Homeowner Tax Rebate 2024 Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married This is the first time the program has been expanded since 2006 The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 for renters Automatically increases the income cap to grow with inflation in years to come

Homeowner Tax Rebate 2024

Homeowner Tax Rebate 2024

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

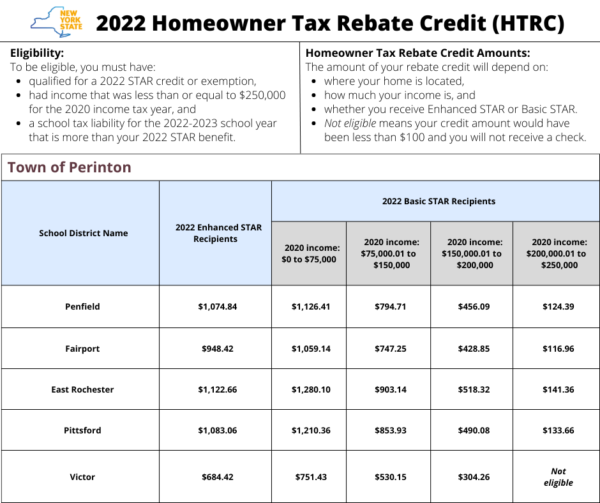

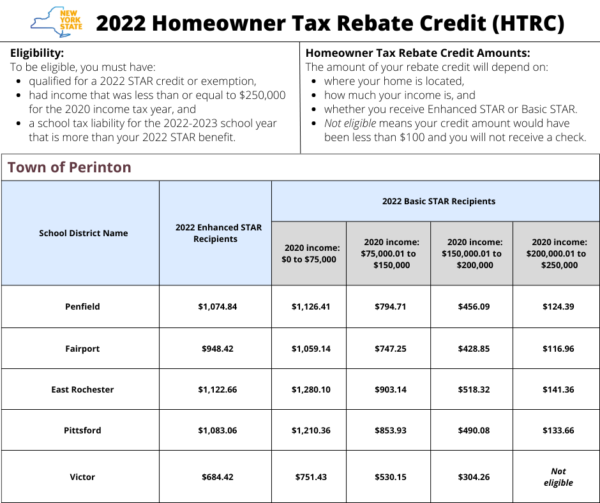

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-600x503.png

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

New Coming Soon for 2023 Claim Year House Bill 1100 signed August 2023 Maximum Eligibility Income increased to 45 000 Maximum Standard Rebate increased to 1 000 Future years will see increase based on annual inflation New Eligibility Table Supplemental Rebates for 2023 No changes to supplemental income eligibility under new law When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married

For joint filers deductions apply to mortgage interest payments on loans up to 1 million or 750 000 for loans made after Dec 15 2017 Single filers can claim half these amounts 500 000 or 375 000 respectively To claim this deduction use IRS Form 1098 provided by your lender in early 2024 entering the amount from Line 1 onto Line We expect to release several large batches of ANCHOR benefits starting January 2 2024 If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits

Download Homeowner Tax Rebate 2024

More picture related to Homeowner Tax Rebate 2024

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

https://i.ytimg.com/vi/Dk6m3vyq3cY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYOSBUKHIwDw==&rs=AOn4CLAiLu8JQ1ipHT9vjuy4jqjIumoU2g

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes The rebates are available to households earning less than 150 of the area s median income If your household income falls Below 80 of the area median income you can claim rebates for 100 of

First the amount you can claim has been reduced to 750 000 This runs until 2025 when the 1 million limit will return There are no differences between filing separately or jointly However married couples filing separately will see the overall amount cut in half 3 Private Mortgage Insurance Deduction On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

https://www.the-sun.com/wp-content/uploads/sites/6/2022/05/NINTCHDBPICT000616816864-6.jpg?w=2640

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX

https://www.cnet.com/personal-finance/taxes/all-the-tax-breaks-homeowners-can-take-for-a-maximum-tax-refund-in-2024/

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

Virginia Tax Rebate 2024

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Regarding The 2022 Homeowner Tax Rebate Credit HTRC From New York State

Homeowner Tax Rebate 2024 - When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married