Homeowner Rebate Gas Furnace 150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for any item of energy efficient building property The residential energy property credit is nonrefundable A nonrefundable tax credit allows taxpayers to

The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For more information please visit the Home Energy Rebates page Furnaces Natural Gas Oil Tax Credits This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim

Homeowner Rebate Gas Furnace

Homeowner Rebate Gas Furnace

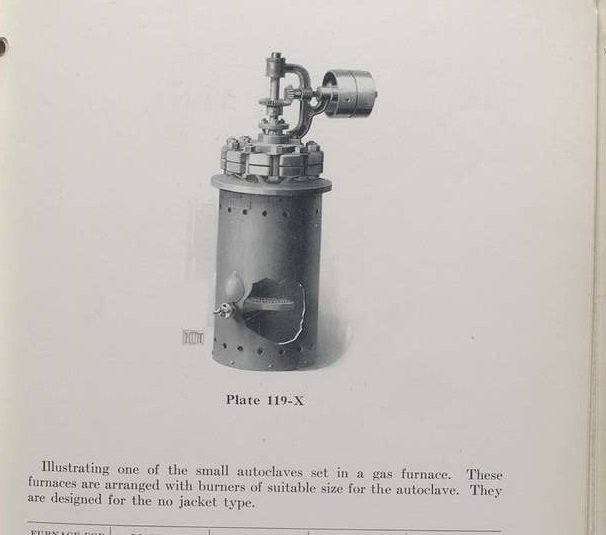

http://static1.squarespace.com/static/5cc724c90490797bcbc46ffe/5cd3064c9b747a516620e9f3/640cbbd1e2e6426ab8762003/1678617331353/plate-119-x-small-autoclave-set-in-a-gas-furnace-1a0d28.jpg?format=1500w

Spend Less On Your Furnace And More On The Things You Love In 2022

https://i.pinimg.com/originals/ea/7d/52/ea7d52c0d3041864976a2dac5f4d6e24.jpg

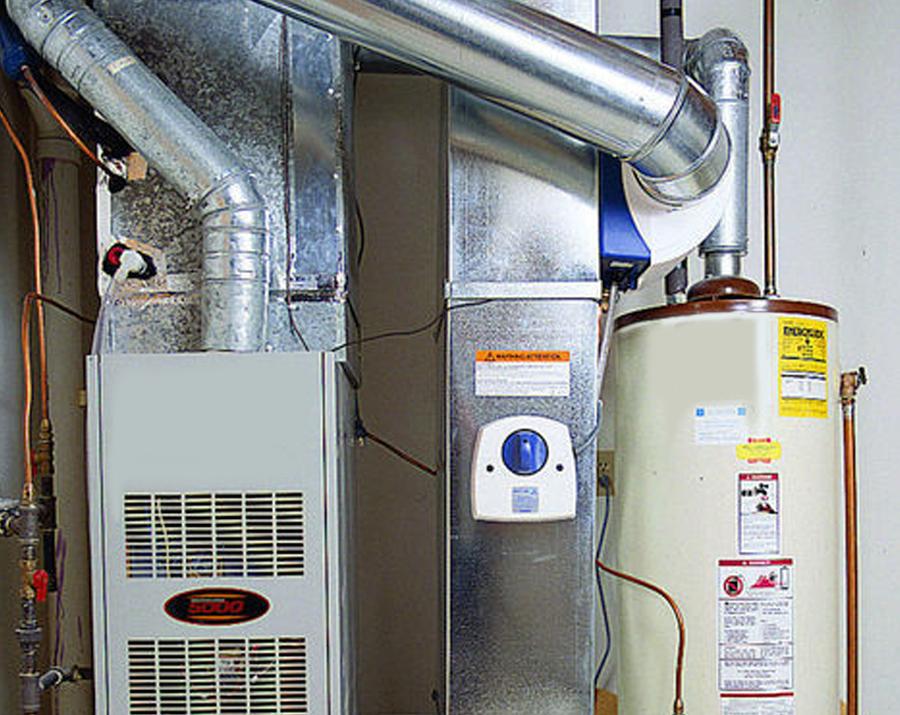

Inspecting High Efficiency Gas Furnaces And Venting YouTube Gas Rebates

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/03/inspecting-high-efficiency-gas-furnaces-and-venting-youtube.jpg?resize=1024%2C576&ssl=1

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified Government rebates for air conditioning and heating in 2024 make it easier and more affordable for homeowners to upgrade to energy efficient HVAC systems By taking advantage of these programs you can reduce your upfront costs and enjoy long term savings on your energy bills

The Home Energy Rebates will help American households save money on energy bills upgrade to clean energy equipment improve energy efficiency improve their comfort support a stable power grid and reduce indoor and outdoor air pollution If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032

Download Homeowner Rebate Gas Furnace

More picture related to Homeowner Rebate Gas Furnace

Save Energy At Home Residential Gas Rebate Form National Grid Gas Rebates

https://www.gasrebates.net/wp-content/uploads/2023/03/2022-national-grid-rebate-for-gas-furnace-gasrebate.jpg

Residential Rebates

https://www.burbankwaterandpower.com/images/2019/06/18/otherrebates_furnacewaterheater.jpg

Wash Gas Energy Rebates Gas Furnace GasRebate

https://i0.wp.com/www.gasrebate.net/wp-content/uploads/2022/08/performance-80-gas-furnace-58tp-carrier-home-comfort.gif

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to

Homeowners are eligible for rebates on 50 of the cost of projects that cut their home energy use through insulation and air sealing improvements and HVAC installations rebates apply for up to 80 of cost for households under 80 of the area median income Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

Carrier Gas Furnace Rebates In 2022 GasRebate

https://www.gasrebate.net/wp-content/uploads/2022/09/carrier-furnace-furnace-ac-experts-heating-cooling.jpg

With A High Efficiency Gas Furnace Customer Can Save A Lot On Their

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/03/with-a-high-efficiency-gas-furnace-customer-can-save-a-lot-on-their.jpg?resize=768%2C1024&ssl=1

https://www.irs.gov › newsroom › energy-incentives-for...

150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for any item of energy efficient building property The residential energy property credit is nonrefundable A nonrefundable tax credit allows taxpayers to

https://www.energy.gov › scep › home-energy-rebates...

The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For more information please visit the Home Energy Rebates page

Rebates In Our Home Efficiency Rebate Program Residential Union Gas

Carrier Gas Furnace Rebates In 2022 GasRebate

Active Rebates On Gas Furnace Or Heat Pump Replacements PumpRebate

Simple Gas Furnace Upkeep For The Average Homeowner Daily Business Hub

Rebate For Gas Furnace Ecm Blower Gas Rebates

Pin On Household Tips

Pin On Household Tips

Consider A Homeowner Who Is Replacing His 25 year Old Natural Gas

Goodman 96 GM9S96 Single Stage ECM Fan Gas Furnaces Local Rebates

How To Claim FortisBC s Furnace Rebates Murray s Solutions

Homeowner Rebate Gas Furnace - The Home Efficiency Rebates HOMES program assists homeowners and renters with whole house energy saving retrofits The Home Electrification and Appliances Rebates HEAR program helps homeowners and renters implement energy efficiency measures including transitions to electric appliances 1