Home Property Tax Refund If you re a Minnesota homeowner or renter you may qualify for a Property Tax Refund The refund provides property tax relief depending on your income and property taxes

Tax refunds If your tax assessment was completed in June you receive your tax refund on 5 August 2024 The refund is transferred to you by the end of the day The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money

Home Property Tax Refund

Home Property Tax Refund

https://anokacountymn.gov/ImageRepository/Document?documentID=21308

Weekly Tax Tip Renters Filing A Property Tax Refund YouTube

https://i.ytimg.com/vi/kQHEmxzNOV0/maxresdefault.jpg

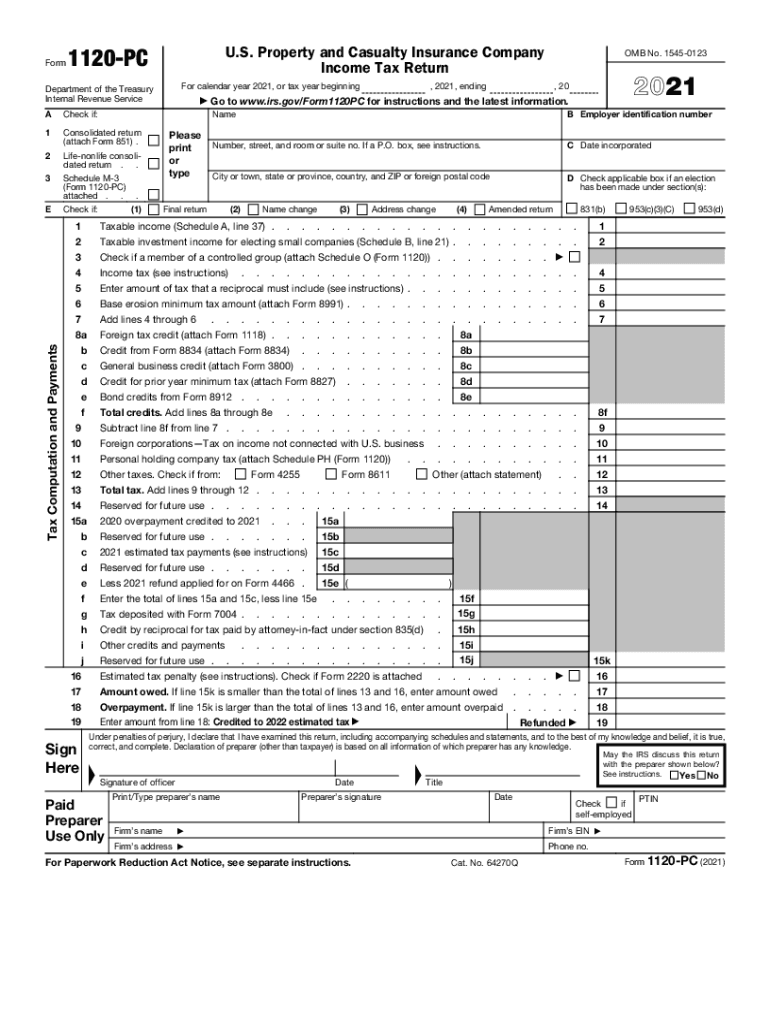

2021 Form IRS 1120 PC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/578/940/578940595/large.png

1 Select Your State Review if there s a property tax relief program in your state or local area 2 Review Eligibility Criteria Learn if you qualify and when to apply each state is different 3 Learn How to Apply If you receive a refund of home mortgage interest that you deducted in an earlier year and that reduced your tax you must generally include the refund in income in the year you

ST PAUL Minn The Minnesota Department of Revenue reminds homeowners and renters to file for their 2019 property tax refund before the August 15 Douglas County this month issued refund checks to property owners saying it will help residents who are facing soaring valuations All told the county is sending

Download Home Property Tax Refund

More picture related to Home Property Tax Refund

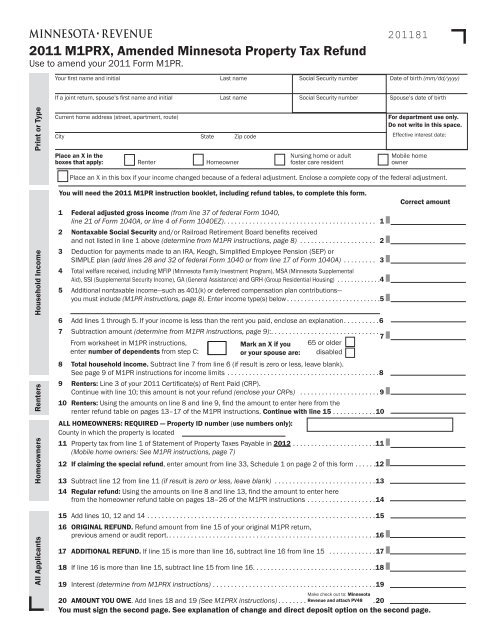

2021 Form MN DoR M1PRFill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/594/774/594774206/large.png

Property Tax Lupon gov ph

https://www.clergyfinancial.com/wp-content/uploads/2021/10/istock_000001340129medium_2.jpg

Using Your Tax Refund To Boost Your Property Value ZING Blog By

http://www.quickenloans.com/blog/wp-content/uploads/2015/04/home-improvement.jpg

Residents also must have paid all 2022 property taxes by June 1 2023 and all 2023 property taxes by June 1 2024 The income requirements cover two years It Property Tax Rebate for Seniors helps low income seniors with the cost of municipal residential property taxes Rebates are 50 of what you paid on last year s property

The Property Tax Rebate is a rebate of up to 675 of property taxes paid on a principal Montana residence The application period opens August 15 and closes October 1 The refunds are part of the city s Low Income Homeowner Assistance Program This is the second time the city has offered to refund the property tax

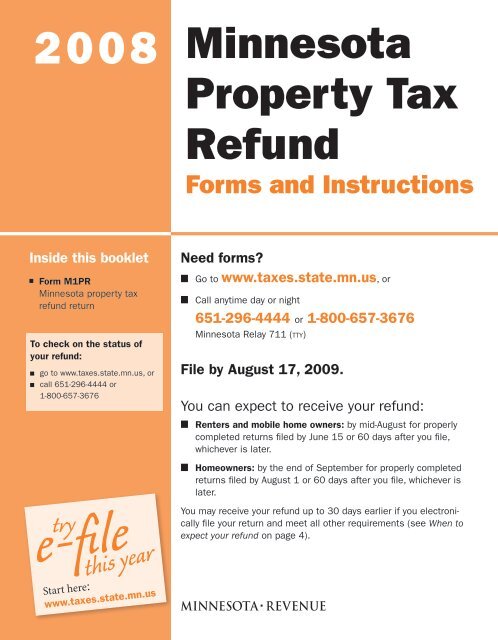

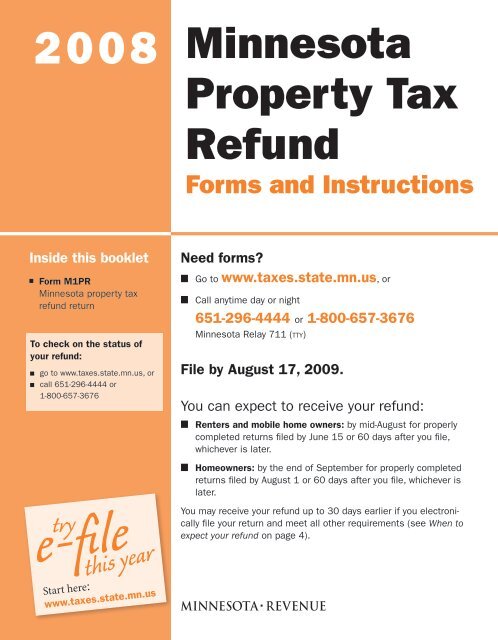

2008 Property Tax Refund Return Form M1PR Instructions

https://img.yumpu.com/28681002/1/500x640/2008-property-tax-refund-return-form-m1pr-instructions.jpg

Michigan Budget Gov Rick Snyder Proposes 103 Million In Property Tax

https://image.mlive.com/home/mlive-media/width620/img/elections_impact/photo/14208438-standard.jpg

https://www.revenue.state.mn.us/property-tax-refund

If you re a Minnesota homeowner or renter you may qualify for a Property Tax Refund The refund provides property tax relief depending on your income and property taxes

https://www.vero.fi/en

Tax refunds If your tax assessment was completed in June you receive your tax refund on 5 August 2024 The refund is transferred to you by the end of the day

File Your Homeowners Property Tax Refund Online YouTube

2008 Property Tax Refund Return Form M1PR Instructions

How Much Is Mn Renters Property Refund Leia Aqui Does Minnesota Have

County Property Tax Refund Specialists Better Business Bureau Profile

Fillable Form M1pr Homestead Credit Refund For Homeowners And

Did You Get An Additional Hilariously Small Tax Refund Check

Did You Get An Additional Hilariously Small Tax Refund Check

Calendar For 2022 Tax Return Calendar Example And Ideas

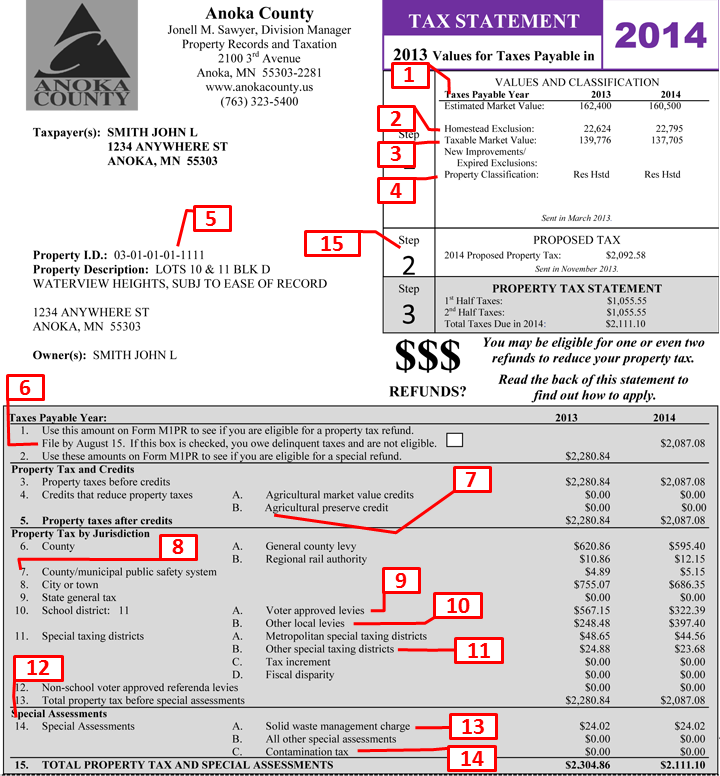

About Your Property Tax Statement Property Records Taxation Anoka

Virginia Department Of Taxation Review Letter Sample 1

Home Property Tax Refund - If you receive a refund of home mortgage interest that you deducted in an earlier year and that reduced your tax you must generally include the refund in income in the year you