Homeowner Tax Rebate Check 2024 Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married Features States Sending Tax Rebate Stimulus Checks State stimulus checks tax rebates or other payments are on their way to eligible residents in some states Is your state one of

Homeowner Tax Rebate Check 2024

Homeowner Tax Rebate Check 2024

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1752&h=986&crop=1

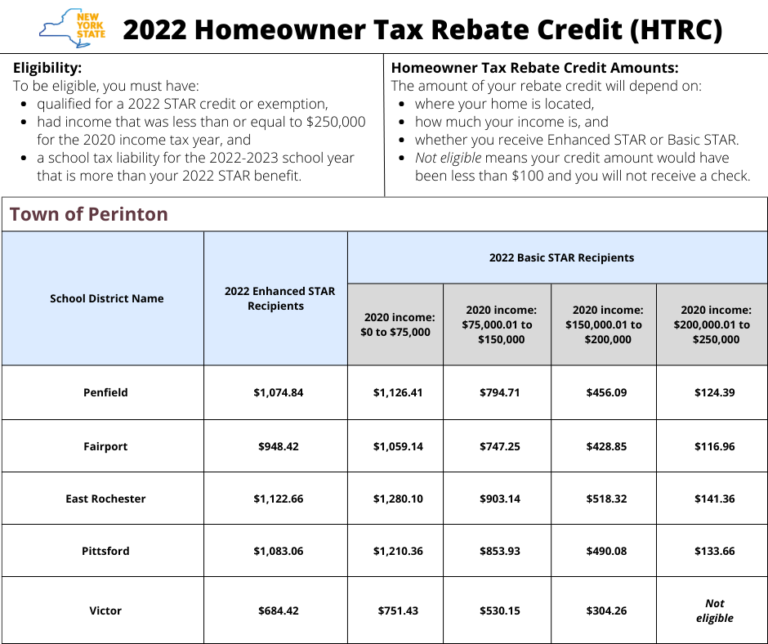

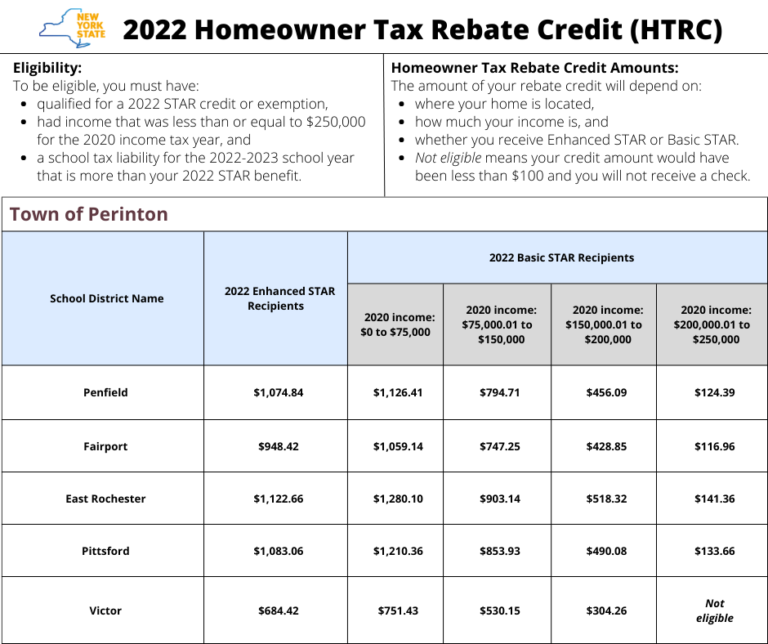

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

NYS 2023 Homeowner Tax Rebate Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/NYS-2023-Homeowner-Tax-Rebate.jpg?fit=996%2C728&ssl=1

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax How to Apply Homeowners Most homeowners may file online with an identification number ID and PIN However if you bought your home in the application year altered your deed or had certain life changes such as a divorce or death of a spouse you must file an application by mail Renters Renters may file using the online option

Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenses Single filers get half those amounts 500 000 or 375 000 respectively To deduct your mortgage interest you ll need to fill out IRS Form 1098 which you should receive from your lender in

Download Homeowner Tax Rebate Check 2024

More picture related to Homeowner Tax Rebate Check 2024

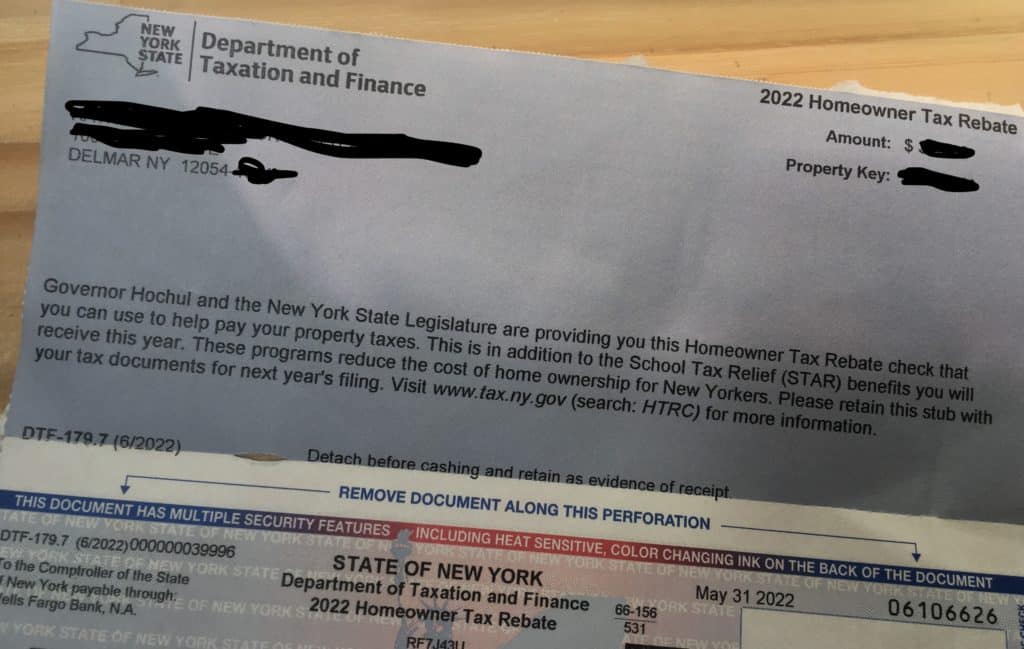

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-1024x649.jpg

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

https://i.ytimg.com/vi/Dk6m3vyq3cY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYOSBUKHIwDw==&rs=AOn4CLAiLu8JQ1ipHT9vjuy4jqjIumoU2g

The rebates are available to households earning less than 150 of the area s median income If your household income falls Below 80 of the area median income you can claim rebates for 100 of The rules vary by year and person depending on your filing status age income and other factors This story is part of Taxes 2024 CNET s coverage of the best tax software tax tips and

2024 tax refund calculator One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator which are offered by tax prep companies such as H R Block as People with incomes less than 8 000 a year could receive the full 1 000 refund Those with income between 8 001 and 15 000 will receive 770 while for those who earn between 15 001 and

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX

https://www.cnet.com/personal-finance/taxes/all-the-tax-breaks-homeowners-can-take-for-a-maximum-tax-refund-in-2024/

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married

Your Stories Q A Are You Still Waiting For Your Homeowner Tax Rebate Credit Check YouTube

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

NY Homeowner Tax Rebate Checks Are In The Mail RBT CPAs LLP

When Will We Get The Extra Tax Rebate Checks In Montana Details

When Will We Get The Extra Tax Rebate Checks In Montana Details

Regarding The 2022 Homeowner Tax Rebate Credit HTRC From New York State

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

One time Tax Rebate Checks For Idaho Residents KLEW

Homeowner Tax Rebate Check 2024 - Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax