Home Owner Tax Rebate 2024 This is the first time the program has been expanded since 2006 The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 for renters Automatically increases the income cap to grow with inflation in years to come

This deduction expired in 2016 and was extended to 2017 After 2018 PMI premiums aren t tax deductible any longer If there s an extension the amount you can deduct depends on your household income It begins to be phased out after 100 000 Married couples filing separately will see the phase out start at 50 000 Here s how big the 15 000 First Time Home Buyer Tax Credit would get for buyers over the next 5 years assuming a 5 annual rate of inflation 2023 Maximum tax credit of 17 850 2024 Maximum tax credit of 18 745 2025 Maximum tax credit of 19 680 2026 Maximum tax credit of 20 665

Home Owner Tax Rebate 2024

Home Owner Tax Rebate 2024

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Most Residential Properties To Incur Higher Tax From Jan 1 2023 Offset By One off Tax Rebate

https://onecms-res.cloudinary.com/image/upload/s--y_Gboejg--/f_auto%2Cq_auto/v1/tdy-migration/tdyhdb0724web1_read-only_0_0.jpg?itok=Y37OI9Fu

Tax Rebate Service No Rebate No Fee MBL Accounting

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit The rules vary by year and person depending on your filing status age income and other factors This story is part of Taxes 2024 CNET s coverage of the best tax software tax tips and

2 PA 1000 Pennsylvania Property Tax or Rent Rebate Program www revenue pa gov 2023 WHAT IS THE PROPERTY TAX RENT REBATE PROGRAM A Pennsylvania program providing rebates on If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age

Download Home Owner Tax Rebate 2024

More picture related to Home Owner Tax Rebate 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

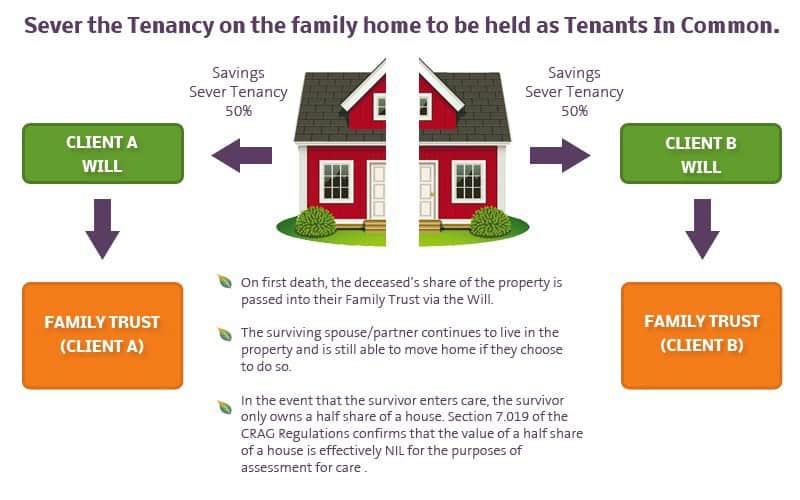

What Is A Tenants In Common Property Ownership

https://iowalum.com/wp-content/uploads/2021/09/home-owner-tax.jpg

January 23 2024 at 9 00 p m by Andrew Wilkins Catoosa County Gary Autry Catoosa County tax commissioner More than 350 Catoosa County property taxpayers will be issued a refund as government Phone 701 328 7988 Toll Free 1 877 649 0112 Email taxprc nd gov Those applying for the credit may be eligible to apply for more than one type of property tax credit including the Homestead Property Tax Credit and the Disabled Veterans Property Tax Credit Additional information on other credits and exemptions can be found here

The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption Make less than 250 000 a year based on federal adjusted gross income from tax year 2020 and Have a school tax liability for the 2022 2023 school year Closings The one year program was initiated to provide property tax relief to homeowners in 2022

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

https://townsquare.media/site/704/files/2022/07/attachment-Untitled-design-4.jpg?w=980&q=75

https://www.media.pa.gov/Pages/Revenue-Details.aspx?newsid=422

This is the first time the program has been expanded since 2006 The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 for renters Automatically increases the income cap to grow with inflation in years to come

https://americantaxservice.org/homeowner-tax-breaks-and-deductions/

This deduction expired in 2016 and was extended to 2017 After 2018 PMI premiums aren t tax deductible any longer If there s an extension the amount you can deduct depends on your household income It begins to be phased out after 100 000 Married couples filing separately will see the phase out start at 50 000

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Big Update On Income Tax Rebate In Union Budget 2023 No Tax Upto 7 Lakh YouTube

Virginia Tax Rebate 2023 Eligibility Application Process And Benefits Tax Rebate

Virginia Tax Rebate 2023 Eligibility Application Process And Benefits Tax Rebate

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Home Owner Tax Rebate 2024 - The rules vary by year and person depending on your filing status age income and other factors This story is part of Taxes 2024 CNET s coverage of the best tax software tax tips and