Home Loan Rebate In Income Tax New Regime With revisions in tax policies applicants now face critical decisions regarding which income tax regime to opt for and its implications on home loan repayments Understanding these changes is crucial for making informed decisions

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs 30 000 per annum Can you claim deductions under both 80C and Section 24

Home Loan Rebate In Income Tax New Regime

Home Loan Rebate In Income Tax New Regime

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

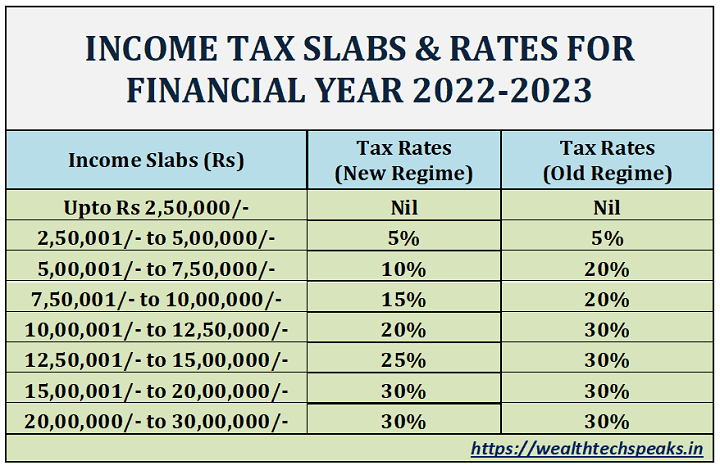

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

https://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-3-1024x576.jpeg

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

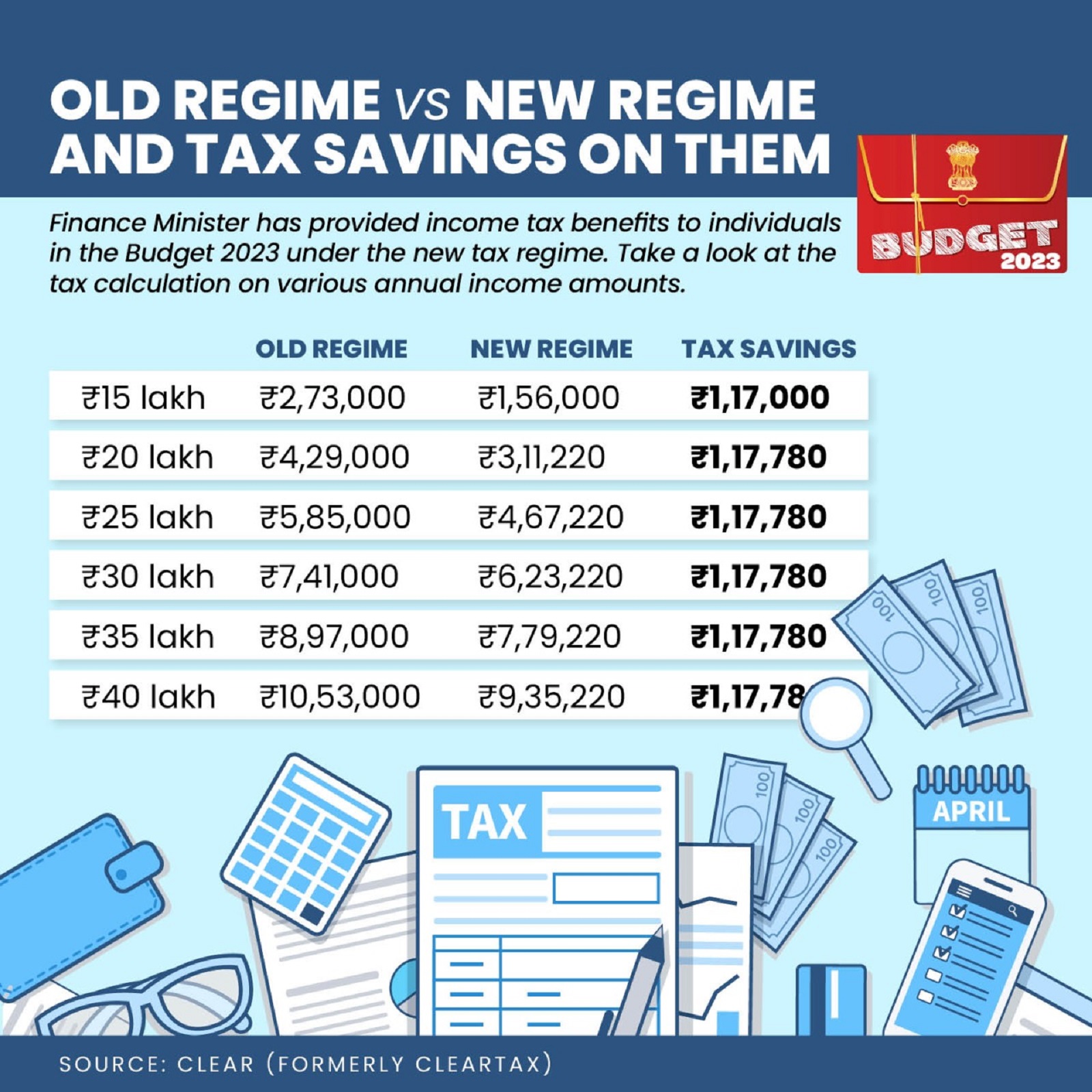

The new tax regime proposes that taxpayers servicing the home loan for a self occupied property can no longer claim income tax benefit on interest payment under Section 24 of the ITA Thus such a rule reduces your tax saving potential by up to Rs 2 lakh In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any tax at all if they opt for the new tax regime

As per the old tax regime the applicable rebate limit is Rs 12 500 for incomes up to Rs 5 lakhs However under the new tax regime this rebate limit has increased to Rs 25 000 if the taxable income is less than or equal to Rs 7 lakhs Tax advantages encompass exempt employer contributions to PF and NPS deductible interest on home loan for let out property and tax free reimbursements New tax regime simplifies tax

Download Home Loan Rebate In Income Tax New Regime

More picture related to Home Loan Rebate In Income Tax New Regime

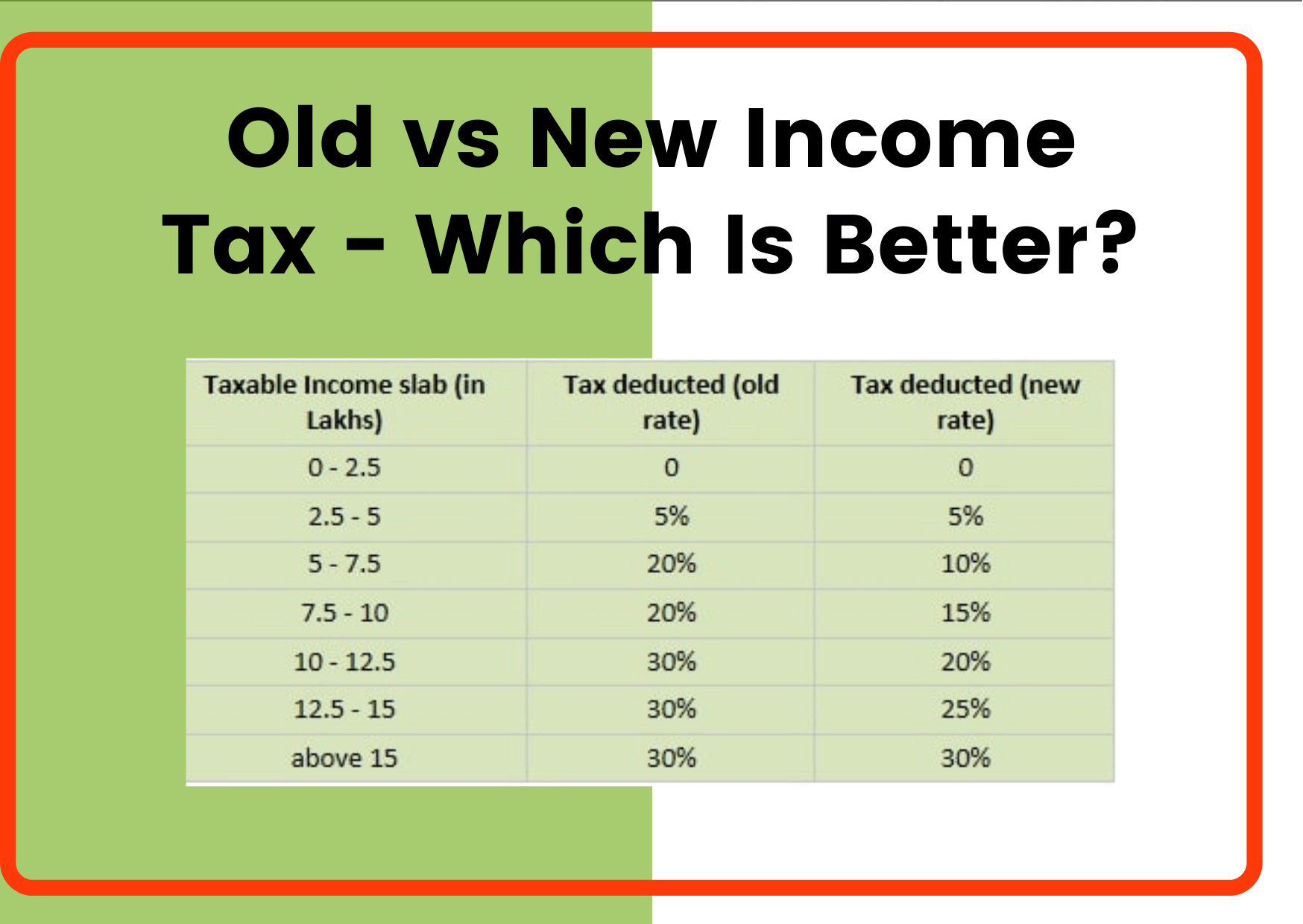

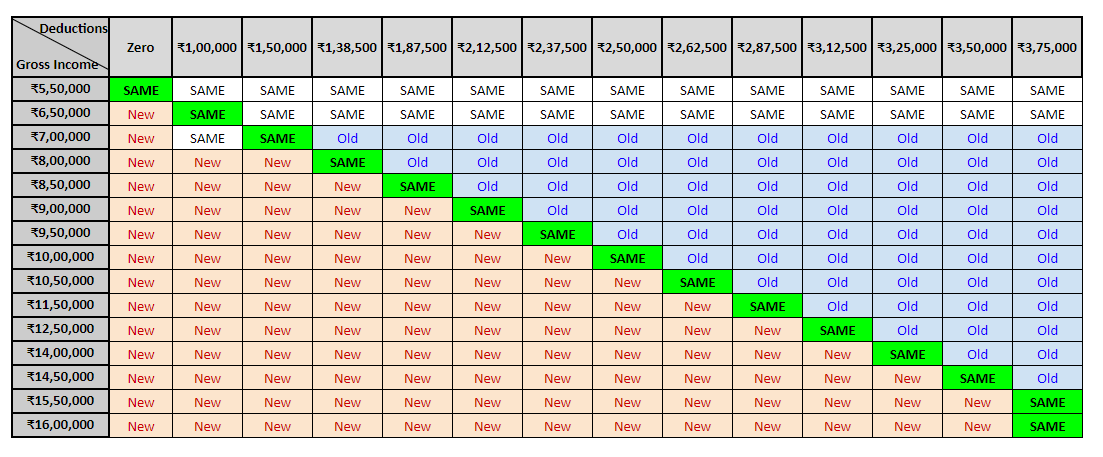

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

https://imgk.timesnownews.com/media/1_2_7.jpg

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260619284.png

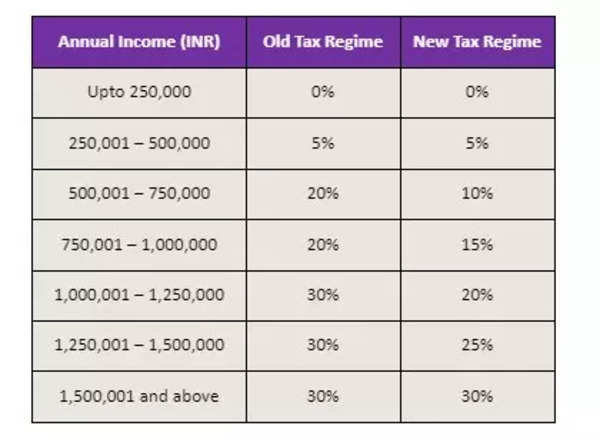

Old Vs New Income Tax Slabs Who Should Choose What

http://savemoremoney.in/wp-content/uploads/2020/09/Old-vs-New-Income-Tax.png

A home loan can help you claim an 80C deduction of up to 1 5 lakh a 80EE deduction of 50 000 and a 24 b deduction of 2 lakh making a total taxable value deduction of up to 4 lakh if Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

Individuals who apply for a home loan can receive home loan tax benefits under several sections such as Section 80 EEA and Section 24b of the Income Tax Act 1961 which grants income tax benefits of up to Rs 1 5 lakh In this article we will look at the various tax benefits for home loans The rule foregoes tax benefit on a home loan on a self occupied property The tax rules still allow deduction on interest paid towards loan on a rented property under section 24 b

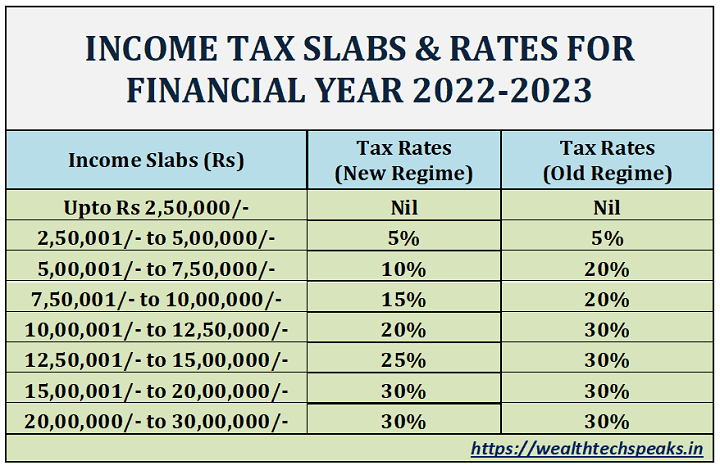

Income Tax Comparison New Vs Old Fy 2022 23 Wealthtech Speaks Hot Sex

https://wealthtechspeaks.in/wp-content/uploads/2022/05/Income-Tax-Rates.png

Budget 2023 Income Tax New Vs Old Tax Regime What Lies Ahead Times

https://static.toiimg.com/thumb/imgsize-23456,msid-97495867,width-600,resizemode-4/97495867.jpg

https://www.godrejcapital.com › media-blog › knowledge...

With revisions in tax policies applicants now face critical decisions regarding which income tax regime to opt for and its implications on home loan repayments Understanding these changes is crucial for making informed decisions

https://www.incometax.gov.in › iec › foportal › sites...

9 Is there any difference in tax rebate under section 87A in old and new tax regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income

Income Tax Slabs Comparison After Budget 2023 Taxes Under Old Regime

Income Tax Comparison New Vs Old Fy 2022 23 Wealthtech Speaks Hot Sex

Why The New Income Tax Regime Has Few Takers

Manoj Arora On Twitter What s Better For You Old Vs New Tax Regime

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

How To Choose Between The New And Old Income Tax Regimes Chandan

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

Home Loan Rebate In Income Tax New Regime - As per the old tax regime the applicable rebate limit is Rs 12 500 for incomes up to Rs 5 lakhs However under the new tax regime this rebate limit has increased to Rs 25 000 if the taxable income is less than or equal to Rs 7 lakhs