Home Office Tax Deduction Germany As of 2023 the limited deduction will be eliminated Instead you can deduct the Home Office Lump Sum for up to 1 260 euros per year This applies regardless of whether you have a tax deductible

Home office implies that you re working from home Whether at the desk at the kitchen table or from the couch A study is a separate room in your living space used Who can deduct home office costs from income tax in Germany You can deduct unlimited home office costs from the taxes if you meet the following criteria Your

Home Office Tax Deduction Germany

Home Office Tax Deduction Germany

https://www.fastcapital360.com/wp-content/uploads/2021/02/homeDeduction.jpg

Home Office Tax Deduction 2020 For Employees PRORFETY

https://i.pinimg.com/736x/b9/76/ac/b976ac9170bf1f7f342c4f4eee6194f2.jpg

Home Office Deduction Worksheet Excel

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5fde6f8d3ee7a056f2dcf497_excel sheet for the home office deduction.png

The government allowed to write off days in bedlam home office at 5 euros per day More details about how to deduct home office expenses from taxes All I can 1 Requirement For Home Office Tax Deduction in Germany 1 1 Home office tax deduction in Germany for salaried employees 1 2 Home office tax deduction in Germany for freelancers

You may have heard that Germany lets you deduct the costs of running a home office if you work from home However if you have been working at a desk in your Can I deduct my home office What about my power and internet bill And can I claim expenses for work related purchases on tax Read on to find out what expenses for your home office you can deduct

Download Home Office Tax Deduction Germany

More picture related to Home Office Tax Deduction Germany

Freelancer Taxes How To Deduct Your Home Office Rags To Reasonable

https://www.ragstoreasonable.com/wp-content/uploads/2016/04/Home-Office-Deduction-1.jpg

Simplified Home Office Deduction 2018 Fill Online Printable

https://www.pdffiller.com/preview/535/780/535780986/big.png

Tax Return In Germany 2022 English Guide My Life In Germany

https://www.mylifeingermany.com/wp-content/uploads/2019/05/tax_salary-in-Germany_are-you-getting-paid-enough_my-life-in-germany_hkwomanabroad-min.jpg

To declare the home office allowance officially called the Homeoffice Pauschal in your Steuererkl rung tax return you must enter the number of days on Now ministers have agreed that taxpayers can continue to deduct 5 euros per day worked exclusively at home on their annual tax returns On top of this the

This means that in future 200 instead of 120 days devoted to home office will be eligible for the 5 per day deduction which was originally introduced amid the In general it s already possible to deduct the Home Office from your taxes But usually you need to meet certain requirements given by the Finanzamt finance

30 Home Office Deduction Worksheet Worksheets Decoomo

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/tax-deduction-excel-spreadsheet-ireland-self-employment-and-728x939.jpg

Home Office Tax Deduction Still Available Just Not For COVID displaced

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e2026bde880761200c-800wi

https://germantaxes.de/tax-tips/home-…

As of 2023 the limited deduction will be eliminated Instead you can deduct the Home Office Lump Sum for up to 1 260 euros per year This applies regardless of whether you have a tax deductible

https://taxfix.de/en/home-office-and-study-deductions

Home office implies that you re working from home Whether at the desk at the kitchen table or from the couch A study is a separate room in your living space used

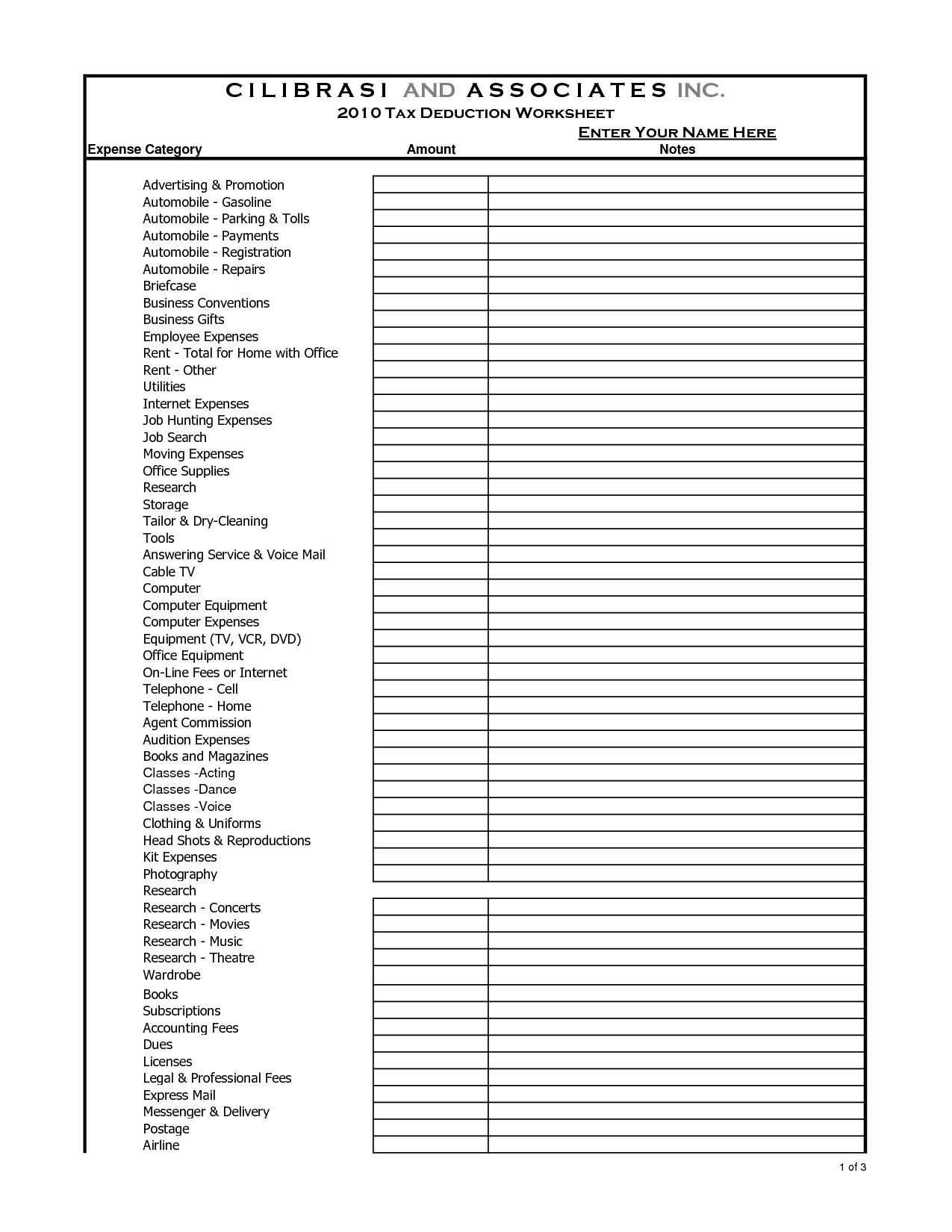

Home Office Tax Deductions Mileage Tracking Log 2020

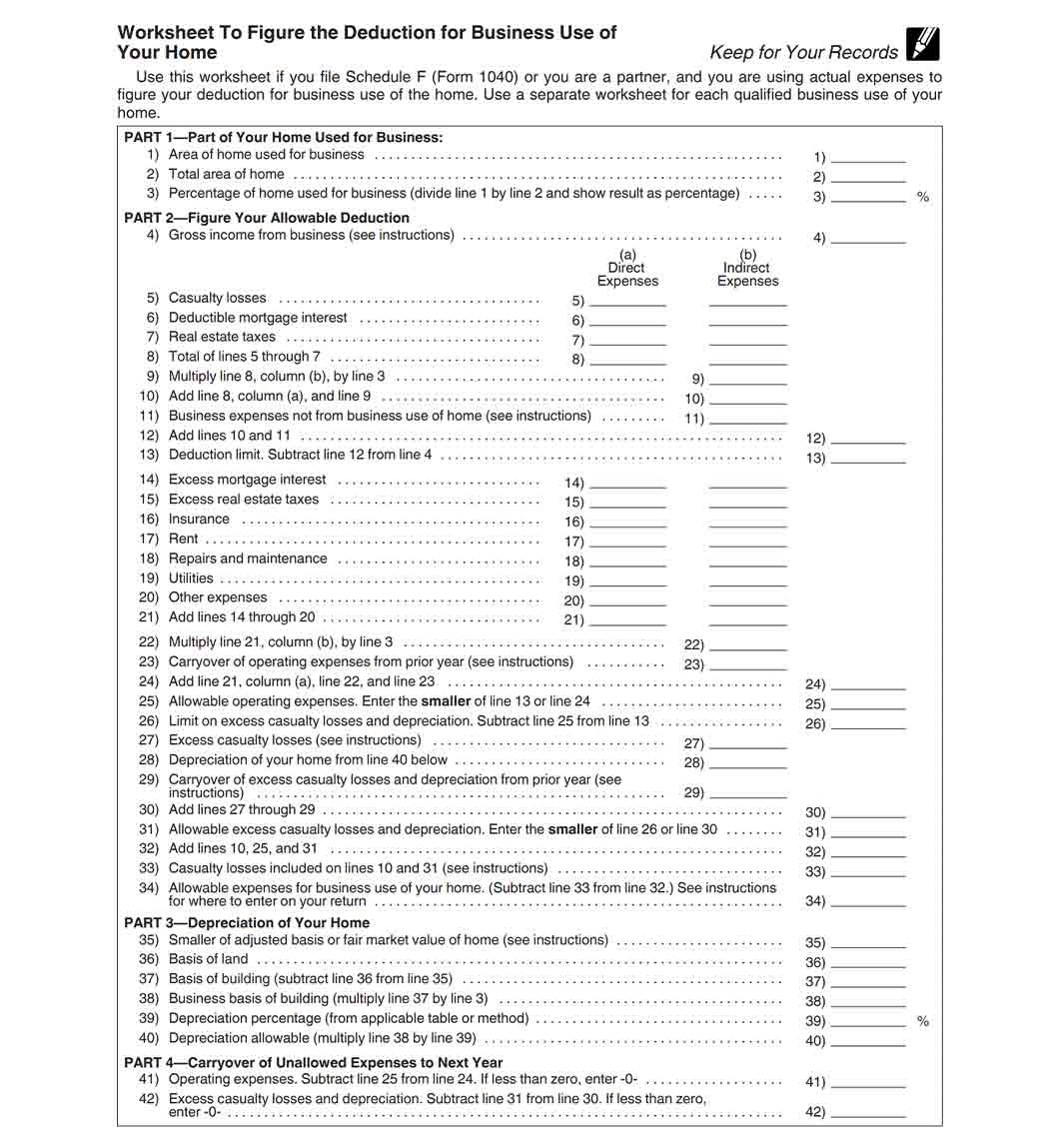

30 Home Office Deduction Worksheet Worksheets Decoomo

:max_bytes(150000):strip_icc()/woman-using-cell-phone-77741801-57bb6f0c5f9b58cdfd4289d4.jpg)

Home Office Tax Deductions For Telecommuting Employees

10 Home Based Business Tax Worksheet Worksheeto

Home Office Deduction Worksheet HMDCRTN

Home Office Deduction Worksheet

Home Office Deduction Worksheet

Home Internetl Home Office Internet Tax Deduction

The 6 Tax Classes In Germany Which One Is Yours

Meals Entertainment Deductions For 2021 2022

Home Office Tax Deduction Germany - You may have heard that Germany lets you deduct the costs of running a home office if you work from home However if you have been working at a desk in your