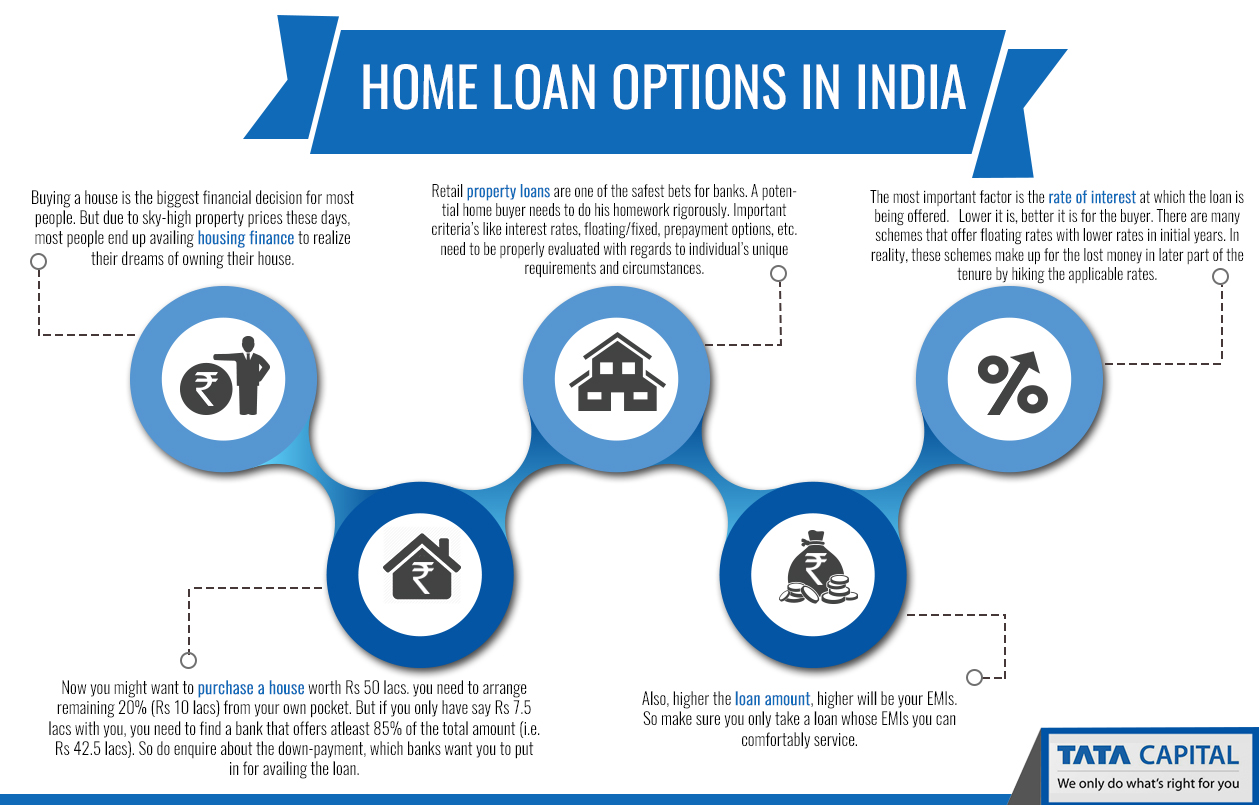

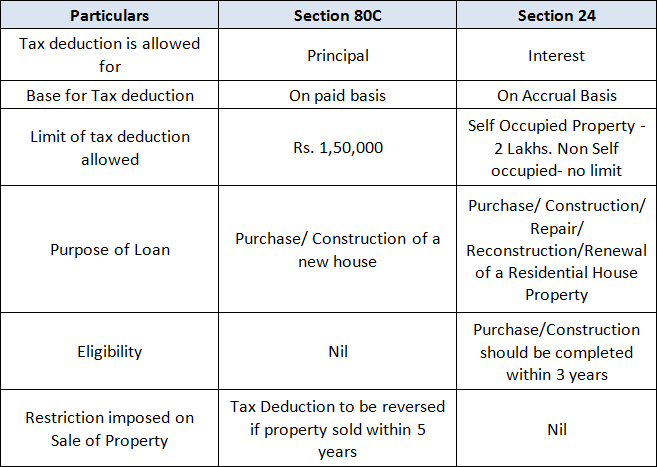

Home Loan Tax Rebate India Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income

Home Loan Tax Rebate India

Home Loan Tax Rebate India

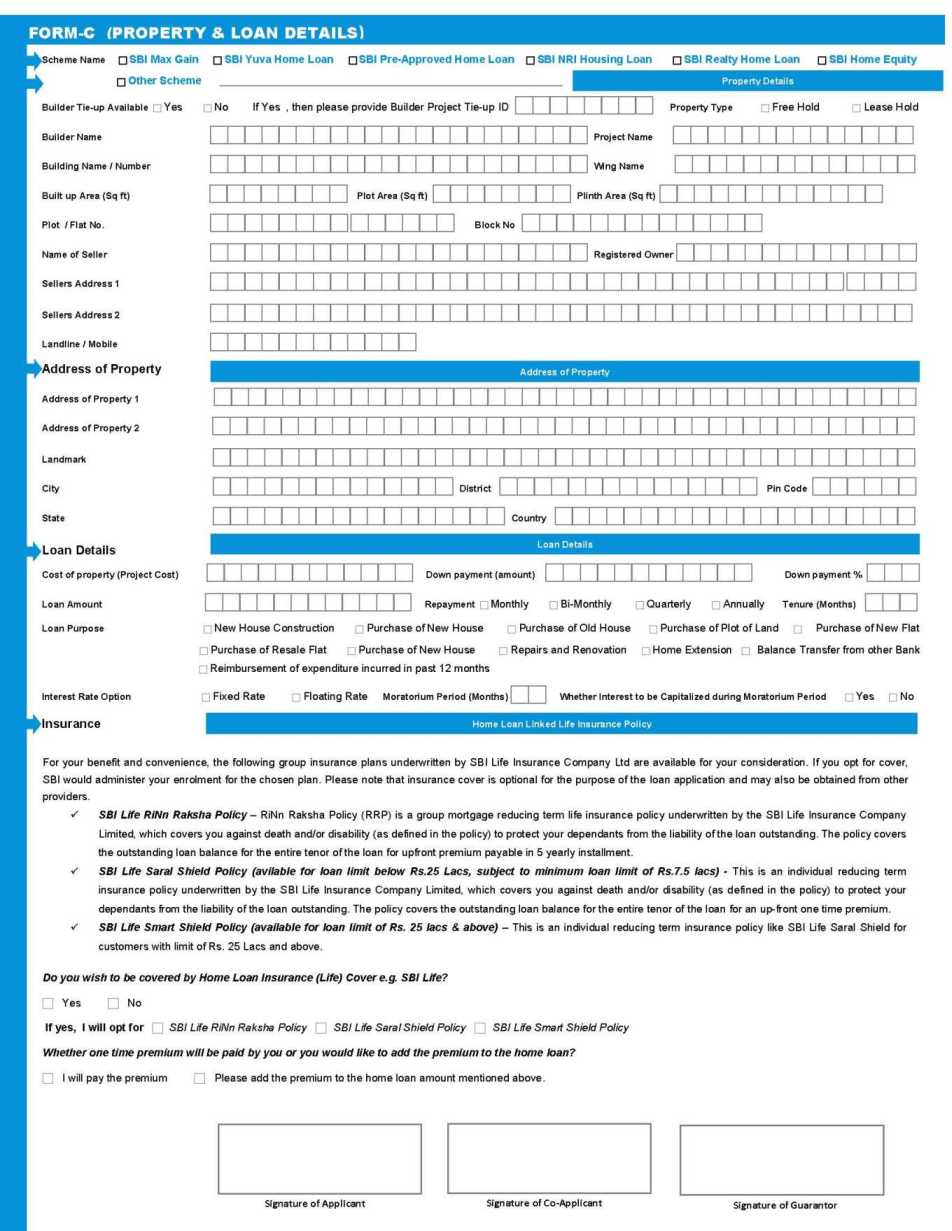

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

https://theviralnewslive.com/wp-content/uploads/2023/02/income-tax-rebate-home-loan-Savings_11zon.jpg

Web 10 mars 2021 nbsp 0183 32 Here is a look at the all the tax benefits that an individual can get on home loan EMI payments if he she has opted for the old tax regime 1 Deduction on repayment of principal amount of home loan Web Can I claim a home loan tax rebate for a joint home loan Joint home loan borrowers can claim individual home loan rebates in income tax up to Rs 2 lakh on interest paid and

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Web 31 mars 2019 nbsp 0183 32 Apply Now Principal Repayment of Home Loan Section 80C In any financial year you can also avail of a deduction on the principal portion of your home loan EMIs This deduction is available under

Download Home Loan Tax Rebate India

More picture related to Home Loan Tax Rebate India

Home Loan Tax Rebate

https://www.indiareviews.com/wp-content/uploads/2022/04/homeloan-tax-rebate-1-750x430.jpg

5 Tax Benefits Of Taking NRI Home Loans In India NRI Banking And

https://1.bp.blogspot.com/-n-WG9aXpdTI/WHGc_w2hYQI/AAAAAAAAHrI/1v6QwacsCmkBIQw5SpdE-_ir-TX1y1_KACLcB/s1600/Home%2Bloan%2Boptions%2Bin%2BIndia%2Bfor%2BNRIs.jpg

Home Loan Tax Benefit 2019 20 In Hindi Home Sweet Home Insurance

https://quickbooks.intuit.com/in/resources/in_qrc/uploads/2019/02/India-Budget-2019-2020-2.jpg

Web Fees amp Charges Interest Rates Balance Transfer Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Web 20 mars 2023 nbsp 0183 32 As per this provision a deduction of up to Rs 50 000 can be claimed on the interest paid towards a home loan for first time home buyers To claim this deduction Web Income Tax Benefits on Home Loans The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://economictimes.indiatimes.com/wealth/…

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

Evolution Of Tax System Concessions On Home Loans Home Loans Tax

Home Loan Tax Benefit Calculator FrankiSoumya

Home Loan Tax Rebate 5

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Download Home Loan Interest Rates In India Home

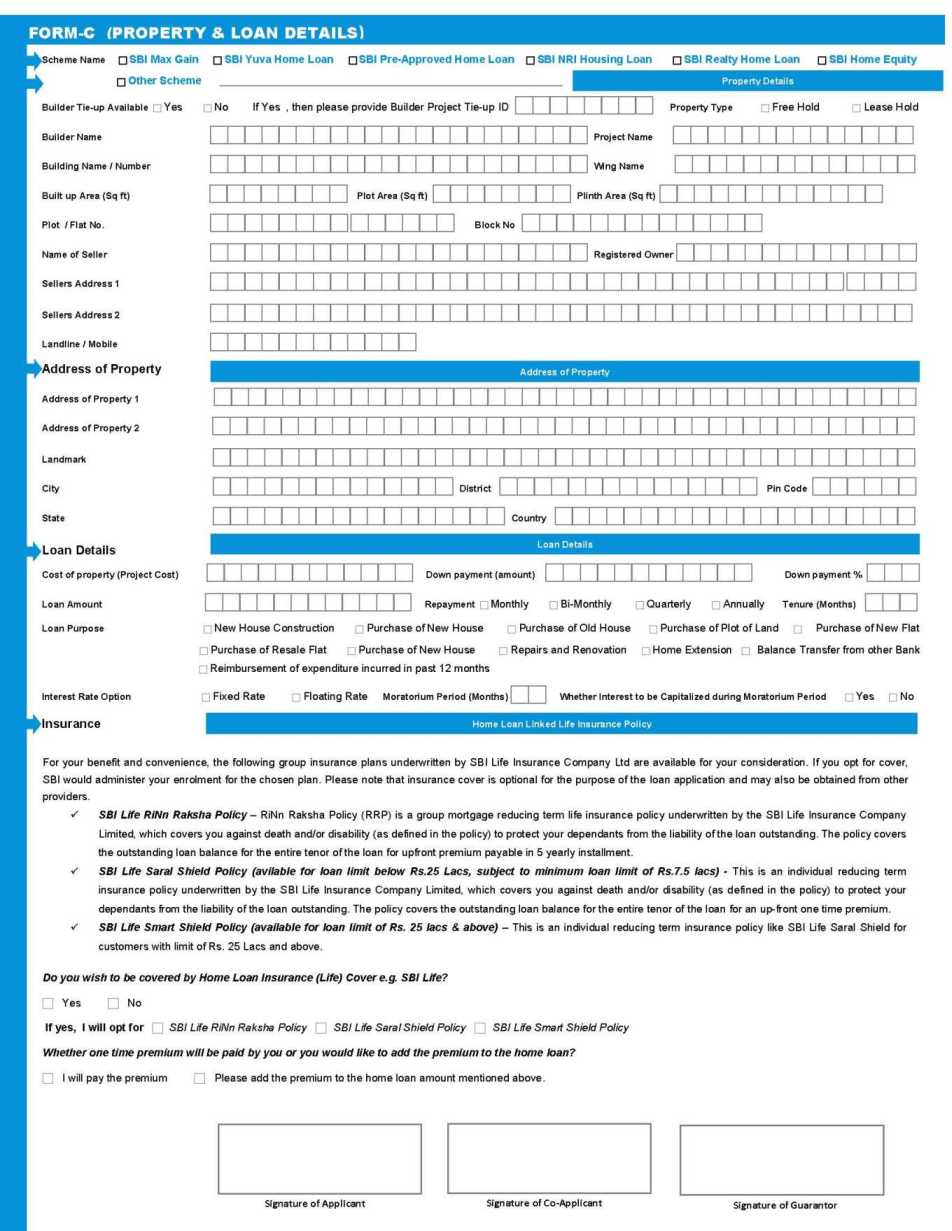

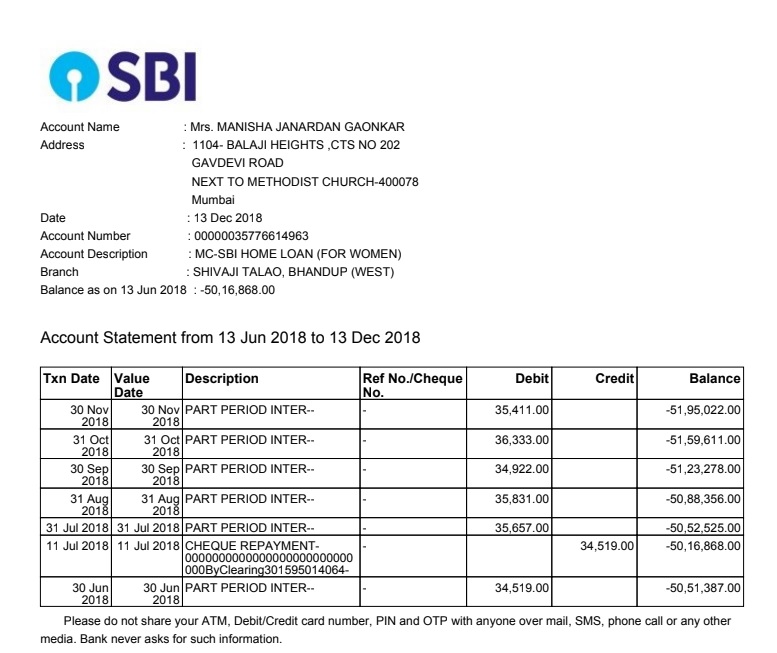

ECS Form SBI Home Loan 2022 2023 EduVark

ECS Form SBI Home Loan 2022 2023 EduVark

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Tax Benefit Of Home Loan In India Income Tax India Pinterest

State Bank Of India SBI Home Loan Emi Not Debited From My Account

Home Loan Tax Rebate India - Web 30 mars 2023 nbsp 0183 32 Updated on Mar 30th 2023 7 min read CONTENTS Show While planning to borrow a home loan for your second time you should get a clear idea of the