Home Owner Tax Rebate Ny 2024 Select Delivery Schedule lookup below Choose the county you live in from the drop down menu Select your school district to view the information for your area Select your town or city The lookup shows the date we began or will begin to mail STAR credit and eligibility letters to your area Please allow five to ten business days for delivery

This deduction expired in 2016 and was extended to 2017 After 2018 PMI premiums aren t tax deductible any longer If there s an extension the amount you can deduct depends on your household income It begins to be phased out after 100 000 Married couples filing separately will see the phase out start at 50 000 30 of cost up to 500 for doors up to 250 each Home Energy Audits 30 of cost up to 150 Free for all New Yorkers Home Electric Vehicle Charger 30 of cost up to 1 000 New Electric Vehicle Up to 7 500 if you meet certain income limitations For more information see the IRS website

Home Owner Tax Rebate Ny 2024

Home Owner Tax Rebate Ny 2024

https://uploads.pl-internal.com/NDM0NGUxYjEtYmQzMy00YThjLWIzNTQtZjY5YjY5MTY1ZDEx/content/2017/03/Networking small.jpg

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

https://townsquare.media/site/704/files/2022/07/attachment-Untitled-design-4.jpg?w=980&q=75

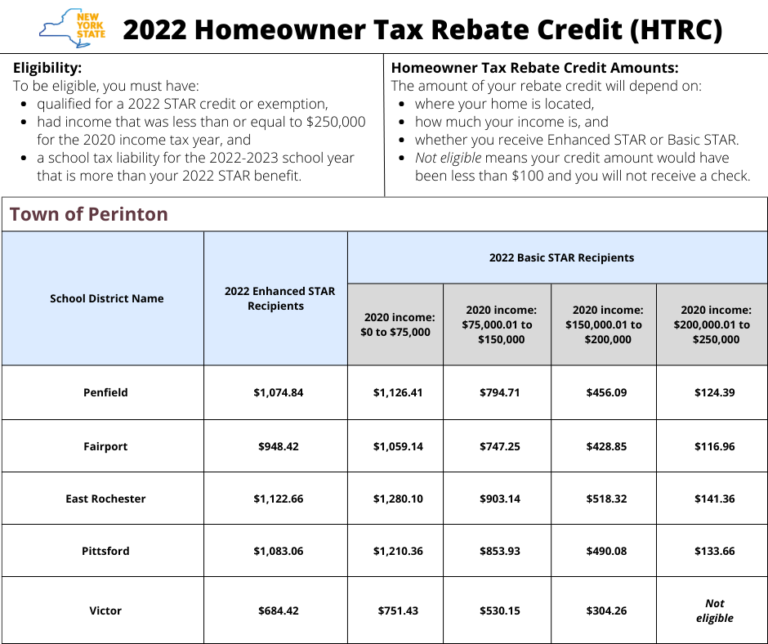

The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Homeowners used this lookup to determine the amount they would receive for the homeowner tax rebate credit HTRC Please note by law we cannot issue checks for the HTRC that are less than 100 New York state homeowners have until December 31 to apply for a rebate that could offer a check of 1 400 or more CHARLY TRIBALLEAU AFP via Getty Images Those who qualify for the Enhanced STAR

To find out when your school property taxes are due consult your city town village or school district If your STAR check hasn t shown up and your due date to pay your school property taxes has Governor Kathy Hochul today announced new efforts to support homeowners and tenants including public and subsidized housing residents as part of the FY 2024 Budget

Download Home Owner Tax Rebate Ny 2024

More picture related to Home Owner Tax Rebate Ny 2024

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Most Residential Properties To Incur Higher Tax From Jan 1 2023 Offset By One off Tax Rebate

https://onecms-res.cloudinary.com/image/upload/s--y_Gboejg--/f_auto%2Cq_auto/v1/tdy-migration/tdyhdb0724web1_read-only_0_0.jpg?itok=Y37OI9Fu

Tax Rebate Service No Rebate No Fee MBL Accounting

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients of the School Tax Relief STAR exemption or credit were automatically qualified and have already received their rebates If you have not received a rebate but believe Jan 14 2024 California has long championed renewable energy but a change in the state s policies last year has led to a sharp decline in the installation of residential rooftop solar in the

This tax credit recently increased to 30 from 26 and is approved through 2033 To be eligible homeowners must own their solar panel system and the credit can be claimed during the reporting For the property tax relief credit income is defined as federal adjusted gross income FAGI from two years prior modified so that the net amount of loss reported on Federal Schedule C D E or F doesn t exceed 3 000 the net amount of any other separate category of loss doesn t exceed 3 000 and the aggregate amount of all losses

Missouri Rent Rebate 2023 Printable Rebate Form PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/missouri-rent-rebate-2023-printable-rebate-form.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

https://www.tax.ny.gov/pit/property/star/star-check-delivery-schedule.htm

Select Delivery Schedule lookup below Choose the county you live in from the drop down menu Select your school district to view the information for your area Select your town or city The lookup shows the date we began or will begin to mail STAR credit and eligibility letters to your area Please allow five to ten business days for delivery

https://americantaxservice.org/homeowner-tax-breaks-and-deductions/

This deduction expired in 2016 and was extended to 2017 After 2018 PMI premiums aren t tax deductible any longer If there s an extension the amount you can deduct depends on your household income It begins to be phased out after 100 000 Married couples filing separately will see the phase out start at 50 000

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Missouri Rent Rebate 2023 Printable Rebate Form PropertyRebate

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Virginia Tax Rebate 2023 Eligibility Application Process And Benefits Tax Rebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Georgia Income Tax Rebate 2023 Printable Rebate Form

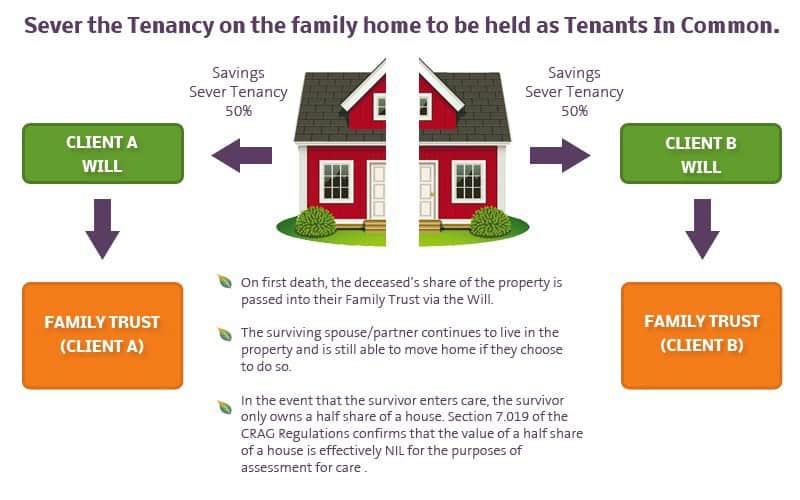

What Is A Tenants In Common Property Ownership

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Home Owner Tax Rebate Ny 2024 - We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Yorkers The credit provides direct property tax relief in the form of checks to eligible homeowners The amount of the credit will depend on your home s location your income and whether you receive Basic or Enhanced STAR