Home Loan Interest Rebate Income Tax India Web 12 juin 2023 nbsp 0183 32 Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income If the house is jointly owned both you and your spouse can claim

Web 20 mars 2023 nbsp 0183 32 A home loan repayment consists of two parts the principal amount and the interest paid on the amount borrowed Under Section 80C and 24 b of the Income Tax Act of 1961 you are eligible to get Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Home Loan Interest Rebate Income Tax India

Home Loan Interest Rebate Income Tax India

https://images.livemint.com/img/2020/07/03/original/loan_1593743157471.png

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

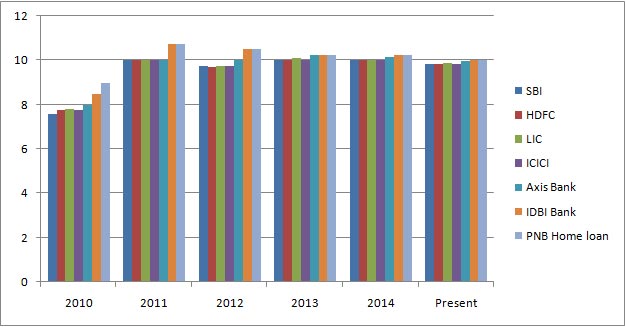

Best Home Loan Interest Rates In 2018 In India

https://myinvestmentideas.com/wp-content/uploads/2018/05/Best-Home-Loan-Interest-Rates-May-2018.jpg

Web Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web Joint Home Loan Borrowers can claim a rebate of up to Rs 2 Lakh each provided they contribute to the EMI payments and are the co owners of the property A certificate

Download Home Loan Interest Rebate Income Tax India

More picture related to Home Loan Interest Rebate Income Tax India

Best Home Loan Interest Rates In India Current Home Loan Interest

https://myinvestmentideas.com/wp-content/uploads/2013/03/Best-home-loan-interest-rates-in-India-Current-home-loan-interest-rates-in-India.png

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Best Home Loan Interest Rates In India Current Home Loan Interest

https://myinvestmentideas.com/wp-content/uploads/2013/03/Best-home-loan-interest-rates-in-India-Current-home-loan-interest-rates-in-India-Apr-2014.jpg

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head

Web 27 avr 2023 nbsp 0183 32 They can each claim deductions up to 2 lakh on the interest Sec 24 and up to 1 5 lakh on the principal Sec 80C component of a home loan says Shetty Web 31 mars 2019 nbsp 0183 32 Apply Now Principal Repayment of Home Loan Section 80C In any financial year you can also avail of a deduction on the principal portion of your home loan EMIs This deduction is available under

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income If the house is jointly owned both you and your spouse can claim

https://www.livemint.com/money/personal-fina…

Web 20 mars 2023 nbsp 0183 32 A home loan repayment consists of two parts the principal amount and the interest paid on the amount borrowed Under Section 80C and 24 b of the Income Tax Act of 1961 you are eligible to get

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Rising Home Loan Interests Have Begun To Impact Homebuyers

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

Best Home Loan In India 2019 20 8 05 Dec Deal4loans

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Home Loan Interest Rate Home Sweet Home Insurance Accident

Home Loan Interest Rate Home Sweet Home Insurance Accident

Home Loan Interest Exemption In Income Tax Home Sweet Home

DEDUCTION UNDER SECTION 80C TO 80U PDF

Interest On Home Loans In India Home Sweet Home Modern Livingroom

Home Loan Interest Rebate Income Tax India - Web Tax Benefit on Home Loan for payment of Interest is allowed as a deduction under Section 24 of the Income Tax Act As per Section 24 the Income from House Property shall be reduced by the amount of Interest paid on Loan where the loan has been taken for the purpose of Purchase Construction Repair Renewal Reconstruction of Property