Home Loan Interest Rebate In Income Tax Section Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web 4 avr 2017 nbsp 0183 32 Updated on Jul 30th 2022 8 34 49 PM 6 min read CONTENTS Show Section 80EE allows income tax benefits on the interest portion of the residential house

Home Loan Interest Rebate In Income Tax Section

Home Loan Interest Rebate In Income Tax Section

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

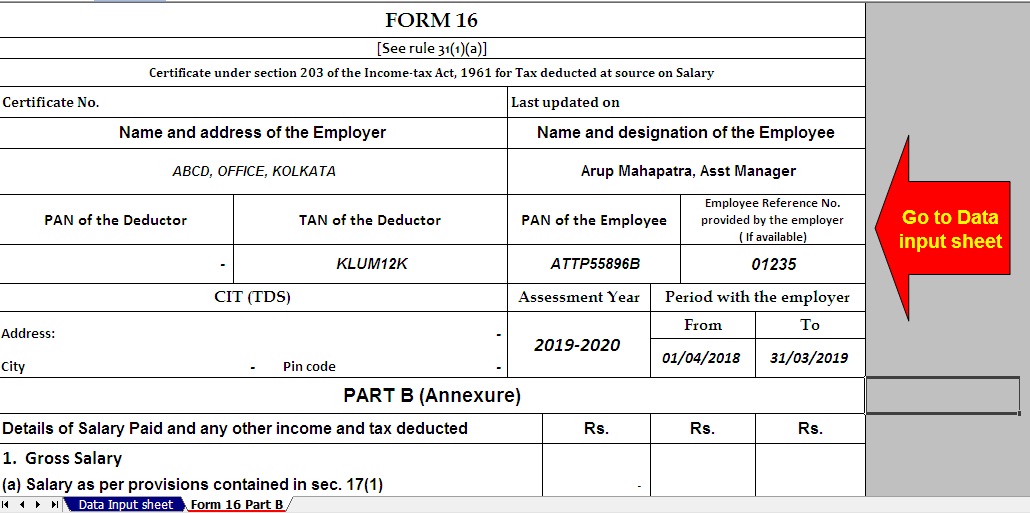

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Web 9 f 233 vr 2018 nbsp 0183 32 The repayment of your Home Loan principal amount and the repayment of the interest on your Home Loan each fall under separate Web income tax Sections that provide tax rebate when you take a home loan you make the home loan repayment to the lender in equated monthly installments EMIs the home

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income Web 24 ao 251 t 2023 nbsp 0183 32 Sections of Income Tax Act Tax Deduction Section 80C Up to Rs 1 5 lakh on principal repayment including stamp duty and registration fee Section 24 b Up

Download Home Loan Interest Rebate In Income Tax Section

More picture related to Home Loan Interest Rebate In Income Tax Section

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh Web You can claim a deduction under your interest category of up to Rs 2 lakh under Section 24 The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as Web 25 mars 2016 nbsp 0183 32 Tax Benefit on Home Loan Interest amp Principle F Y 2022 23 Updated on March 21 2023 CA PRADEEP KUMAWAT Latest Income Tax News amp Articles Taxes

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Lic Home Loan Interest Rate 2020 Calculator Online Offer Save 61

https://images.livemint.com/img/2020/08/30/original/pg_10_bhl_1598806777944.png

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Essential Design Smartphone Apps

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

Home Loan Interest Rebate In Income Tax Section - Web Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA On the interest payments for a home loan you can claim