Home Loan Principal Deduction In Income Tax Ay 2022 23 For the first time buyer there is an additional deduction on interest on a home loan under section 80EE of INR 50000 a deduction on payment of stamp duty under section 80C and a principal repayment and interest deduction under section 24

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced in Avail Income Tax Benefits on Home Loan under section 24 b 80C for up to Rs 2 00 000 Know home loan tax benefits for FY 2022 23 for second home loan joint home loan

Home Loan Principal Deduction In Income Tax Ay 2022 23

Home Loan Principal Deduction In Income Tax Ay 2022 23

https://i.ytimg.com/vi/_bM1Y6-JXl4/maxresdefault.jpg

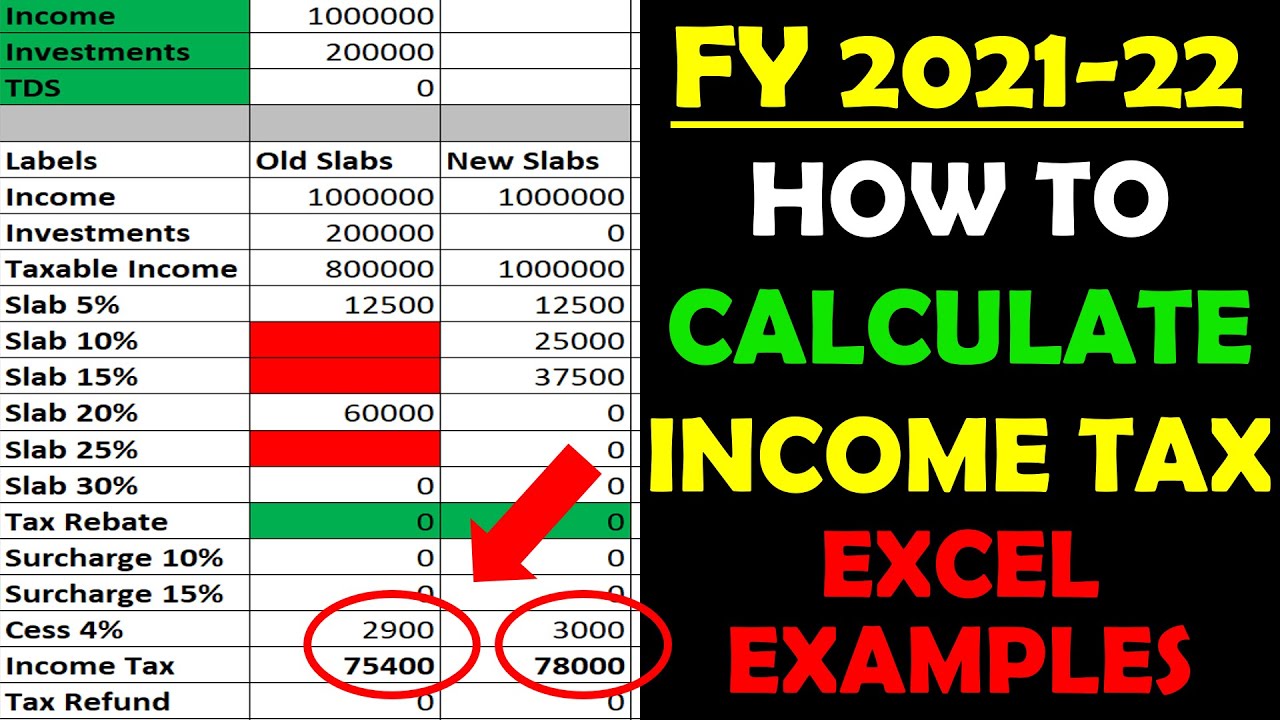

Standard Deduction In New Tax Regime Budget 2023 Standard Deduction

https://i.ytimg.com/vi/ghLUWQFoxoc/maxresdefault.jpg

Standard Deduction On Salary For AY 2022 23 New Tax Route

https://newtaxroute.com/wp-content/uploads/2021/07/standard-deduction-on-salary-for-ay-2022-23.png

Deduction under section 80C of the Act Principal of Home Loan The borrower of a home loan has an option to claim deduction of repayment of principal amount of funds borrowed for construction or purchases of home in India for residential purpose under section 80C of the Act If you take out a home loan jointly each borrower can claim a deduction for home loan interest up to Rs 2 lakh under Section 24 b and a tax deduction for principal repayment up to Rs 1 5 lakh under Section 80C

Get income tax benefits on Home Loan under Section 24 80EE and 80C Know how much income tax exemption on a housing loan you can claim in 2024 Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Download Home Loan Principal Deduction In Income Tax Ay 2022 23

More picture related to Home Loan Principal Deduction In Income Tax Ay 2022 23

Form 10 IA Online For Claiming Deduction Under Section 80DD 80U In

https://i.ytimg.com/vi/x6gP5cozmFY/maxresdefault.jpg

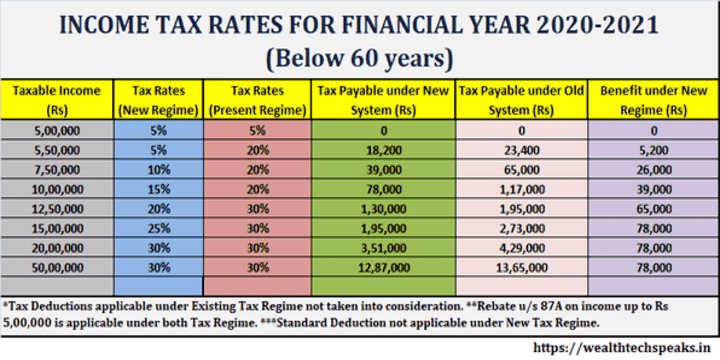

Income Tax Slab For Ay 2023 24 Deduction Printable Forms Free Online

https://cdn.statically.io/img/i0.wp.com/wealthtechspeaks.in/wp-content/uploads/2020/03/Income-Tax-Rates-FY-2020-21.png?resize=160,120

Income Tax Rebate Astonishingceiyrs

https://i.ytimg.com/vi/mw-erFuYboM/maxresdefault.jpg

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a home loan between 1 April 2016 to 31 March 2017 Under section 80C of the Income Tax Act the maximum deduction allowed for the repayment of the principal amount of a home loan is Rs 1 5 lakh

That means Budget 2021 has extended the availability of additional deduction allowed under section 80EEA of the Income Tax Act for interest paid on affordable housing loan by one year to March 31 2022 This additional deduction of Rs 1 5 lakh was available under section 80EEA only up till March 31 2021 prior to the How To Fill Home Loan Interest and Principal in Income Tax Return Home Loan Tax Benefit in 2023 24 In this video I have tried to explain the knowledge about how to show

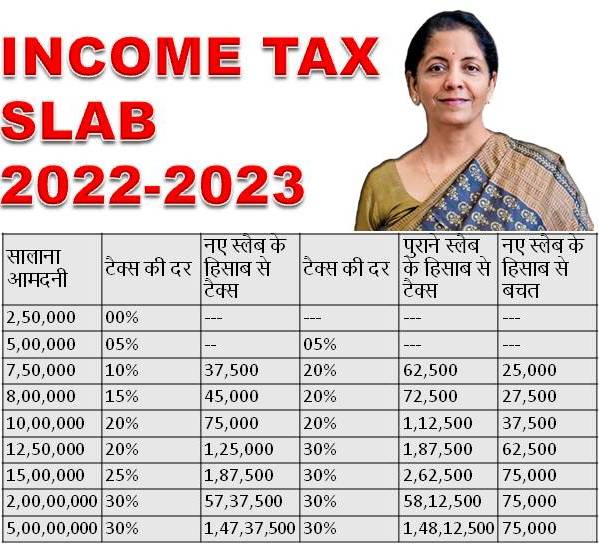

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

https://1.bp.blogspot.com/-yM7MY4B2SMI/YBfAzHLhY8I/AAAAAAAADSw/D-Xb_4wwy9Ip7PuNNaBnb23mAT5xoVitQCLcBGAsYHQ/w640-h526/images%2B%252816%2529.jpeg

Income Tax Slab For Ay 2023 24 Deduction Printable Forms Free Online

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

https://tax2win.in/guide/tax-saving-benefits-for-home-buyers

For the first time buyer there is an additional deduction on interest on a home loan under section 80EE of INR 50000 a deduction on payment of stamp duty under section 80C and a principal repayment and interest deduction under section 24

https://www.livemint.com/money/personal-finance/...

New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced in

How To Choose Between The New And Old Income Tax Regimes Chandan

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Standard Deduction In Income Tax 2022

80C Deduction

Income Tax Benefits On Home Loan Loanfasttrack

Capital Gains Tax Rate 2022 23 Latest News Update

Capital Gains Tax Rate 2022 23 Latest News Update

Home Loan Principal Deduction Explained

Home Loan Benefits After Budget Home Sweet Home Modern Livingroom

Deduction Of Principal Component And Interest Paid On Housing Loan

Home Loan Principal Deduction In Income Tax Ay 2022 23 - Home Loan Deductions and Tax Benefits AY 2022 23 Home Loan Tax Benefits 2022 home loan deduction in income tax ay 2022 23home loan tax benefit 2022 23home