Home Rebates 2024 We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Home Rebates 2024

Home Rebates 2024

https://hosbak.com/wp-content/uploads/smud-brochure-port2.jpg

Rebates Incentives Eco Home Pros

https://ecohomepros.com/wp-content/uploads/2022/04/Untitled-design-14-1024x576-1.png

MOA Education Business Smarts

http://www.moaeducation.com/wp-content/uploads/2017/02/Charleston-New-Home-Rebates.jpg

1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 Largely the most significant change to Inflation Reduction Act incentives in 2024 is their availability While IRA tax credits have been available since January 1 2023 the timeline for home electrification rebates has been up in the air while states awaited guidance from the U S Department of Energy on implementing these new policies

Maximum rebates are as follows with a total of 14 000 in rebates allowed for any home In addition to the upfront rebates homeowners would reduce their energy costs through these upgrades resulting in ongoing savings Electric heat pump for space heating and cooling 8 000 Electric load service center 4 000 Electric wiring Energy Efficiency Rebates and Tax Credits in 2024 Home Electrification From the IRA By Sam Wigness Dec 22 2023 From the windows to the walls The recently signed Inflation Reduction Act is creating energy efficiency rebates and tax credits for all kinds of home electrification upgrades

Download Home Rebates 2024

More picture related to Home Rebates 2024

Tampa Bay Water Wise

https://tampabaywaterwise.org/wp-content/uploads/2022/05/house-rebate-2.png

Rebates For 2013 Home Buyers YouTube

https://i.ytimg.com/vi/4kTBr5e1VaE/maxresdefault.jpg

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

Requirements in the IRA Home Electrification and Appliances Rebates Sec 50122 Program Requirements and Application Instructions and Administrative and Legal Requirements Document ALRD The RFP should instruct the bidders to review DOE s Home Energy Rebates Frequency Asked Questions and Recommendations pages Jan 9 2023 Getting a substantial instant discount would simplify electrification for homeowners and widen its appeal But that means a system must be put in place for a contractor a state energy

High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes Share Key Points The Inflation Reduction Act which President Joe Biden signed in August 2022 created rebate programs for consumers tied to energy efficiency There are two initiatives the

Home Rebates Energy Solutions Guide Hostetler Bakkie Design

https://hosbak.com/wp-content/uploads/smud-brochure-port1.jpg

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

Home Rebates Energy Solutions Guide Hostetler Bakkie Design

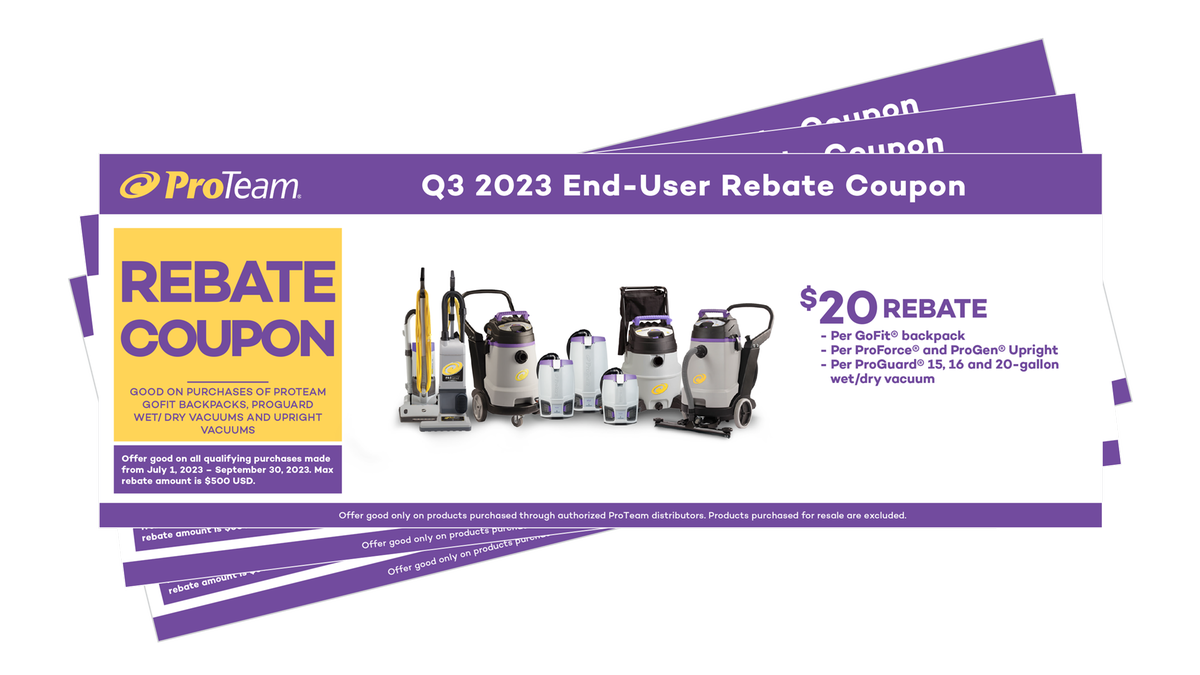

Manufacturer Rebates CleanFreak

How Do Home Buyer Rebates Work YouTube

NWC Tryouts 2023 2024 NWC Alliance

Milwaukee Tool Rebates Printable Rebate Form

Milwaukee Tool Rebates Printable Rebate Form

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Printable Alcon Rebate Form 2022 Printable Rebate Form

1920x1080 Averux 2173899 WallHere

Home Rebates 2024 - Largely the most significant change to Inflation Reduction Act incentives in 2024 is their availability While IRA tax credits have been available since January 1 2023 the timeline for home electrification rebates has been up in the air while states awaited guidance from the U S Department of Energy on implementing these new policies