Home Rebate Program 2024 Introduction This document provides example responses 1and additional guidance to assist a state territory in applying for and implementing the Inflation Reduction Act IRA Home Rebate Program s in accordance with the requirements of the Administrative and Legal Requirements Document and the Program Requirements Application Instructions 2

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

Home Rebate Program 2024

Home Rebate Program 2024

https://aircomfortofky.com/wp-content/uploads/HEERA_Blog-Header.png

What The Climate Bill s HOMES Rebates Program Means For States Energy Offices And Home Performance

https://snuggpro.com/images/uploads/benjamin_m_a_high_quality_illustration_of_residential_street_wi_d0e634aa-5d4b-4444-86fb-246cc9a3dbf8.jpg

Mass Save Whole Home Rebate Consultation

https://myenergymonster.com/ma/wp-content/uploads/sites/2/2022/05/mass-save-whole-home-rebate-1024x576.jpg

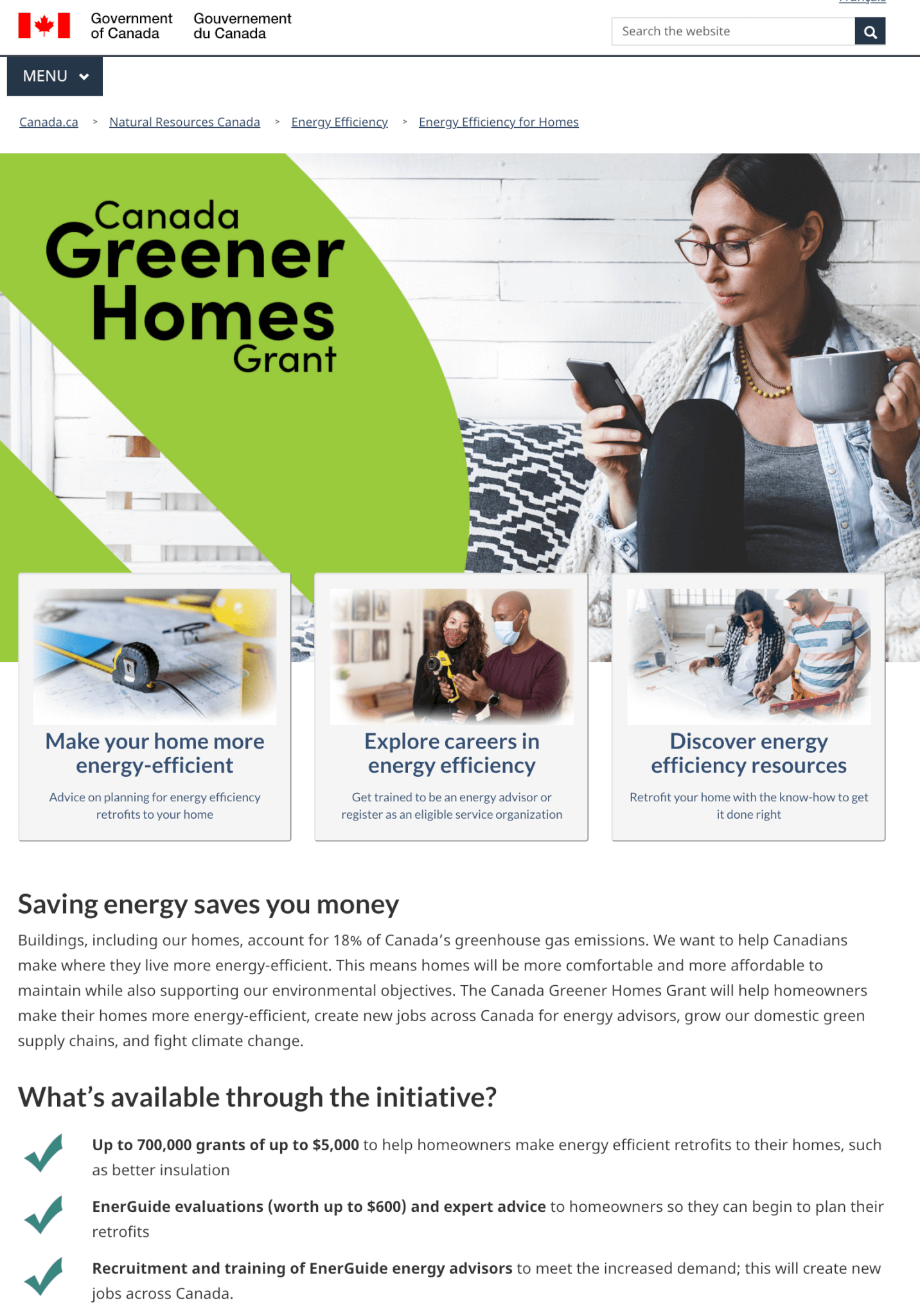

Key Points The Inflation Reduction Act which President Joe Biden signed in August 2022 created rebate programs for consumers tied to energy efficiency There are two initiatives the Home This is the first time the program has been expanded since 2006 The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 for renters Automatically increases the income cap to grow with inflation in years to come

January 2024 Program Overview Under the Inflation Reduction Act of 2022 IRA DOE received 4 3 billion for the Home Efficiency Rebate Program 4 5 billion for the Home Electrification and Appliance Rebate Program collectively the Home Energy Rebate Programs and 200 million for Contractor Training Grants Online applications in Spanish and English are available at mypath pa gov Applicants can access forms and other information about the program at revenue pa gov ptrr and can call 1 888 222 9190

Download Home Rebate Program 2024

More picture related to Home Rebate Program 2024

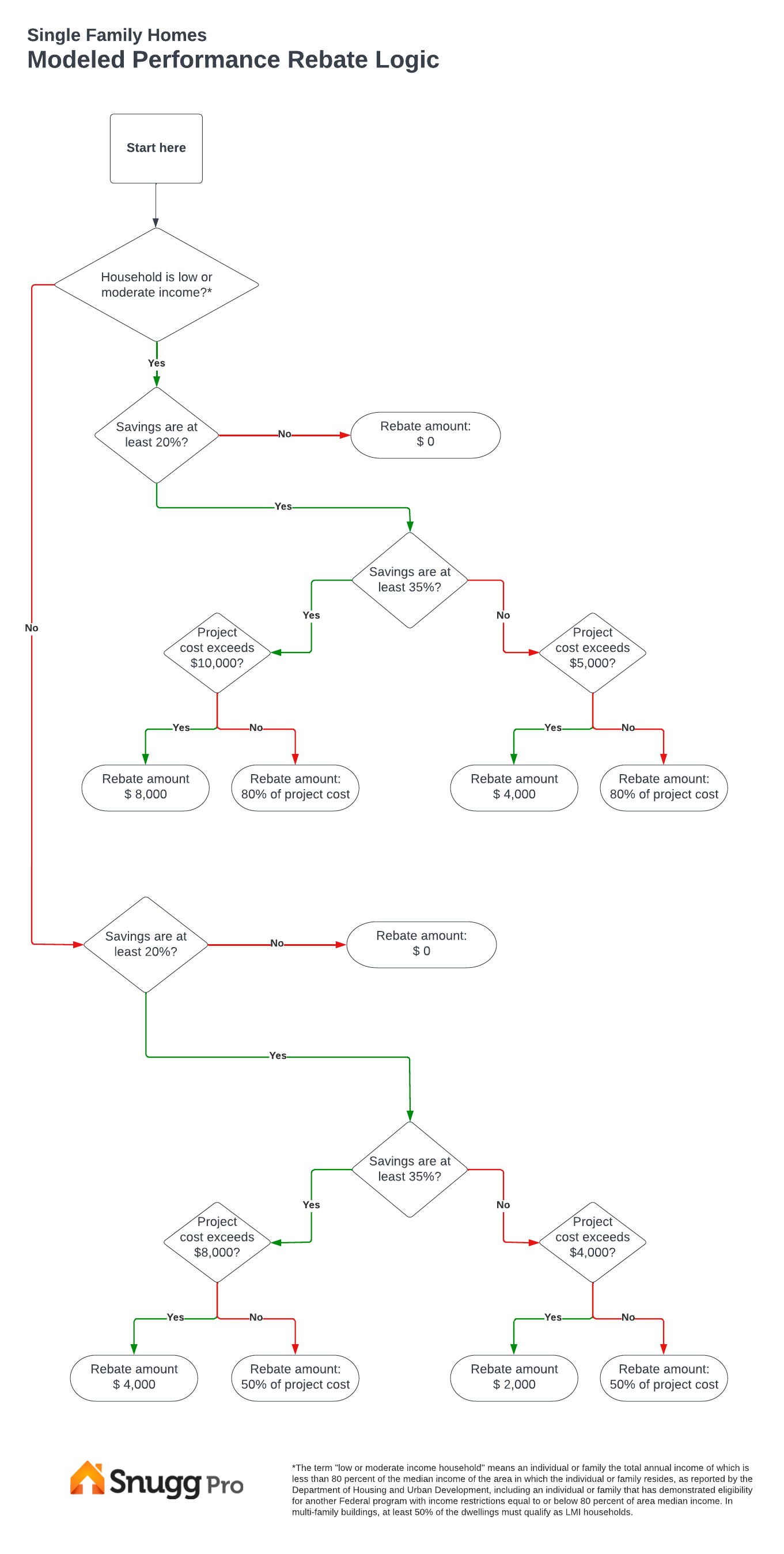

What The Climate Bill s HOMES Rebates Program Means For States Energy Offices And Home Performance

https://snuggpro.com/images/uploads/HOMES_Rebate_Program_Modeled_Savings.png

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Federal Tax Credits Carrier Residential

https://images.carriercms.com/image/upload/w_auto,c_lfill,q_auto,f_auto/v1660863072/carrier/residential-hvac/buildings/high-efficiency-electric-home-rebate-program.jpg

Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0 to 8 000 1 000 We expect to release several large batches of ANCHOR benefits starting January 2 2024 If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits

Home Energy Rebate Application Program Dates February 1 2023 January 31 2024 CPS Energy will offer a Home Energy Rebate sometimes rebate for residential account holders to make any of the below energy saving 2023 January 31 2024 Applications must be received within 30 days of installation For faster processing time please In 2023 the U S Department of Energy released its program guidance for the Home Efficiency Rebates HER and Home Electrification and Appliance Rebates HEAR programs which together allocate over 208 million to North Carolina to provide energy efficiency rebates As of January 2024 DEQ is applying for the planning grant funding for the

New Construction Home Rebate Pay Less For A New Home

https://www.builderhomez.com/wp-content/uploads/2020/03/DSC_0608-md-768x512.jpg

Get 10 000 Back With Home Efficiency Rebate Program

https://a-plusquality.ca/img/ac/ac.jpg

https://www.energy.gov/sites/default/files/2024-01/50121%20Sample%20Application%20Responses%20Revised.pdf

Introduction This document provides example responses 1and additional guidance to assist a state territory in applying for and implementing the Inflation Reduction Act IRA Home Rebate Program s in accordance with the requirements of the Administrative and Legal Requirements Document and the Program Requirements Application Instructions 2

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

HOME EFFICIENCY REBATE PROGRAM Crose Mechanical

New Construction Home Rebate Pay Less For A New Home

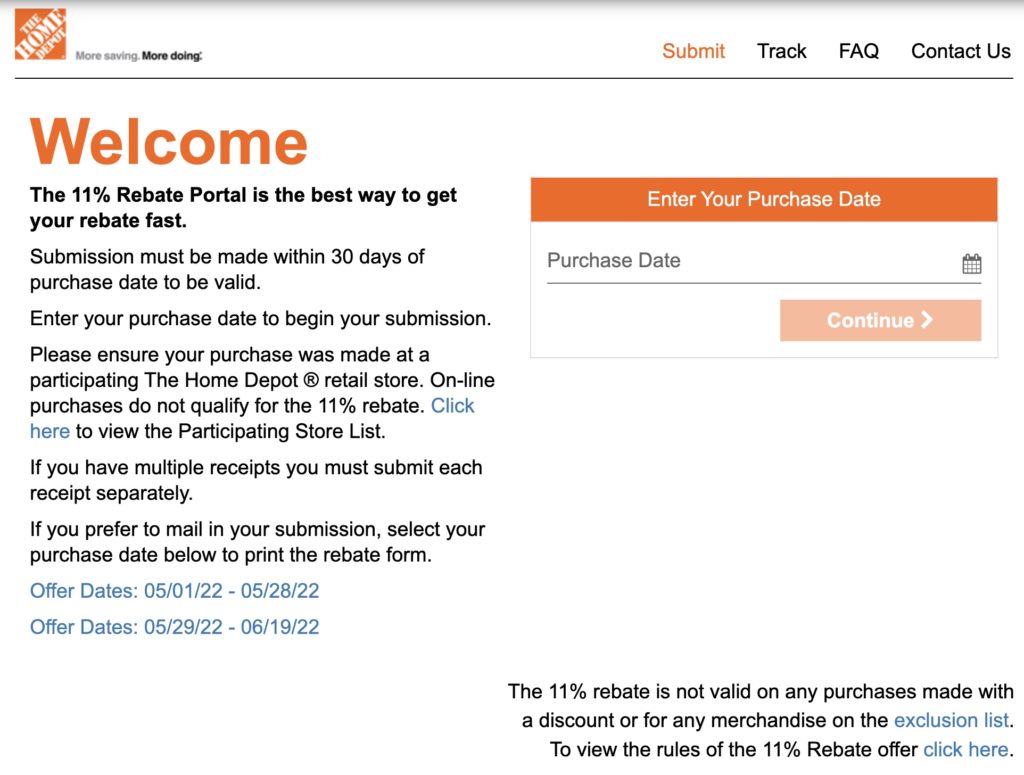

How Does Home Depot s 11 Rebate Match Work AisleofShame

Toronto Vacant Fill Online Printable Fillable Blank PdfFiller

Rebate USA

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Delaware New Home Rebate Get 1 Back At Closing

Understanding The High Efficiency Electric Home Rebate Act HEEHRA CleanTechnica

Understanding The HOMES Rebate Program Building Performance Institute Inc

Home Rebate Program 2024 - Online applications in Spanish and English are available at mypath pa gov Applicants can access forms and other information about the program at revenue pa gov ptrr and can call 1 888 222 9190