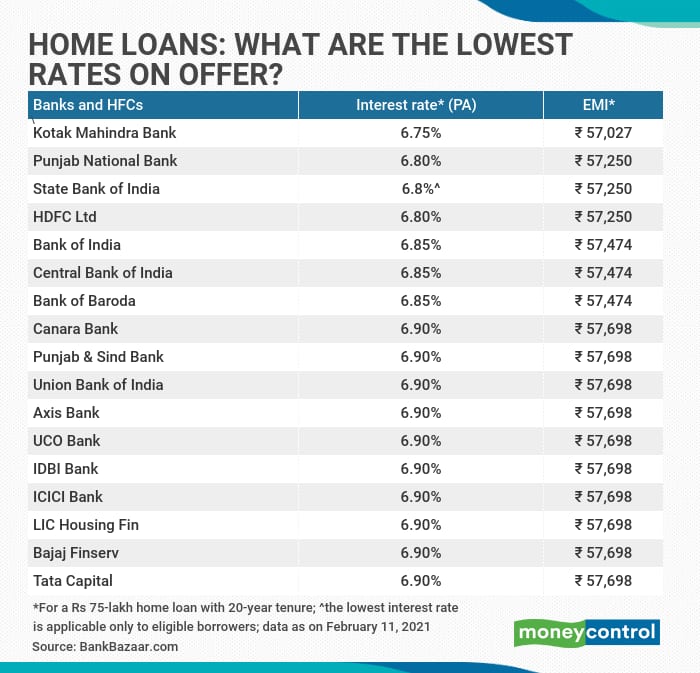

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

https://images.moneycontrol.com/static-mcnews/2021/02/Home-loans-Feb-26.png

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can Web 15 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Web Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Form 12BB New Form To Claim Income Tax Benefits Rebate

https://www.relakhs.com/wp-content/uploads/2016/05/Income-Tax-Deduction-home-loan-interest-payment-form-12bb-home-loan-lender-details-pic.jpg

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

https://www.kotak.com/.../home-loan/home-loan-tax-benefit-calculator.html

Web 0 INR Tax before Home Loan 0 INR Tax after Home Loan 0 INR Apply Now Apply Now Home Loan Tax Benefit Whether you are a salaried or a self employed individual you

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Rising Home Loan Interests Have Begun To Impact Homebuyers

DEDUCTION UNDER SECTION 80C TO 80U PDF

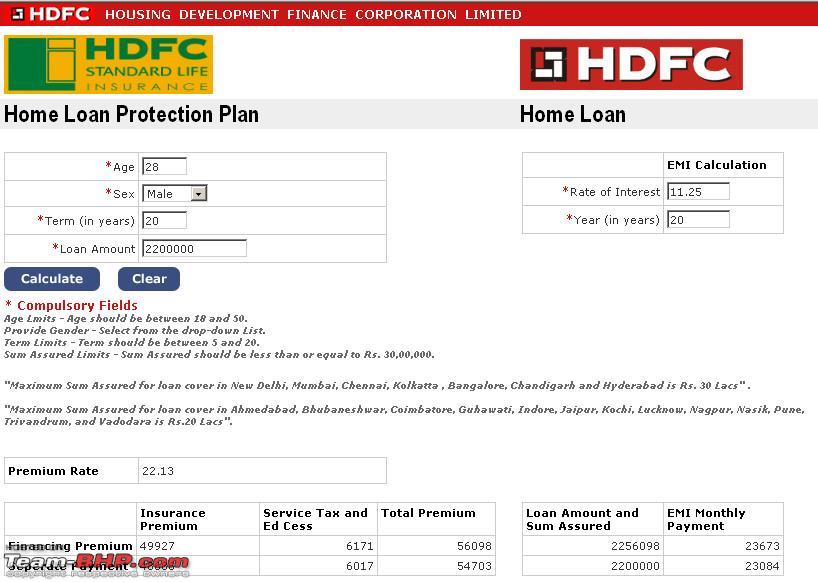

Hdfc Home Loan Interest Rate Reduction For Existing Customers

Home Loan Interest Exemption In Income Tax Home Sweet Home

Home Loan Interest Exemption In Income Tax Home Sweet Home

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Joint Home Loan Declaration Form For Income Tax Savings And Non

Home Loan Interest Income Tax Rebate - Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to