Home Loan Rebate On Income Tax In India Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less Web 20 mars 2023 nbsp 0183 32 Fortunately you can still avail of tax benefits on home loans under section 80EE of the Income Tax Act This section offers additional tax benefits to first time homebuyers

Home Loan Rebate On Income Tax In India

Home Loan Rebate On Income Tax In India

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

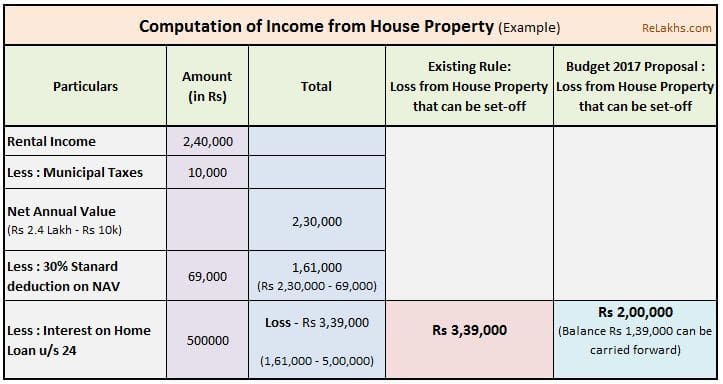

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Web Joint home loan borrowers can claim individual home loan rebates in income tax up to Rs 2 lakh on interest paid and Rs 1 5 lakh on the principal amount Are there any other Web 7 janv 2023 nbsp 0183 32 Currently homebuyers can claim an income tax deduction on the interest paid on their home loan under Section 24 b of the Income tax Act 1961 The maximum amount of deduction that can be claimed is

Web On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head

Download Home Loan Rebate On Income Tax In India

More picture related to Home Loan Rebate On Income Tax In India

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Web 31 mars 2019 nbsp 0183 32 At a Glance We understand that while a home purchase brings you one step closer to achieving your financial goals it also enables you to save a lot of tax The Indian Income Tax Act extends home loan Web 27 avr 2023 nbsp 0183 32 If you can claim a total deduction of over 4 25 lakh including your home loan you may wish to continue with the old tax regime as your savings on tax may be

Web 30 ao 251 t 2022 nbsp 0183 32 Rs 1 5 lakh is the maximum income tax benefit on a home loan in 2022 that can be claimed every year on the principal repayment portion of the home loan s EMI Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Latest Income Tax Rebate On Home Loan 2023

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

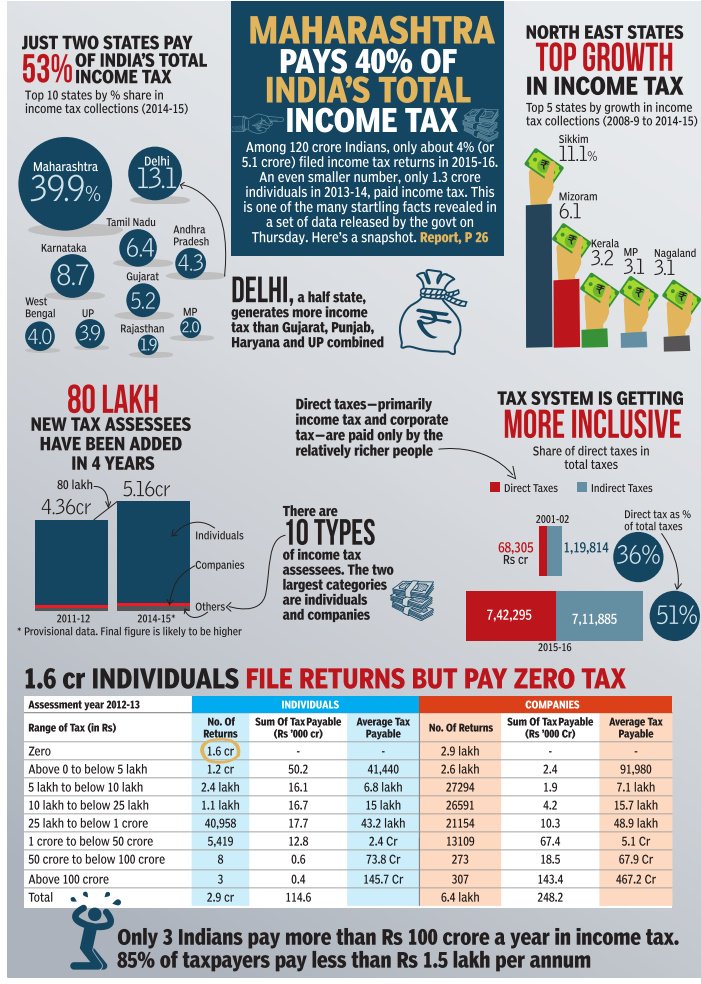

Infographic Income Tax In India Alpha Ideas

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Income Tax Benefits On Home Loan Loanfasttrack

Home Loan Rebate On Income Tax In India - Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head