Home Loan Rebate In Income Tax 2024 23 Tax Benefits of Home Ownership The two big areas where homeownership can save a lot of money are Interest expense Homeowners can deduct interest expenses on up to 750 000 of mortgage debt from their income taxes though when they itemize these deductions they forgo the standard deduction of 12 550 for individuals or married couples filing individually 18 800 for head of household

For homeowners learning as much as you can about your potential tax benefits can help you maximize your tax refund when you file your income tax return Most homeowners with mortgages Home loan tax benefits in 2024 The government offers various tax rebates against home loan repayment On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability

Home Loan Rebate In Income Tax 2024 23

Home Loan Rebate In Income Tax 2024 23

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-750x512.jpg

Important Tips To Remember While Applying For A Home Loan Online Techno FAQ

https://technofaq.org/wp-content/uploads/2015/04/Mortgage-Refinance-Loan.jpg

Home Loan Tax Rebate 4 Income Tax Benefits That Home Loan Borrowers Shouldn t Miss To Claim

https://cdn.zeebiz.com/sites/default/files/2020/01/30/110401-home-loan-1-pixabay.JPG

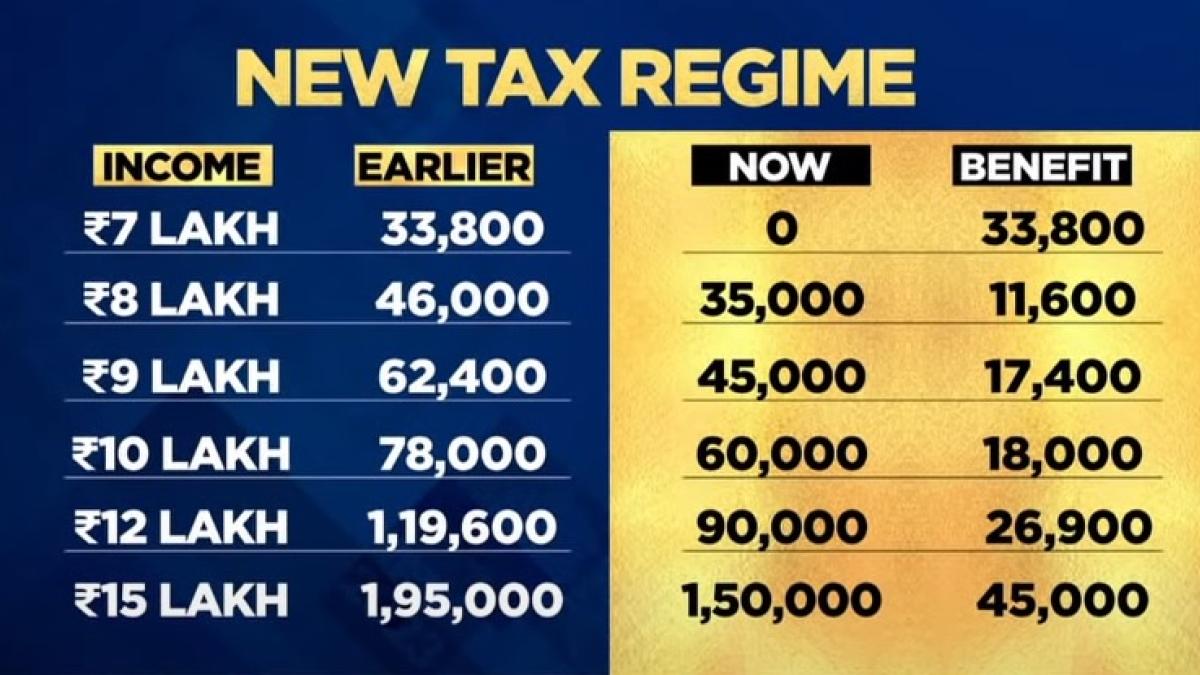

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief The new Income tax slabs under new tax regime for FY 2023 24 AY 2024 25 is What is the surcharge amount under the revised new tax regime Is that change applicable only for those with an income more than 5 crores The surcharge rate has been reduced to 25 from 37 for taxpayers earning income more than Rs 5 crores under the new tax regime

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline The tax for the year was 730 and was due and paid by the seller on August 15 You owned your new home during the property tax year for 122 days September 1 to December 31 including your date of purchase You figure your deduction for real estate taxes on your home as follows 1

Download Home Loan Rebate In Income Tax 2024 23

More picture related to Home Loan Rebate In Income Tax 2024 23

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Home Loan EMI Calculator Quick And Accurate Tata Capital

https://www.tatacapital.com/blog/wp-content/uploads/2023/09/home-loan-rebate-unveiled-save-more-on-your-mortgage.jpg

5 Must Have Documents While Filing Income Tax Returns

https://www.meidilight.com/wp-content/uploads/2019/02/Home-Loan-Tax-Benefits.png

Providing a tax rebate on income taxes owed it allowed a credit of up to 10 of the purchase price on a principal residence to a maximum of 8 000 The IRS defined a first time home buyer as The Early Refund Advance loan which has a 35 53 annual percentage rate is available starting in December 2023 while the No Fee Refund Advance loan with a 0 APR is available in January 2024

Updated on Jan 24th 2024 7 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the regulations of the Income Tax Act 1961 The latest financial budget included provisions that further enhanced these benefits IRS Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Tax credits A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their

Home Loan Tax Rebate If You Are Buying A House For The First Time Then You Can Take Tax

https://www.newsncr.com/wp-content/uploads/2022/01/Home-Loan-Tax-Rebate-If-you-are-buying-a-house.jpg

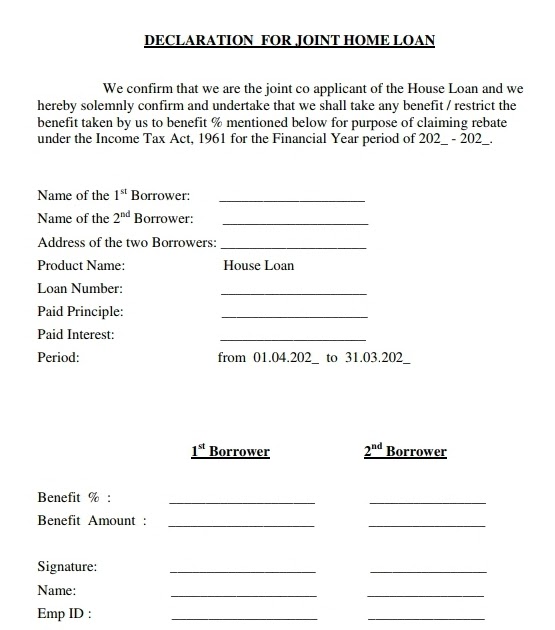

Joint Home Loan Declaration Form For Income Tax Savings And Non Availing Certificate

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

https://www.mortgagecalculator.org/helpful-advice/home-ownership-tax-benefits.php

Tax Benefits of Home Ownership The two big areas where homeownership can save a lot of money are Interest expense Homeowners can deduct interest expenses on up to 750 000 of mortgage debt from their income taxes though when they itemize these deductions they forgo the standard deduction of 12 550 for individuals or married couples filing individually 18 800 for head of household

https://www.msn.com/en-us/money/realestate/all-the-tax-breaks-homeowners-can-take-for-a-maximum-tax-refund-in-2024/ar-AA14dOIg

For homeowners learning as much as you can about your potential tax benefits can help you maximize your tax refund when you file your income tax return Most homeowners with mortgages

Home Loan Tax Rebate 4 Income Tax Benefits For Home Loan Borrowers

Home Loan Tax Rebate If You Are Buying A House For The First Time Then You Can Take Tax

Income Tax Rebate Under Section 87A

Income Tax Return Acknowledgement What Is It And How Do I Get It

Latest Income Tax Rebate On Home Loan 2023

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Rebate U s 87A For The Financial Year 2022 23

LHDN IRB Personal Income Tax Rebate 2022

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime Quick Guide India Today

Home Loan Rebate In Income Tax 2024 23 - The tax for the year was 730 and was due and paid by the seller on August 15 You owned your new home during the property tax year for 122 days September 1 to December 31 including your date of purchase You figure your deduction for real estate taxes on your home as follows 1