Home Loan Interest Rebate In Income Tax Fy 2023 23 Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Web 27 avr 2023 nbsp 0183 32 Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of

Home Loan Interest Rebate In Income Tax Fy 2023 23

Home Loan Interest Rebate In Income Tax Fy 2023 23

https://i0.wp.com/www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg?resize=650,400

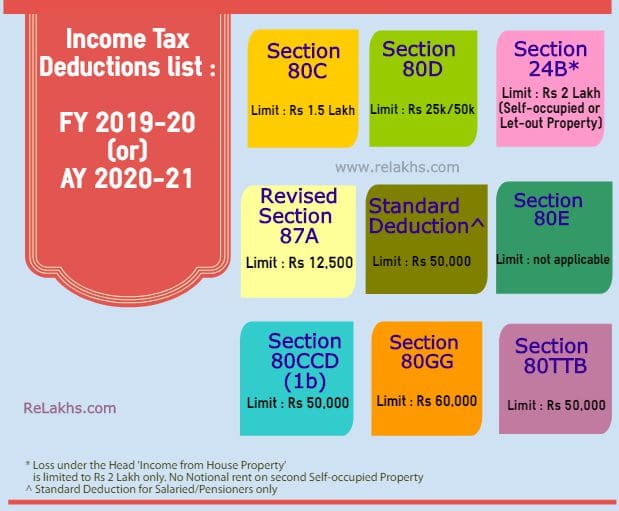

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Senior Citizen Income Tax Calculator FY 2023 24 Excel DOWNLOAD

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Web The eligibility threshold remains at Rs 2 lakh Take into account for example that you pay Rs 10 000 in interest each month on a home loan for construction In 2022 the house s Web 11 janv 2023 nbsp 0183 32 Home loan tax benefits in 2023 The government offers various tax rebates especially if the property has been purchased using a home loan to make property purchases more lucrative for home

Web 25 mars 2016 nbsp 0183 32 1 5 Lakh The stamp value of the property is under INR 45 lakh Taxpayers not eligible to claim deduction under section 80EE Interest on Home Loan paid during Prior Period is as follows Financial Year Web Under the Section 24 b of the Income Tax Act you can claim income tax deduction of upto Rs 2 lakh on the interest payments on your home loan Take a look at the

Download Home Loan Interest Rebate In Income Tax Fy 2023 23

More picture related to Home Loan Interest Rebate In Income Tax Fy 2023 23

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

https://static.toiimg.com/thumb/msid-97531244,width-1070,height-580,imgsize-103792,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

Income Tax Slab Ay 2019 2020 In Pdf Carfare me 2019 2020

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Web Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

Web 3 mars 2023 nbsp 0183 32 March 3 2023 Everyone dreams to own a house someday As per the Indian act of Income Tax 1961 referred to as the Income Tax Act the government offers Web 15 juin 2023 nbsp 0183 32 How To Fill Home Loan Interest and Principal in Income Tax Return Home Loan Tax Benefit in 2023 24 In this video I have tried to explain the knowledge abou

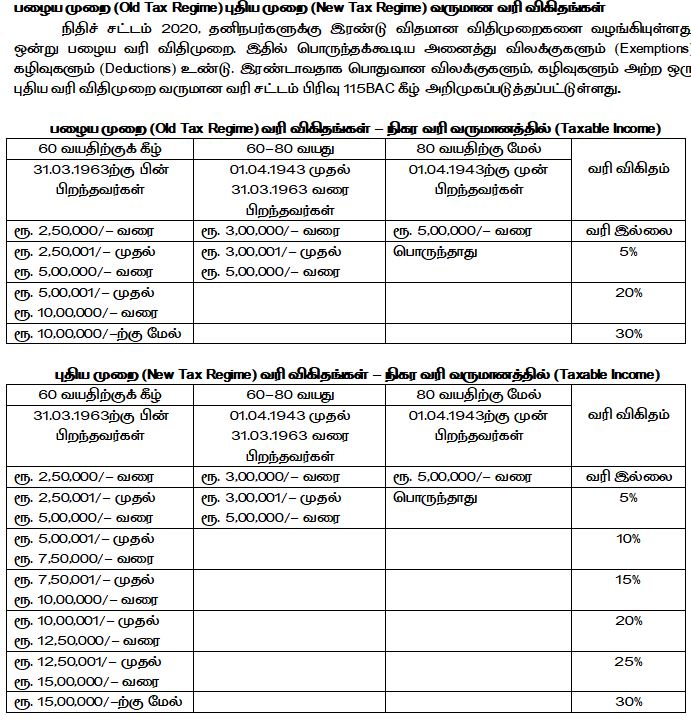

Tamil Nadu Government Servant Income Tax FY 22 23 Slab Rates

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgAoZ34cbA-OygRfPhld4i_KdbziNILXozv5gKXvU3uEYbkLBKJ4Lttjt8McEu-R8qYzhz_-3zkhHavtZpMBhCyh7Lq9PxggmBPCpSv-aV9b3hrk7wxD5RBwytV66NM0E2DgQ_pMvJdkTTVP1MU-SP8HgfKKj4_uvG1T5Kr1xfWc7n7amIhWgV018PK/s721/FY 22-23 Slab Rates.JPG

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

https://www.businessinsider.in/personal-finance/news/how-much-tax...

Web 27 avr 2023 nbsp 0183 32 Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

Tamil Nadu Government Servant Income Tax FY 22 23 Slab Rates

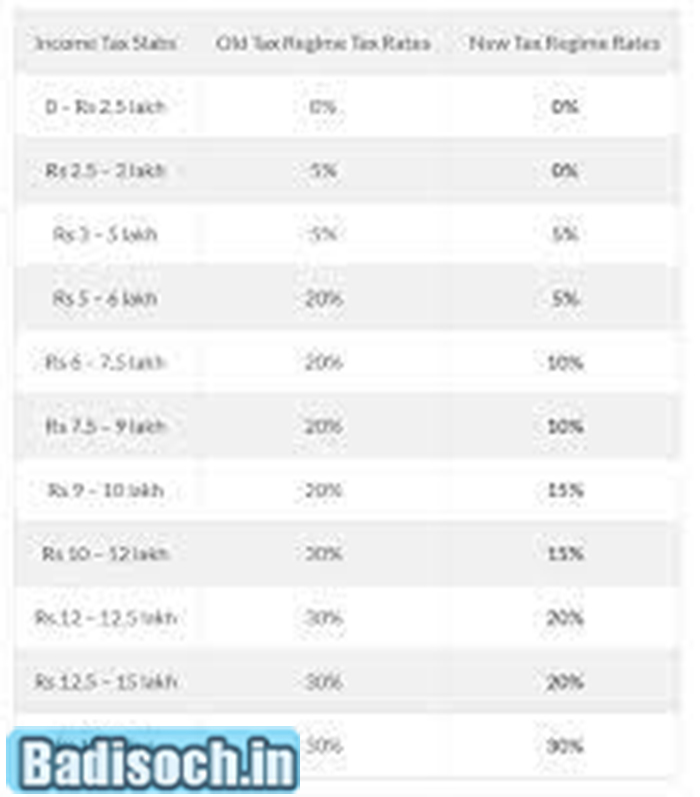

Comparison Of OLD And NEW Income Tax Deduction Exemptions And Rebate

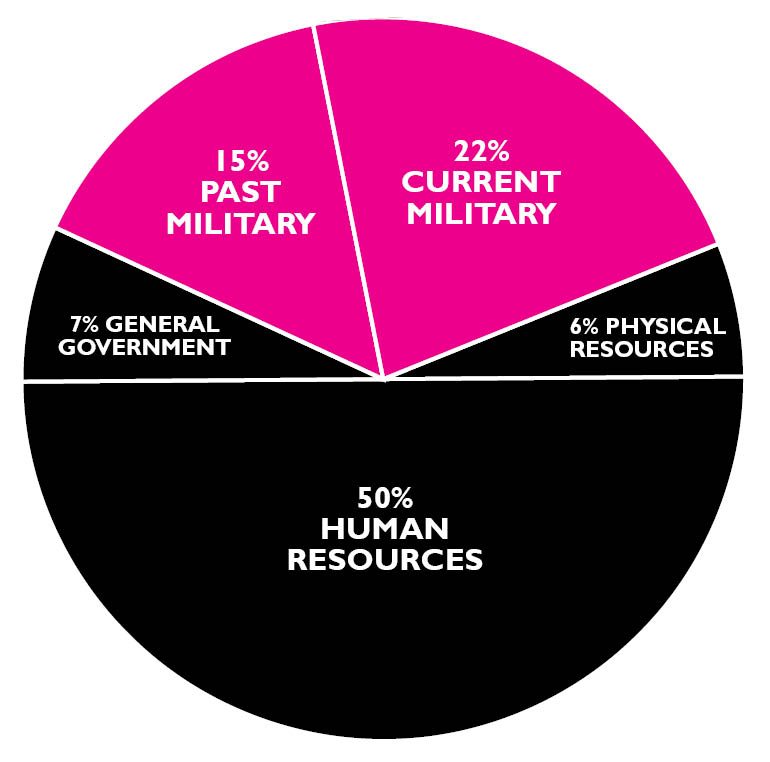

Where Your Income Tax Money Really Goes FY2023 WRL Pie Chart Published

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

New Income Tax Slabs FY 2023 24 AY 2024 25 Latest New Income Tax FY

Income Tax Calculator Ay 2023 24 Excel For Government Salaried

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Home Loan Interest Rebate In Income Tax Fy 2023 23 - Web 11 janv 2023 nbsp 0183 32 Home loan tax benefits in 2023 The government offers various tax rebates especially if the property has been purchased using a home loan to make property purchases more lucrative for home