Home Loan Rebate In Income Tax Section Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The

The repayment of your Home Loan principal amount and the repayment of the interest on your Home Loan each fall under separate sections of the Income Tax Act These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In

Home Loan Rebate In Income Tax Section

Home Loan Rebate In Income Tax Section

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

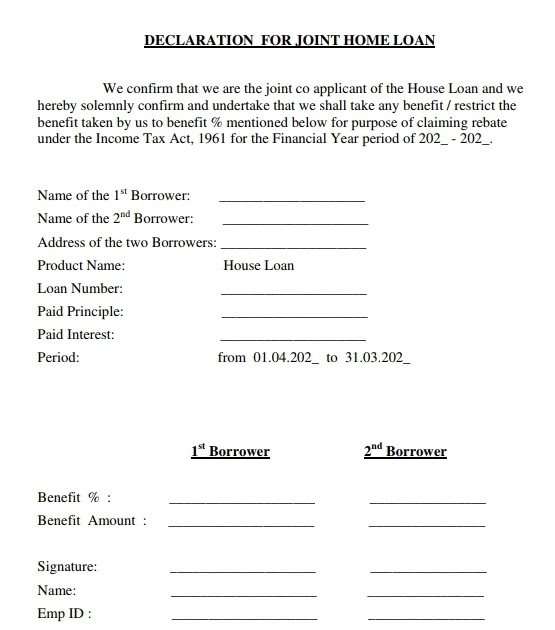

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

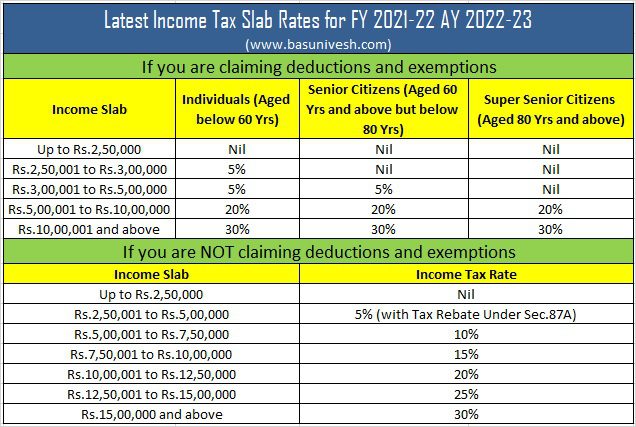

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

Deduction of Interest on Home Loan for the property House Property owners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family reside Section 80EE offers tax relief to taxpayers who have taken out a home loan It allows home buyers to take income tax benefits on the interest they need to pay on a

Home loan borrowers may claim an income tax deduction of up to Rs 1 50 000 on the principal amount paid back throughout the year under Section 80C of Tax Benefit on Home Loan Interest Rate You can also benefit from a tax deduction on the interest paid for your home loan According to section 24 of the Income Tax Act if your

Download Home Loan Rebate In Income Tax Section

More picture related to Home Loan Rebate In Income Tax Section

Income Tax Rebate Meaning Types How To Calculate HDFC Life

https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/knowledge-center/images/tax/section-87A.jpg

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March Yes you can claim income tax exemption if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question

Income Tax Rebate On Home Loan 2022

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-750x512.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The

https://blog.bankbazaar.com/home-loan-tax-benefits...

The repayment of your Home Loan principal amount and the repayment of the interest on your Home Loan each fall under separate sections of the Income Tax Act

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate On Home Loan 2022

Province Of Manitoba School Tax Rebate

ITR Forms AY 2022 23 FY 2021 22 Which Form To Use BasuNivesh

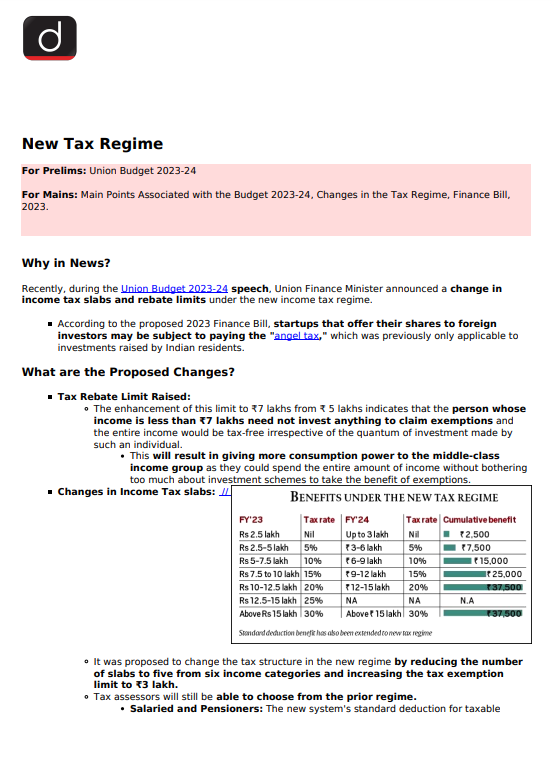

Rebate Under New Tax Regime PrintableRebateForm

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Joint Home Loan Declaration Form For Income Tax Savings And Non

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Home Loan Rebate In Income Tax Section - Tax Benefit on Home Loan Interest Rate You can also benefit from a tax deduction on the interest paid for your home loan According to section 24 of the Income Tax Act if your