Home Owner Tax Breaks 2023 Homeowner Tax Deductions It s tax time which means you have until the middle of April 2024 to cash in on the 2023 tax year it s time to reap all the best homeowner tax deductions and credits to maximize your return or reduce

As a homeowner you may be eligible for various tax deductions credits and other benefits on your tax return The Tax Cuts and Jobs reduced the 1 million ceiling on home acquisition indebtedness to 750 000 375 000 for married couples filing separately and 11 tax deductions for homeowners in 2023 For your 2022 taxes which you file in early 2023 there are a number of deductions available to homeowners However most of these deductions are only available if you itemize deductions

Home Owner Tax Breaks 2023

Home Owner Tax Breaks 2023

http://infographicplaza.com/wp-content/uploads/Tax-Breaks-Every-Home-owner-infographic-plaza-thumb.jpg

Tax Breaks And Benefits Of Owning A Home

https://www.firstoptiononline.com/wp-content/uploads/2017/01/First-Option-12-5-16-Taxes-and-Home-ownership-infographic_20-Title.png

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

Whether you re filing taxes for the first time as a homeowner filing after a recent refinance or just sold a home read below to review some of the tax deductions for homeowners as the filing deadline approaches Tax credits and breaks for first time home buyers can be an attractive incentive that makes purchasing a home more affordable These credits are designed to support new buyers and stimulate the housing market Take

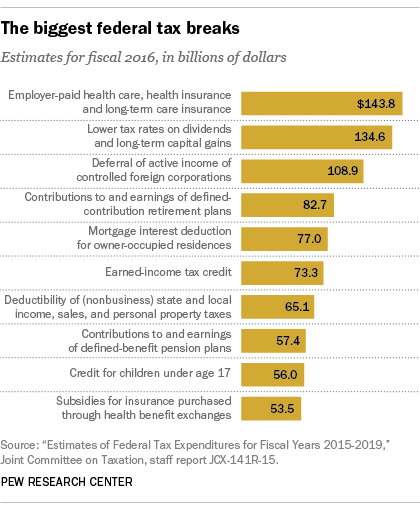

Tax incentives help current owners protect their investment and make homeownership more accessible for all When filing this year make sure you know about these new federal tax credits that will help make homes more energy efficient while reducing energy Here you are to list out and claim specific home owner tax breaks on your tax return All nine of the options given below fall under itemized

Download Home Owner Tax Breaks 2023

More picture related to Home Owner Tax Breaks 2023

7 Tax Breaks Every First Time Homebuyer Must Know GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2015/12/6-HomeImprovement-Patryk-Kosmider-shutterstock_215706484-848x477.jpg

23 Tax Breaks For Small Businesses In 2023 Quickbooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/tax-breaks-2023-header-image-us-en.jpg

Home Owner Tax Deductions Fiona Gilmour

https://uploads.pl-internal.com/NDM0NGUxYjEtYmQzMy00YThjLWIzNTQtZjY5YjY5MTY1ZDEx/content/2017/03/Networking small.jpg

A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about common tax breaks and how to claim them Roughly 37 of taxpayers are eligible You know that you can get an income tax deduction on the mortgage interest you pay But there are other tax deductions you can take on your principal residence or second home such as property taxes

The bottom line on homeowner tax breaks Homeowner tax deductions can save you thousands of dollars a year effectively reducing the cost of owning your home Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first 750 000 of their mortgage debt or mortgage debt up to 1 000 000 if you re

Tax Credits And Deductions Every Homeowner Should Know

http://static.boomtowncdn.com/wp-content/blogs.dir/2001/files/2016/12/home-owner-tax-deduction.jpg

Tax Credits Every First Time Home Owner Needs To Know About Mortgage

https://mortgagesolutions.net/wp-content/uploads/tax-credits-first-time-home-buyer.jpg

https://marketplacehomes.com › blog › real …

Homeowner Tax Deductions It s tax time which means you have until the middle of April 2024 to cash in on the 2023 tax year it s time to reap all the best homeowner tax deductions and credits to maximize your return or reduce

https://www.thisoldhouse.com › home-finances › reviews › ...

As a homeowner you may be eligible for various tax deductions credits and other benefits on your tax return The Tax Cuts and Jobs reduced the 1 million ceiling on home acquisition indebtedness to 750 000 375 000 for married couples filing separately and

Home Owner Tax Deductions

Tax Credits And Deductions Every Homeowner Should Know

Top Homeowner Tax Deductions Alta Realty Group

Tax Breaks That Are Going Away So Use These Deductions Now

Six Overlooked Tax Breaks For Individuals Montgomery Community Media

The 9 Best 2017 Tax Deductions For Homeowners PureWow

The 9 Best 2017 Tax Deductions For Homeowners PureWow

The Biggest U S Tax Breaks Pew Research Center

The 9 Best 2017 Tax Deductions For Homeowners PureWow

Marly Real Estate Home Owner Tax Savings YouTube

Home Owner Tax Breaks 2023 - There are tax benefits that can help taxpayers save money and offset some of the costs that come with homeownership Homeowners should review the tax deductions programs and housing allowances to see if they are eligible