Home Loan Rebate In Tax Web 12 juin 2023 nbsp 0183 32 Updated on Jun 15th 2023 9 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the

Web 31 mai 2022 nbsp 0183 32 1 Section 80C Tax Deduction On Principal Amount It allows you to claim a yearly tax exemption of Rs 1 5 lakh from your taxable income on the principal repayment amount Individuals and HUF Hindu Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that allows tax

Home Loan Rebate In Tax

Home Loan Rebate In Tax

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

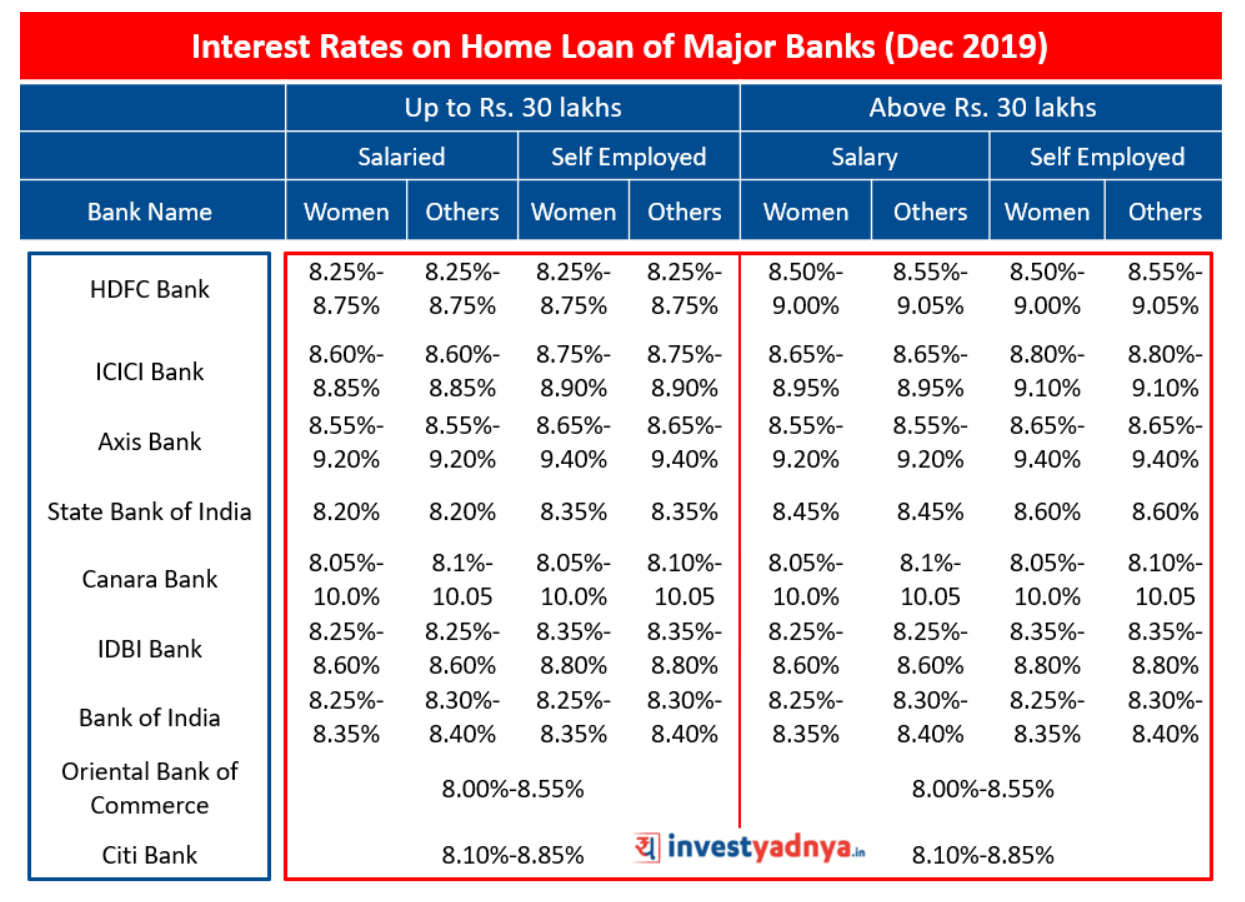

Comparing Interest Rates On Home Loan Archives Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web 18 juil 2023 nbsp 0183 32 Key Takeaways When you repay a mortgage loan you can typically deduct the interest portion of your payments if the loan meets IRS mortgage requirements Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a deduction of up to

Web You are eligible for a home loan tax benefit of up to 2 lakhs for a self occupied home under section 24 of the Income Tax Act If you have a second home the total tax deduction on Web 3 mars 2023 nbsp 0183 32 Interest payment As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout

Download Home Loan Rebate In Tax

More picture related to Home Loan Rebate In Tax

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

How To Find The Lowest Home Loan Rates The Lazy Site

https://i.imgur.com/80cZ3pS.jpg

Home Loan Rebate In Income Tax In Hindi

https://expertkamai.com/wp-content/uploads/2023/05/Home-Loan-Rebate-In-Income-Tax-In-Hindi-768x431.jpg

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web 24 ao 251 t 2023 nbsp 0183 32 Home loan tax benefits FY 2023 24 Income tax deduction on home loan interest and principal repayment Check tax deductions under Sections 24 b and 80C

Web As a home loan borrower you can claim tax exemption on principal repayment every year under Section 80C interest payments under Section 24 b and an additional benefit on Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as

Tax Rebate Calculator On Home Loan TAXW

https://i.pinimg.com/originals/2d/bd/5f/2dbd5ff444ba9c2a0ba1915a2d8781b2.jpg

Famous Greenline Loans Interest Rates References

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2020/08/Interest-Rates-on-Home-Loan-of-Major-Banks-Sept-2020_Featured.png?fit=1024%2C743&ssl=1

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 Updated on Jun 15th 2023 9 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the

https://navi.com/blog/tax-benefit-on-home-loan

Web 31 mai 2022 nbsp 0183 32 1 Section 80C Tax Deduction On Principal Amount It allows you to claim a yearly tax exemption of Rs 1 5 lakh from your taxable income on the principal repayment amount Individuals and HUF Hindu

July 2015 Best Home Loan Interest Rates In India Latest Home Loan

Tax Rebate Calculator On Home Loan TAXW

Pin On Canada Home Tax Rebate

How Home Loan Interest Is Calculated Kabar Flores

Home Loan Tax Benefits In India Important Facts

Government Rebate Program Fill Out Sign Online DocHub

Government Rebate Program Fill Out Sign Online DocHub

Cashbacks And Offers Provided By Banks TimesProperty

Fortune India Business News Strategy Finance And Corporate Insight

DEDUCTION UNDER SECTION 80C TO 80U PDF

Home Loan Rebate In Tax - Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your