Home Office Tax Deduction Canada 2022 This page describes the recent changes to claiming work space in the home expenses Eligible employees who worked from home in 2023 or later tax years will be

How to calculate your home office tax deduction Under the temporary flat rate method the home office expense deduction is calculated at 2 per day for each day the eligible employee worked from home in 2021 due to To be entitled to deduct home office expenses you must be required to use a part of your home for work The CRA has confirmed that the requirement to maintain a home office need not be

Home Office Tax Deduction Canada 2022

Home Office Tax Deduction Canada 2022

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110caa30ac41d7943be1376_60d8291523d85b36c5631154_Use-of-home-as-office.jpeg

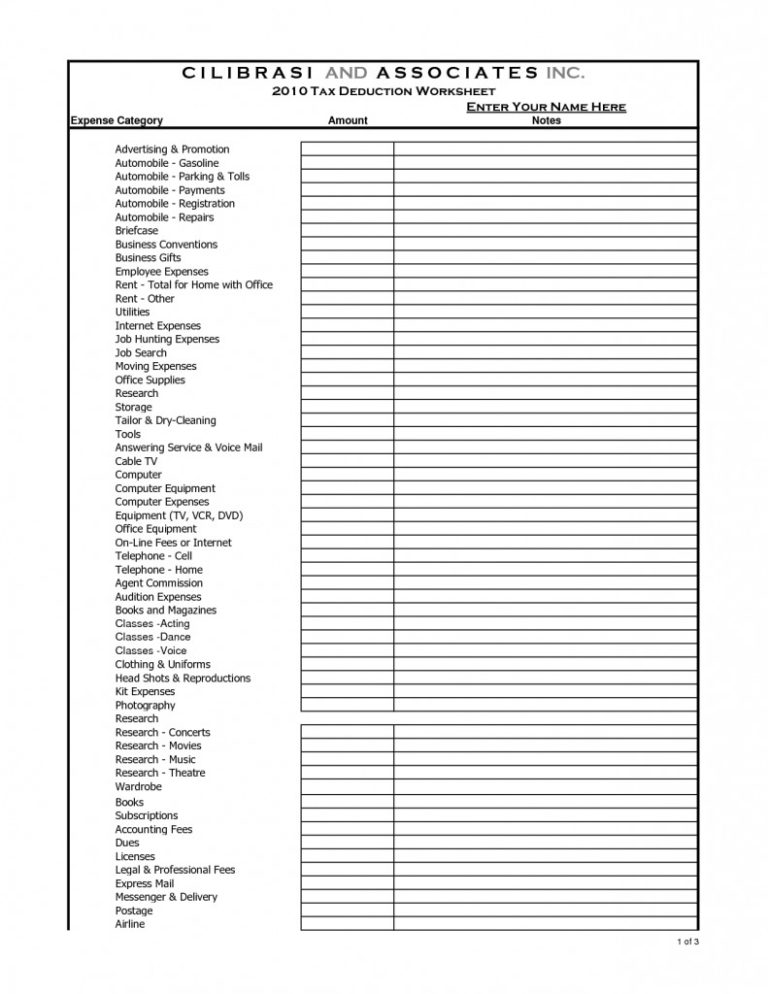

Printable Itemized Deductions Worksheet

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

Self Employed Tax Deductions Worksheet

https://i.pinimg.com/originals/ed/37/23/ed372359aac4e974a39e6494da5610e6.jpg

For tax year 2022 the CRA has maintained the claim amount for the work from home tax credit of 500 with the flat rate method which allows Canadians working from home If you are an employee working from home may allow you to claim home office deductions However it s essential to understand the intricacies of claiming home office

If your home office qualifies for the tax deduction you can claim a portion of your household expenses For example if your home office takes up 10 percent of the square footage of your home you can claim 10 percent of utilities insurance The 2023 claims of home office expenses represent a 41 4 increase over the 2022 tax year when 1 47 billion was claimed The 2022 amount includes more than 863 million 59

Download Home Office Tax Deduction Canada 2022

More picture related to Home Office Tax Deduction Canada 2022

Canada s Work From Home Tax Deduction Here s How To Make The Most Out

https://www.narcity.com/media-library/eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJpbWFnZSI6Imh0dHBzOi8vYXNzZXRzLnJibC5tcy8yNjAwODc1Ni9vcmlnaW4uanBnIiwiZXhwaXJlc19hdCI6MTYzNjExNDMyNn0.gjikVURInXYXLSzKIQpF2w4YEnqD2Q0gDkSdpo9BHGM/image.jpg?width=1200&coordinates=0%2C112%2C0%2C112&height=600

Irs Itemized Deductions Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/itemized-deduction-worksheet-soccerphysicsonline-768x994.jpg

Small Business Bookkeeping Small Business Tax Startup Business Plan

https://i.pinimg.com/originals/85/2b/9c/852b9c217ad1122b0bd8d12f2d36175e.png

As part of the 2021 Economic and Fiscal Update tabled on December 14 2022 the government announced that they will extend the simplified rules for deducting home office expenses for the Canadians who were required to work from home as a direct result of the pandemic were able to claim 2 for every day they worked remotely to a maximum of 400 for the year based on certain criteria The deduction can be

For 2022 tax year the Canada Revenue Agency CRA has extended the temporary simplified flat rate method for deducting home office expenses for employees who worked from home due to This is the second consecutive tax filing season that claiming home office expenses follows pre pandemic protocol with no flat rate method temporarily implemented

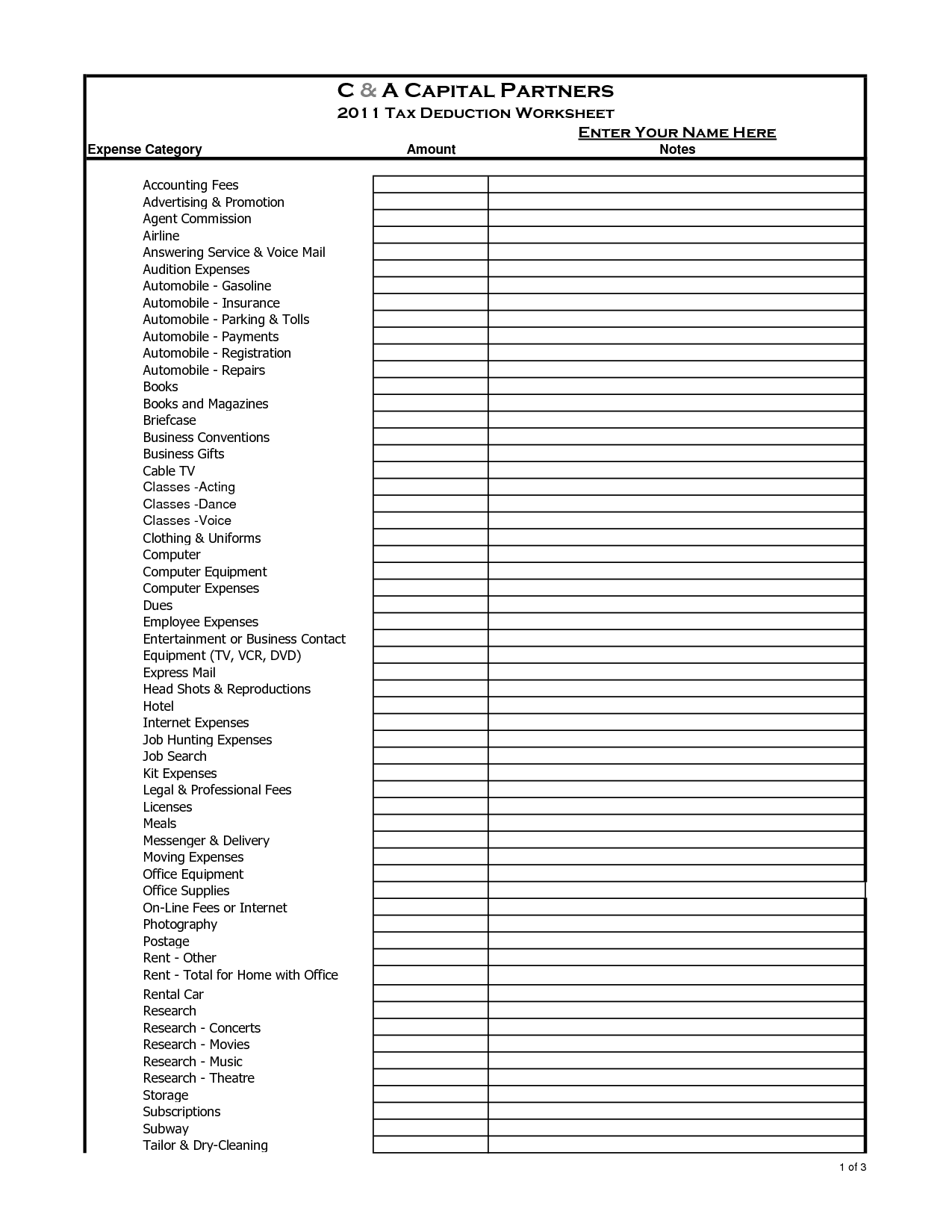

Small Business Tax Deductions Worksheets

https://www.pdffiller.com/preview/391/382/391382225/large.png

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

https://www.canada.ca › en › revenue-agency › services › ...

This page describes the recent changes to claiming work space in the home expenses Eligible employees who worked from home in 2023 or later tax years will be

https://www.bdo.ca › insights › claiming-a-h…

How to calculate your home office tax deduction Under the temporary flat rate method the home office expense deduction is calculated at 2 per day for each day the eligible employee worked from home in 2021 due to

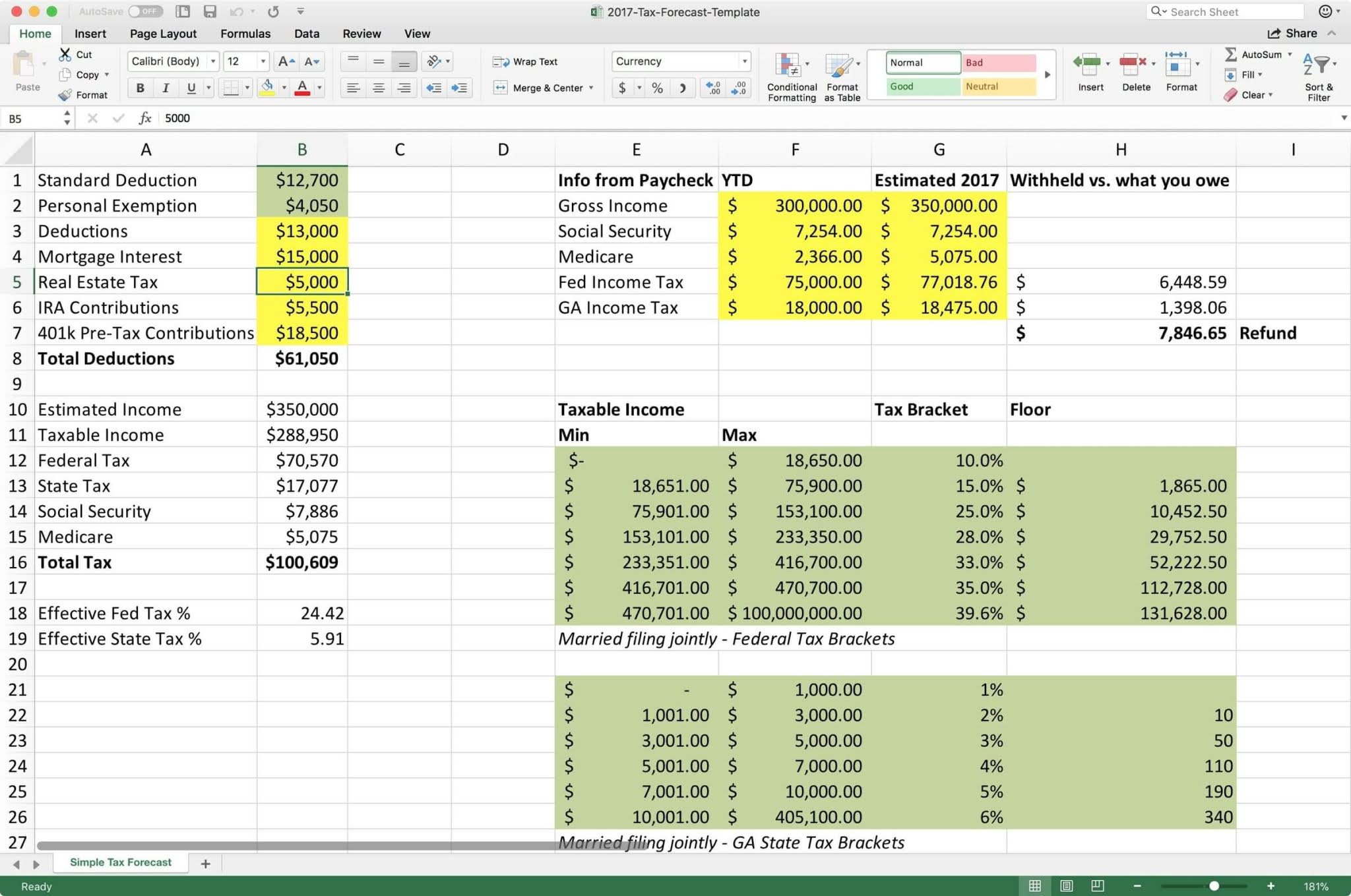

Simple Withholding Calculator Medical Resume

Small Business Tax Deductions Worksheets

Realtor Tax Deductions Worksheet

FunctionalBest Of Self Employed Tax Deductions Worksheet Check More At

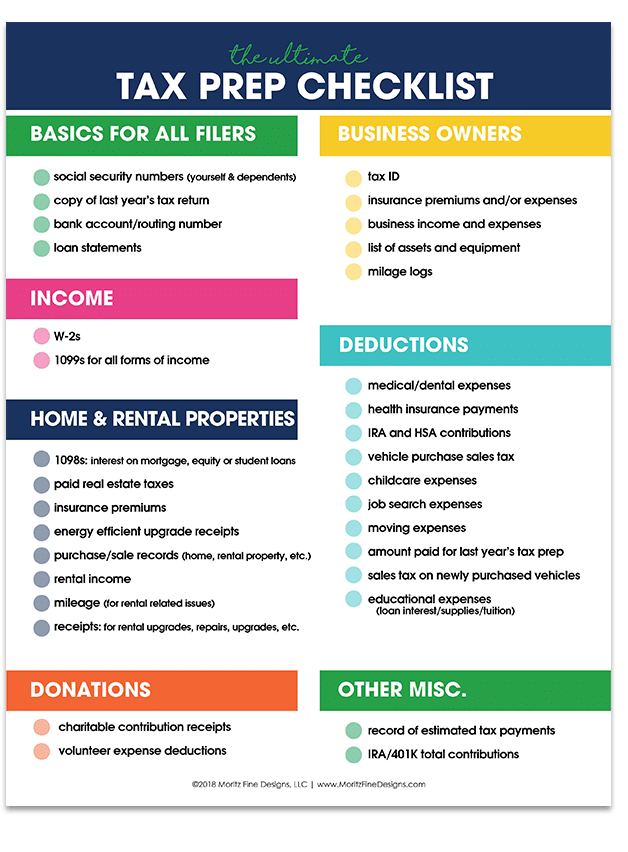

Income Tax Prep Checklist Free Printable Checklist

Your Guide To Claiming A Legit Home Office Tax Deduction Tax

Your Guide To Claiming A Legit Home Office Tax Deduction Tax

Tax Rates Absolute Accounting Services

8 Tax Preparation Organizer Worksheet Worksheeto

New Tax Regime Complete List Of Exemptions And Deductions Disallowed

Home Office Tax Deduction Canada 2022 - For tax year 2022 the CRA has maintained the claim amount for the work from home tax credit of 500 with the flat rate method which allows Canadians working from home