Home Loan Tax Deduction Benefits On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan Home loan tax benefits FY 2024 25 Income tax deduction on home loan interest and principal repayment Check tax deductions under Sections 24 b and 80C

Home Loan Tax Deduction Benefits

Home Loan Tax Deduction Benefits

https://img.money.com/2021/01/Student_Loan_Tax_Deduction.jpg?quality=85

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Home Loan Tax Benefits Interest On Home Loan Section 24 And

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

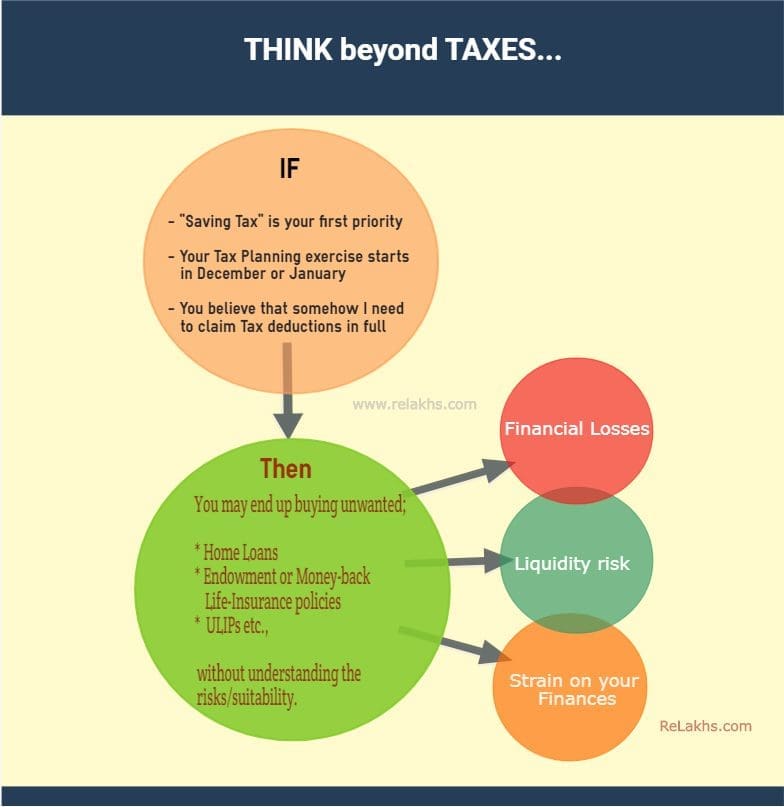

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section Joint owners can avail tax benefits on a joint home loan if they are co owners and co borrowers Tax benefits are based on ownership percentage Deductions include interest and principal repayment with limits Quantum of tax deduction depends on loan ownership proportion Deemed ownership can affect tax calculations

If you are applying for a home loan to purchase a new home you must know the ways to avail tax benefits on the second home loan Under Section 80C of the Income Tax Act borrowers can avail tax deductions on the principal amount The IRS has extensive rules about the tax breaks available for homeowners Let s dive into the tax breaks you should consider as a homeowner 1 Mortgage Interest If you have a mortgage on your home you can take advantage of the mortgage interest deduction You can lower your taxable income through this itemized deduction of

Download Home Loan Tax Deduction Benefits

More picture related to Home Loan Tax Deduction Benefits

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Individuals can enjoy tax benefits in obtaining a home loan under the Income Tax Act Section 24 b Section 80 EE Section 80EEA and Section 80C 1961 In addition a joint home loan also brings many tax benefits resulting in significant savings In this post we see in details what these home loan tax benefits are and what home loan tax deductions can prospective home buyers consider in 2024 When you take a home loan you pay your monthly EMIs Now like loans themselves these EMIs too have 2 components principal and interest

You can deduct the interest from your mortgage payments when you file a tax return but only if the loan is secured by your home Also the loan proceeds must have been used to buy build or improve your main home and one other home you own and use for The mortgage interest deduction is a deduction for interest paid on mortgage debt People who take the standard deduction on their returns cannot take advantage of this tax break because it

Home Loan Tax Benefits Learn To Save Income Tax On Home Loan

https://www.aavas.in/uploads/images/blog/tax-benifits-2022-2023-aavasin-min-195380998.jpg

Home Loan Tax Benefits

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

https://housing.com/news/home-loans-guide-claiming-tax-benefits

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Home Loan Tax Deduction Benefits 2024 All You Need To Know Stable

Home Loan Tax Benefits Learn To Save Income Tax On Home Loan

Know How To Avail The Maximum Home Loan Tax Benefits

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Maximizing Home Loan Tax Benefits In India 2023

Home Loan Tax Benefits MeidilighT

Home Loan Tax Benefits MeidilighT

Tax Deduction Letter PDF Templates Jotform

How Beneficial Is Rs 1 5 Lakh Additional Home Loan Tax Deduction 2019

Home Loan You Won t Benefit Much From Affordable Home Loan Tax

Home Loan Tax Deduction Benefits - Individuals who have taken a home loan for purchasing or constructing a residential property can claim tax deductions on the interest paid on the loan under Section 24 of the Income Tax Act Additionally principal repayments are eligible for