Home Loan Rebate In Income Tax 2023 23 Web 27 avr 2023 nbsp 0183 32 Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional

Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Home Loan Rebate In Income Tax 2023 23

Home Loan Rebate In Income Tax 2023 23

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

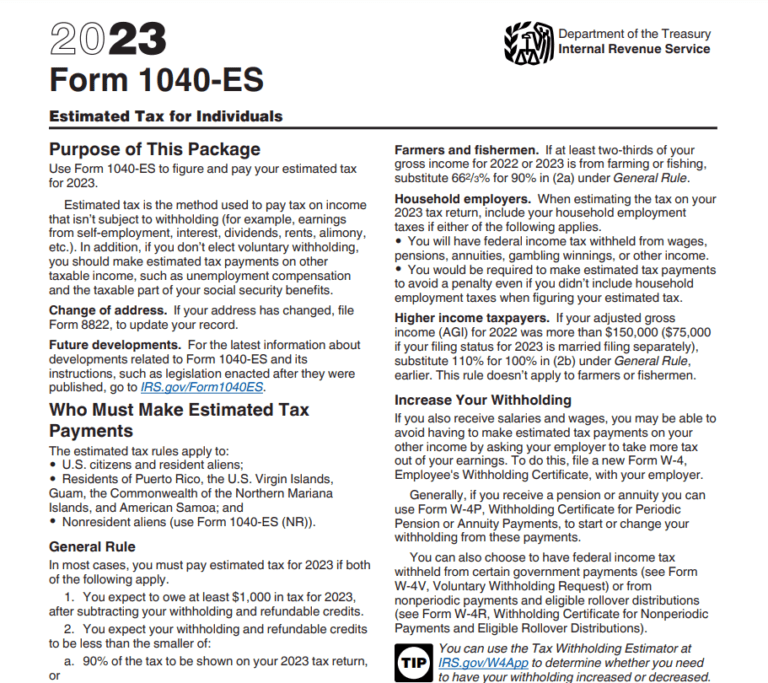

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

https://www.staffnews.in/wp-content/uploads/2023/02/budget-2023-24-finance-bill-2023-rates-of-income-tax.jpg

Web Tax Rebate on a Home Loan that Can be Availed u s 80C For self occupied and also let out properties you are allowed to claim up to a maximum of 1 5 lakhs every year from a Web 2 f 233 vr 2021 nbsp 0183 32 Le cr 233 dit d imp 244 t pour adapter son logement prolong 233 jusqu en 2023 Actualit 233 publi 233 e le 02 02 2021 224 11h50 La R 233 daction de DemarchesAdministratives fr Alors

Web 7 janv 2023 nbsp 0183 32 Budget 2023 should hike the tax rebate on housing loan interest under Section 24 b to Rs 5 lakh said experts The government should seriously consider revising the price bandwidths for homes to Web 31 mai 2022 nbsp 0183 32 Under Section 80EEA first time homebuyers can claim additional tax benefits of up to Rs 1 5 lakh if their loan was sanctioned in FY 2019 20 extended to FY 2020 21 This exemption is over and

Download Home Loan Rebate In Income Tax 2023 23

More picture related to Home Loan Rebate In Income Tax 2023 23

Comprehensive Stimulus Checks And Income Rebates For 2023 Financial

https://stimuluschecknews.com/wp-content/uploads/2023/03/stimulus-check.png

Income Tax Slab Budget 2023 LIVE Updates Highlights Tax Rebate New

https://www.financialexpress.com/wp-content/uploads/2023/01/income-tax-budget-2023.jpg?resize=300

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Web As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the Web 30 janv 2023 nbsp 0183 32 According to experts budget 2023 should increase the tax rebate on home loan interest to Rs 5 Lakh under Section 24 b The government should revise the price bandwidths for houses to qualify as

Web 20 mars 2023 nbsp 0183 32 A Home Loan is a financial source for your dream come true along with making a better deal for tax savers A home loan provides a number of benefits upon repayment through tax Web Home Loan Income Tax Benefits 2023 For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

https://weaverexterior.ca/wp-content/uploads/2022/01/Home-Energy-Loan-Program.png

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

https://roofandfloor.thehindu.com/raf/real-estate-blog/wp-content/uploads/sites/14/2017/04/thumbnail_MoU-for-home-loan-rebate_Banner-840x560.jpg

https://www.businessinsider.in/personal-finance/news/how-much-tax...

Web 27 avr 2023 nbsp 0183 32 Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional

https://housing.com/news/income-tax-rebate-on-home-loan-2

Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they

Taxes 2023 IRS Says California Most State Tax Rebates Aren t

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

What Is Rebate U s 87A For AY 2023 24

2023 Federal Budget Includes One time grocery Rebate For Canadians

10 Calculate Tax Return 2023 For You 2023 VJK

Home Loan Rebate In Income Tax In Hindi

Home Loan Rebate In Income Tax In Hindi

Budget 2023 Income Tax Slabs Explained New Tax Regime Vs Existing New

How To Calculate Tax Rebate In Income Tax Of Bangladesh BDesheba Com

Budget 2023 What Is Rebate In Income Tax Explained YouTube

Home Loan Rebate In Income Tax 2023 23 - Web 7 janv 2023 nbsp 0183 32 Budget 2023 should hike the tax rebate on housing loan interest under Section 24 b to Rs 5 lakh said experts The government should seriously consider revising the price bandwidths for homes to