Home Office Tax Return Germany In your tax returns for the tax years 2020 2021 and 2022 you can simply deduct 5 euros for each calendar day spent exclusively working from home The lump sum is limited to 600 euros per calendar year and the limit of days that can be deducted for remote work is 120 days

But did you know that if you made the switch to the home office you might be entitled to extra benefits on your tax return Taxfix the tax expert led app explains all Plus submit your return by October 31 2021 to save 50 percent on the cost of filing voucher code below Information for expats on how to complete the German tax return Einkommensteuererkl rung tax forms ELSTER tax classes tax deductions and exemptions

Home Office Tax Return Germany

Home Office Tax Return Germany

https://i.ytimg.com/vi/mMOYDRrbuHQ/maxresdefault.jpg

Tax Return In Germany 2024 English Guide My Life In Germany

https://www.mylifeingermany.com/wp-content/uploads/2020/02/featured-image_tax-return-in-germany_guide-for-expats_my-life-in-germany_hkwomanabroad-min.jpg

Taxes In Germany The Only Free Easy Way To File A Tax Return

https://nomadandinlove.com/wp-content/uploads/taxes-in-germany-768x1152.jpg

With the home office lump sum credit you can claim 6 for every day you work from home for a maximum of 210 days for the 2023 tax return meaning up to 1 260 You can even claim this deduction if you chose to work from home voluntarily What home office expenses can you deduct from your tax return in Germany What expenses can you deduct even without a home office Cheatsheet to Save Taxes Free Download Home office lump sum vs commuting lump sum Who can deduct home office costs from income tax in Germany

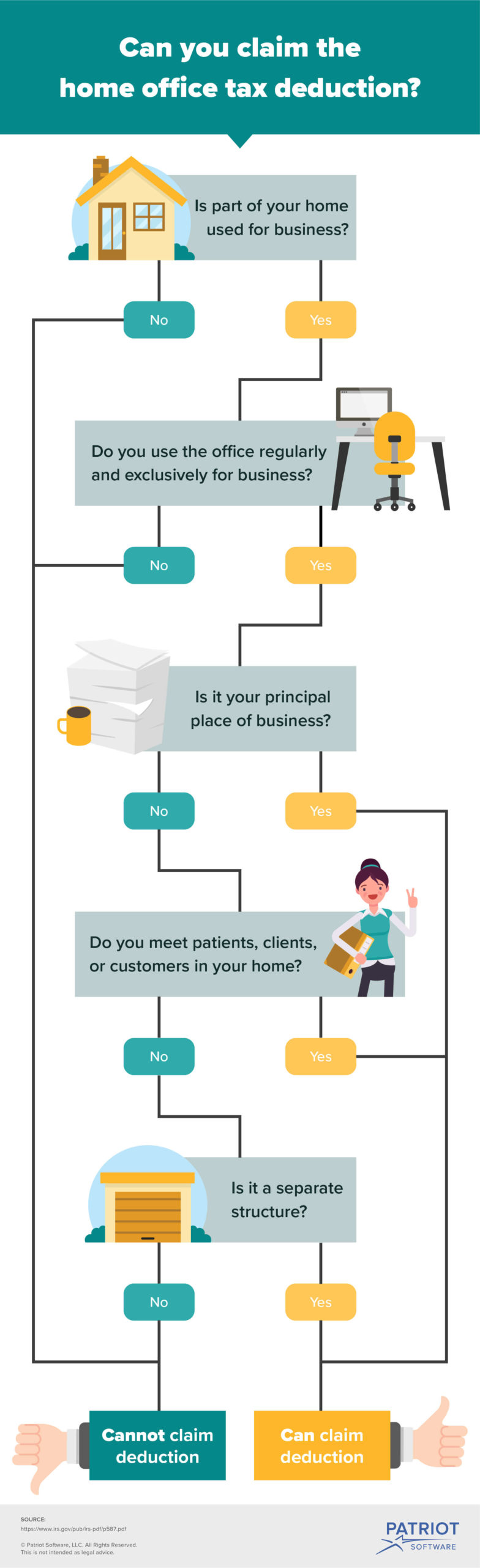

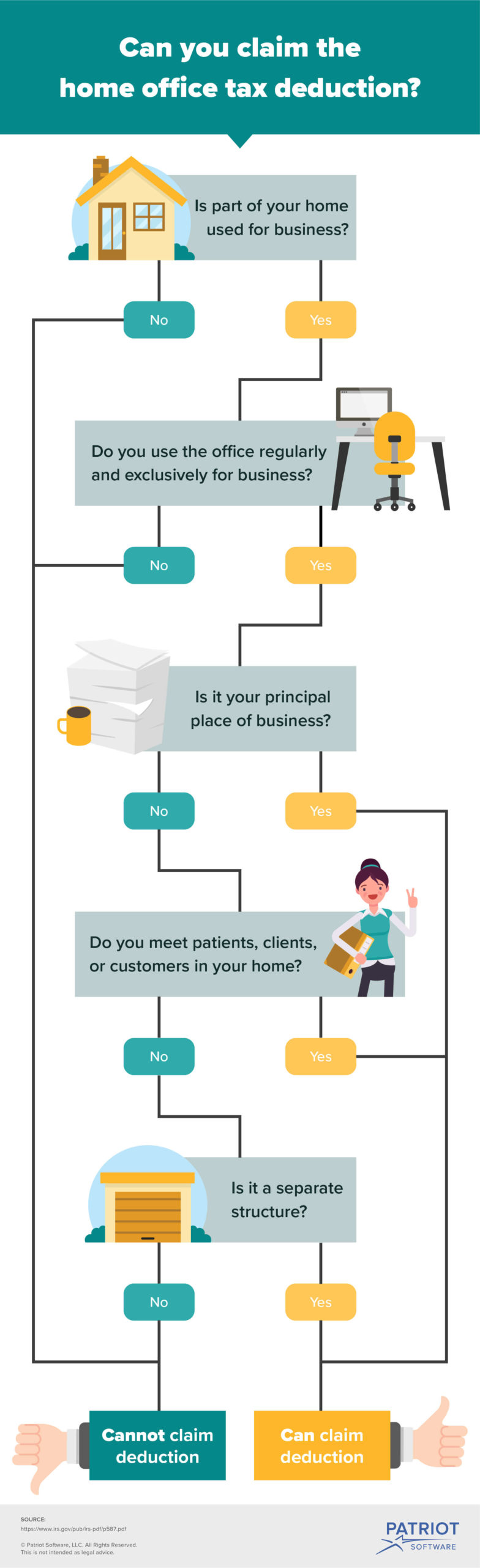

Can I deduct my home office What about my power and internet bill And can I claim expenses for work related purchases on tax Read on to find out what expenses for your home office you can deduct from tax Related Managing your taxes as a freelancer in Germany Home office tax deductions in Germany First things first your home office It was recommended to enter the paushal in line 47 Anlage N and write something like Homeoffice Pauschal 100 Tage 500 Euro For year 2021 there is a special line line 45 How much At 5 euros per day but not more than 600 euros per year

Download Home Office Tax Return Germany

More picture related to Home Office Tax Return Germany

Tax Deductions The Developer Finance Guide

https://www.developersfinance.guide/img/assets/homeofficetax_russellknight1.png

Qualifying For The Home Office Deduction

https://www.condorcapital.com/wp-content/uploads/2022/01/home-office.jpg

Tax Return Free Of Charge Creative Commons Green Highway Sign Image

https://www.picserver.org/highway-signs2/images/tax-return.jpg

Now ministers have agreed that taxpayers can continue to deduct 5 euros per day worked exclusively at home on their annual tax returns On top of this the maximum deduction is being increased from 600 euros 120 home office days in 2022 to 1 000 euros 200 home office days in 2023 Updated on August 22 2023 Read in 3 minutes Due to the COVID crisis lots of people were suddenly required to work from home and had to transform their living space into a Home Office However until now you had to follow strict guidelines in order to be able to deduct a Home Office from your taxes But now there is a new Home Office allowance

Homeoffice Home office under german law Current legal situation in Germany A right to work from home or even a duty to do so In Germany around 27 9 percent of employees currently work from home In contrast to the Netherlands Germany does not yet have a legal right for employees to work from home Home office implies that you re working from home Whether at the desk at the kitchen table or from the couch A study is a separate room in your living space used specifically for work and work only To have a tax deductible study strict requirements apply Prepare your own tax return 39 99

How To Submit Your Tax Return In Germany Germanymore de

https://www.germanymore.de/wp-content/uploads/2018/12/tax-return-germany.jpg

Tax Class In Germany Explained Easy 2024 English Guide

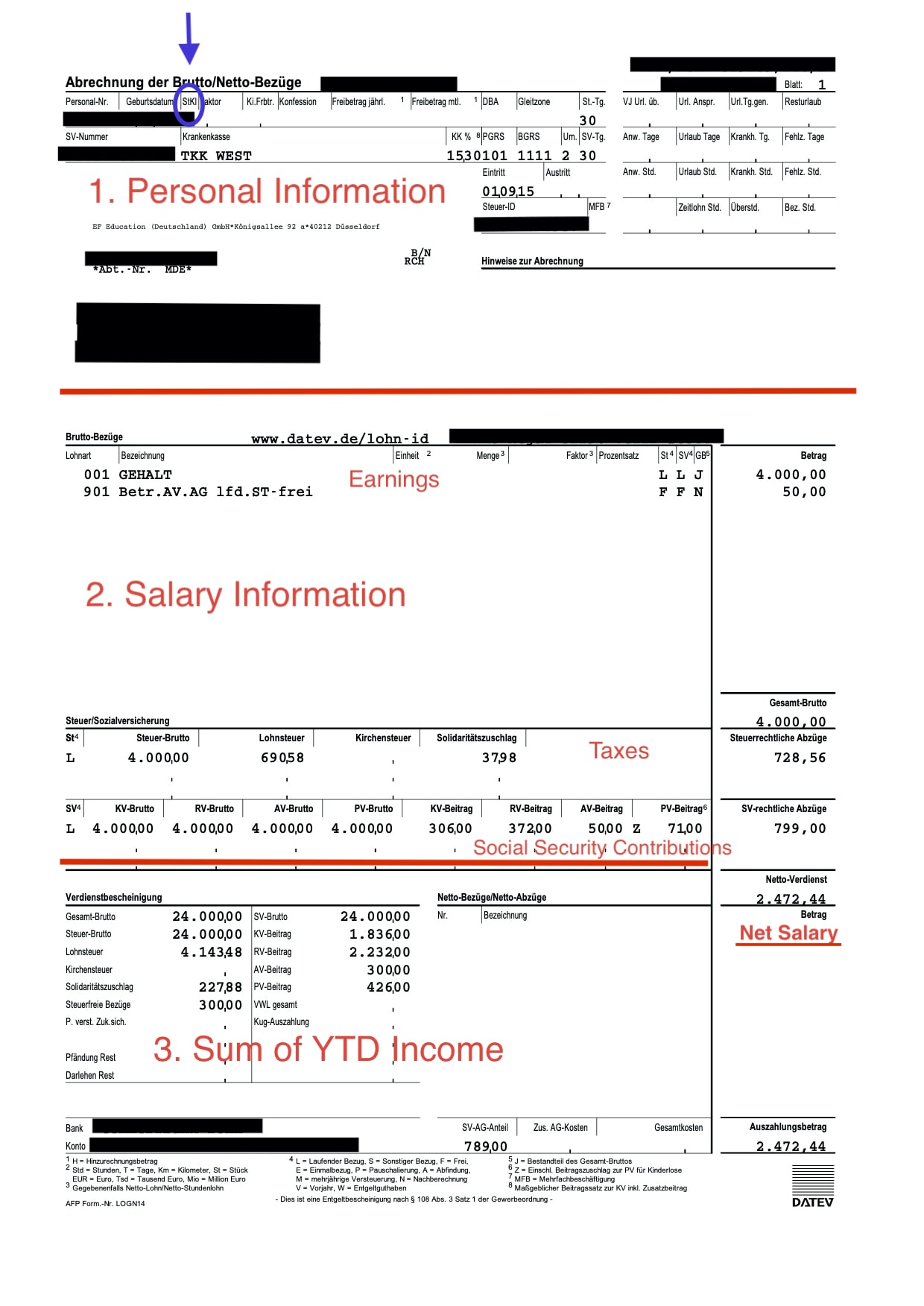

https://www.simplegermany.com/wp-content/uploads/2020/10/Example-of-German-Payslip-with-English-Translation.jpg

https://germantaxes.de/tax-tips/home-office-lump-sum

In your tax returns for the tax years 2020 2021 and 2022 you can simply deduct 5 euros for each calendar day spent exclusively working from home The lump sum is limited to 600 euros per calendar year and the limit of days that can be deducted for remote work is 120 days

https://www.iamexpat.de/expat-info/german-expat...

But did you know that if you made the switch to the home office you might be entitled to extra benefits on your tax return Taxfix the tax expert led app explains all Plus submit your return by October 31 2021 to save 50 percent on the cost of filing voucher code below

German Tax Return For Tax Office With Form Editorial Stock Photo

How To Submit Your Tax Return In Germany Germanymore de

Tax Return Germany 49 Deductible Expenses In 2021 GermanSuperfast

How To Do Your Income Tax Return In Germany VLOG 10 YouTube

German Annual Income Tax Return Declaration Form For 2022 Year Close Up

Home Office Tax Deduction What Is It And How Can It Help You

Home Office Tax Deduction What Is It And How Can It Help You

Steuerpauschale Flat Rate Tax Deductibles In Germany And How To Use

Tax Return Germany SteuerGo Android

Therapists Home Office Tax Deductions TL DR Accounting

Home Office Tax Return Germany - What home office expenses can you deduct from your tax return in Germany What expenses can you deduct even without a home office Cheatsheet to Save Taxes Free Download Home office lump sum vs commuting lump sum Who can deduct home office costs from income tax in Germany